Perspective on Risk - Nov. 13, 2024

Commercial Real Estate; Fiscal Dominance; Fraud; Money Laundering; Bagehot; Culture in Central Banks & Bank Supervision; More

Commercial Real Estate

Banks face growing risk as double defaults on commercial loans mount (FT)

The number of US borrowers in danger of defaulting a second time on commercial property loans is at the highest level in a decade, raising concerns that a bank practice known as “extend and pretend” is hiding growing systemic risk.

Last month, a Moody’s review of property loan modifications found that banks offered little in terms of payment breaks, often less than 2 per cent off total payments in the majority of bank modifications.

Instead borrowers were allowed to delay missed payments, and given more time to pay them back.

Still, about only about a third of the modifications that banks have offered in the past year have resulted in the borrower defaulting for a second time.

Fiscal Dominance

I’ve written on this in the past.1 There is currently little evidence of fiscal dominance. Credit spreads are remarkably low. Still, Fidelity’s Jurrien Timmer authored the following tweet stream which is worth considering:

If there is one thesis that I have high conviction in for the coming years, is that the US is on a path towards fiscal dominance. With the Fed and other central banks no longer the buyer of first and last resort, it seems plausible that the term premium might rise in the months and years ahead.

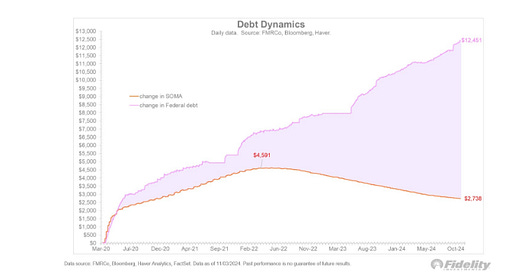

If you are skeptical of that view, take a look at the chart below and tell me what compensation investors might demand to fill the $10 trillion gap between the federal debt and the Fed’s balance sheet. As of last week, the term premium was 22 bps. It’s higher than it has been, but it still seems low to me. [bp: sorry it is so faint - you may want to click over to his tweet for a better view]

Rising term premia mean rising real yields. In a regime of positive correlations (between stocks and bonds), rising rates can and will cause wobbles in the stock market

We saw this in 2022 and one year ago in October 2023 (when the 10-year pushed against 5%), and again several times this year. Rate tantrums may not necessarily end equity bull markets, but they can sure put a dent in the bullish momentum (as we saw again last week).

A rising term premium could offset the otherwise bullish implications for bonds stemming from the expected path of rate cuts from the Fed. My bond model (below) regresses the forward curve and GDP growth to estimate the fair value for bonds. It has been indicating that 3.6% is roughly fair value, based mostly on the expected path of Fed rate cuts (to 3.6%).

However, this model assumes that the current term premium is “correct,” much like the discounted cash flow model (DCF) assumes that the implied equity risk premium (iERP) is correct in computing the fair value for stocks. Risk premia are really sentiment indicators, and they can flip on a dime.

If in the model above we add a gradual expansion in the term premium from the current 22 bps to a historically more typical 125 bps, we get what is in my opinion a more plausible path forward. High 4’s with an occasional flare-up to a 5-handle.

Rate cuts have dominated bond yields so far during this cycle, but going forward the term premium may well trump the Fed cycle (no pun intended). The Fed model has returned and is likely here to stay.

Fraud

Money Laundering

Fed Chooses Not To Invoke Death Penalty

Maybe if they did, banks would ex-ante take more care.

In the Matter of: BANCOMER, S.A. ,BANCA SERFIN, S.A.

In March 1999, pursuant to plea agreements, Bancomer and Sertin were each convicted of violations of the federal criminal money laundering statute.

Although the IBA provides that the Board must notify a foreign bank convicted of a money laundering violation of the Board’s intention to commence a hearing to determine whether to terminate the bank’s operations in the United States, none of the material facts in the existing record is disputed. As a general principle of administrative law, the Board is not required to conduct a formal administrative hearing, even where an opportunity for a hearing is provided for by statute, if the hearing will serve no purpose because no material facts are in dispute.‘

In light of the applicable statutory factors and the facts in the record, the Board finds that the activities of Bancomer’s agencies in the United States should not be terminated as a result of the bank’s conviction in 1999 of a money laundering offense.

Sen. Warren Questions DOJ Side-stepping Congressional Intent

When the distinction between money laundering and a “conspiracy” to launder money matters.

