Perspective on Risk - June 27, 2024

Snarky; Resolution Plans; Basel III tidbit; Inflation; Transparency & Market Discipline; CRE; Private Credit; Levine on Prime Brokers; More Things

I’m Just Feeling Snarky

OCC Report Highlights Key Risks in Federal Banking System

The OCC reported that the overall condition of the federal banking system remains sound.

Have you ever said the system was unsound?

Credit risk is increasing.

When is the last time it was decreasing? Is it increasing off of a low base, or high?

From a market risk perspective, net interest margins (NIMs) are under pressure due to strong deposit competition.

Again, has it ever not been under pressure? Has competition ever been weak?

Operational risk is elevated.

Yes, but is it increasing? Sorry. lol. Has it ever been anything other than elevated?

The OCC has been conducting discussions with banks with more than $100 billion in total assets to understand climate-related financial risk management programs.

This is cited as a key risk in the Report - why didn’t it make the News Release (don’t answer, it was a rhetorical question)

And why no mention in the key risk section of the unrealized losses in the banking sector?

I actually think that this report has become dumbed down over the last decade, and not as useful as in the past. You can do better OCC.

Basel III

Federal Reserve Floats Weaker Version of Planned Bank-Capital Overhaul (Bloomberg)

I just want to comment on one pernicious line:

American officials have said that most US banks have enough capital to meet the higher requirements, which could be phased in starting in 2025 if approved.

This is only true if firms are willing to have an increased probability of breaching the minimum capital threshold.

Stay with the ‘over.’

Resolution Plans

Realistically, it’s funnier that regulators think Citi and their brethren can be wound down in accord with the plans.

Regulators hit Citigroup, JPMorgan Chase, Goldman Sachs and Bank of America over living will plans (CNBC)

Regulators found fault with the way each of the banks planned to unwind their massive derivatives portfolios.

… when asked to quickly test Citigroup’s ability to unwind its contracts using different inputs than those chosen by the bank, the firm came up short, according to the regulators. That part of the exercise appears to have snared all the banks that struggled with the exam.

Unstated in the headline is that Bank of NY Mellon, Morgan Stanley, State Street and Wells Fargo “passed.”

A majority of the Federal Deposit Insurance Corp. board determined in a closed-door meeting on Thursday that the bank’s so-called living will was deficient, said one of the people, who asked not to be identified speaking about the private discussion.1

The FDIC Board is comprised of four FDIC officials and the OCC’s Hsu. Presumably, Hsu is the dissenter.

Here is the Press Release: Agencies announce results of resolution plan review for largest and most complex banks. The individual feedback letters can be found there.

Specific to the derivatives deficiencies:

Citigroup Inc.: The firm's resolution forecasting tools and systems demonstrated a lack of capability to incorporate updated stress scenarios and assumptions. Ongoing weaknesses in data reliability and compensating controls contributed to materially inaccurate calculations of resolution capital execution needs (RCEN) and resolution liquidity execution needs (RLEN). The magnitude and impact of these weaknesses led the FDIC to consider them a deficiency.

The Goldman Sachs Group, Inc.: The firm's resolution plan lacked the ability to segment its derivatives portfolio with the necessary granularity to accurately measure exit timing, costs, and difficulty of unwinding in a resolution scenario. This raises questions about the reasonableness of the derivatives unwind related to liquidity and cost estimates, and consequently, the ability of the firm to implement this aspect of its preferred resolution strategy.

JPMorgan Chase & Co.: The firm was unable to update certain economic conditions in its entity-level resource needs calculation of RCEN and RLEN associated with unwinding its derivatives portfolio in a timely manner. Furthermore, the firm did not accurately incorporate funding assumptions as specified by the Amended and Restated Support Agreement dated June 5, 2019, as amended, in the current resolution metrics production process.

Bank of America Corporation: The firm's systems could not incorporate dates outside the usual business process for certain derivatives, raising concerns about the accuracy of resource needs estimates in a resolution scenario.

