Perspective on Risk - Oct. 20, 2023

Treasury Basis Trade; Blockchain For Settlement; Commercial Real Estate Developments; Honey, I Shrunk The Factor Zoo; Barr Wants More Stress Tests

I really wanted to send out a post on the mortality problems facing the USA, but this banking and finance stuff keeps getting in the way. I spam you enough as it is.

Treasury Basis Trade

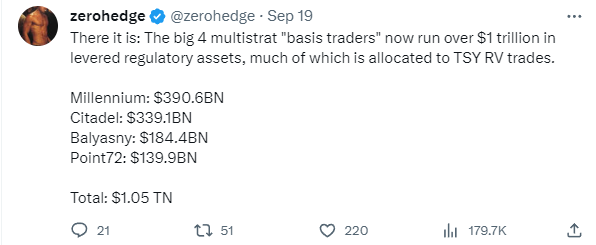

I’ve highlighted back in the Perspective - Sept. 5 and Perspective - Sept. 15 that there was increasing noise around relative value HF’s treasury basis trades. It started with a DC Fed economist paper, and increasingly reports are coming out about regulatory concern.

US Weighs Leaning on Banks to Curb Hedge Fund Leveraged Trading (Bloomberg)

Securities and Exchange Commission Chair Gary Gensler this week sounded the alarm bells. He said on Wednesday that the funding that prime brokerages provide to some hedge funds on a “very generous basis” is the biggest source of risk in the financial system. “If a problem happens, it’s going to be the public that bears the risk of any challenges in this market,” Gensler said in an interview.

Some US officials have recently discussed a 2 percentage-point haircut on Treasury repo borrowing, according to one of the people, who asked not to be identified discussing private conversations.

The idea of a hypothetical minimum haircut of at least that size was floated in a research note by two Fed staffers last month.

“Regulators are right to focus on the relationship between leverage at nonbanks, especially hedge funds, and the banking system,” said Lev Menand, an associate professor at Columbia Law School, who teaches about financial institutions and administrative law. “Bank regulators can use their supervisory powers to examine and assess the safety and soundness of prime brokerage businesses and bank lending to hedge funds.”

And as an aside, I know the Fed and OCC have been watching this space for at least 20 years.

We’ve highlighted before that the US financial system increasingly has risk borne outside of the regulated sector; this trend goes back into at least the 1990s. What this means is that the bank’s prime brokerage units are the gatekeepers on leverage in the system, and there are information asymmetries that make this a difficult job. So the regulators continue to sound caution here; and the Fed worries about the effect on the UST market. This means the regulators will get more proscriptive in dictating things like haircuts; regulators these days seem to love dictating things.

Bloomberg wrote a primer on the basis trade in question: What’s the Basis Trade? Why Does It Worry Regulators?

Blockchain For Settlement

Bitcoin (and the various Shitcoins) have tarnished public enthusiasm for blockchain technology. But the technology itself may be very useful where one needs a public, shared ledger. Here are two recent developments:

JPMorgan Debuts Blockchain Collateral Settlement in BlackRock-Barclays Trade (Bloomberg)

JPMorgan Chase & Co. has gone live with its first collateral settlement for clients using blockchain, as the largest US bank by assets pushes ahead with commercial applications built on the technology at crypto’s core.

JPMorgan’s Tokenized Collateral Network, or TCN, was used by BlackRock Inc. to turn shares in one of its money market funds into digital tokens, which were then transferred to Barclays Plc as collateral for an over-the-counter derivatives trade between the two institutions

JPMorgan also runs a system called JPM Coin, which enables wholesale clients to make dollar and euro-denominated payments through a blockchain network. The bank has used it to process around $300 billion from its launch until June this year. In addition, the company runs a blockchain-based repo application, and is exploring a digital deposit token to accelerate cross-border settlements.

US Clearinghouse DTCC Buys Securrency to Deepen Blockchain Push (Bloomberg)

Depository Trust & Clearing Corp. agreed to buy startup Securrency Inc, part of the main US stock-market clearinghouse’s drive to offer blockchain technology and services for functions like post-trade processing of tokenized assets.

While Wall Street firms have been investing in developing systems using the techonology for almost a decade, few applications have gone live and reached significant usage.

Commercial Real Estate Developments

Commercial Real Estate: We Believe the “Doom Loop” Continues to Unfold (Loomis Sayles)

Fundamentals in the commercial real estate market (CRE) market have deteriorated notably since last March, when the sector came under scrutiny due to the high concentration of CRE loans in smaller regional banks.

