Perspective on Risk - July 14, 2023 (Are We Already In A Recession?)

Are We Already In A Recession? Shrinking The Fed’s B/S; Money Market Reform (Again); Debt; Historical Real Returns Are Impressively Uncorrelated; The Wisdom Of Crowds (of Economists); Reading List

Are We Already In A Recession?

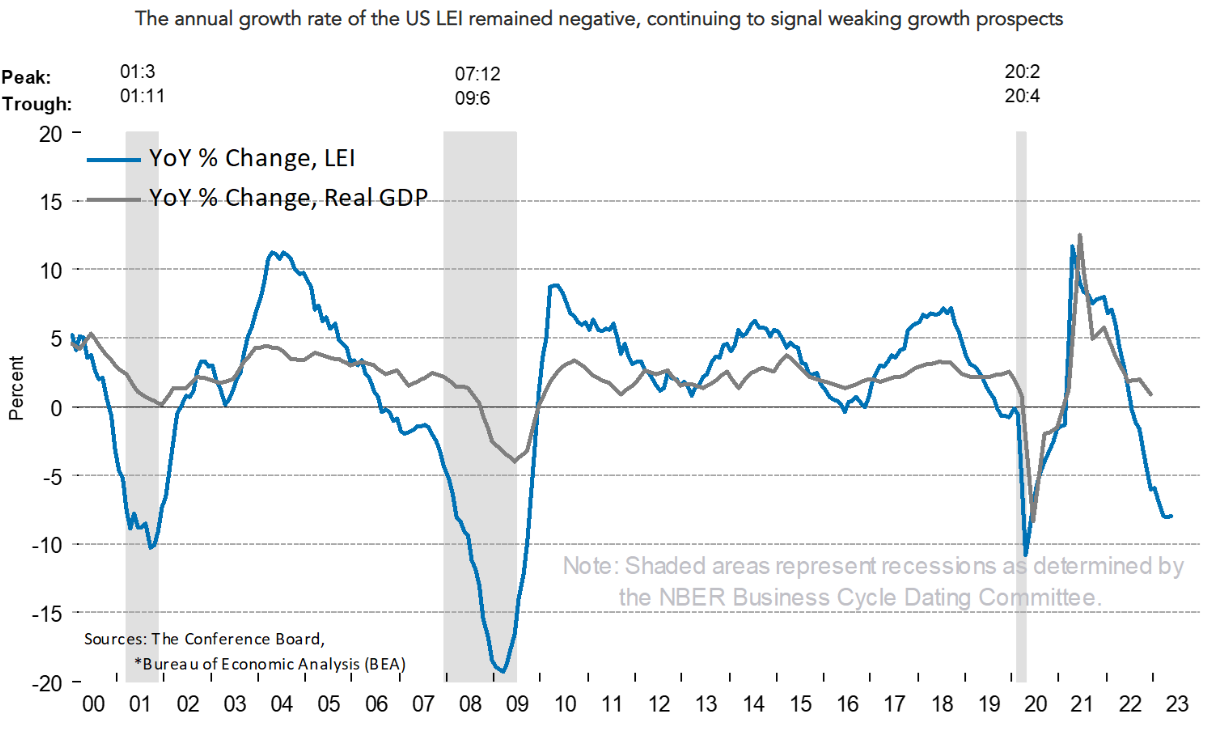

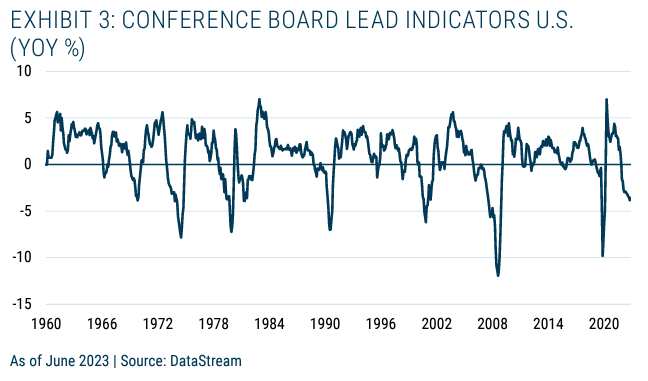

Negative year-over-year changes in the Conference Board LEI is a pretty good indicator. Right on time with the prediction coming from the yield curve inversion.

