Perspective on Risk - July 3, 2024

Corporate BS; Fiscal Dominance; Incentives; Insurance (and cow farts)

Happy 4th everyone.

Corporate BS

Read this quote from the president of McCormick on their latest earnings call:

Our differentiated results demonstrate the success of our prioritized investments to accelerate volume trends and further capitalize on the underlying growth of our categories.

How about just saying:

Our results show that our investments are increasing sales and taking advantage of market growth.

Do they think their language helps attract investors?

My new favorite thing is to have ChatGPT translate corporate BS into English.

Fiscal Dominance

I first wrote about this back in May 15, 2023 Perspective. I wrote about this again on July 17, 2023. It’s been a recurring concern for a while. Fidelity’s Jurian Timmer had a nice tweet stream I am copying here.

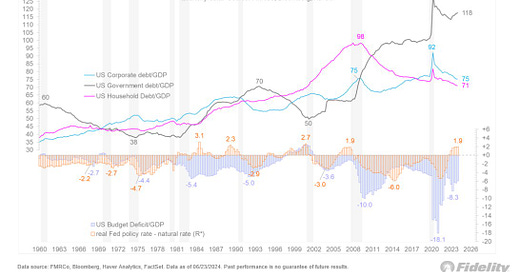

We are now in an era of fiscal dominance, with deficits running at 7% of GDP with no end in sight. The US is now spending more than a trillion dollars on debt service, and projections from the Congressional Budget Office (CBO) give little reason to expect this to improve. The big question is what role the Fed will play in this new regime.

For now, the Fed is on the other side of fiscal policy, keeping monetary policy restrictive while fiscal policy is loose. Debt levels are high, although relative to GDP they are below the 2020 extreme.

This divergence between fiscal and monetary policy may be what is keeping the dollar bid these day. …

And while rising debt levels often lead to punishment of the currency (especially when they are monetized by central banks, as is the case in Japan), that hasn’t happened in the US.

Perhaps this reflects the superior demographic growth in the US vs other major regions like the Eurozone, Japan, and China. Or perhaps it’s the potential of the US economy to stay ahead of a debt trap via the AI revolution that is now underway. As long as GDP is growing faster than the debt stock, a fiscal crisis can be avoided, so boosting the economic speed limit through demographics or productivity is the great hope.

Brings us back to two of the three big picture forces: demographics and technology.

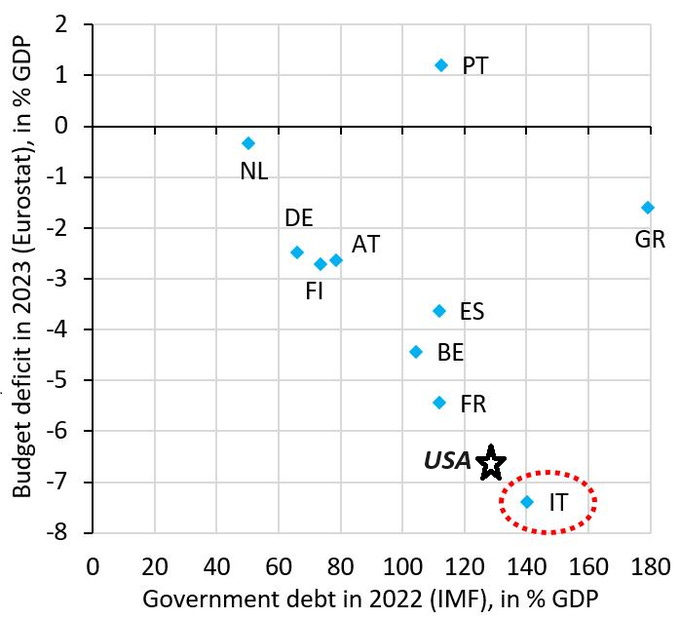

The US is not alone, but it is an outlier:

Incentives

Is vehicle weight associated with risky driving behavior? Analysis of complete national records

Using complete national data of the car fleet and police-issued speeding tickets over the course of an entire calendar year in Israel, we examined the association between vehicle mass and risky driving behavior in terms of speeding tickets. Controlling for consumers’ choice of car, our results indicate a positive association between vehicle mass and speeding tickets, suggesting that larger, heavier vehicles are associated with risky driving behavior.