Signs of a bank-led credit crunch started to emerge in the CRE sector during 2022 as financial conditions tightened rapidly. The credit crunch appears to have spread to other sectors of the economy, and we are seeing initial signs of rising delinquencies on commercial mortgages on properties of all types. For now, the office sector is showing the most stress, but we expect asset revaluations during a period of highly constrained lending to lead to difficulties in other property types next year.

The banking channel remains a key transmission mechanism for more widespread distress within CRE. Additional shocks from bank failures and capital impairments have the potential to transform the challenging backdrop for CRE into a systemic debt/deflation spiral, in our opinion. With CRE loans representing up to 30% of assets for regional banks, we think the linkage is highly material. We believe the adverse feedback loop we discussed in March is worth reiterating:

Failed banks must sell assets, crystallizing trading losses and eroding their capital positions.

With impaired capital levels, banks tighten lending standards and reduce credit availability.

CRE values drop sharply, leading to widespread negative equity positions and rising delinquencies.

Additional loan distress brings on higher capital charges related to non-performing assets.

This further depletes bank capital and repeats the cycle.

… strained bank capital levels will likely prolong the ongoing credit crunch in commercial real estate. Higher capital requirements restrict banks' ability to absorb even modest losses, leading to a faster pullback in lending. This reduction in credit availability will likely place additional downward pressure on CRE valuations. In turn, further declines in collateral values appear destined to result in a new wave of credit losses for banks with heavy exposures to distressed CRE loans.

Important point in that last paragraph; the CRE losses are coming at a time that the regulators are increasing capital requirements. Talk about pro-cyclicality.

Brookfield’s ‘core’ weakness (FT Alphaville)

Brookfield Property Partners, known as BPY … no longer covers the cost of its debt

BPY’s income from real estate in the first half of the year was less than it paid out in interest costs, prompting S&P Ratings to warn this month that it may cut the entity’s credit rating to junk.

Woes Grow at Credit Suisse’s Ailing Property Funds (Bloomberg)

Credit Suisse’s flagship real estate fund saw the value of its portfolio plunge by 9% in the third quarter as the global property correction accelerated.

The Credit Suisse Real Estate Fund International is trying to sell “several properties in a challenging market environment,” it said in a statement Friday. It’s also seeking to diversify its portfolio, it added.

Pimco Fund Walks Away From 20 Hotels With $240 Million of Debt (Bloomberg)

A joint venture tied to a Pacific Investment Management Co. fund surrendered a portfolio of 20 hotels with a $240 million mortgage.

The Pimco portfolio, valued at $326 million when the debt was originated in 2017, was cut 16% to $272.8 million in a December appraisal.

Pimco defaulted on a portfolio of office buildings with $1.7 billion of debt earlier this year but continues to negotiate with lenders “as to the best path forward to maximize recovery,” according to a commentary on the commercial mortgage-backed security.

Honey, I Shrunk The Factor Zoo

The number of factors allegedly driving the cross-section of stock returns has grown steadily over time. We explore how much this ‘factor zoo’ can be compressed, focusing on explaining the available alpha rather than the covariance matrix of factor returns. Our findings indicate that about 15 factors are enough to span the entire factor zoo. This evidence suggests that many factors are redundant but also that merely using a handful of factors, as in common asset pricing models, is insufficient. While the selected factor styles remain persistent, the specific style representatives vary over time, underscoring the importance of continuous factor innovation.

Using a comprehensive set of 153 U.S. equity factors, we find that a set of 10 to 20 factors spans the entire factor zoo, depending on the selected statistical significance level.

Barr Wants More Stress Tests

I’ve written before on how Fed. Gov. Barr wants to increase the number of stress tests that the banks run. Stress tests set the amount of buffer capital that institutions need to hold. He has reiterated this intent in a recent speech Multiple Scenarios in Stress Testing. So let’s dive in

While our stress test is an important measure of the strength and resilience of the banking system, we must recognize that it does have limitations, as does any exercise. I'll walk through three limitations and explain how they can be at least partially mitigated by incorporating multiple exploratory scenarios into our stress test program.

Multiple scenarios will certainly provide more information and are a best-practice for firm’s internal risk management. In other words, they are useful for micro-prudential purposes; whether they are needed for macro-prudential purposes is a different question.

Limitations of Stress Testing

The failures of three large banks last spring showed that acute banking strains can emerge even without a severe recession. A single scenario cannot cover the range of plausible risks faced by all large banks.

We also do not take into account second-order effects of stress within the financial system, which are channels that amplify the effects of the shocks hitting bank's balance sheets, leading to losses spreading throughout the financial system.

