Perspective on Risk - June 4, 2024

Where Are We; SLOOS; Not The Way To Handle Real Estate Problems; Investors Push HFs For Cash Hurdle Rate; FinReg; Ph.D. Duration; Private Credit (w/ Levine); Discount Window is Boring; Bailey; More

Not my best work. Go read the May 25th post. It’s better than this one. Central bank geeks will want to read the Bailey piece on reserves and the Kaminska comments.

Where Are We

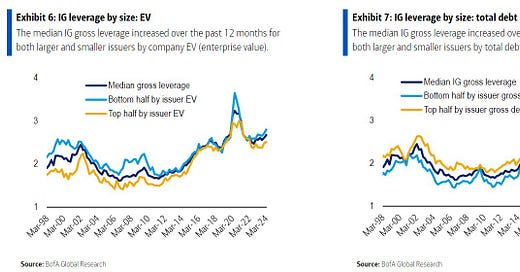

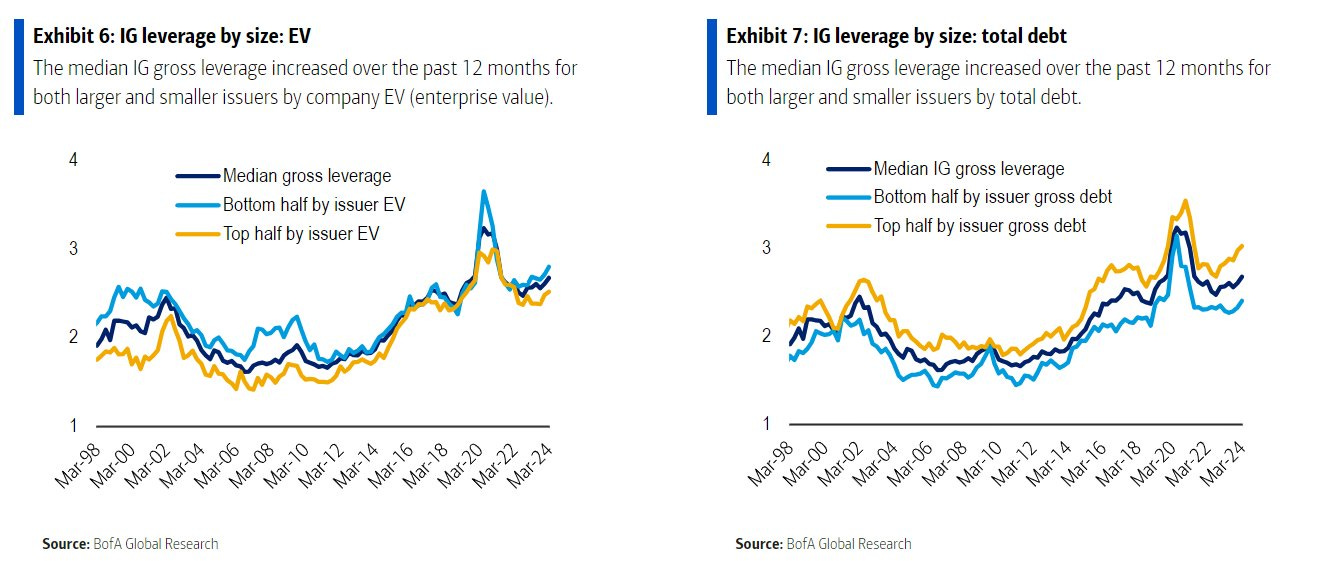

Leverage is Up, and Spreads Are Tightening

Shady’s Back, and So Are PIKs

Private Credit Has a New Workaround to Allow Borrowers to Defer Interest Payments (Bloomberg)

Synthetic PIKs let firms use additional loans to pay interest

Direct lenders including Blue Owl Capital Inc. have pitched deals in recent weeks that include a “synthetic PIK,” a feature that lets companies make some of the interest payments with additional borrowing without having to count the debt as being serviced “in kind,” according to people with knowledge of the matter.

In a synthetic PIK, lenders provide a company two separate pieces of debt: the main loan the company planned to borrow in the first place, plus a smaller delayed-draw term loan that sits at the same level in the capital structure and has similar terms.

Banks can impose terms on the facilities, including a cap on the share of PIKs in the portfolio, which helps guard against an excess of lower-quality credits in the collateral pool. However, synthetic PIKs don’t count toward the cap, the people said.

The second advantage concerns rules on Business Development Companies, a common private credit retail product. BDCs must pay out 90% of taxable income in cash, even when that income comes from payments-in-kind.

