Perspective on Risk - Sept. 15, 2023 (Happy Lehman Day)

FOIA Request; An OCC Mystery; Recessioncast; Fmr OCC Examiner Reviews SVB & 1st Republic; Pushback Against The Endgame; CRE; HF Synthetic Leverage; FHLB Is A Systemic Risk; Mis-selling; Research

Happy Lehman Day to all who celebrate. 15 years seems like yesterday.

I Made A FOIA Request

The fact that the regulatory agencies did not use the Dodd-Frank resolution procedures for SVB and Signature, and in fact decided to use the systemic risk exemption, has been bothering me for quite some time. So I made FOIA requests to the FDIC and Federal Reserve. I’m probably going to be on vacation when the results come in. Let’s see what comes of it.

Some have asked why I get worked up over this. I take moral hazard and the incentives it creates very seriously. Michael Pettis summarizes the argument pretty succinctly in commenting on Chinese insurers (I’ve reformatted his tweet stream):

This excellent Caixin article suggests that there are deep systemic problems with the Chinese insurance sector. In particular I noted this paragraph: "So far, no Chinese insurance company has gone bankrupt, and there is a widely held belief among policyholders of an implicit guarantee that they will still be fully compensated even when an insurer fails."

It is precisely these implicit guarantees that suggest the problem with the insurers is likely to be deep and systemic.

In an insurance system underpinned by moral hazard (i.e. "implicit guarantee"), there is little reason for policyholders to select on the basis of credit risk, and so there will be a tendency for insurers to compete mainly through more aggressive premiums.

This creates a competitive advantage for those insurers who have the most optimistic expectations and the greatest risk appetite. In that case, the more prudent insurance companies will lose market share very rapidly to the less prudent.

If this goes on long enough, eventually every insurer must shift towards excessive risk-taking in order to survive. In a market in which customers are indifferent to risk, the less risky insurers have no competitive advantage.

The consequences are fairly predictable. As the regulators are forced to confront excessive risk-taking and have to clean up the sector, we will hear a lot about fraud, stupidity and self-dealing as having caused the mess.

But these will not have been the real causes.

In any system underpinned by moral hazard, all we need is for there to be a normal distribution of risk appetite within the system for excessive risk-taking to become the norm. We've already seen this in real estate, trusts and insurance. We'll see it many more times again.

A strong argument can be made for that being the case with SVB, Signature and the other recent bank failures (including those firms that have not failed but are funding through the Fed’s off-market term funding facility).

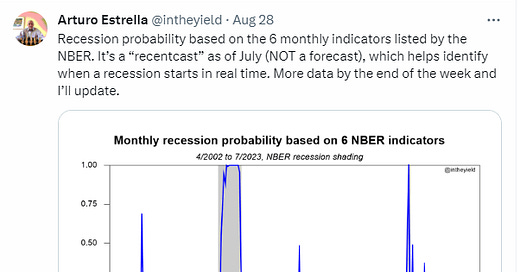

Recession, Yes or No

Not As Of July According To Arturo’s ‘Recentcast’

Ken Griffin

Sara Eisen interviewed Ken Griffin of Citadel on CNBC. Ken is clearly in our “it takes a while for rate hikes to affect the economy” camp.

EISEN: It’s been a surprisingly good year for the markets and the economy which I think is reflected in the fact that they’re going public. Question Ken is what comes next?

…

GRIFFIN: So, it takes about a year to two years for an interest rate hike to work its way through the economy. It’s not instantaneous. We’re now at the point where we’re going to see the impact of these hikes really start to play out. We’re seeing the job market starting to weaken. There’s been there’s been a number of news stories in recent weeks about how companies are willing to pull back with what they’re paying for starting roles. We’re seeing signs that consumers have had enough in terms of price increases, that they’re starting to walk away from products or trying to push through price increases. So there’s signs here that we’re heading very quickly into hopefully the soft landing, potentially more difficult scenario, moving into mid to late last year in terms of an actual recession.

FRB-Chicago Thinks Fed’s Tightened Enough

The Chicago Fed economists, in Past and Future Effects of the Recent Monetary Policy Tightening, argue that:

the policy tightening that has already been implemented will exert further restraint in the quarters ahead, amounting to downward pressure of about 3 percentage points on the level of real gross domestic product (GDP) and 2.5 percentage points on the Consumer Price Index (CPI) level. Tightening effects on the labor market manifest more slowly, so more than half the policy impact on total hours worked is yet to come. According to the model’s forecast, the policy tightening that’s already been done is sufficient to bring inflation back near the Fed’s target by the middle of 2024 while avoiding a recession.