… and demographics and xenophobia

South Korea considering £59k incentive for each child born amid declining birth rate

South Korea is considering paying parents 100 million won (£59,000) in cash for each baby born in a bid to boost the country’s diminishing birth rate.

Iran Incentivizes Religious Leaders to Boost Population

Amir Hossein Banikipour, a member of the Parliamentary Cultural Commission, announced a plan to award the "best Friday Prayer leader" for their efforts in boosting the country's declining fertility rates. … The planned National Population Awards next year will commend clerics who excel in promoting higher fertility rates among their congregations.

Have four or more babies in Hungary and you’ll pay no income tax for life, prime minister says (CNBC)

Giving his annual State of the Nation address Sunday, Hungarian Prime Minister Viktor Orban announced a seven-point “Family Protection Action Plan” designed to promote marriage and families.

Measures announced included waivers on personal income tax for women raising at least four children for the rest of their lives and subsidies for large families to buy larger cars. The ‘action plan’ also extended a loan program to help families with at least two children to buy homes. Every woman under 40 will also be eligible for a preferential loan when she first gets married.

Insurance

Increasing Disaster Risk

Property Insurance and Disaster Risk: New Evidence from Mortgage Escrow Data

… First, we find a sharp 33% increase in average premiums from 2020 to 2023 (13% in real terms) that is highly uneven across geographies. This growth is associated with a stronger relationship between premiums and local disaster risk: A one standard-deviation increase in disaster risk is associated with $500 higher premiums in 2023, up from $300 in 2018.

Second, using the rapid rise in reinsurance prices as a natural experiment, we show that the increase in the risk-to-premium gradient was largely caused by the pass-through of reinsurance costs.

Third, we project that if the reinsurance shock persists, growing disaster risk will lead climate-exposed households to face $700 higher annual premiums by 2053.

Our results highlight that prices in global reinsurance markets pass through to household budgets, and will ultimately drive the cost of rising climate risk.

Related: Insurance Rates Are Soaring for US Homeowners in Climate Danger Zones

Physical Climate Risk

Measuring the Climate Risk Exposure of Insurers (NY Fed)

Insurance companies can be exposed to climate-related physical risk through their operations and to transition risk through their $12 trillion of financial asset holdings. We assess the climate risk exposure of property and casualty (P&C) and life insurance companies in the U.S. We construct a novel physical risk factor by forming a portfolio of P&C insurers’ stocks, with each insurer’s weight reflecting their operational exposure to states associated with high physical climate risk. We then estimate the dynamic physical climate beta, representing the stock return sensitivity of each insurer to the physical risk factor. …

Our findings indicate a positive association between larger exposures to risky states and higher holdings of brown assets with higher sensitivity to physical and transition risk, respectively.

ChatGPT had a pithy summary:

This paper makes a solid effort to identify causal relationships, but like a weather forecast, it's not foolproof. Their methods are strong, and the correlations are clear, but establishing true causality would need more rigorous controls and perhaps real-world experimentations, which are challenging in this context.

Model Risk In Insurance

As background, insurers generally rely on two vendors to provide model-based estimates of catastrophe risk. These vendors periodically update their models.

Notable how RMS model update triggered wave of cat bond selling activity: Tenax (Artemis)

It is notable how the recent update of one of the main hurricane risk models triggered a wave of selling in the catastrophe bond market, investment manager Tenax Capital has commented.

As we reported recently, the update of the Moody’s RMS hurricane model to version 23 had triggered a response in the catastrophe bond market, with at least a portion of recent cat bond spread widening attributed to it.

While some thought this model update would not have any effect on catastrophe bonds, that has turned out not to be the case.

Tenax Capital explained that it noted the effect of the risk model change, saying that, “A recent update to a vendor model has led to more conservative risk metrics, influencing the adjustment of the expected risk-reward profile for several bonds.”

The investment manager said, “It is also noteworthy how such an update can trigger a wave of selling activity, with spreads widening as bondholders suddenly realize they are exposed to risks beyond their comfort levels.”

