Perspective on Risk - July 25, 2023

Existential Risk vs Uncertainty; Collateral Calls During LDI Event; Fiscal Dominance (Again); Counterpoint on Decoupling; Anecdotal Updates; Bullshit; What I’m Listening To;

Existential Risk vs Uncertainty

Astral Codex writes about The Extinction Tournament.

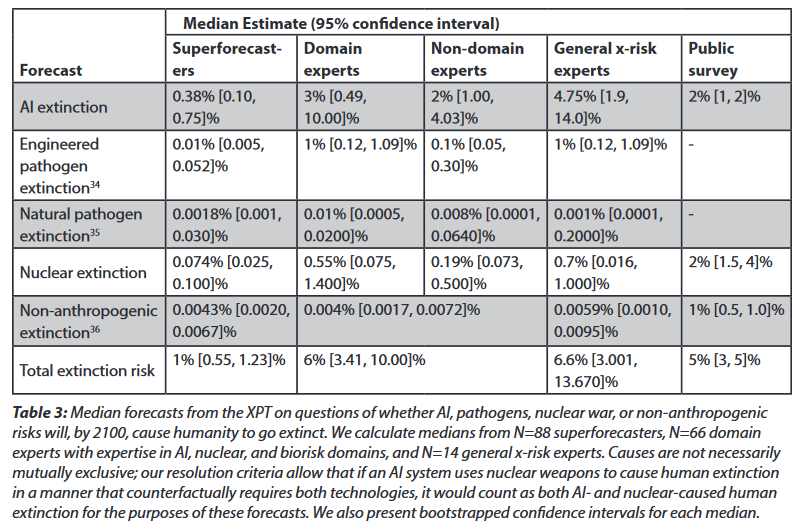

the Forecasting Research Institute has released the results of the Existential Risk Persuasion Tournament (XPT). XPT was supposed to use cutting-edge forecasting techniques to develop consensus estimates of the danger from various global risks like climate change, nuclear war, etc.

The plan was: get domain experts (eg climatologists, nuclear policy experts) and superforecasters (people with a proven track record of making very good predictions) in the same room. Have them talk to each other. Use team-based competition with monetary prizes to incentivize accurate answers. Between the domain experts’ knowledge and the superforecasters’ prediction-making ability, they should be able to converge on good predictions.

They didn’t. In most risk categories, the domain experts predicted higher chances of doom than the superforecasters. No amount of discussion could change minds on either side.

This touches on a number of things that I have written about in the past: the ability to improve forecasts using techniques utilized by ‘superforecasters,’ the behavioral biases exhibited by ‘domain experts.’

Domain experts tend to exhibit two biases:

‘curse of knowledge’ where they may overlook simple explanations or fail to consider alternative approaches because their expertise narrows their focus, and

‘overconfidence bias’ where they ascribe higher levels of confidence in their predictions than is warranted.

Superforecasters, on the other hand, are trained to try and avoid these biases.

So an ex-ante prediction would be that the domain experts will both find catastrophes in their domain more likely than the superforecasters, and have more certainty in their predictions. And we can see this in the results:

In virtually all of the cases the superforecaster results were significantly lower than the domain experts.

It is also interesting to review the aggregate results; I wounder if given the feedback that in aggregate they predicted a 6% chance of extinction within the next 77 years the experts would revise down their estimates.

The rest of the post goes on to try and understand the reason for the differences, including incentives, composition of domain experts, etc. Interesting rabbit hole for those so inclined.

The post also highlights the difference between risk and uncertainty. Risk is generally something that can be measured, priced, perhaps transferred in markets. Uncertainty is different; uncertainty refers to situations where the probabilities of outcomes are unknown or unknowable. What we are seeing here is the testing of the boundary between uncertainty and risk.

Collateral Calls During LDI Event

The Bank of England published an informative piece Lifting the lid on a liquidity crisis on their BankUnderground blog. They examined collateral flows during the 2022 LDI unwind.

For those who forget, a number of UK institutions used derivative trades to enhance net income by essentially borrowing long and lending short. This blew up as rates rose.

The authors summarize their findings with typical British understatement:

This article provides quantitative evidence on the origin of margin calls during the Autumn 2022 stress and how these were managed via sales of assets across bond markets and the unwinding of repo positions.

But the details are much more interesting than that.

Liability-driven investors in our sample reported a total of £205 billion of net gilt repo borrowing (sum of red bars) coming into the stress, or around 60% of the total net gilt repo borrowing by non-banks. On aggregate, they also reported a net notional position of £167 billion in interest rate swaps (sum of green bars) – receiving a fixed rate while paying floating – and £57 billion in inflation swaps (sum of blue bars).