An OCC Mystery

Bank Supervision blogging is a very small world, and I thought I knew everyone until this story hit my radar. What Happened to the OCC's Chief Fintech Officer?

Jason Mikula writes the Fintech Business Weekly substack.

He writes about this March 30th press release: OCC Establishes Office of Financial Technology. In it:

The Office of the Comptroller of the Currency (OCC) today announced the establishment of its Office of Financial Technology and the selection of Prashant Bhardwaj to lead the office as Deputy Comptroller and Chief Financial Technology Officer, effective April 10, 2023.

…

Mr. Bhardwaj joins the agency after nearly 30 years of experience serving in a variety of roles across the financial sector.

He holds a master's degree in accounting from University of Cincinnati and a master's degree in business administration from the International Management Institute Universiade de Brussels.

But …. Mr. Mikula writes:

But digging in to Bhardwaj’s background — or attempting to, anyway — raised more questions than answers.

For an industry veteran with “nearly 30 years of experience,” there’s no identifiable trace of him online.

His background mentioned in the OCC release didn’t specify any prior employers, and, when asked for additional detail, the OCC spokesperson declined to comment.

The release did specify two education credentials: a master’s degree in accounting, from the University of Cincinnati, and an MBA from the International Management Institute Universiade de Brussels.

The University of Cincinnati was unable to verify if Bhardwaj attended and completed an accounting master’s by the time of publication.

Bhardwaj’s MBA from “the International Management Institute Universiade de Brussels” seems to be a more convoluted tale.

For starters, there is no school by that name. It’s not clear if “Universiade” was a typo, but it isn’t even a word.

He notes:

…at some point between April and now, Bhardwaj quietly disappeared from his role at the OCC.

The Office of Financial Technology is now headed by Miriam Bazan, a long-time OCC bank examiner.

I reached out to the OCC to ask what happened to Bhardwaj, and a spokesperson for the national bank regulator declined to comment.

Click over to his Substack for more details. Juicy.

Former OCC Examiner Reviews The SVB Supervisory Letters

A former OCC examiner authors the uponfurtheranalysis blog. Glad to see more former supervisory practitioners writing; his is a nice blog to follow. In How To Write A Supervisory Letter he both educates you as to how these letters conveying regulatory findings are written, and he critiques the Fed’s Supervisory Letters for SVB.

I reviewed two SLs. The first, an asset quality and credit risk management target completed in 2021, is a bit of a mess. The letter runs seven pages (longish for an SL) and includes two MRAs. The first 16 paragraphs make no more than passing reference to the two new MRAs. This is a classic case of what journalists call burying the lede. Even when the letter gets around to discussing the MRAs, the “issue” (concern) paragraph starts with the statement that “risk ratings are timely, accurate, and generally supported” before getting to the “however.” This is a good example of balance for the sake of balance. This approach may be trying to make the point that processes that may have been satisfactory for a small bank no longer cut it as the bank gets larger. There are, however, more direct ways to communicate this “welcome to the NFL” message.

The second, a November 2021 liquidity planning target, is much better. The target resulted in four MRAs and two matters requiring immediate attention (MRIAs). The letter starts with a clear, unambiguous summary of the bank’s weaknesses in liquidity risk management. It doesn’t waste a lot of space with extraneous information and summarizes the key issues in the first two pages. Some have asserted that “the [SVB] examiners were far too focused on risk management processes and procedures, and not on actual risk.” This criticism trivializes serious risk management weaknesses related to stress testing, risk limits, and contingency funding plans. However, a more effective SL would have also emphasized the bank’s high concentration risk to add needed context to these risk management weaknesses.

Supervisory actions (or inaction) after issuing the SL presented a bigger problem. At the time of the 2021 target, liquidity was rated “1.” The Fed did not downgrade liquidity until August 2022 and, even then, to a still satisfactory “2.” The risk management weaknesses alone should merit a rating no better than “3,” and possibly a “4” given extreme funding concentrations. The Liquidity rating remained at “2” until the bank failed in March of 2023. A clear, authoritative Supervisory Letter is a necessary but not sufficient condition for effective supervision. Regular monitoring and decisive follow-up are just as important.