Sen. Warren’s letter. It’s quite good, and quite readable. She essentially asks why the regulators and DOJ have avoided using the death penalty when that was Congress’ intent.

Your recent settlement with TD Bank over money laundering and other charges failed to hold corporate executives accountable—and appears to be carefully crafted to allow the banking regulators to side-step the penalties that Congress intended to apply to money laundering crimes. I write to seek an explanation for these failures.

For a decade, TD Bank leadership knowingly presided over a criminally deficient anti-money laundering program,22 and according to Attorney General Garland: “at various times high-level executives, including the person who became the bank’s chief anti-money laundering officer, knew there were serious problems with the bank’s anti-money laundering program. But the bank failed to correct them.”

The settlement also allows TD Bank to evade the full scope of penalties that Congress intended for bank regulators to employ in response to criminal money laundering. Specifically, the charges settled against TD Bank and TD BHC shift responsibility for the hundreds of millions of dollars in money laundering from the bank to the bank’s holding company, which precludes the OCC from invoking the bank “death penalty” provision.

First, DOJ avoided the most obvious charge against the bank: money laundering. Instead, TD Bank pleaded guilty to “conspiracy” to launder money. This is not an academic distinction. A guilty plea to money laundering charges would have triggered the bank “death penalty” provision administered by the OCC.

Hat tip to Bank Reg Blog for highlighting this letter.

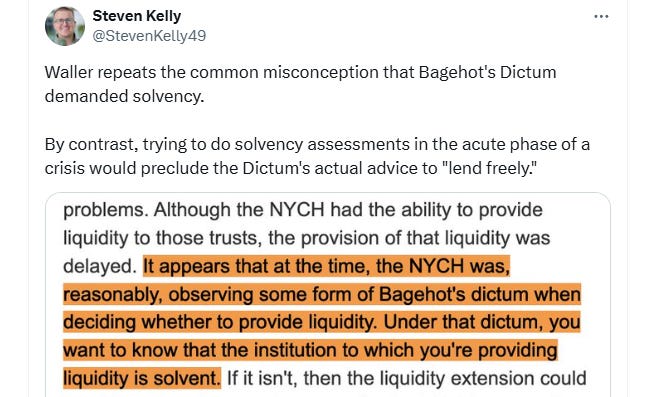

Waller on Payments (and Bagehot)

What Roles Should the Private Sector and the Federal Reserve Play in Payments?

Culture in Central Banks & Bank Supervision

Beyond the rules: promoting an ethical culture in central banks and supervisory authorities (DNB)

‘If we are to live up to the high standards we set for ourselves, we need rules, but first and foremost we need an ethical culture.’ said Klaas Knot in his speech at the DNB Ethics and Compliance Conference today. He spoke about promoting an ethical culture in central banks and supervisory authorities.

FDIC’s Cultural Reform

The rotting fish continues to emanate an odor.

Today, at a Board meeting that was again closed to the public over my objections, the Board finally reached consensus on how to investigate allegations of misconduct by FDIC executives. This belated consensus follows five months of debate, delays, and false starts.

… the Board voted down my proposal … [that] would have just replicated the same committee structure that successfully and quickly oversaw Cleary Gottlieb's review, tasked that committee with retaining and overseeing outside investigators, and directed Cleary Gottlieb to provide all information relevant to potential executive misconduct to those outside investigators, subject of course to Cleary Gottlieb first obtaining the consent of individuals who provided hotline information or interview information to the sharing of that information with the outside investigators.

Instead, the Board adopted … a process to explore whether the National Credit Union Administration ("NCUA"), the Government Services Administration ("GSA"), or perhaps another to-be-specified regulator might agree to hopefully, eventually oversee investigations by outside investigators of potential executive misconduct on behalf of the FDIC.

Trying to put this more simply, under the approach adopted today, some executive misconduct likely won't be investigated, or won’t be investigated using all available information. … To be more concrete, if also blunt, the debate here comes down largely to the allegations against the Chairman.

Bad Examiner

The rare bad apple; a bank supervision bosses worst nightmare; unfortunately taints all examiners in some people’s eyes.

SECURITIES AND EXCHANGE COMMISSION, Plaintiff, against ROBERT BRIAN THOMPSON

From at least October 2023 through January 2024 (the “Relevant Period”), Thompson, then a senior banking supervisor and examiner at the Federal Reserve Bank of Richmond (the “Federal Reserve Bank”), unlawfully traded in stocks and options of at least two banks that were under his supervisory purview based on inside information.

More

Steven Kelly on Private Credit and De-Risking the Banking System (OddLots)