Perspective on Risk - Dec. 15, 2024

USD; FDIC Speculation; FDIC Can't Handle Even A Regional Bank Failure; Petrou on FSOC; BIS Quarterly Review; De-banking BS; Final Thoughts

Last post of the year, and I think it’s another good one. Ending on a pretty good streak of posts, if I do say so myself! Everyone please enjoy the holidays.

More On The USD

The Three-Dollars Problem (FT)

The article focuses on three primary functions of USD:

the "National Security Dollar,"

the "Trade Dollar," and

the "Financial Stability Dollar."

The tension between these three roles can create contradictory policy outcomes. For instance, tariff-driven dollar appreciation may offset inflationary pressures but exacerbates financial instability abroad, complicating efforts to balance trade objectives and systemic stability.

A policy that prioritizes geopolitical dominance might undermine global financial stability or worsen domestic economic conditions by reducing trade competitiveness.

The role of the dollar as the leading denomination for cross-border borrowing and invoicing means that when it is too strong... it tightens financial conditions in large parts of the world.

For more than a decade now, many developing countries have grappled with the problem of having their financial cycles determined in Washington even as critical components of their real cycle—commodity demand and prices, for example—are determined in Beijing.

Brad Setzer tweets with some facts for the discussion:

Treasury coupon issuance has increased relative to the fiscal deficit, and now covers about 2/3rds of the deficit

Net note (coupon) issuance was about 4% of GDP, and if you add in the increase in privately held marketable Treasuries from the Fed's balance sheet contraction, the net "supply" of notes to market mapped to the fiscal deficit

The stock of marketable Treasuries held in the market is now around 80% of US GDP -- a huge change from the years prior to the global financial crisis.

Domestic US investors hold a lot more Treasuries than in the past -- tho at 50% of US GDP total domestic (private) holdings are still only half the total marketable stock

So one possible conclusion for the guardians of global financial stability -- risks to the Treasury market may come less from foreign investors and more from domestic intermediaries using repo funding / basis traders.

Keep this last point in mind when you read the section on the BIS Quarterly Review.

FDIC Board Meeting Speculation

December 17, 2024 — Sunshine Act Meeting Notice

As soon as the notice was posted, Bank Reg Blog speculated that the AML discussion could be about charter terminations for banks like TD that are repeat or horrible offenders, and Yale’s Stephen Kelly noted the third bullet’s use of the term “unusual and exigent” which if Fed-speak for evoking emergency lending authority.

As you know, I’ve suggested that the threat of revocation of charters would strengthen the incentives to spend on AML (see Perspective on Risk - Nov. 13, 2024), and the Fed still hasn’t responded to my FOIA request about their use of this authority in the SVB bailout (see Perspective on Risk - Sept. 15, 2023 (Happy Lehman Day))

FDIC Can’t Handle Even A Regional Bank Failure

Adding to the FDIC’s cultural problems, we now have the FDIC admitting they cannot handle even the failure of a regional bank without the use of the systemic risk exemption (no wonder the Fed won’t respond to my FOIA request).

FDIC Readiness to Resolve Large Regional Banks

We determined the FDIC’s readiness to resolve large regional banks under the FDI Act was not sufficiently mature to facilitate consistently efficient response efforts in a potential crisis failure environment.

The language of the report bends over backwards to put the findings in administrative speak, but the Report is damning. Here’s an example of the gobbledygook:

Specifically, the FDIC could have been more effective in demonstrating its readiness to resolve large regional bank failures by completing, communicating, and coordinating the regional resolution framework guidance; improving large regional bank resolution plans; training key staff on their resolution roles; conducting interdivisional exercises to test resolution procedures; and periodically evaluating and monitoring large bank resolution readiness.

The FDIC hadn’t ensured it had the staff, technology, and internal coordination needed to respond effectively. Key gaps included incomplete resolution plans for large regional banks, insufficient training for staff on their roles in resolving such failures, and a lack of coordinated testing and monitoring of its readiness.