100% in agreement.

The OCC Guy Also Looks At First Republic

He’s a bit harsher than me, but in the same vein. FIRST REPUBLIC AND HALO EFFECTS. He highlights a phrase from the report that I missed:

The postmortem indicates (on page 6), “First Republic’s primary interest rate risk mitigation strategy relied on continual growth to produce a consistent volume of loans priced at current interest rates. Each examination report restated First Republic’s growth and repricing strategy as key to mitigating interest rate risk.” In other words, the bank sought to mitigate IRR by doubling down on the risk.

He argues persuasively that First Republic benefitted from a ‘halo effect.’

The post-mortem notes that “First Republic had historically been viewed by FDIC officials as a generally sound and well-managed institution” with pristine asset quality.” Moreover, FDIC officials found bank management to be “responsive to supervisory feedback and recommendations, quick to remediate findings, and easy to deal with.” That’s all great but can also create blind spots. I’ve seen many times over the years where a bank’s strong reputation caused supervisors to overlook red flags. Reputation should count for something, but it shouldn’t be the end all and be all.

Quite true. My biggest blunder as a supervisory manager was ascribing a halo to a certain SIFI and ‘pushing back’ on the examiner when he felt they deserved to be downgraded.

The Pushback Against The Endgame Is Afoot

Subtitle: Always Take The Over

The proposal to overhaul the bank capital rules (yet again) goes by the moniker “Basel Endgame.” Picture Jamie Dimon as Tony Stark and you get the picture.

Federal Financial Analytics

Karen Petrou is out with a public piece/hit: The PCA Cure for Much That Ails New Banking Rules. As usual, the first rule of pushback is to blame the implementation of the existing rules (in this case the inaction by supervisors).

…the agencies have done a remarkably poor job conjuring the impact of each of these sweeping proposals, let alone their cumulative impact in the context of all the other rules and the grievous supervisory lapses that contributed to recent failures no matter all the rules that could well have sufficed if enforced.

There are few – if any – specific plans laid out by either the Fed or FDIC to ensure prompt corrective action if capital seems robust and profits seem plentiful.

the new rules are for naught if supervisors do nothing and more than a little in the complex, burdensome rules is unnecessary were supervisors to do more and act a lot faster.

Then explain that the new rules don’t address certain specific recent failures:

nothing in the capital standards addresses another obvious cause of each recent bank failure: helter-skelter growth.

For example, interest-rate risk – unaddressed in any of the new standards – is one grievous flaw in bank failures going back to the S&L crisis

She isn’t wrong, but the proposed changes are not in response to the SVB, etc. failures.

Bank Earnings Calls

The Bank Reg Blog substack summarizes Jamie Dimon Shares Thoughts on Basel Endgame. Click over if you want all of the details. Jamie addresses substance, process and politics:

On substance:

“[W]e would have to hold 30% more capital than a European bank. Is that what they wanted? Is that good long term? Why? Didn't we say we have international standards? What was the ---damn point of Basel in the first place?”

“I've always thought G-SIFI is an asinine calculation. Operational risk is even more asinine.”

“Operational risk -- are all revenues equally bad, really? Like, honestly, I look who did that, what person in what ivory tower thinks that that is a rational thing to do.”

On process:

“Do you think the NPRs going to make a ---- of difference? It's my academics argue with their academics, then they’re going to do what they want anyway. That's all that's going to happen.”

“We used to have real conversations with regulators. There is virtually none anymore. Of course we simply have to take it because they are judge, jury and hangman, and that is what it is.”

On politics:

“I would prefer more transparency … [on] the process they went through. Did all the governors have a point of view? I'd like to know what the other governors think.”

Unless, that is, “some other Fed governors or other people decide to get deeply involved and try to do what's right and fair and they think about what's good for the country, not just can they stop themselves ever from being blamed for a bank failure.”

He also has comments from BNY Mellon, Truist, Citizens, and Huntington. All of these banks cited single-digit RWA increases.

Bank Lobbying Groups

Six bank lobbying groups (Bank Policy Institute, American Bankers Assn., Financial Services Forum, Institute of International Bankers, Securities Industry and Financial Markets Association, U.S. Chamber of Commerce) jointly authored a comment letter. These are heavyweights, and a joint letter will be even more impactful.

