Perspective on Risk - June 21, 2024

Things I've Learned; Prospective Treasury Market Developments; Swiss Re’s SONAR; Climate Game

Some Things I’ve Learned

Economics

We May Be In A Recession. Been a long time coming if true. Mea culpa; only off by a year (if it drops). The Kantro indicator has triggered, but the Sahm indicator has not (yet). The Conference Board’s LEI has now been in decline for fifteen months—the longest streak of consecutive decreases since 2007-08, during the runup to the Great Recession.

US federal interest payments now exceed the defense budget.

Geopolitical

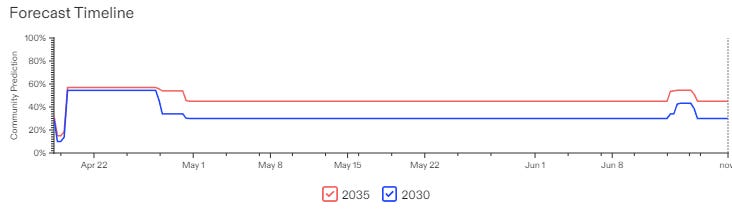

Forecasters on Metaculus think it is more likely than not that China will aim for a quarantine within the next 10 years

Climate

We’ve just experienced 11 months of temperatures 1.5C above pre-industrial levels.

As of June 1st, the 365-day running mean for the global surface temperature has reached 1.63°C above the 1850-1900 pre-industrial baseline.

Winters have warmed faster than summers in the United States (OurWorldInData).

American winters have warmed by nearly 3 degrees Fahrenheit (°F), compared to 1.5°F to 2°F in other seasons.

Minimum temperatures have increased faster than maximum temperatures. That means nighttime temperatures have increased more than daytime temperatures.

A 2°F rise in sea surface temperatures can increase a hurricane's wind speeds by over 13%.

This means a 140 mph Category 4 hurricane can become a 160 mph Category 5 (in favorable atmospheric conditions), with nearly 3x the damage potential. (@US_Stormwatch twitter post)

I previously linked to a paper that implied a “social cost of carbon” of $1,056 per ton of CO2. $1000/ton is like $10/gallon.1

Last year, we installed about 460 GW of solar capacity globally. Solar has a “learning rate” of 44% means that the cost falls by 44% for every doubling of production, and production is currently doubling roughly every 18 months.2

Battery technology currently has a 23% learning rate

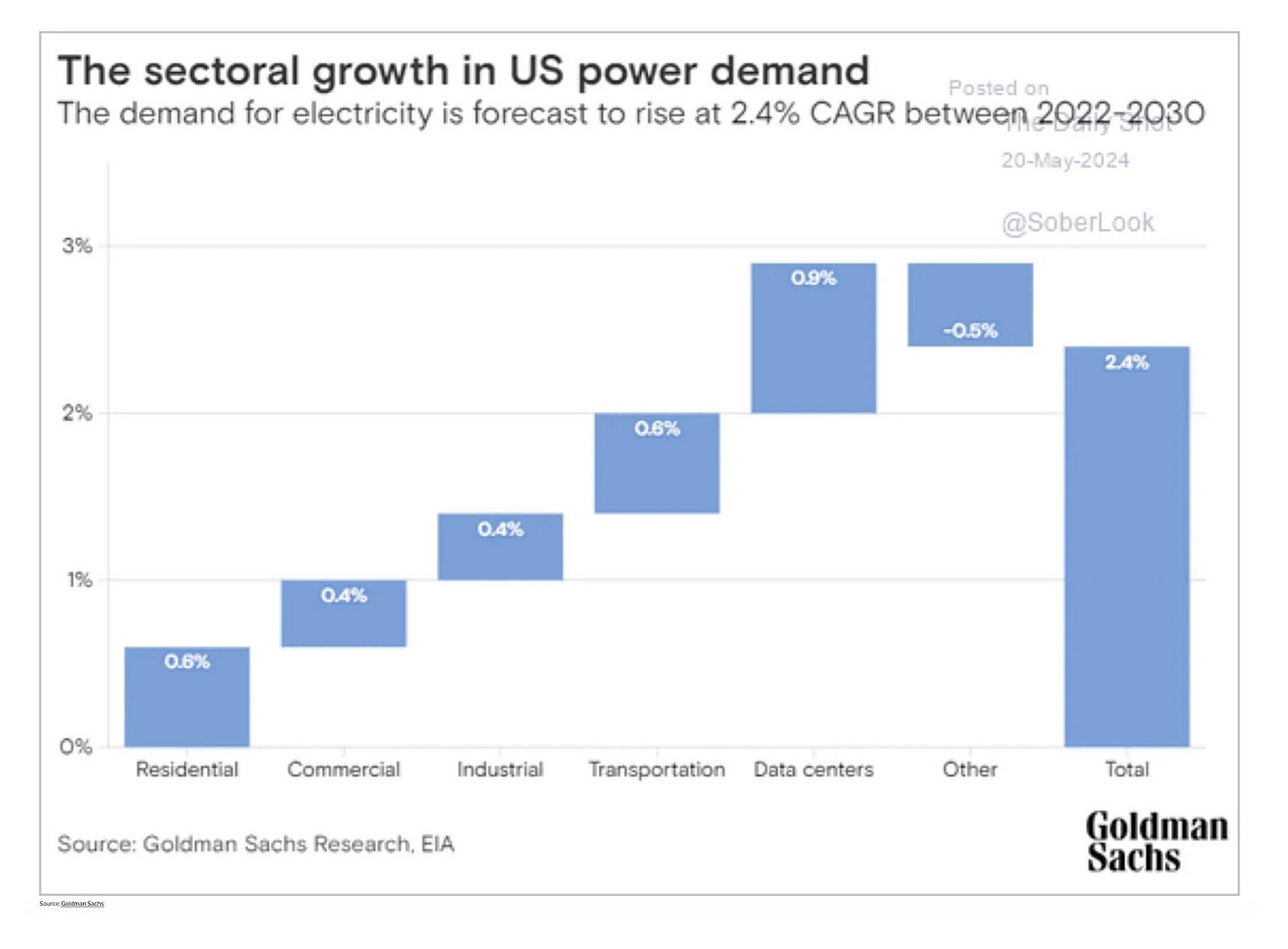

US demand for electricity is expected to grow 2.4% p.a. through 2030, largely due to data centers.