This we sort of knew already. To leverage up I buy Gilts, repo them, and enter into receiver swaps. Here’s where it gets … well, not good but interesting.

We estimate that around 50% of net repo borrowing by the sector was secured with longer-dated gilts (20+ years) and more than 70% with inflation-linked gilts. The value of this collateral was therefore particularly sensitive to movements in long-term rates, as we’ll come on to. Derivative positions on the other hand were less sensitive – they had a shorter ‘duration’. Interest rate swaps held by liability-driven investors were generally shorter maturity and less sensitive overall to movements in interest rates than repo.

Read that again. It was not the derivatives, it was the repo. The duration of the repo was longer than the duration of the swaps.

We estimate that between the announcement of the ‘Growth Plan’ and the announcement of the Bank of England intervention, liability-driven investors faced approximately £66 billion in calls for variation margin, around 80% of which related to repo positions.

They don’t give the specifics, but we are left to speculate on the nature of the collateral that firms were using to meet derivative margin calls.

Liability-driven investors, mostly pension funds, sold non-gilt assets held outside of LDI portfolios to generate liquidity. … Chart 5 shows significant net sales of corporate bonds by pension and LDI funds, totaling around £10 billion, or around 30% of the size of gilt sales over the period.

Fiscal Dominance (Again)

I’ve written a few times now about the constraints financial and fiscal dominance may have on monetary policy, and I know this may be boring to a number of you. But I read a paper that several of you will find interesting.

The economist Carlie Calomiris has now weighed in with Fiscal Dominance and the Return of Zero-Interest Bank Reserve Requirements which has been published by the St. Louis Fed.

This article considers fiscal dominance, which is the possibility that accumulating government debt and deficits can produce increases in inflation that “dominate” central bank intentions to keep inflation low.

Under current policy and based on this report’s assumptions, [government debt relative to GDP] is projected to reach 566 percent by 2097. The projected continuous rise of the debt-to-GDP ratio indicates that current policy is unsustainable. —Financial Report of the United States Government, February 16, 2023

Charlie writes an interesting article that shows the causal linkage from fiscal dominance to other economic effects, specifically the policy of paying interest on reserves, the size of reserve requirements, and ultimately to financial disintermediation (and the political backlash from the banks that might follow. The focus on financial disintermediation effects is what caught my eye, and is something you may have inferred from past Perspectives that I have recently been considering.

Charlie writes:

Some changes in policy with respect to reserve requirements are likely if fiscal dominance becomes a reality. … if the government wishes to fund large real deficits, that will be easier to do if the government eliminates the payment of interest on reserves

it is quite possible that a fiscal dominance episode … would … also a return to requiring banks to hold a large fraction of their deposit liabilities as zero-interest reserves.

Imposing high reserve requirements for zero-interest paying reserves may seem quite attractive to a policymaker interested in reducing the inflationary consequences of fiscal dominance.

Such a policy change would not only reduce bank profitability but also reduce the real return earned on bank deposits to substantially below other rates of return on liquid assets, which potentially could spur a new era of “financial disintermediation,” as consumers and firms seek alternatives to low-interest paying bank deposits.

Charlie goes on to do an economists napkin exercise to estimate how a fiscal dominance scenario would play out. Those of you who are economists will be interested in this section; the rest of you not so much.

I’ll summarize his conclusions here:

Many things would likely change in a fiscal dominance scenario to make the inflation tax base larger to facilitate the funding of continuing deficits with less of a rise in inflation.

Interest on reserves would likely be eliminated

If the elimination of interest on reserves were accompanied by a new large reserve requirement, inflationary consequences could be much lower.

If the bond market does not anticipate a fiscal dominance shock sufficiently far in advance … then bond investors would be caught with losses on high-duration bonds.

All of these changes imply that the effects on banks and mutual funds and pension funds and others would be potentially quite dramatic.

In the 1970s and 1980s, major financial disintermediation from banks accompanied the rise in inflation taxation because rising inflation reduced the real rate earned on bank deposits.

Similar pressures to disintermediate banks could rise again as the result of a rise in inflation taxation.

If that occurs, however, banks and their political allies will redouble their efforts to use regulation to protect the banking system from innovation and competition.

Ultimately, the US may face a political choice between reforming entitlement programs and tolerating high inflation and financial backwardness.

Another interesting aside, at the end of reading Roger Farmer’s Where's the Inflation? Where's the Beef? I saw this little nugget:

When reserves of private banks at the Fed pay interest, as they do now, the opportunity cost of holding money is not the T-bill rate. It is the T-bill rate minus the reserve rate. If the Fed raises the interest rate and continues to pay interest on excess reserves, the connection between velocity and the interest rate will remain permanently broken.