Echoing Jamie Dimon’s comments, these groups rail against the lack of transparency (highlighting is mine):

… the proposed rule repeatedly relies on data and analyses that the agencies have not made available to the public. This reliance on non-public information violates clear requirements under the Administrative Procedure Act that agencies must publicly disclose the data and analyses on which their rulemaking is based. To remedy this violation, the agencies must make available the various types of missing material identified below—along with any and all other evidence and analyses the agencies relied on in proposing the rule—and re-propose the rule.

As part of the APA’s notice-and-comment requirements, all agencies have the “duty to identify and make available technical studies and data that [they] ha[ve] employed in reaching the decisions to propose particular rules.” Agencies “must explain the assumptions and methodology” underlying a proposed rule “and, if the methodology is challenged, must provide a complete analytic defense.” And, where an agency omits some of the “critical factual material” and analyses from a proposed rule, it must disclose the material and then provide “further opportunity to comment.” Indeed, “[a]n agency commits serious procedural error when it fails to reveal portions of the technical basis for a proposed rule in time to allow for meaningful commentary.”

The proposed rule violates these basic legal obligations.

Because of the critical procedural deficiencies described above, neither we nor other commenters are able to fully and properly comment on the proposal at this time.

This goes on for seven pages.

240 More Pages On The 1,087 Page Proposal

Here is the longest reference piece I could find. The folks at Davis Polk must have too much (unbillable) time on their hands: U.S. Basel III endgame proposed rule

Given the split votes on the Fed and FDIC Boards, and the vast pushback, this is clearly set to be a political football going into 2024. Take the over. Probably even DOA except for the politics.

Commercial Real Estate

Real-Estate Doom Loop Threatens America’s Banks (WSJ)

Pettis comments on WSJ article

Banks also increased their exposure to commercial real estate in ways that aren’t usually counted in their tallies. They lent to financial companies that make loans to those same landlords, and they bought bonds backed by the same properties.

US banks may have gotten caught up in the same Minsky trap as Chinese banks. In rising markets, the "winners" are those who most aggressively find new ways of taking on risk, and while markets rise, they systematically outperform their more prudent competitors.

The problem is that when markets have risen for a very long time, whether for good or bad reasons, the more prudent players either have to become excessively risk-taking themselves or lose market share, and so eventually the whole sector shifts towards excessive risk taking.

What is worse, as banks become increasingly aggressive in taking on these risks, their activity becomes self-reinforcing, driving markets up further, which in turn reinforces the rewards for those that take too much risk.

When these things unravel, the unraveling itself becomes even more highly self-reinforcing, as vastly over-exposed banks are forced by declining markets to sell, and their selling forces markets to decline even faster.

This process has been well understood for centuries, and is often blamed on stupidity, but it's not "stupidity" that causes this process. It is simply the automatic result of the ways dynamic systems react when there is a wide distribution of risk appetite.

Minsky argued that because this process is endogenous to financial systems, there's no point trying to prevent it. The best that can be done is to keep the financial system fragmented, so as to prevent a problem in one sector from contaminating the rest of the system.

We need, in other words, smaller, more specialized and localized banks, with limited links across the system. This would make banking a little less "efficient", of course, and certainly less profitable, but it would be much better for the economy.

Similar argument to the moral hazard argument above. Incentives and endogeneity leads to financial fragility. Financial fragility without the proper costs of failure further distorts pricing and leads to moral hazard.

Hedge Fund Synthetic Leverage

I commented a couple of Perspectives ago that the Fed had published a paper suggesting the return of the basis trade. Now I read FSB warns of risks posed by hedge funds’ ‘hidden leverage’ (FT), so you might imagine I was interested if there was an immediate concern (relax: there isn’t). Hedge fund leverage has been a regulatory obsession since the failure of LTCM. The article for some reason likes to refer to Archegos, but they weren’t really a player in the highly-leveraged basis trades.

The Financial Stability Board, comprised of the world’s top finance ministers, central bankers and regulators, warned on Wednesday that some hedge funds had “very high levels of synthetic leverage”.

“A few prime brokers dominate the provision of lending to hedge funds, and this concentration could amplify shocks and propagate them through the financial system,” it said.

The role played by hedge funds and other financial institutions such as asset managers and pension funds in bond markets has come under increased scrutiny since March 2020, when US government bond yields dramatically increased as demand evaporated.

The FSB has already begun work on leverage in non-banks and on Wednesday said the area would be a “key area of policy focus in 2024”.