PIKs Are Going Public

Banks Are Now Targeting Some of Private Credit’s Riskiest Debt

“A lot of sponsors have been doing PIK but in the private market,” said Luke Gillam, co-head of EMEA credit capital markets at Goldman Sachs. “This is now the chance to use the public markets to refinance those instruments, which are much cheaper than private credit.”

In many cases, the private debt can be refinanced as PIK toggle bonds, which give borrowers the option to delay interest payments until the notes’ final maturity.

Some banks are even pitching PIKs as a tool to fund dividends. Such deals were popular during the easy money era, as well as in the run-up to the 2008 financial crisis.

Shady’s back.

Recovery Rates Are Falling

One of the first things Til Schuermann taught me is that recovery rates are bimodal. What Do We Know About Loss Given Default? We appear to be at/past the switching point in this cycle.

Loan Frenzy Masks Rising Losses on Defaults: Credit Weekly (Bloomberg)

For newly issued first-lien debt in the US and Canada in the first quarter, investors could expect to get back less than 35% of their investment when loans sour, compared with 72% from 2018 through 2022, according to a presentation this month by S&P Global Ratings.

More SLOOS

I wrote a bit about the SLOOS in Perspective on Risk - May 10, 2024

Now, Fed Board economists have written Measuring Bank Credit Supply Shocks Using the Senior Loan Officer Survey

In this note, we present a measure of credit supply shocks that exploits bank-level responses to the Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices (SLOOS) applying a variation of the methodology introduced by Bassett et al. (2014), which consists of purging banks' responses regarding changes in lending standards from the influence of macroeconomic, financial, and bank-specific factors.

Our estimates show that in the second half of 2022 and the first quarter of 2023 there was a sizable negative bank credit supply shock, as banks restricted credit supply in excess of what would have been expected given the historical empirical relationship between past bank lending standards, determinants of borrower demand, banks' characteristics, and changes in the macroeconomic outlook.

Not The Way To Handle Real Estate Problems

Extend and pretend, and avoid marking down prices.

China’s Top Cities Ease Housing Rules as Beijing Extends Aid (Bloomberg)

Shanghai and Shenzhen reduced downpayment requirements by 10 percentage points to a minimum of 20% for first-time buyers and 30% for second-home purchasers, according to two separate statements on Monday and Tuesday. The floor for mortgage rates was also lowered.

Investors Push Hedge Funds For Cash Hurdle Rate

An interesting letter is circulating; a number of investors/allocators are pushing for cash hurdle rates on incentive fee arrangements.

We, the undersigned investors and consultants, advocate for the implementation of cash hurdles in incentive fee arrangements across the hedge fund industry. The long-term health of the industry is dependent on a healthy alignment of interests between GPs and LPs, and we believe incentive payments on true value-add fixes a misalignment that has been present in fee structures throughout the maturation of the hedge fund industry.

cash hurdles better promote proper risk taking, as the financial health of the GP is dependent on delivering the valuable good LPs seek – alpha.

Seems to make some sense, but we’ll see if it gets traction.

Financial Regulation

Toxic Politicisation

The toxic politicisation of financial regulation (FT)

Last week, Marty Gruenberg, the Democrat chair of the Federal Deposit Insurance Corporation, an important banking supervisor, tendered his resignation. … Only with Gruenberg in place does the FDIC board have a 3-2 Democrat majority to push through a tougher set of bank capital requirements, dubbed the Basel III Endgame, over the coming months. … So far, Gruenberg seems to have outsmarted his critics, specifying that his resignation will apply only once a successor is anointed.

Should Central Banks Formally Target Financial Conditions

In Financial Conditions Targeting, several prominent economists have suggested that central banks announce “a soft target for some measure of financial health — eg the Chicago Fed National Financial Conditions Index or the St Louis Fed Financial Stress Index, or the Federal Reserve’s own brand new one.”1

Regulatory Hubris?

Karen Petrou: Why Regulators Fail

… the Vice Chair of the Federal Reserve has been forced to concede that the end-game capital rules that are his handiwork as much as anyone’s will get a “broad, material” rewrite.

Key assumptions were rarely explained and all possibly-problematic results were explained away by the argument the banking agencies have long attempted: no cost is as grave as a systemic crisis and thus anything the regulators think will avert a crisis warrants all costs.

The end-game proposal starts with heart-rending descriptions of the March 2023 banking crisis – one that never should have been systemic in the first place. It then lays this debacle out as the grave ill the proposal would surely cure.

There’s actually much in the end-game rules that makes at least some sense – the 2013 Basel III rules do need an update. But, like the SEC, the banking agencies apparently felt they could get what they want because they wanted it, ultimately putting at risk that which makes sense because even allies despaired of getting the regulators to explain the sense they made.