And remember private sector debt-to-GDP remains above 150% (historically the risky threshold) in the US, Japan, France, the UK, Spain, Australia, and broadly across the EM. Germany is slightly better at 130%.

The End of QE; The Beginning of QT

Shrinking The Fed’s Balance Sheet

Powell Haunted by Repo Crisis as Fed Aims to Cut Balance Sheet

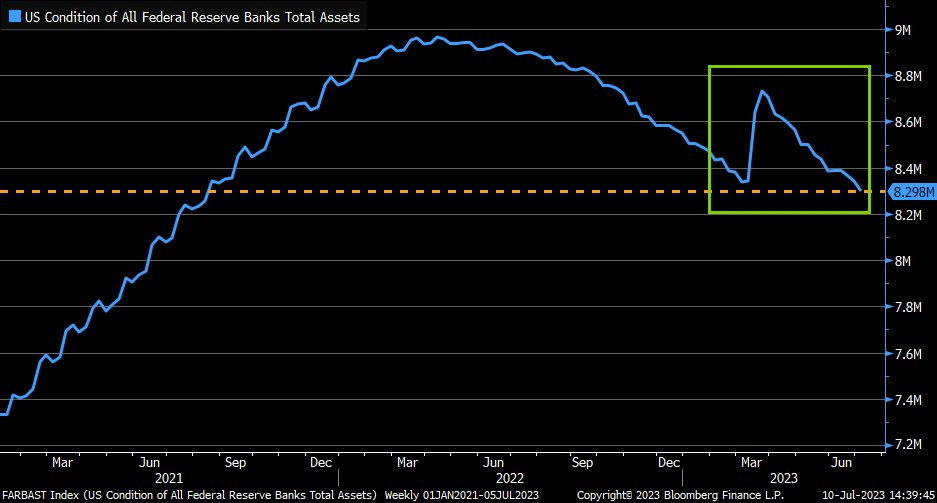

The Fed is currently shedding its bond holdings at an annual pace of roughly $1 trillion, much faster than in 2019 but from a much bigger base.

The Fed’s liquidity injections during the spring — to help address regional bank troubles — expanded the balance sheet. The Treasury was also limiting sales of bills — which remove liquidity — while it was constrained by the debt-limit standoff.

Those two dynamics have largely ended now, however.

The RRP can shrink “dramatically” without “particularly important macroeconomic effects,” Powell explained last month. And he told a Senate panel that “that’s what we would have hoped to see, rather than taking reserves out of the system.”

From the FOMC minutes, staff believes we are still in an ‘abundant reserve’ position.

On net, the staff judged that reserves at the end of the year were likely to remain abundant. Uncertainty surrounding the outlooks for both reserves and ON RRP participation was substantial.

Odds are, though, that deposit rates will have to rise more rapidly to keep reserves in the system, and to have the ON RPP shrink as Powell would like.

And ECB QE Is Ending Too

Money Market Reform (Again)

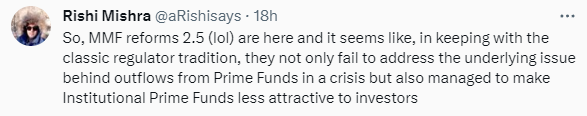

The U.S. Securities and Exchange Commission on Wednesday finalized rules aimed at increasing the resilience of the $5.5 trillion money market fund industry …1

U.S. regulators rewrote the rules for money-market funds for the third time in 15 years in hopes of preventing bailouts in times of turmoil, as investors pour money into the funds this year.2

The SEC's decision not to impose "swing pricing" represents a major victory for asset managers [that] had argued the pricing mechanism, meant to deter hasty investor redemptions in times of market stress, would make money market funds unattractive and be challenging operationally to implement.3

The Securities and Exchange Commission voted 3-2 Wednesday to change the rules governing money-market funds, which the Federal Reserve had to backstop with emergency lending facilities in 2008 and 2020. Two previous overhauls by the SEC failed to stop investors from fleeing certain funds en masse when markets faced extreme stress.4

The final rule requires certain money-market funds used by institutional investors to impose fees when a fund sees daily net redemptions that exceed 5% of net assets.