It wants to address “the most salient data gaps” on the exposures of non-bank financial institutions, potentially by pulling in information from trade repositories and from the banks providing them with leverage.

The problem here is aggregating the data across dealers.

Looking over to the FSB site one finds The Financial Stability Implications of Leverage in Non-Bank Financial Intermediation. Principally, the paper that caused the aforementioned “warning” “ identifies a number of data gaps which have made it difficult to fully assess the vulnerabilities associated with NBFI leverage.”

There’s nothing particularly urgent about the paper, but it does contain a wealth of information on trends in leverage across countries and different NBFIs.

FHLB Is A Systemic Risk

Stephen Cecchetti, Kim Schoenholtz & Lawrence White fire some shots in The dangerous role of America’s weird lenders-of-next-to-last resort (FT)

The FHLBs’ include in their routine wholesale lending loans to banks that are highly vulnerable to runs

Some government financial institutions strengthen the system; others do not. Nowhere is that clearer than with the tangled mess of the Federal Home Loan Bank system.

In theory, their loans are very safe. FHLB advances to members are always over-collateralised.

In the event that the borrowing member becomes insolvent and goes into receivership, the lending FHLB has a (statutory-based) super-lien on the borrower’s assets — and thereby subordinates all other claimants, including the Federal Reserve and the FDIC.

Today, the FHLBs are basically large interconnected wholesale banks that lend to their members — around 6,000 banks and around 500 insurance companies — and their importance has risen sharply since the 1990s. Together, they now hold about $1.5tn of total assets, of which over $1tn are loans to their members.

The role of the FHLBs as lenders of next-to-last resort first became prominent during the financial crisis of 2007-09. In that period, FHLB advances rose by nearly two-thirds by lending to large, poorly capitalised banks — some of which, such as Washington Mutual, Countrywide and Wachovia — eventually failed.

We saw this dangerous pattern again over the past year when loans from FHLBs tripled to a record of more than $1tn, helping postpone the inevitable reckoning for Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank.

While their mission is to promote residential mortgage finance and community development, the FHLBs’ include in their routine wholesale lending loans to banks that are highly vulnerable to runs.

If SVB, Signature, and First Republic had instead been forced to face market discipline during 2022, their borrowing costs would have been far higher. These expenses likely would have motivated the banks to have addressed their losses at an earlier stage

As it stands, the FHLBs are a clearly destabilising force in the US financial system by providing subsidised loans during periods of stress and undercutting the actual lender-of-last resort, the Federal Reserve. Fixing this would improve financial resilience by creating greater incentives for banks to manage their risks.

The authors advocate removing the senior-lien status, requiring formal regulatory approval for FHLB loans, and increasing FHLB transparency around the loans made.

I’d add they should be designated as systemically-important by FSOC.

More Deutsche Bank Mis-Selling

Guess it’s a pet peeve of mine, going all the way back to when Bankers Trust was ripping off Gibson Greetings and a host of Indonesian firms. In the latest news on mis-selling highly complex products:

Deutsche Bank continued to push risky derivatives years after probe found mis-selling (Bloomberg)

Deutsche Bank continued to sell risky foreign exchange derivatives to companies in Spain that had suffered big losses from such products even after an internal inquiry found long-standing mis-selling.

An internal probe that began in 2019 after a whistleblower complaint found that staff exploited flaws in the bank’s controls and broke EU rules, pushing small and medium-sized Spanish companies to buy highly complex products that were promoted as safe and cheap hedges against foreign exchange risks.

a family-owned fruit and vegetable wholesaler with €3mn in annual sales … which has just four employees, sells pumpkins, carrots, oranges and other produce to clients in Switzerland … wanted to hedge its Swiss Franc exposure and, according to the owner, was offered products that Deutsche said would be low cost and low risk. He said he only realised what he had been sold in early 2023 and that the product had caused the business €1.5mn of trading losses.

A Madrid-based importer of sporting goods made in Asia … uncovered €1.5mn in trading losses on Deutsche derivatives that it needed to provision for. The company imports sporting goods worth $7mn a year but was sold derivatives covering an import volume of €35mn by Deutsche Bank ... The company only sells products in Spain, but Deutsche also sold it €27mn in derivates to hedge exports.

One of the lawyers for the Spanish companies said that changes to derivatives contracts made by Deutsche last year mean it is now harder to sue the bank. The bank added new clauses stipulating conflicts must be resolved in private arbitration tribunals rather than public courts. While private-sector tribunals can work faster than courts, they act without public scrutiny and can be expensive.