If this were a bank, they’d be under a Written Agreement or a Cease-And-Desist Order.

Petrou on FSOC

Do We Need the Financial Stability Oversight Council? (Federal Financial Analytics)

As far as we can tell, all it has done for all of the last four years is issue some nice papers about digital assets and the payment system about which nothing was ever done and put forth dutiful annual reports along with two new systemic-designation standards with which it has since done absolutely nothing.

She advocates for a model more like the UK, which I have admired as well.

Effective system-wide governance is not impossible. Late last month, the Bank of England showed what can and should be done to address systemic risk. Using the Bank’s authority to govern across the financial industry, it released a “System-Wide Exploratory Scenario” (SWES), essentially a financial-system wide stress test based on an acute geopolitical risk scenario run by fifty banks, insurers, hedge funds, CCPs, and asset managers.

The Bank of England has a signal advantage over FSOC: actual authority to mandate action by nonbanks as well as banks …

So two thoughts:

first, in the US there are always tensions to reduce the Fed’s authority in financial stability (divided supervisory responsibilities over banks with the OCC, FDIC and States, no authority over non-banks including insurers (unless designated as systemic)), and

second is that either because of the divided authority or in spite of the lack of authority, the US system always goes bank to “protecting the banking system” and “imposing market discipline on all non-bank firms.”

Over time, even if banks are still better able to save themselves than they are now, a financial system with asymmetric safety-and-soundness rules is one in which regulated companies consolidate into a few behemoths and the occasional community banks along with specialized, concentrated nonbank financial intermediaries with unchecked market power and ever-more certain taxpayer bailouts.

This is a messy sentence, but essentially she is asking whether we want the financial system to evolve in this matter, and who, if anyone, is doing anything other than chatter about it.

BIS Quarterly Review

December Review

The latest BIS Quarterly Review has been published.

The December review places extraordinary emphasis on government bond market risks, particularly through its detailed analysis of negative swap spreads and quantitative tightening impacts. They spend a fair amount of time discussing rising term premia and widening sovereign spreads.

I read the review as suggesting greater concern over currency markets, the tightening financial conditions in emerging markets, and EMEs' exposure to external shocks than to tight US credit spreads and the extended equity market valuations that seem to occupy the current priority in the US/

Concern Over Government Debt Markets

The primary concern centers on market absorption capacity for government debt. The BIS identifies a significant shift in market dynamics, evidenced by consistently negative swap spreads across multiple currencies and maturities. The persistence of negative swap spreads, particularly in U.S. Treasury markets, indicates this is not a temporary technical adjustment but rather a structural challenge. The BIS highlights how government bond market stress has become more synchronized across major economies, with negative swap spreads appearing in euro and yen markets as well.

Their detailed examination of "soft" auction results, particularly in U.S. Treasury markets, suggests growing difficulty in distributing new government debt efficiently. Their analysis suggests that higher term premia and funding costs could transmit stress to other markets, potentially triggering a broader tightening of financial conditions.

Currency Markets

On currency, the BIS notes that option-implied measures of skewness suggest growing concern about currency crash risk, particularly in high-yielding emerging market currencies. The BIS notes a strong correlation between interest rate differentials and crash risk, indicating potential vulnerability to sudden market shifts.

Evolution of Perspective

I review the latest BIS Quarterly Review, December 2024 along with the prior three (March, July and September) reviews.

Degree Of Concern Has Risen

The Bank for International Settlements' quarterly reviews through 2024 reflect an increasingly cautious outlook on global financial markets, with particular focus on emerging vulnerabilities in government funding markets and potential mispricing of risk in credit markets. While maintaining their characteristically measured tone, the BIS's analysis suggests growing concern about system-wide stability despite surface resilience.