Yet again I agree with Ms. Petrou (not my usual position)

The Ever Expanding Regulatory Burden

“Mitigating TBTF With Recovery Planning” (Acting OCC Comptroller Hsu)

As a financial regulator in the 2008 financial crisis, I had a front seat to the collapses of Lehman Brothers and AIG. In a way, they represent the two tracks of the trolley problem. With Lehman, the firm filed for bankruptcy and the result was financial instability, while with AIG, extraordinary government actions were taken to protect the financial system and the result was a loss of trust in government.

Neither outcome was right. Strong and effective recovery planning at those firms could have helped in two ways.

I mean, wow. Dick Fuld had a solid six months even if he only thought about action the day Bear failed. They had a possible deal with Korea Development Bank that fell apart based on valuation of Lehman’s assets. Immediately prior to failure, they had talks with both Barclays and Bank of America. No amount of planning was going to save them. I also don’t think the SEC staff can claim a “front row seat” when they left back to DC before the failure.

If a bank is not too big to fail, FDIC resolution should be sufficient.

Important Lessons in Regulatory Impact (Another Karen Petrou)

Once, forward-looking stress-testing was an important complement to point-in-time capital standards. But, moving through the fifteen years since stress-testing began and new rules grew ever stronger, the Fed’s annual exercise has become a rote and opaque-model-driven exercise that no longer anticipates the dynamic nature of likely stresses and regulatory interactions. … the complexity of stress-testing and its capital consequences have created a class of stress-test bureaucrats who readily cycle back and forth between the Fed, consulting companies, and the biggest banks in ways far more advantageous to themselves than to disciplined, innovative, and – yes – tough tests.

So basically what I’ve been saying.

Fed Shortens Ph.D. Duration

One of my most common phrases has been “The Fed is long Ph.D.s. When there is a problem, they throw them at the problem whether they are the correct tool or not.”

Wigglesworth points out in The fading Fed reign of economics PhDs (Alphaville) that this is slightly ebbing.

In a fit of boredom/curiosity, FTAV took a look at the composition of the Fed board and the various regional Fed heads 10 and 20 years ago, and compared them to the new constellation.

A decade ago, 12 out of 17 Fed governors and presidents had economics doctorates, or ca 70 per cent. When Hammack replaces Mester in August, only 10 out of 19 will have one, or 53 per cent. … Two decades ago the reign of econ PhDs was even more dominant, with 14 out of 19 of the top jobs held by people with dismal science doctorates — almost 74 per cent, stats fans.

Banks & Private Credit

Private credit helps drives surge in bank securitisation exposures (Risky Finance)

The boom in private credit helped boost bank securitisation exposures to a record $1.2 trillion at end of 2023 for the largest 11 G-SIB banks, according to Risky Finance analysis of Pillar 3 filings. This compares to $700 billion of securitisation exposures for the same banks in December 2015, when Basel III regulations first required G-SIBs to disclose this information.

Risk-Adjusting the Returns to Private Debt Funds

We evaluate their risk-adjusted returns, applying a cash-flow based method to form a replicating portfolio that mimics their risk profiles. Using both equity and debt benchmarks to measure risk, a typical private debt fund produces an insignificant abnormal return to its investors. … The rates at which private debt funds lend appear to be high enough to offset the funds’ fees and risks, but not high enough to exceed both their fees and investors' risk-adjusted rates of return.

Goldman Racks Up $21 Billion for Its Largest Private Credit Pool

One nascent trend among banks has been to pair up with money managers. “There are unnatural partnerships being formed,” Olafson said.

Matt Levine has a cute anecdote2 that supports the retranching of the financial system discussed previously.

you want to be the outside alternative asset manager managing money on behalf of insurance companies, not the division of the insurance company whose own parent company is cheating on you with outside managers.

Today Bloomberg’s Silas Brown, Paula Seligson, and Esteban Duarte have a story about the bond department of Massachusetts Mutual Life Insurance Co. Wait, no, sorry, that’s wrong: They have a story about the private credit (“Global Private Finance”) team at Barings LLC, an investment management firm that happens to be owned by MassMutual. The Barings private credit team had a mass defection (and accompanying lawsuits) in March, apparently because … they didn’t want to work at an insurance company?

He goes on to quote the Brown story:

Documents seen by Bloomberg show management fees and “carry,” the share of profit fund managers got to keep, were meaningfully lower than at rivals Ares Management Corp. and Tikehau Capital. Some LPs say the leavers grew frustrated about revenue-sharing arrangements with Barings’ head honchos.

