Perspective on Risk - August 13, 2023

The Thing We Are Not Talking About; Long & Variable Lags; YPFS (Held & Singh); Dealer Capacity; Tarullo Is Fed Up With These Damn Stress Test; Comically MTM; Fiscal Dominance; SVP Collateral

The Big Thing We Are Not Talking About

Not climate change. Not the fight against fascism. Not Ukraine. Not even the US fiscal position, demographics or AI.

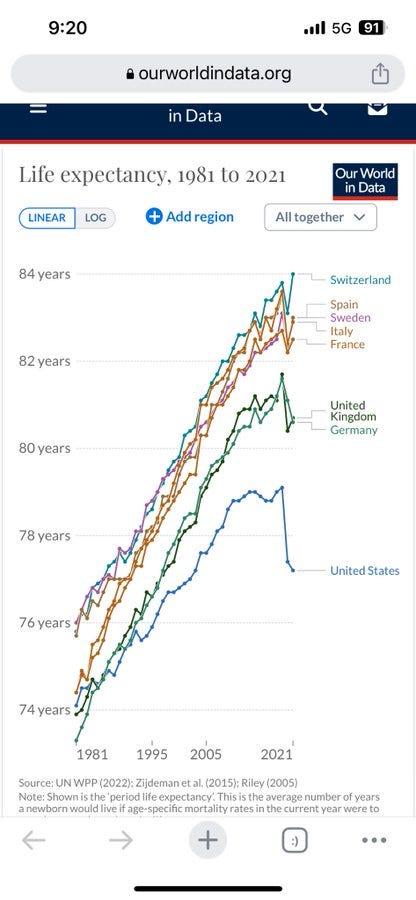

Life expectancy in the U.S. is falling (dramatically) and is much worse than other developed countries.

For example, Americans live shorter life than the English across all portions of the income spectrum, despite the fact that without London the UK would be poorer than Mississippi.

Traditionally, life expectancy was driven by infant mortality. Not his time. It is between the ages of 5 and 40 that we underperform.

The causes are drugs, guns, autos and obesity. We underperform the developed world in each of these areas.

Hattip John Burn-Murdoch @jburnmurdoch at the FT for the charts

Thinking About Long & Variable Lags

If you’ve been reading this for any length of time, I am on record believing in the predictive power of yield curve inversions, but have cautioned that the research shows the start of any recession is 12+ months from the first inversion. We are in that window now.

While the Fed says it will remain ‘higher for longer’ and doesn’t rule out an additional rate hike, the Treasury market has adjusted its probabilities away from a continued inflation story to one where the Fed drops rates quickly, as we ‘dis-inflate.’ This appears born out by the data.

What I worry about (and certainly don’t have the answer to) is long-and-variable lags, both on the monetary and fiscal policy side. Arturo Estrella (the YC guy) argues that the effect of the inversion of the yield curve has probably NOT been felt yet on inflation.

Monetary policy is not driving disinflation, at least not yet

Much of the (inflationary) effects of the $500 billion Inflation Reduction Act has yet to be felt.

You may want to discuss with your economists how these different monetary and fiscal cycles will play out. I sure am not as confident as the market.

Yale Program On Financial Stability

The Yale folks publish some very nice oral histories from financial crisis. They just published two related to the 2020 Covid crisis. I worked with Michael but did not know Mr. Singh. Two very different, but complementary perspectives. This is part of what made working at the NY Fed so fulfilling.

NY Fed GC Michael Held

They recently published talks with Michael Held that discusses his perspective on 2020 market developments. Quotes will follow, but some things come through:

The 2020 was more of a collective Treasury & Fed-Board-led response than a NY Fed driven response.

Illustrates how the Fed hews to the limit and spirit of the law. In the GFC we needed to push on the limits of antiquated legislation

Highlights some of the complexity of structuring programs with Treasury and Fed money; but this too has become more routine do to “muscle memory,”

Fed was clearly more attuned to communication needs; PR wasn’t something the Fed had historically focused on

I think we had been home for about a week, is my recollection, when the markets really started to tighten up, and we saw more and more dysfunction, and we really started to dig in on the response. I think one real difference this time around from the GFC—and it was a lesson from the GFC—was really to go out with force and alacrity immediately. And part of that is just having the benefit of having developed a lot of [emergency liquidity] facilities during the GFC. We had things we could do immediately.