The third limitation is how the stress test affects bank behavior. Using scenarios that test for the same underlying risks year after year could disincentivize firms from investing in their own risk management as the test becomes predictable, and may encourage concentration across the system in assets that receive comparably lighter treatment in the test.

On the first point, sure, banks have different strategies. But the basis of the Basel capital models is that banks face a “single systematic risk factor.” In the tail, it is generally credit losses that drive failure. The failure of the regional banks 1) debatably was not systemic, 2) was caused by a lack of limits and capital on interest rate risk. If you are stress-testing to the regulatory capital ratio, and you don’t include unrealized losses, the rate-up scenario will still not bite.

The second point is, I believe, incorrect. I believe, for the large dealer banks, the stress test includes the failure of their largest counterparty. But further to this, the way the Bank of England is considering macro-prudential stress-tests seems wiser.

The third point is outrageous! Regulator-mandated stress testing crowds out resources that could be devoted to internal risk-management stress testing. It certainly did where I worked. It prevented us from running those additional scenarios requested in the first point that would have uncovered institution-specific risks. It is the REGULATORS that specified the scenarios with only minor variation. Risk managers at firms did question why the Fed was continuing with the same old stress test when the environment had changed.

Exploratory stress test scenarios could mitigate these and other risks. … Given the limited number of unique bank business models and variables that drive losses, a relatively small number of scenarios may be all that is required to capture a wide range of outcomes for the banking system.

Yes, but at what cost? This is something that supervisors should insure that firms are doing for their own risk management. Belying his first point, if there are different business models with different risks, then why subject firms to running stress tests that are inappropriate for their business model?

On the macroeconomic side, additional scenarios could be used to explore the effects of qualitatively different macroeconomic and financial environments.

Again, see the Bank of England’s proposed approach.

With respect to market risk, the current single market shock used in the test is a one-time shock to several thousand variables in bank trading books. This is just one realization of a large set of risk factors that determine changes in market values. Using additional market shocks would help us understand how the trading books and counterparty concentrations of firms would change under a range of financial conditions.

This is true, and MIGHT provide information if firm’s risk positions are structural rather than tactical and subject to change. I’m moderately skeptical.

A current use of the stress test is to help set capital requirements for large banks to help prepare firms to withstand a severe economic recession and continue to lend and operate. The key features of the scenario used to calculate the capital requirements are generally similar from year to year. Since the stress test is used to set each firm's stress capital buffer requirement, there is a benefit to predictability so that firms are better able to conduct capital and business planning.

However, a tradeoff with producing predictable scenarios is stifling creativity in scenario design and less bank resilience to a range of potential scenarios, and this is where exploratory scenarios can help. The use of stress scenarios and shocks that do not set a firm's stress capital buffer requirement can provide room to explore a wider range of vulnerabilities to inform risk-based supervision. For example, if the purpose of the exploratory scenario is to inform the Board or the public about new or underappreciated risks, the Board could explore the impact of a scenario using a different set of variables than the ones it has currently defined in its policy statement.

So in concept, scenarios designed to inform regulators and policymakers could be a good idea. But how will regulators react when the losses under one of these scenarios exceeds the buffer capital required under the standard recession-based scenario. They will demand the higher level be held, and they should, and the bank should already be holding that buffer anyhow.1

Exploratory scenarios would also allow the Board to have more flexibility in its modeling approaches. For example, the Board could explicitly model the behavioral response of depositors to losses, allowing for contagion of the type we saw earlier this year, the interaction of the broader economy and the banking system under stress, or the transmission of stress through nonbank parts of the financial system.

So here we come to the crux of the matter; do banks run their firms or do regulators? Regulators should expect their firms to run in a safe and sound manner, having risk systems that appropriately measure the risk to their institutions, and hold capital commensurate with, or higher than, the losses they may face. Systemic firms should run at a higher confidence level than non-systemic firms.

One question that the Fed should ask themselves is if they would have changed the pace of rate increases if they had foreknowledge (which they arguably did) that regional banks would face distress and possibly fail.

And maybe Barr should go back and read this 2013 paper by Til Schuermann Stress Testing Banks and the Bank of England’s recent Macroprudential stress‑test models: a survey. Remember, even Dan Tarullo thinks the stress tests have outlived their usefulness.

Turning risk-management into regulatory capital compliance is bad policy.

Maybe examiners should be reading loans these days and not worrying so much about the technicalities of the stress tests.

With the normal caveats about being at common confidence intervals, etc.