CA To Allow Forward-Looking Predictive Models For Pricing

California Reveals Fire-Prone Areas It Wants Insurers to Cover

California, rushing to halt an exodus of property insurers fleeing wildfire risk, has designated regions of the state where companies will be required to provide coverage in exchange for new industry-friendly regulations.

Faced with rising risks tied to climate change, the state is developing rules to allow insurers to request rate increases based on forward-looking catastrophe models — computerized simulations of potential disasters – instead of historical data. Companies will be allowed to use the predictive models once the new rules are implemented, but they must first publicly commit to underwriting new policies in wildfire zones.

Related: California’s firefighters can’t get fire insurance; Major Insurer for Seniors Stops Insuring New Homes in California; California Sees Two More Property Insurers Exit From Market

Artificial Intelligence can provide accurate forecasts of extreme floods at global scale

Global prediction of extreme floods in ungauged watersheds

Here we show that artificial intelligence-based forecasting achieves reliability in predicting extreme riverine events in ungauged watersheds … we achieve accuracies over five-year return period events that are similar to or better than current accuracies over one-year return period events.

Addressing Climate Change

Taxing The Cow Fart Externality

World’s first carbon tax on livestock will cost farmers $100 per cow (CNN)

Dairy farmers in Denmark face having to pay an annual tax of 672 krone ($96) per cow for the planet-heating emissions they generate. The country’s coalition government agreed this week to introduce the world’s first carbon emissions tax on agriculture. It will mean new levies on livestock starting in 2030.

I mean, it is a real externality.

$100 per cow per year is also within the range of empirical social cost, which Gemini estimates at $140 per cow (based on EPA estimates)1

Some Things I’ve Recently Learned

Hurricane Beryl is now the earliest cat 5 on record, beating Emily 2005 by 2 full weeks.

Amazon now has over 750,000 robots deployed. Each robot packer at a warehouse can replace 24 workers2

The National Weather Service is forecasting Death Valley to hit 130°F (54.4°C) next Monday, which would tie the highest the highest temperature ever reliably recorded on Earth.3

Two instances of the LLM Claude have been talking to each other. They have a safe word to end the conversation in case of ‘psychic distress’, as well as a human observer. Recently, for the first time, one version asked the human to intervene to help the other versions distress.4

We used to be a proper country.

The EPA estimates for the social cost of methane (SC-CH4) and carbon dioxide (SC-CO2) are provided in dollars per metric ton. To determine the 'per cow' externality cost per year, we will convert the annual methane and CO2 emissions from grams to metric tons, then multiply by their respective social costs.

Given values:

SC-CH4 = $1500 / metric ton

SC-CO2 = $0.12 / kilogram (upper bound of EPA estimate)

Annual CH4 emission per cow = 91250 grams

Annual CO2 emission per cow = 182500 grams

We will calculate the externality cost for methane and carbon dioxide separately and then sum them to find the total 'per cow' externality cost.

Python

# Annual CH4 and CO2 emissions per cow in grams (from previous information)

CH4_emissions_g = 91250

CO2_emissions_g = 182500

# Social costs per metric ton (from EPA estimates)

SC_CH4 = 1500 # USD per metric ton of CH4

SC_CO2 = 19 # USD per metric ton of CO2 (using the lower end of the EPA range)

# Convert emissions to metric tons

CH4_emissions_tonnes = CH4_emissions_g / 1e6

CO2_emissions_tonnes = CO2_emissions_g / 1e6

# Calculate annual externality costs

CH4_cost = CH4_emissions_tonnes * SC_CH4

CO2_cost = CO2_emissions_tonnes * SC_CO2

# Total annual externality cost per cow

total_cost = CH4_cost + CO2_cost

# Print the result

print(f"The total annual externality cost per cow is: ${total_cost:.2f} USD")Code output

The total annual externality cost per cow is: $140.34 USD

Using the EPA estimates, the total annual externality cost per cow is approximately $140.34 USD.https://x.com/OrderflowES/status/1807494694785404934

https://x.com/US_Stormwatch/status/1807933502500774281

https://x.com/AISafetyMemes/status/1807634649075900538