Inflation

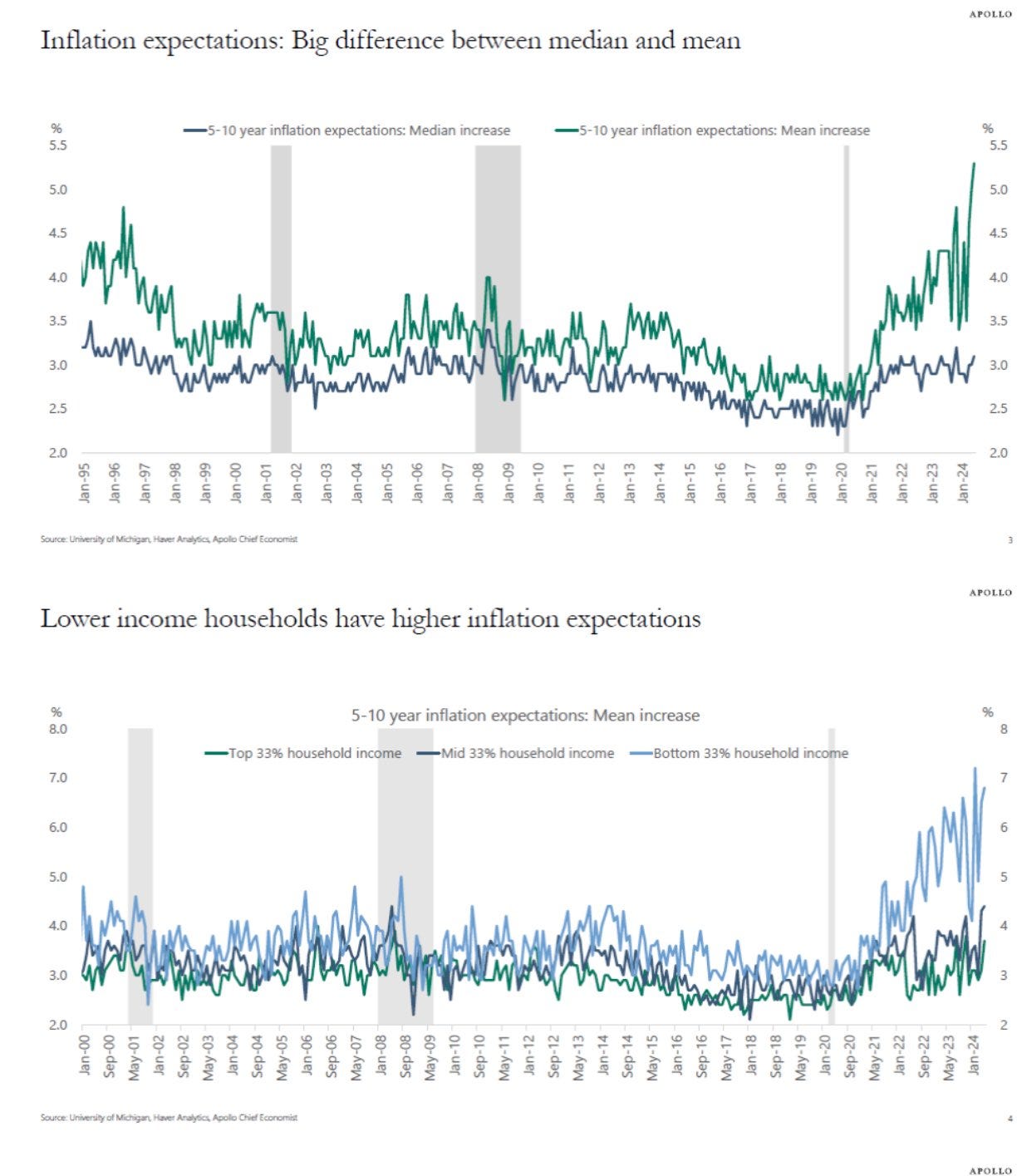

Torsten Sløk, Apollo Chief Economist, thinks Inflation Expectations Becoming Unanchored

There is a major gap opening up between the mean and the median of long-term inflation expectations, which means that half of the population has long-term inflation expectations that are dramatically higher than the other half. ... This is a very significant challenge for the Fed because it cannot cut interest rates when inflation expectations are out of control.

Low income households in particular think inflation will remain higher.

Transparency & Market Discipline

Goodwill Gone Bad

Quant chart: Has goodwill accounting gone bad? (Robeco)

Before 2000, reported goodwill accounted for approximately 3% and 7% of total assets for developed markets outside the US and the US, respectively. However, following the accounting reforms in the early 2000s, these numbers quickly increased to about 11% and 15%.

