Perspective on Risk - Jan. 8, 2024 (Predictions)

Forecasting Is Hard; How To Make Your Predictions For The Next Year More Accurate; Superforecasting 2024; Eurasia Group Top Risks 2024; Positive Developments; Following Up On Wirecard Fraud

Let’s start the year with something light and simple. No r* or “Bagehot must die” talk.

It’s the time of year for predictions.

For the most part, predictions are noise rather than signal. However, Phillip Tetlock of Wharton has shown that there are techniques to improve the quality of predictions1. He does this with a group of people known as ‘Superforecasters.” Here is a 2016 paper in the HBR that describes the basics of his findings: Superforecasting: How to Upgrade Your Company’s Judgment. Improving decision quality can be taught. More on this in a minute.

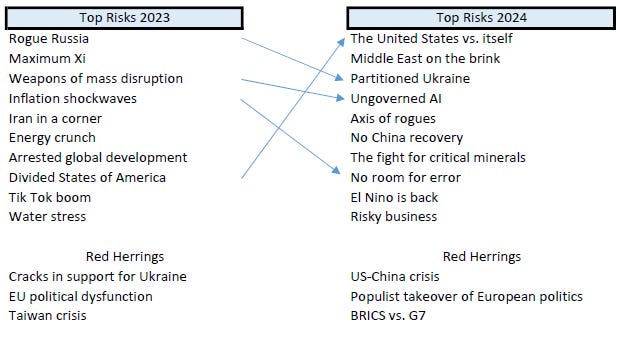

I do want to add, though, that Ian Bremmer’s Eurasia Group had a good set of predictions for 2023, so riding the hot hand I will review their predictions for 2024.

Forecasting Is Hard

Before you read the rest of this, and before you seek to make your own predictions, read this:

How To Make Your Predictions For The Next Year More Accurate

Related from the FT: The art of superforecasting: how FT readers fared against the experts in 2023

To help illustrate what makes a superforecaster worthy of the name, the FT asked both readers and Good Judgment superforecasters to make predictions on ten questions early this year, spanning from GDP growth rates to viewership of the Fifa women’s world cup final.

A total of 95 superforecasters answered questions, while the reader poll had approximately 8,500 respondents. The latter was more casual than scientific and only lasted for one week rather than the whole year. Still, the results shed interesting light on what we think about when we think about the future.

Using a scoring system that ranges from 0.5 (or pure guessing) to 1 (perfect choices) over nine questions, FT readers scored a 0.73 while superforecasters scored 0.91, using their responses from February 2 2023.

One of my greatest disappointments was that I could not get AIG excited to learn about how to make better predictions by learning from Phillip Tetlock’s crew. You can teach your firm how to make better predictions; this would seem to be a high ROI no-brain investment.

Superforecasting 2024

You all know that one of my favorite areas is the science of making better predictions, and in particular the work of Daniel Tetlock in identifying how to make individuals better forecasters. Their work takes many lessons (Bayesian thinking, aggregation of truly independent forecasts, etc.) into their approach.

The Superforecaster team was perfect on their 2023 predictions for the economist, so it’s perhaps worthwhile looking at what they think about 2024.

What the “superforecasters” predict for major events in 2024 (Economist)

Let’s Get Ready To Rumble

What will the results of the United States 2024 election be?

63% Democrat wins electoral and popular vote

25% Republican wins the electoral vote but not the popular vote

10% Republican wins electoral and popular vote

2% Democrat wins the electoral vote but not the popular vote

More predictions

When will Russia and Ukraine sign or announce an agreement to end the current conflict? 91% say Not before 1 October 2023.

What will be the world’s annual GDP growth in 2024?

Will the euro experience two consecutive quarters of negative GDP growth? 14% Yes; 82% No, but there will be at least one quarter of negative growth

What will be the results of the United States presidential election in 2024 be? 62% between 1.5% and 3%’ 22% greater than 3%; 12% between 0% and 1.5%, and 4% negative.

Eurasia Group Top Risks 2024

As I stated earlier, I like to review Ian Bremmer and Cliff Kupchan’s list of top risks. In my opinion, they sort through the current zeitgeist intelligently and provide a valuable framing perspective.

You can, and should, read their Top Risks 2024.

Reading the 2024 report along with the 2023 report highlights where the environment or their view has changed.

Sadly, the US is the Top Risk

For 2024, the top risk is a dysfunctional US 2024 election where there is virtual certainty that a significant portion of the population will consider the results illegitimate, and where the potential for political violence is high. This is their best case scenario.