I do think there was a desire to really think about where the effects were here so that we weren't just fighting the last war—meaning the GFC—and really trying to craft solutions that maybe built on what we did during the GFC, conceptually, but were getting the assistance where it was needed.

Reg A, along with 13(3), were amended after the last crisis. And our job is to comply with the law, including, I'd say, the spirit of the law. So, there was “message received” around what we did during 2008 and concerns about some of that work, and I think the goal here was to make sure we were doing everything that was consistent with the letter and the spirit of the changes that were made after that crisis.

Daleep Singh, Head of the Markets Group, FRBNY

Bet you didn’t know the shear number of programs to support market function; few people do.

Highlights Fed’s role in providing international liquidity, and preference to lend to other central banks rather than directly to foreign financial firms.

People are sometimes surprised when I tell them the importance with which the Fed took in controls needed when markets were fast.

What began to tell the story that would soon unfold was the safe-haven bid in the dollar, as well as the downdraft in oil markets. You could then start to see concentric circles from the fragility in currency markets to credit markets and then equities.

In a sense, markets were telling the Fed, "It's time for you to move." And we had to move quickly, because there were visible liquidity stresses building in US credit markets.

Beyond all the observable market signals, and the growing left tail of the probability distribution, we were facing Knightian uncertainty—the “unknown unknowns” of how the shock would propagate to the real economy. Markets weren’t waiting for clarity to emerge; almost anyone who managed risk according to a VaR model was cutting position at the same time and in large size.

It wasn't as though we were getting requests for a parachute, but it was full-scale panic by the first week of March.

We knew that, really, the largest demand for dollar liquidity could very well be offshore institutions that have dollar liabilities and need to refinance at relatively frequent maturities. And so, we could see from the cross-currency basis—which is the cost of borrowing dollars in exchange for other currencies held as collateral—that wholesale dollar funding markets were seizing up, as much as 6 or 7 percentage points above normal. And so, we really needed to find a way for offshore borrowers to post high-quality collateral in exchange for cash.

Hence the FIMA Repo Facility. It gave 30 or so central banks the ability to borrow cash against their holdings of Treasuries, which accounted for about 75 percent of total holdings among foreign official institutions. We also expanded, as you said, the swap lines to 14 central bank counterparties. We made sure the pricing of these facilities was set at a backstop rate, such that they would self-liquidate when market conditions normalized, and also to ensure that we weren't creating adverse pricing for domestic actors relative to international institutions

We went out to 30 counterparties and basically explained to them the modalities of the facility and that we welcomed their participation. It was up to those counterparties as to whether they’d apply, and I think almost all of them did so.

Our comparative advantage in New York was to diagnose the clogs in market plumbing that were evolving at breathtaking speed. Based on that diagnosis, which was unfolding in real time, and the fact that our job was to be the eyes and ears of the Fed into financial markets, those of us in New York played an important role in the design of the emergency facilities.

So, we had the seven... PDCF, CPFF, PMCCF, SMCCF, MLF, TALF, and PPPLF were the facilities we managed in New York.4 Boston had its two.

We also invited audits, both internal and external, just to make sure we were following best practices. Our board of directors in New York was extremely helpful in helping us think about how we could establish guiding principles— even in the middle of a crisis—around transparency, governance, and accountability. If any of us were called to testify before Congress, we could say, "These were the principles that guided the way in which we set up our processes and our information flows and the manner in which we deployed taxpayer resources executed." It was deliberate and thoughtful—no one was putting their finger to the wind.

Dealer Treasury Capacity

Dealers' Treasury Market Intermediation and the Supplementary Leverage Ratio (Fed Board)

Treasury market intermediation by dealers, including Treasury securities market making and financing, requires regulatory capital. In particular, the six largest U.S. Treasury securities dealers are subsidiaries of large U.S. bank holding companies (BHCs),2 which are required to maintain a supplementary leverage ratio (SLR) of at least 5 percent at the BHC level.

The SLRs have trended down in recent quarters, approaching the 5 percent minimum level, as [total leverage] TLEs have increased faster than Tier 1 capital.

For a few large BHCs, especially those with large dealer subsidiaries, the SLR rule has implied higher capital requirements than risk-based capital rules in recent years , making it possible that the SLR may affect their willingness and ability to intermediate in Treasury markets, especially during periods of increased demand for intermediation.