10-K Complexity

10-K Complexity, Analysts’ Forecasts, and Price Discovery in Capital Markets

This paper examines whether 10-K complexity has unintended consequences in terms of impairing price discovery in capital markets. More specifically, we examine the impact on market efficiency of sell-side financial analysts’ first revised forecasts following publication of high- versus low-complexity 10-Ks. We find that:

analyst underreaction to 10-K information increases with complexity; and

the impact of analyst underreaction on stock price efficiency also increases with 10-K complexity.

Our results suggest that analyst forecasting behavior in response to complex 10-K information constrains price discovery in capital markets.

BREIT’s (“not reliable”) Disclosures

More on BREIT below, but I wanted to highlight this section on their disclosures (courtesy of the The Big Bad BREIT Post: Bakstack)

BREIT’s self-reported performance is – by their own admission – “not reliable.”

According to their prospectus, Blackstone values the fund itself once a month; then once a year it brings in an outsider who prepares a valuation based on their direction. But in its March 28, 2023 prospectus amendment, BREIT removed the steps in bold.

a third-party appraisal firm conducts appraisals and renders appraisal reports annually;

an independent valuation advisor reviews the appraisal reports for reasonableness;

the advisor (Blackstone) receives the appraisal reports and based in part on the most recent appraisals, renders an internal valuation to calculate NAV monthly;

the independent valuation advisor reviews and confirms the internal valuations prepared by the advisor.

BREIT will promptly disclose any changes to the identity or role of the independent valuation advisor in its reports publicly filed with the SEC.

The highlighted portions seem to be saying that Blackstone uses baseless returns in their SEC filings. They are not using a methodology prescribed by the SEC or any regulatory body. They do not adhere to any accounting rules or standards. Nor is their monthly NAV calculation audited by an independent public accounting firm. Blackstone uses it solely to determine the price at which the fund will redeem and sell shares. The NAV also happens to dictate the fees they can earn.

BREIT’s disavowal of its NAV for calculating historical performance is unambiguous but Blackstone’s website, press releases, presentations and SEC filings prominently tout returns based on it. Despite this clear admission, they’ve been using it to report performance to the SEC and felt comfortable enough to pay themselves $4.6 billion in asset management and performance incentive fees based entirely on it.

Commercial Real Estate

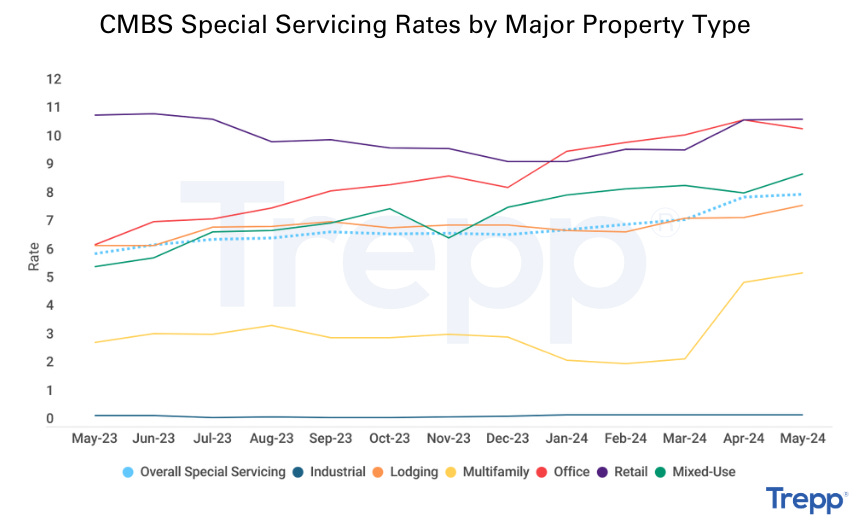

The Trepp #CMBS Special Servicing Rate for office declined for the first time this year in May, falling 32 basis points to 10.52%. Access the report at https://hubs.li/Q02BhfwJ0

Whistling in the graveyard of CMBS (mrzepczynski.blogspot.com)

Available rates for every major city are at or above 20%, delinquencies are at 7% and do not seem to be at a peak. Major firms are walking away from buildings and real estate transactions are showing massive discounts. … The slow walk of a crisis is at hand.