And Levine concludes:

Right you want to be the outside alternative asset manager managing money on behalf of insurance companies, not the division of the insurance company whose own parent company is cheating on you with outside managers.

Sounds about right.

I’m Bored With The Discount Window Debate

But if you’re not, here’s a few things:

Federal Reserve’s Discount Window: Policy Issues (Congressional Research Services)

hat-tip to Steven Kelly

Putting the Lender of Last Resort at the Center of Financial Stability (Yale Center For Financial Stability)

Andrew Metrick & Sir Paul Tucker discuss how the Banking Crisis of 2023 reinforced the case for banks to preposition at central banks—& how that could transform financial stability.

Can Discount Window Stigma Be Cured? (Liberty Street)

Over the years, DW policies have been modified on multiple occasions with the explicit objective of promoting DW borrowing and mitigating stigma.

… our results suggest that the latest proposed reform, mandating regular DW borrowing, may ensure operational readiness, but it may not be sufficient to break stigma. In fact, our finding that even extreme interventions, such as making the DW free, may not fully cure stigma raises the question of whether there is any hope of removing the stigma already attached to the Federal Reserve’s DW.

Bailey On Reserves

The importance of central bank reserves by Andrew Bailey (Bank of England)

… whenever money has to be transferred from an account at one commercial bank to an account at another commercial bank, that transaction has to be settled between them. That is where the central bank’s balance sheet comes in. … transactions can be settled by moving these reserves – claims on the central bank – across the central bank balance sheet by debiting one commercial bank’s reserve account and crediting another’s.

As the global financial crisis unfolded later in the decade, wholesale funding markets dried up and it became increasingly difficult for banks to sell securities backed by mortgages or other assets, or to use them as collateral to borrow cash. Banks were now left with an ‘overhang’ of illiquid assets on their balance sheets. The Bank had to widen the collateral it was prepared to accept in its money market operations, and it introduced schemes to allow banks to swap what had become illiquid private securities for UK Treasury bills.

… the process of reserve expansion has now gone into reverse. Asset purchases are being unwound through Quantitative Tightening,… It is this reversal that gives rise to the question of what the level of reserves should be in the future.

Before the financial crisis, monetary policy was implemented with a much lower level of reserves than we have today. That worked well enough for monetary policy. But as we discovered to our cost, the level of liquid assets in the system, including central bank reserves, was too low for financial stability purposes, and this contributed to the scale of the financial crisis.

A key consideration is how much interest rate risk – the exposure to swings in the value of assets as interest rates change – should reside on the central bank balance sheet. (bp: “and how much should be born by institutions in the market.”)

… in line with the fundamental principle of minimising market distortions from central bank operations (principle c.), financial risk is best managed and distributed by the financial sector … So from this perspective, providing central bank reserves through repo-operations has much appeal.

Expanding the pre-positioning of collateral at the Bank is one way in which we can ensure that the system can expand rapidly and at scale when it needs to through secured lending, allowing for a lower level of reserves in ‘normal’ times.

Admittedly, lending this way leaves banks with a higher level of encumbered assets – assets that are effectively set aside to allow banks to access reserves through repos. … It is not clear what level of asset encumbrance is sensible or feasible, especially to allow for sufficient emergency liquidity support.

Iza Kaminska on Andrew Bailey’s speech (Twitter)

the paper also heavily hints that the BoE is moving towards the King/Tucker pre-positioning regime. In such a regime, repos will do the heavy lifting for liquidity distribution. They will do this against pre-positioned (and thus encumbered) collateral representing most runnable liabilities in the system (making runs largely impossible).

Bailey … highlights this is not a costless regime.

An extended/ inflated PMRR (Preferred Minimum Range of Reserves) is a cost to the taxpayer due to the govt debt it absorbs and the interest-rate risk it passes on. This forces the state to de facto underwrite economic intraday idleness through interest rate risk.

The other cost is the BoE becoming an active market player in its own right in terms of lending decisions. … the BoE will become an active state-bank style lender to the economy based on what sorts of collateral it accepts and how it haircuts it.

Some More Stuff

Better To Be Lucky

JGB Back To 1% After 12 years

Norinchukin

Bad Bets Force Norinchukin to Reshape $384 Billion Portfolio

Norinchukin Weighs $7.7 Billion Fundraise to Cover Bond Loss

Commercial Real Estate

Can US offices collapse without breaking something important? (FT Alphaville)

Cutting a long story short: the situation in the US office market is hopeless. But it is probably not serious. Knock them down.

Should central banks target financial conditions? (FT Alphaville)

Archegos Sent Goldman Some Free Money (Bloomberg)