Research

Stock/Bond Correlation

In Implications of Regime-Shifting Stock-Bond Correlation, Larry Swedroe summarizes “Empirical Evidence on the Stock-Bond Correlationa by Molenaar, Senechal, Swinkels, and Wang. At my last firm, we explicitly imbedded different correlations in an up-rate vs down-rate stress scenario, so this will be of interest to you folks:

The correlation between stocks and bonds should be a critical component of any asset allocation decision, as it impacts not only the overall risk of a diversified multi-asset class portfolio but also the risk premia one should expect to receive for taking risk in different asset classes. The problem for investors is that the correlation between stocks and bonds fluctuates extensively across time and economic regimes.

Capital Allocation

Global Capital Allocation is a bit of a survey piece. It touches a bit on market segmentation and tax havens as drivers in the data.

We survey the literature on global capital allocation. We begin by reviewing the rise of cross-border investment, the shift towards portfolio investment, and the literature focusing on aggregate patterns in multilateral and bilateral positions. We then turn to the recent literature that uses micro-data to document patterns in global capital allocations. We focus on the importance of the currency of denomination of assets in international portfolios and the role that tax havens and offshore financial centers play in intermediating global capital. We conclude with directions for future research in this area.

Financial Crisis

The Capital Spectator summarizes and links to five new papers in The Latest Research on Financial Crisis (The Capital Spectator)

Interesting piece from Steve Kelly of Yale’s Program on Financial Stability: Is the Fed Financing the FDIC? (withoutwarning)

Answering this question can’t be done via a straightforward accounting of inflows and outflows with respect to resolutions given the disparate/incompatible public disclosures from regulators and banks—and due to the rapidly changing nature of bank balance sheets in their end-days. However, there is evidence in the public data.

… in none of the purchases of the failed banks did the acquirers assume the Fed debts. As noted in the initial excerpt from the Fed, this debt has become backed by an FDIC guarantee of repayment—that is, “the full faith and credit of the United States.” The Fed noted the discount window loans to SVB and Signature bridge banks were subject to an FDIC guarantee, as were the First Republic discount window and BTFP loans.

…in the case of First Republic, all or effectively all the collateral that was posted to the Fed was sold to JPMorgan. So there’s no collateral left at the Fed—which means the FDIC either replaced the collateral with its Treasury holdings … or, more likely, simply replaced the collateral altogether with the FDIC guarantee. … if nothing else, we can say with virtual certainty that the Fed’s BTFP loan to First Republic is now “financing the FDIC.”

Deutsche Bank's mis-selling of risky, complicated derivatives to small businesses that don't need them reminds me of what Goldman's Daniel Sparks did with Timber Wolf CDO. (I was reading Senate Report: Anatomy of a Financial Collapse, April 2011) Goldman sold horrible sub-prime mortgage CDOs to Korean life insurers and Japanese private investors, who had never owned CDOs before.

I'm glad you mentioned FHLBs! My former bank relied on the Dallas FHLB after they were cut off from borrowing at the Fed's discount window. The FHLB doesn't reveal amounts loaned, so as to avoid reputational harm to borrowers, and then future reticence to borrow. Other than that, the FHLBs are quite transparent about their operations. The Dallas FHLB runs a tight ship, or so it seemed to me from reading their publicly available annual reports.

You're probably correct, that the FSOC should designate FHLBs as systemically-important. I was told that cost of borrowing from the regional FHLBs is higher than from the Fed's discount window. Also, a bank's use of funds borrowed from the FHLB is more restricted than from the Fed. The FHLBs have four (maybe five?) categories for borrower institutions. My former bank transitioned one category down during my time there. Due to that transition, the FHLB required higher quality collateral from us. They also made us bring physical paper, certificates, documents of securities ownership, etc. (used as collateral) to Dallas to be held by the FHLB until we paid back our loans.

Failure to verify credentials and work history by the OCC (for its new Office of Finance Technology) is awful and hilarious. I was disappointed with the meh backgrounds of the FDIC's and CFTC's new Office of FinTech chiefs when announced because they were unremarkable Georgetown Law grads with a few years of quasi-fintech work experience. (I was jealous because the position sounded very fun to me at the time.) In retrospect, FDIC and CFTC due diligence of appointees to that role was MUCH better than the OCC's!!!