Friedman’s quantity theory of money posits that as rates rise “money is like a hot potato that is passed from hand to hand more quickly.” If the Fed continues to pay interest on reserves this may not happen (or at least happen differently than past experience).

Stress Tests As A Goal Seeking Exercise

Regulators want to have full control over bank balance sheets. They want to not only set regulatory minimum standards (the strike price for regulatory default) but also the buffer above the minimums that banks must hold through their stress testing exercises. I wrote about this in the Perspectives - July 10, 2023.

Barr said as much in his speech:

changes in the risk-based capital requirements affect the way that minimum capital requirements are calculated, and the stress test is used to calculate the buffer. …

The stress test should evolve to better capture the range of salient risks that banks face.

Now, in Europe, the ECB is taking a heavier hand in adjusting bank submissions: ECB Made Major Stress Test Adjustment After Banks Took Rosy View

Banks, which are being asked in the tests to calculate the impact of specific economic scenarios, initially estimated their total capital ratio would decline by about 3.5 percentage points in a worst case, according to people familiar with the matter. The ECB subsequently adjusted the figure, leading to an impact of about 5 percentage points in the final results, the people said.

Now I do want to be a bit cautious in my criticism here. When the US regulators conducted the initial set of stress tests we did have to correct for many inconsistent and aggressive assumptions, and had to reconcile our priors with those of the banks.

But by now one would think that the banks and regulators would have reached an equilibrium understanding on the mechanics of the stress tests, and that submissions (in aggregate at least) could be relied upon.

Counterpoint on Decoupling

I’ve highlighted before in our deglobalization/decoupling discussions the trends observed in value chains. I always find it useful to look for information that contradicts conventional wisdom (and especially my priors). This is one such paper.

Employing insights from political economics, international relations, and China studies, we identify the key variables that shape the dynamics of the U.S.–China rivalry and investigate their impacts on the bifurcation and value-chain decoupling processes. We show that the ongoing conflict and disengagement processes are more likely to evolve in the long run in significantly different ways to the one envisioned by current Washington decision-makers and echoed by Petricevic and Teece (2019). The latter predicted an escalation of the disengagement processes and inevitable convergence to a ‘bifurcated world’.

Our main findings are: (1) The potential costs of bifurcation and consequent value-chain decoupling are prohibitive to both China and the U.S. Resistance is likely to grow by U.S.’ own MNEs and allies; (2) Washington decision-makers overstate the threats that ‘China’s rise’ poses to the survival of the liberal world order; and (3) China’s techno-nationalistic threats are likely to dissipate after a period of escalation, as a result of its own resource constraints, increasing costs of key programs, and inability to sustain in the long run its rapid innovation processes due to growing central controls. We conclude the paper by outlining an approach to maintain an open global economy and secure innovation systems.

Using AI To Predict What We Already Know

We develop early warning models for financial crisis prediction by applying machine learning techniques to macrofinancial data for 17 countries over 1870–2016. Most nonlinear machine learning models outperform logistic regression in out-of-sample predictions and forecasting. We identify economic drivers of our machine learning models using a novel framework based on Shapley values, uncovering nonlinear relationships between the predictors and crisis risk. Throughout, the most important predictors are credit growth and the slope of the yield curve, both domestically and globally. A flat or inverted yield curve is of most concern when nominal interest rates are low and credit growth is high.

The thing is, we already know this. Rapid credit growth is a predictor of future bank credit problems, and the yield curve is our best predictor of future recessions (decrease in growth).

Anecdotal Updates

Decoupling - Chip Wars

TSMC Delays Start of First Arizona Chip Factory, Citing Worker Shortage (Bloomberg)

Highlighted this risk back in the Jan 31, 2023 Perspective

Decoupling - Dedollarization Is Popular With Countries Without Dollars

Jamie Dimon’s Hurricane Hit Barry Sternlicht

Billionaire Sternlicht Sees ‘Category 5 Hurricane’ Spurred by Fed Rate Hikes (Bloomberg)

“You could see a second RTC,” Sternlicht said, referring to Resolution Trust Corp., the government entity charged with liquidating assets of the savings and loan associations that failed in the late 1980s and early 1990s.

“You could see 400 or 500 banks that could fail,” he said. “And they will have to sell. It also will be a great opportunity.”

Bullshit

What I’m Listening To

GWAR performs an NPR Tiny Desk concert

Probably the least likely band to ever play Tiny Desk. No blood anywhere; iykyk

Sex Cow in G flat minor; I’ll Be Your Monster Baby; Rat Catcher; Phantom Limb