The BIS's communication evolved from balanced assessment in early 2024 to increasingly pointed concern by year-end, particularly regarding market interconnections and systemic risk. In the March 2024 review, the BIS maintained a relatively balanced tone, focusing on the disconnect between market expectations and central bank guidance regarding rate cuts. The December review presents the most concerned tone of the year, though still carefully measured.

The government bond market stands out as the area where market developments and institutional concern most closely aligned. The BIS's increasing emphasis on funding market stress paralleled the actual deterioration in market conditions, with negative swap spreads and volatile yields confirming their earlier concerns. Their language became progressively more direct in addressing these issues, suggesting they view this market as a potential source of broader instability.

Credit markets presents an interesting contrast between market conditions and institutional concern. While market spreads remained compressed throughout the year, the BIS's tone became increasingly worried. Their characterization evolved from cautious observation to explicit concern about mispricing of risk, even as market conditions remained apparently benign.

Regarding currency markets, the BIS's analysis of the yen carry trade unwind in August marked a turning point, with their language becoming more explicit about the risks of leveraged positioning. By December, their discussion of EME currency vulnerabilities reflected a more comprehensive understanding of potential transmission channels for market stress.

De-Banking BS

There is a clear lobbying effort underway by the crypto industry to play the victim card by saying they’ve been “de-banked” by the Federal bank regulatory agencies. Such BS.

Debanking hurts everyone. It’s time to end it once and for all (Fortune)

Two weeks ago, venture capitalist Marc Andreessen appeared on the Joe Rogan Experience and introduced many Americans to the notion of debanking. Describing it as a “privatized sanctions regime that lets bureaucrats do to American citizens the same thing that we do to Iran,”…

There is also abundant evidence that the banks’ decision to cut off crypto clients was not a spontaneous, bottom-up phenomenon, but was instead instigated by regulators.

Crypto markets are highly volatile and are often used for illicit activities, including money laundering and sanctions evasion, and the firms involved are often targeted for, or actively facilitate, illicit activities, including money laundering and sanctions evasion, and have weak or non-existent compliance programs.

The regulators have issued a fairly standard set of expectations to the banks that deal with crypto firms1: tailored risk management frameworks, requiring banks to ensure crypto firms have effective programs to detect and report suspicious activities and comply with sanctions regulations, conducting robust due diligence on crypto firms, including understanding their business models, risk profiles, and compliance with laws such as the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) requirements, capital and liquidity requirements that account for the potential volatility and risk.

Patrick McKenzie, who writes about compliance issues at Bits About Money, and who once worked at Stripe, takes a more thoughtful approach in Debanking (and Debunking?). This is an extensive crypto-compliance tour-de-force. You likely won’t read anything better.

He draws the proper analogy to Money Services Businesses (MSBs) and the approach that regulators take to bank’s dealings with them.

Running a money services business (MSB) is virtually universally called out as a high-risk activity by banks’ internal AML policies. Explaining why would require explaining the entire history and object of AML. Please just take as writ for the moment: all banks have a list, those lists rhyme with some variation, and MSBs are on all the lists.

Some banks have built out so-called enhanced due diligence (EDD) programs under which they will bank MSBs. Many banks have not. …

Running EDD processes and ongoing monitoring is expensive. Banking a bodega isn’t very lucrative. And thus most banks won’t bank a bodega that is also an MSB, despite them having no particular malice against bodegas or the people who run them.

Some MSBs are fintechs. They have teams of people who are extremely aware of financial regulation. Those professionals intentionally chose a bank which was capable of banking at least some MSBs. They then had a laborious bespoke conversation about risk tolerance and mutually agreed-upon compliance procedures.

Many regular people who get the offboarding letter are confused and upset. … Some of these customers are getting the letter because the bank looked into their account after a transaction was flagged as suspicious. This generally happens because an automated system twinged on it. … if the analyst … decides that a transaction has… nothing irregular about it … they compose a … Suspicious Activity Report (SAR) … [that the] bank files it with FinCEN … and SARs will sometimes, fairly mechanically, cause banks to decide that they probably don’t want to … continue working with you.

