Perspective on Risk - Oct. 12, 2023

Recession; Board Oversight Responsibilities; Two Fed Papers; One BIS Paper; How Germans Market to Market; Lot's of Updates

Recession

Two good posts from Arturo: we are pretty close now to the median time from inversion to recession based on past recessions.

Board Oversight Responsibilities

The annual letter from Martin Lipton of Wachtell, Lipton, Rosen & Katz for Board directors on risk management developments is out. Risk Management and the Board of Directors. This is generally a good piece to share with junior staff to help them understand the role of the Board vs management.

The major emphasis this year is on risk oversight, as opposed to risk management.

Both the law and common sense continue to support the proposition that boards cannot and should not be involved in day-to-day risk management. However, every board’s oversight role should include active engagement in monitoring key corporate risk factors, including through appropriate use of board committees.

The note includes a very good summary of the Board’s fiduciary obligations (under Delaware law). It includes a list of specific recommendations for Boards to improve risk oversight (which would be a worthwhile checklist for most firms). Finally it includes specific sections and recommendations on ESG, Cybersecurity, and data privacy.

Two Fed Papers

Risk Free Rates & Treasury Convenience Yield

Options for Calculating Risk-Free Rates (Liberty Street)

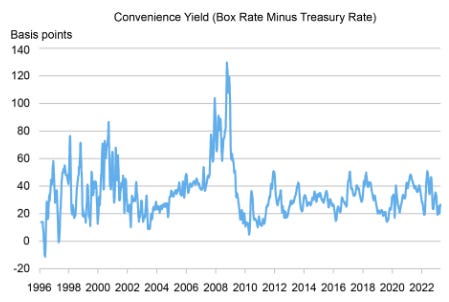

This paper looks at calculating Rf from S&P500 box spreads. It then looks at this version of the risk-free rate and compares it with UST to estimate the ‘convenience yield’ embedded in Treasury prices.

The authors show that the convenience yield spikes, as expected, during crisis:

And that the term structure of the convenience yield is flat out to 3 years:

Safe Asset Creation

A Theory of Safe Asset Creation, Systemic Risk, and Aggregate Demand (Fed Board)

This paper presents a theory of safe asset creation and the interactions between systemic risk and aggregate demand. The creation of private safe assets by financial intermediaries requires them to take leverage, which generates a risk of future crisis (systemic risk) in which intermediaries liquidate assets to service their debt. In contrast, the creation of public safe assets by the government does not generate systemic risk as the government’s power to tax allows it to better absorb losses. The level of systemic risk determines the neutral rate of interest through households’ precautionary saving and aggregate demand. The model features a two-way interaction between systemic risk and aggregate demand. Monetary and fiscal policy can stabilize aggregate demand and reduce systemic risk by altering the mix of private and public safe assets held by savers. When monetary policy is constrained, the economy can enter a risk-driven stagnation trap in which economic stagnation arises due to excessive systemic risk. Macroprudential policies which reduce systemic risk can stimulate aggregate demand.

One BIS Paper

Two economists at the BIS have authored The cumulant risk premium.

We develop a novel methodology for measuring the risk premium of higher-order moments based on leveraged ETFs. The methodology presents an alternative way to measure the risk of higher-order moments by using liquid ETFs instead of illiquid option portfolios, as widely used in the existing literature. Our paper illustrates that higher leverage involves increasing exposure to higher-order moments, in contrast to a common misperception that this risk declines with the number of higher-order terms. These results have implications for hedge funds and anyone who uses leverage. Our findings have also implications for portfolio theory, momentum strategies, factor models and option pricing.

First, we find that the risk premium on any asset is the sum of a linear term in an asset's leverage, and a non-linear term, which depends on the difference between higher-order physical and risk-neutral cumulants of the factor. We call the sum of these differences the cumulant risk premium (CRP). The returns on highly leveraged strategies are dominated by the non-linear term, and are thus highly sensitive to the CRP.

Second, we find that the average CRP is –7.4% annualized across assets and is more than 100% of the factor risk premium.

Third, we show that momentum strategies are exposed to cumulants.

Fourth, we find that liquidity provision to leveraged strategies is exposed to higher-order even cumulants and show that a strategy to mimic liquidity provision earns large Sharpe ratios in some assets.

Finally, we develop a global index of market stress based on cumulants. The index is easy to compute in real time and takes the prospective of a liquidity provider who is exposed to cumulants across asset classes.

How Germans Market to Market

One traditional role examiners play is in forcing banks to recognize the deterioration in their loan portfolios in a moderately timely manner.

ECB Steps Up Scrutiny of Banks’ Commercial Real Estate Loans (Bloomberg)

Regulators are concerned that appraisers and banks have been slow to mark prices down

The ECB said last year that its inspections at lenders showed the valuation of collateral “is a blind spot for many of the banks,” with some firms failing to update appraisal reports. In some cases, the banks accepted valuations provided by clients rather than seeking an independent report.

German valuations take a long-term view of the market, meaning prices tend to be less volatile than those in the U.S. and U.K., which have already seen sharp adjustments as a result of rising borrowing costs.

Random Updates

The Roof, The Roof, The Roof Is On Fire

We don’t need no water let the motherf#cker burn. Burn, motherf#cker, burn.

The scientists have consistently told us we need to keep warming to below 1.5C to avoid catastrophic events. We’ve failed; we haven’t even reached peak carbon emissions yet.

World breaches key 1.5C warming mark for record number of days

On about a third of days in 2023, the average global temperature was at least 1.5C higher than pre-industrial levels.