BREIT

As promised, here is Phil Bak’s The Big Bad BREIT Post.

Blackstone’s BREIT Is Far Ahead of Public REITs. … The primary difference between the two is the method used to estimate their value: Blackstone uses a discounted cash flow model to estimate BREITs’ Net Asset Value (NAV) while public REITs use traded market prices.

The yawning gap is due to listed REIT indexes not reflecting their 70/80/90 subsector and geographical portfolio makeup.

If investors think the real estate is worth less than the reported NAV, they have an incentive to pull out cash since the fund buys the shares back at those reported values. ... And that’s exactly what savvy investors did – they entered the queue early.

BREIT uses misleading language when it says, “BREIT has delivered strong returns...” BREIT has not delivered any returns except distributions to 80% of its investors.

BREIT has sold 5,380,409,198 shares since inception and has met redemption requests for just 1,318,817,970 shares. Only investors who bought and redeemed shares have experienced both distributions and changes in NAV. Most of the remaining 76% have been told they cannot sell their shares, so few investors have received what BREIT claims as returns delivered to investors.

How much do you want to bet that there investors haven’t marked down their positions?

One of BREIT’s big selling points was the ability to get a dividend of around 4% when interest rates were near zero, but the fund cannot – and has never been able to - cover the dividend payment. The current Class S distribution of 3.74% and Class I yield of 4.6% aren’t fully earned based on a key REIT cash-flow measure: Available Funds from Operations (AFFO).

Blackstone reports AFFO, but their reported number is janky. It omits the management fees they charge. … BREIT’s AFFO also omits recurring real estate maintenance capital expenditures and stockholder servicing fees which are part of the sales load. Computing an AFFO more consistent with public company peers would result in a payout ratio for the first half of 2023 of more than 250%.

BREITs recurring distributable cash flow doesn’t come close to covering the dividend.

Blackstone is very clear in their marketing materials that distributions are primarily paid through subscriptions, borrowings and asset sales - and not necessarily from recurring cash flow which is typical for listed REITs.

For the first two quarters of 2023, redemptions requests outnumbered honored redemption requests by about 4:1.

The BREIT outflow bear case is playing out. … Even with the gates closed, nearly $70 billion in equity NAV with 47% embedded leverage means that if they allow 20% redemptions per year, they will need $27.6 billion in asset sales. $6.9 billion in real estate sales per quarter; $2.3 billion per month. Unless they can start selling properties at the appraisal-based NAVs, they’re in big trouble.

Maybe it ain’t over until BREIT cracks?

Private Credit

Past Perspectives on Private Credit

Insurer Exposure Increasing

PGIM Seeks Deals to Expand Private-Market Assets to $500 Billion

PGIM is looking to boost its private-market assets by more than 50% to $500 billion in the next five years, with a major push into private credit through acquisitions.

Interesting; while other insurers have increasingly outsourced their privates origination to Blackstone and the like, PGIM seeks to build. This was the path AIG/Corebridge was on before they decided to outsource.

Private Debt Returns

The true return on private debt (Klement)

The chart below shows that the average cumulative return above the risk-free asset is 33.9% in this sample. And since the average lifetime of a fund is somewhere around 5.5 years, that amounts to an internal rate of return (risk-free plus alpha) of 8.6% per year.

Once the performance of private credit is adjusted for the risk factors of both stocks and bonds, the resulting alpha over the lifetime of a fund is… drum roll… -0.1%.

In essence, this research indicates that even in the past, holding private credit was likely not going to improve a portfolio that already was diversified between stocks and bonds.

When Avoiding Markdowns Is Not Enough

The Little-Known Secret to the Success of Secondaries (Institutional Investor)

A 2015 FASB rule allowed buyers to boost their performance, and the market has soared.

… secondaries have another, little discussed, advantage for buyers since the market began to take off in 2015. That year, the Financial Accounting Standards Board decided in a new rule that after purchasing LP interests at a discount, investors can mark them up to the NAV of the private equity fund.

According to a UBS report on secondaries, “The sky-high IRRs of more recent vintage years are driven by initial gains as managers take advantage of acquiring assets at discounts to reported net asset values.”