Amount of energy used to train a GPT-4 like model has declined 350x since 2016. Inferencing energy usage down 45,000x. (NVidia)

The latest CMIP6 climate models suggest a 36% risk of an abrupt cooling event affecting Europe due to changes in the AMOC. This is down from 45% in the CMIP5 models

If the top 10% of emitters globally maintain their current emissions levels from now onwards, they alone will exceed the remaining carbon budget in the IEA’s Net Zero Emissions by 2050 Scenario by the year 2046.

The world’s top 1% of emitters produce over 1000 times more CO2 than the bottom 1%.3 The richest 0.1% of the world’s population emitted 10 times more than all the rest of the richest 10% combined, exceeding a total footprint of 200 tonnes of CO2 per capita annually.4

Fixed Income

Households & Businesses Are Deleveraging. The Government Is Not. (Wallerstein)

UST Now Account For Nearly 50% Of US Fixed Income (Baeza)

AI & LLMs

Generative model can achieve capabilities that surpass the abilities of the experts generating its data. AI is effectively aggregating the wisdom of the expert crowd.5

Eat More Cheese

"Sweet dreams are made of cheese, who am I to dis a Brie?...."

A higher intake of cheese (and fruit) is one of the standout contributors in those who had high well-being scores. It had a 3.67% positive impact on those healthy aging factors.6

Prospective Treasury Market Developments

I’ve noticed that Fed economists have been publishing a lot of notes and papers on the Treasury market of late. In particular:

"Measuring Treasury Market Depth" by Michael Fleming, Isabel Krogh, and Claire Nelson

"Open-Ended Treasury Purchases: From Market Functioning to Financial Easing" by Stefania D’Amico, Max Gillet, Sam Schulhofer-Wohl, and Tim Seida

"Who Buys Treasuries When the Fed Reduces its Holdings" by Lucy Cordes and Erin Ferris

"Reaching for Duration and Leverage in the Treasury Market" by Daniel Barth, R. Jay Kahn, Phillip Monin, and Oleg Sokolinskiy

I asked ChatGPT-4o to read and relate the papers:

Liquidity and Market Functioning: Both "Measuring Treasury Market Depth" and "Open-Ended Treasury Purchases" address liquidity issues but from different angles. The former focuses on the intrinsic liquidity of the market, while the latter evaluates how the Fed's interventions influence liquidity during crises and periods of economic stress.

Impact of Fed's Actions: The theme of the Federal Reserve's influence runs through all the papers. "Open-Ended Treasury Purchases" directly examines the effects of Fed interventions, while "Who Buys Treasuries When the Fed Reduces its Holdings" and "Reaching for Duration and Leverage in the Treasury Market" look at market responses to changes in Fed policies and the behavior of different market participants.

Market Participants and Behavior: "Who Buys Treasuries When the Fed Reduces its Holdings" and "Reaching for Duration and Leverage in the Treasury Market" provide insights into the behavior of different types of investors in response to Fed policies, highlighting how these behaviors can affect market dynamics and stability.

My whole dialogue is here, feel free to read it. With additional follow-up questions, all of this took about 3 minutes.

Swiss Re’s SONAR

I always liked reading Swiss Re’s emerging risk publication, SONAR. This is one of the rare risk reports that I have found insightful (probably on par with Ian Bremmer’s work). Their 2024 issue is out. The report lists 13 Emerging risk themes and 3 Trend spotlights.

They highlight two emerging risks as HIGH over the next 0-3 years:

Beyond broken infrastructure – the cascading effects of natural catastrophes

Floods, wildfires, severe convective storms and other natural peril events

routinely inflict widespread property damage and what can be massive,

headline-grabbing economic and insurance losses.99 Less well publicised and

understood are the cascading (negative) effects of such events on the systems

that underpin society, including energy, water and transport infrastructure.

AI – unintended insurance impacts and lessons from “silent cyber”

The increasing use of artificial intelligence (AI) could trigger claims across

many lines of business. Insurers will need to develop an understanding of

intended and unintended effects, and design products that mitigate the risks.

In the first case, cascades (or correlation) among events could lead to larger losses; in the second, the opposite, a single technological change could result in hidden exposure correlations across numerous business lines.

I’d recommend reading the whole report, or having a junior member of your staff read it and present a summary to you.

The Climate Game

Can you reach net zero by 2050? Play the Climate game by the Financial Times

I failed.

Carbon Dioxide Emissions Coefficients (EIA.gov)

The solar industrial revolution is the biggest investment opportunity in history (Casey Handmer’s blog)

THE CARBON INEQUALITY ERA (Stockholm Environment Institute)

In this case, I firmly believe correlation is causation.

Eating cheese plays a role in healthy, happy aging – who are we to argue? (New Atlas)

For healthy ageing, it's all about how you feel, and cheese helps, apparently