Insurance

Progressive to exit more property insurance business in Florida (Artemis)

Progressive confirmed that it will not be renewing around 100,000 homeowners property insurance policies in Florida, the second time it has elected to non-renew a block of business there. … 47,000 DP3 policies, typically related to secondary residences, will be non-renewed, as well as 53,000 policies for properties considered to be higher-risk.

As with all the moves we’ve seen and reported on where major carriers are pulling-back in catastrophe and severe weather exposed regions, Progressive cited exposure management as a driver.

Surging Insurance Costs Have Come for Office Landlords (WSJ)

Commercial property owners, already struggling with high interest rates and rising vacancies, face exploding insurance costs that keep hitting new highs.

While insurance premiums are rising virtually everywhere and for all building types, some cities have been particularly hard hit, especially for multifamily buildings. Costs to insure rental-apartment buildings rose 14.4% annually on average in Dallas, 13% in Los Angeles and 12.6% in Houston.

Intensifying natural disasters are a big reason for the increase, particularly in cities vulnerable to wildfires, floods or storms. The cost of reinsurance has also increased, trickling down to higher property insurance rates. Meanwhile, inflation has pushed up the cost of repairing or rebuilding damaged properties. In some cases insurers choose to not even provide quotes, leaving those who do free to charge higher premiums.

More FHLB

Hat tip again to Steven Kelly for noticing this. In Implementing Monetary Policy: What’s Working and Where We’re Headed, Roberto Perli, the NY Fed’s Manager of the System Open Market Account, gives a really thorough discussion of the interaction of the ‘ample reserves’ framework, the runoff of the Fed’s balance sheet, and market function. It’s a really good piece for those who like these kind of details. Anyway, concerning the FHLB, Perli notes:

… this past spring some banks reported significant deposit outflows which, in turn, reduced the reserve holdings and overall liquidity position of the affected institutions. These outgoing funds were primarily transferred to larger banks at first and eventually migrated to money market funds. Most of the affected banks turned to private markets, particularly advances from the FHLB system, to replace outflowing deposit funding. Many used the same instruments to source precautionary liquidity as well. In total, private markets supplied around $250 billion to domestic commercial banks over just a one-week period, a significant portion of which appeared to be provided by the FHLB system (Panel 5).13 FHLBs funded that credit expansion primarily by issuing short-term debt, including discount notes, at a modest premium to the ON RRP rate.

MMFs were responsive to relatively small price incentives, reallocating their activity away from the ON RRP and toward FHLB debt, thereby channeling much needed liquidity back into the banking system at a reasonable cost relative to other wholesale alternatives.

Steve summarizes as follows:

For as destabilizing as the FHLBs can be, they can also offset another potential stability risk: the risk of a run *into* the Fed's RRP facility.

Perli makes the point that, in the March panic, FHLBs were able to attract funds from the RRP and redistribute them to banks:

In the July 8, 2023 Perspective, I wrote about my philosophical distain for the FHLB system and Dan Tarullo’s paper highlighting the FHLBs as a systemic risk, and in the Sept. 15, 2023 Perspective I highlighted Stephen Cecchetti, Kim Schoenholtz & Lawrence White firing some shots in The dangerous role of America’s weird lenders-of-next-to-last resort (FT)

The FHLB needs to be explicitly delinked from USG support, and declared a systemically significant financial institution subject to Fed supervision.

China Evergrande > Argentina

Evergrande Investors Warn of ‘Uncontrollable Collapse’ (WSJ)

Evergrande had the equivalent of more than $332 billion in liabilities by June, which included money owed to suppliers, unfinished projects and its bond and loan obligations.

The three Argentina debt defaults between 2005 and 2020 totaled $141 billion. Current Argentina debt is a bit larger at $392 billion.

KYC Comes For Tech

Tech Industry Slams US Government’s Plan For Keeping Hackers Away From the Cloud

Government officials believe that requiring cloud providers to obtain users’ personal information during the signup process would make it harder for hackers to use those platforms as launchpads for cyberattacks, since digital wrongdoers wouldn’t want to be identified in connection with their activities.

De-Euroization

We worry about dedollarization, but it appears de-euroization is what’s happening.

Thinking in Bets

Matt Levine has one of his better posts: SBF’s Bets Used to Work Out.

In it, he discusses why individual traders will take less risk than is optimal for the firm, provided that their choices are truly independent.

It is optimal for a firm like Jane Street with a lot of traders to encourage each of them to take a lot of positive-expected value risk, because Jane Street has enough of them to benefit from the law of large numbers. With enough independent positive-expected-value bets, it will make money, even if some traders lose money.

But if every Jane Street trader took the optimal amount of risk for her, she would probably put a high premium on not losing everything. She’d size her bets too small for the firm. Jane Street has to, in some sense, train the risk-aversion out of her.

And then some young traders leave … and the lesson they take away is “I should bet a huge proportion of my bankroll on every positive-expected-value trade” But that is not quite the right lesson! Bankman-Fried’s pathological aggressiveness might have worked really well within the restrictive environment of Jane Street, but it blew him up once he was on his own.

Term Premium

Interesting chart from Dario Perkins; looks pretty linear in yield

Coming Attractions

Q3 for banks should have:

Large unrealized losses on securities portfolios

Rising losses on CRE

Rising loan loss allowances

Narrowing net interest margins (as deposit costs rise faster than asset yields)

Watch the bank CDS market.