The decrease in SLRs shown in Figure 1, which accelerated in late 2019, was largely driven by a broad-based expansion of BHC balance sheets, including loans and securities holdings.

The high-volume, low-margin, and high frequency nature of Treasury market intermediation might make it more sensitive to the SLR constraint than lending and other banking activities.

The cross-sectional standard deviation in the share of Treasury positions is large, implying a range for the contribution from dealers' Treasury holdings between 0.02 percent and 3.7 percent of TLE, with a mean close to 2 percent. Thus, the contribution from dealer's Treasury market making to the SLR appears limited.

We estimate that dealers' [securities financing transactions] SFTs backed by Treasury securities contribute about 6 percent to total TLE, and their share of TLE has changed little in recent years

Overall, our inspection during the temporary exclusions of Treasury securities and reserves from TLE between April 2020 and March 2021 does not show a noticeable effect on the big six dealers' Treasury intermediation, including direct holdings of Treasuries and SFTs backed by Treasuries.

Dan Tarullo Has Had Enough Of The Damn Stress Tests

I have been saying that the stress tests have outlived their usefulness. As a reminder, when they discuss minimum solvency levels, this is about the governments loss in the event of default, and when they talk about the level of stress tests (and the ‘buffer’) it is about reducing the probability of breaching the minimum capital threshold.

Talking to Dan Tarullo about mergers, stress tests, and supervision (Brookings)

Big banks today must hold enough capital to pass the stress tests that have been administered by bank regulators since 2009. The intent was to make sure banks’ capital cushions are large enough for them to survive an adverse economic scenario devised by the Fed. But Tarullo said that the stress tests may have outlived their usefulness for setting capital requirements because they have become more predictable, and banks have figured out how to tailor their balance sheets to “pass” the tests.

Of course, Dan wants to increase minimum capital levels.

Tarullo favors lifting the minimum capital requirements on G-SIBs and super-regional banks …

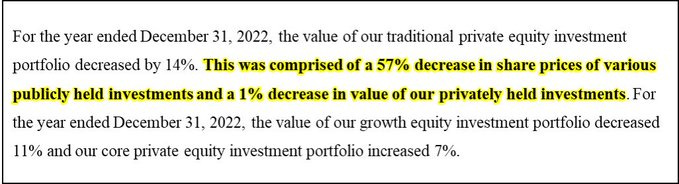

Comically Marking to “Market”

From KKR’s 10K:

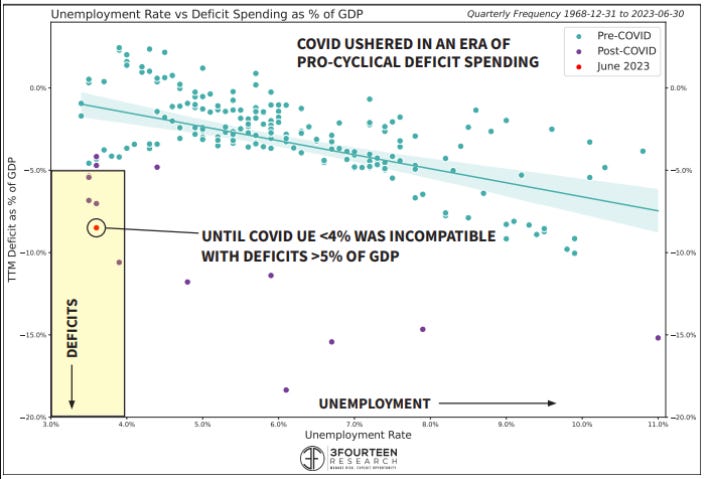

Fiscal Dominance

In Japan

Japan’s Fiscal Plight Draws Scrutiny After BOJ Tweak to YCC

If 10-year yields rise by 1 percentage point from a base case, Japan’s debt-servicing payments are expected to increase by 3.6 trillion yen by fiscal year 2026, according to Finance Ministry calculations. Japan is expected to spend 22.1% of its 114 trillion yen ($795 billion) national budget for this year on debt-servicing costs.

Yields on those securities touched a fresh nine-year high of 0.65% Thursday, prodding the BOJ to announce an unscheduled bond-purchase operation for the second time this week in a sign of its determination to support the market.

In The US

3Fourteen Research shows the unprecedented nature of the US fiscal deficits relative to current levels of unemployment. Put in sports terms, we’re juicing.