‘Everything Is Not Going to Be OK’ in Private Equity, Apollo’s Co-President Says (Bloomberg)

Private equity firms didn’t take significant markdowns during the recent period of rapid rate hikes which means that “investors of all sorts are going to have swallow the lump moving through the system,” he said, referring to assets that private equity firms bought up until 2022.

A record $3.2 trillion was tied up in aging, closely held companies at the end of 2023, according to Preqin data.

Late Stage Behavior?

Private Equity’s Latest Move to Gin Up Cash: Borrowing Against Its Stock Holdings (Bloomberg)

Private equity firms have used margin loans backed by shares in companies they’ve taken public to supercharge returns for more than a decade, and to return cash to clients frustrated by the recent drought in asset sales. Industry executives estimate up to $50 billion of the debt is now outstanding.

On top of the margin loans, funds have adopted more novel forms of borrowing against their holdings to free up cash for investors, adding to the proliferation of debt across private equity.

Private Credit Faces Pain From High Interest Rates, Moody’s Says

The rating company is already seeing credit quality deteriorate at some managers. Big direct lending funds managed by BlackRock Inc., KKR & Co., FS Investments and Oaktree Capital Management have already had their credit rating outlook cut to negative from stable by Moody’s on concerns about an increase in their loans on non-accrual status, meaning they’re in danger of losing money on those investments.

Other signs of eroding asset quality, such as an increase in payment-in-kind loans, raise questions about portfolio valuations, according to the report by analysts led by Christina Padgett.

Private Debt Stress Rates Map Closely with Single-B Default Experience

High-Yield Was Oxy. Private Credit Is Fentanyl (Institutional Investor)

Cambridge Associates … points out that comparing default rates on private credit to those on high-yield bonds isn’t an apples-to-apples comparison. A large percentage of private credit loans are renegotiated before maturity, meaning that private credit firms that advertise lower default rates are obfuscating the true risks of the asset class — material renegotiations that essentially “extend and pretend” loans that would otherwise default. Including these material renegotiations, private credit default rates look virtually identical to publicly rated single-B issuers.

Bank Funding of Private Credit

Nicola Cetorelli writes in Nonbanks Are Growing but Their Growth Is Heavily Supported by Banks (NY Fed - Liberty Street)

… the chart below shows that banks’ term-lending to NBFIs grows considerably as a share of their total term-lending (to NBFIs and non-financial corporations), suggesting that the last decade’s growth in NBFI assets has been coincident with an increase in bank financing of NBFIs.

This level of funding/liquidity dependence of NBFIs on banks is even stronger if we look beyond the balance sheet and focus our attention on contingent liabilities, that is contractual obligations under which banks provide committed lines of credit that NBFIs can draw down as needs arise. The chart below shows the aggregate time-series of banks’ credit lines to NBFI counterparties, as reported by the stress-tested largest bank holding companies.

The Systemic Risk Of Private Credit

The Chicago Fed is rightfully considering whether private credit on insurers balance sheets poses a systemic risk. These are a nice set of articles for those interested in the intersection of (US) insurance and private credit.

Privately Placed Debt on Life Insurers’ Balance Sheets: Part 1—A Primer

Privately Placed Debt on Life Insurers’ Balance Sheets: Part 2—Increasing Complexity

Part 1 provides some interesting trend information:

Since 2013, life insurers’ private placement holdings have shifted toward higher-rated investment grade securities (rated AAA to A), while their public bond holdings have shifted toward lower-rated BBB securities (see figure 2). The declining credit quality of life insurers’ publicly traded bonds is likely a result of the corresponding decrease in AAA- to A-rated public debt issuance, rather than an active shift on the part of insurers. However, over the same period, life insurers have been purchasing more AAA- to A-rated private placements, perhaps to maintain the overall credit quality of their portfolios.

Despite the trend of investing in higher-rated private placements, the credit quality of life insurers’ publicly traded bond portfolios is better than that of the private placement portfolios

They acknowledge something we have been stating, namely that insurers may be better holders of this debt than banks:

One benefit of private placements is that their maturity composition better aligns with life insurers’ preferred investment strategy of duration matching than publicly traded bonds. Life insurers prefer to invest in assets that match their long-dated (20-plus year) liabilities. As shown in figure 5, the vast majority of public bonds are issued with maturities of less than ten years, while 15% are issued with maturity of ten to 20 years, and 17% have maturities of greater than 20 years (see column 1).