… the bank cannot explain why SARs triggered a debanking, because disclosing the existence of a SAR is illegal.

Crypto-investing VCs are not low-sophistication operators of the corner bodega. They are extremely aware that crypto is on the high-risk list at many institutions. They would prefer this were not so.

Banking reputable, legal crypto businesses is a risky endeavor

This is from only about 1/3rd of his excellent analysis. He goes on to talk about SBF, Operation Choke Point, Silvergate, Signature Bank, political posturing, the CFPB’s role, the (alleged) specifically commanded politically-motivated debanking of individuals (in Canada) and politically-exposed-persons (PEPs). It is a serious compliance tour-de-force.

If one is worried about extraordinary debanking, worry less about formal guidance, and worry more about the Current Thing. Because Compliance doesn’t need to get an email from a regulator or read a position paper to get the Current Thing. The Current Thing was in the New York Times this morning. The Current Thing is all over Twitter. The Current Thing is in the air we breathe. Who could possibly be so oblivious as to not understand the Current Thing? Certainly not a competent professional in a bank or fintech Compliance department.

Bank Policy Institute weighs in with some recommendations in The Truth About Account Closures

Refocus AML (Anti-Money Laundering) compliance by targeting higher-risk activities rather than overwhelming banks with unnecessary low-risk SAR (Suspicious Activity Report) filings.

Address the vague concept of "reputational risk," which allows regulators to push banks away from politically disfavored business lines (examples include payday lenders, firearms stores, and certain mortgage-related services).

Roll back regulatory interference that restricts lending and forces banks to exit certain businesses, even when they comply with liquidity and capital rules.

Allow banks to leverage advanced AI tools to identify illicit financing more effectively and streamline anti-money laundering processes.

Final Thoughts

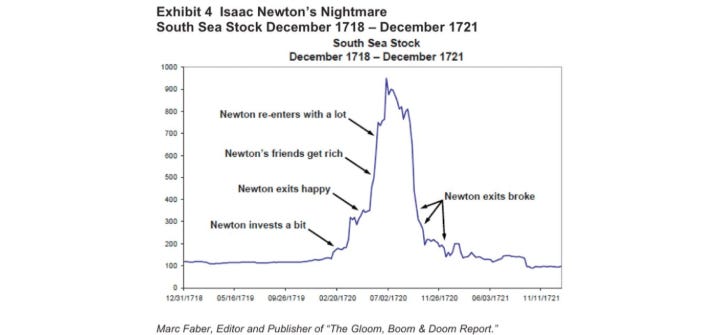

Priced To Perfection

High yield spreads down to 1998 and 2007 lows. Watch your risk/return tradeoff.

Being Smart & Being Risk-Aware Are Not The Same Thing

Without NVidia, US Underperforming Europe

On a PPP Basis, China Already Bigger Than US

January 2023 Joint Statement on Crypto Risks:

Issued by the Federal Reserve, OCC, and FDIC, this statement highlighted risks to banks from crypto-related activities, including volatility, fraud, legal uncertainties, and exposure to money laundering. It cautioned banks against engaging in activities that pose safety and soundness concerns.

November 2021 OCC Interpretive Letter 1179:

Clarified that national banks may provide crypto-related services (like custody and stablecoin issuance) only after obtaining supervisory approval and demonstrating robust risk management capabilities.

Supervisory Letters from the Federal Reserve:

Directed banks under its supervision to notify the Fed before engaging in crypto-related activities to ensure they adhere to safety and soundness standards.

SR 22-6 / CA 22-6: Engagement in Crypto-Asset-Related Activities by Federal Reserve-Supervised Banking Organizations (August 16, 2022)

SR 23-8 / CA 23-5: Supervisory Nonobjection Process for State Member Banks Seeking to Engage in Certain Activities Involving Dollar Tokens (August 8, 2023)

SR 23-7: Creation of a Novel Activities Supervision Program (August 8, 2023)