And then there’s the tail risk (unlikely but plausible) that you’d rather not think about: What if the world’s most powerful country is unable to hold a free and fair election on 5 November? Efforts to subvert the election could come from cyberattacks, deep fakes and disinformation, physical attacks on election process and oversight, and even terrorism to disrupt voting on the day. There’s no more geopolitically significant target than the upcoming ballot—a softer and more vulnerable target than most homeland security challenges—with plenty of foreign (and more than a few domestic) adversaries that would love nothing more than to see more chaos in America.

Russia and China

Russia is seen effectively winning and gaining its land-bridge in Ukraine.

Concerns about China have morphed from the 2023 focus, which emphasized policy volatility due to centralized power, public health crises, economic challenges from state control, and assertive foreign policies. The 2024 document suggests that while Xi Jinping might have achieved certain goals, such as consolidating power and focusing on security, other objectives, particularly economic ones, appear less successful. The persistence of economic challenges and the lack of a robust recovery indicate that the goals related to revitalizing the economy and addressing financial vulnerabilities might not have been fully accomplished.

AI

On Artificial Intelligence, it appears that the concerns in 2023 have evolved by 2024 into a more pronounced focus on the governance gap and its implications for global security and democracy, emphasizing the urgency and complexity of the challenges posed by AI.

Economics

Economics is not their bread-and-butter. Nevertheless, it is worth looking at what they have written. Relative to other views, like the IMF and JPMC, Eurasia Group highlights persistent high interest rates and inflation as major challenges for global economic growth. They also focus on the political aspect of persistently higher interest rates and inflation, noting that this has historically led to political instability in some EM countries.

Positive Developments For 2024

There is a good chance 2024 will be the year of peak global greenhouse gas emissions.

Relatedly, Renewables could become largest electricity source by 2024, surpassing coal

The global solar PV manufacturing capacity is expected to double, reaching nearly 1 terrawatt.

The US may send astronauts back to orbit the moon.

A woman will become President of Mexico

A new malaria vaccine will be released in Africa.

I asked GPT-4 to estimate how much weight Americans will lose in 2024 by usingOzempic, Wegovy, and Mounjaro. It estimated we would collectively lose approximately 23,148,510 pounds. But it also told me this was conservative and encouraged me to take the over.

Following Up On Wirecard Fraud

Wrote about this back initially in Dec, 12, 2022 Perspective, and the again in the May 4, 2023 Perspective and the June 23 Perspective. As I wrote in the initial piece:

the story is much wilder. We’re talking shell corporations, Libyan and Russian agents, money laundering, regulators defending Wirecard against the FT, Wirecard trying to buy Deutsche Bank, etc. Some totally outrageous stuff here too: the BaFin defending Wirecard against the allegations by the FT; the Bundestag stamping secret a report by E&Y's on Wirecard.

If this had happened in the US it would be much bigger than FTX, etc.

Now there are three new updates; the WSJ has added to the story with He’s Wanted for Wirecard’s Missing $2 Billion. He’s Now Suspected of Being a Russian Spy, the FT reports Wirecard’s former chief financial officer charged with fraud, and Wirecard hacker sentenced to 80 months in prison.

First, let’s talk about the WSJ piece:

Soon after payment-processing giant Wirecard reported in June 2020 that nearly $2 billion had gone missing from its balance sheet, its chief operating officer Jan Marsalek boarded a private jet out of Austria. After a landing in Belarus, he was whisked by car to Moscow, where he got a Russian passport under an assumed name.

Western intelligence and security officials now say they have reached the unsettling conclusion that Marsalek had likely been a Russian agent for nearly a decade.

British prosecutors say that from 2020 to 2023, Marsalek ran a ring of five U.K. based Bulgarians who are alleged to have spied for Russia, directing them to gather information on people with the aim of helping the Kremlin abduct them.

Western intelligence officials also say that Marsalek has visited Dubai and worked with a retired Russian intelligence officer based there who has been acquiring weapons for Moscow.

Now on to the FT:

Burkhard Ley, who was CFO from 2006 to 2017 and then worked as an external adviser to Wirecard, was on Thursday charged with fraud, breach of trust, accounting and market manipulation.

Munich prosecutors allege Ley deceived Wirecard’s investors and creditors by inventing the outsourced business in Asia. According to prosecutors, the operations, which accounted for half the company’s revenue and almost all its profits, were used to inflate its results and share price.

and

An Israeli private detective has been sentenced to 80 months in prison for his role in a $4.8mn hacking scheme that targeted journalists and critics of German fintech group Wirecard

Federal prosecutors had alleged that between 2014 and 2019 Azari, of Kiryat Yam, was involved in an “extensive” conspiracy to target individuals and unnamed companies in New York using phishing emails in an attempt to steal passwords.

His victims included “climate change activists and individuals and financial firms that had been a critical part of the German payment processing company Wirecard”, they said in a statement on Thursday.

Danny Kahneman once told me that he expected Tetlock to win a Nobel Prize for his work.