In part 2 they get into the perceived risks:

We start by documenting that these investments have shifted toward issuers in financial and real estate sectors. We then show that this shift reflects more lending to asset managers, including private direct lending funds. One reason for this shift to financial issuers is that these private placements tend to be more complex and less liquid, resulting in higher yields. Lastly, we show that, while private placements can be sold in the secondary market, liquidity in this secondary market is significantly lower than in the secondary market for publicly traded corporate bonds. The growing investment in this less liquid asset class therefore increases the risk of fire sales during times of crisis.

Within the financial sector, life insurers’ investments are concentrated in asset managers, specialty finance, lenders that operate outside of the traditional banking sector and often serve nontraditional business and industries, and real estate entities, including REITs.

They conclude:

Life insurers have significantly increased their holdings of private placements and within private placements, have shifted investments toward more complex issuances. While private placements can be traded, they typically are less liquid than public bonds. Moreover, the investor base is limited for some private placements as the terms of deals are tailored to life insurers with their unique long-duration liabilities. These concerns are particularly salient for more complex private placements, which tend to have an even smaller investor base and as a result, tend to have even lower liquidity than other private placements. Hence, while a life insurer may be able to sell some private placements without large discounts when facing an idiosyncratic liquidity need, the liquidity of private placements, especially for more complex issuances, is likely to diminish during an economy-wide liquidity shock affecting all life insurers. From a systemic risk perspective, continued increases in private placement holdings, and especially in more complex securities, raises concerns about life insurers’ liquidity position in times of stress.

So close. I guess they had to say this, it’s the Fed after all. They just needed to take the next step.

The complexity/liquidity argument posed would affect any holder. So who do we want to be the holder? They’ve already made the point that insurers may be better holders of this paper than banks.

The next step is to say are the capital regulations and resolution regime compatible with these types of holdings? The answer is certainly that in the US the regime is more friendly than the increasingly mark-to-market approach at the banks. And most importantly, rather than being closed over a weekend, insurer death is a much slower process, with firms put into receivership with many of their assets and liabilities allowed to run off (and pull to par) over time.

Private Credit Bank Linkages

Nonbanks Are Growing but Their Growth Is Heavily Supported by Banks (Liberty Street)

Traditional approaches to financial sector regulation view banks and nonbank financial institutions (NBFIs) as substitutes, one inside and the other outside the perimeter of prudential regulation, with the growth of one implying the shrinking of the other. In this post, we argue instead that banks and NBFIs are better described as intimately interconnected, with NBFIs being especially dependent on banks both for term loans and lines of credit.

As I have told you many times, it all comes back to Corrigan’s Are Banks Special?

Was Private Credit Just A Fad For Banks To Offload Credit

Banks Transfer Risk to Themselves (Matt Levine)

On the circularity of origination, leverage and investing.

Matt Levine With Instructive Post On Running A Prime Broker

Berkshire Was Too Cheap, Then Too Pricey (Money Stuff)

Jefferies calls CEO Rich Handler, who is on holiday in Turks and Caicos with a spicy margarita on the way. They tell him Archegos isn’t answering their calls. Handler says he’s going to get his cocktail and he wants Archegos positions gone and a tally of losses by the time he comes back. It was one of the few banks that escaped with minimal losses.

Honestly a great read.

More Things I’ve Learned

Epidemiologists are worried that Bird Flu will make the jump to humans. Finland will already start bird flu vaccinations for humans next week.

China has surpassed Japan to become the world’s leading exporter of automobiles.

To cover the required cost of blending aviation fuel with 2% sustainable fuel, Lufthansa will begin to add an Environmental Cost Surcharge of up to 75 Euros to tickets. This is to pay for the EU’s Sustainable Aviation Fuel requirements. The SAF quota will increase from 2% in 2025 to 6% in 2035, 20% in 2030 and 70% in 2050.

In 2004, it took a year to install a gigawatt of PV globally. In 2010, a month. In 2016, a week. In 2023, a day. In 2024, half a day.2

The exponential growth of solar power will change the world (The Economist)