The final rule also requires funds to keep at least 25% of their holdings in assets that mature in one day, up from 10% currently, and at least 50% of their holdings in assets that mature within one week, up from 30% currently.

All of this is about the structure between regulated banking and market-based finance, and how to construct mechanisms that avoid moral hazard, incent safe and sound behavior, and lessen ‘first-mover’ advantage to prevent the sovereign/Fed from having to use public funds.

Bank of America doesn’t think it solves the problem. New SEC Money-Fund Rules Don’t Fix Dash-for-Cash Risk, Bank of America Says

“Future investor behavior in an acute flight to quality episode could see prime MMF or other short-duration asset managers rapidly sell CP & CD again, even with the higher liquidity thresholds,” they wrote. “Limited dealer balance sheet capacity could then see another market freeze.”

I tend to agree.

Debt

10 Year Real Yield At GFC Levels

Fixed Income Is Now a Buyer’s Market (Guggenheim)

We believe that the credit sector in the aggregate has the strength to weather a potential recession that could come as soon as the second half of this year.

Comparing to a similar point in history in 2018 when fears of overtightening caused the Fed to pause its rate-hiking cycle, yields are significantly higher now and spreads are wider in most sectors, as shown in our chart. Like 2018, the Fed has vowed to continue with quantitative tightening. But the fundamental picture is arguably better today. Net leverage is lower and interest coverage is higher across most rating categories relative to prior downturns, due to strong nominal profit growth and lower interest expense. Balance sheet liquidity, while not evenly distributed, remains robust at the index level with high cash-to-debt ratios.

Leverage Is Creeping Back Into Corporate Credit, Citi Warns

“The first signs of a re-leveraging cycle have surfaced in the US high-grade market,” write Citi strategists Daniel Sorid and James Keefe in a note published on Wednesday. “If recent history is a guide, the trend is not our friend.”

From the Apollo deck:

Corporate Bankruptcies

Apollo recently published a 60+ page Credit Market Outlook, for those who like to peruse these things. They state:

a default cycle has started

The Corporate Bankruptcy Wave Will Get Even Uglier (Bloomberg)

US bankruptcies in the first six months of 2023 were the highest since 2010 among the companies covered by S&P Global Market Intelligence. In England and Wales, corporate insolvencies are near a 14-year high. Swedish bankruptcies are the highest in a decade, while in Germany bankruptcies jumped almost 50% year-on-year in June to the highest level since 2016. In Japan, bankruptcies are at their the highest in five years.

Distressed Firms and the Large Effects of Monetary Policy Tightenings (FEDS Notes)

The stance of U.S. monetary policy has tightened significantly starting in March 2022. At the same time, the share of nonfinancial firms in financial distress has reached a level that is higher than during most previous tightening episodes since the 1970s

Our results suggest that in the current environment characterized by a high share of firms in distress, a restrictive monetary policy stance may contribute to a marked slowdown in investment and employment in the near term.

The evidence in this note carries two important policy implications.

First, the strength of the transmission of monetary policy depends on the aggregate distribution of firm financial distress.

Second, financial distress is important to explain why the response of investment and employment is stronger after tightening shocks than after easing shocks.

With the share of distressed firms currently standing at around 37 percent, our estimates suggest that the recent policy tightening is likely to have effects on investment, employment, and aggregate activity that are stronger than in most tightening episodes since the late 1970s. The effects in our analysis peak around 1 or 2 years after the shock, suggesting that these effects might be most noticeable in 2023 and 2024.

Our estimates suggest that the recent policy tightening is likely to have effects on investment, employment, and aggregate activity that are stronger than in most tightening episodes since the late 1970s.

Private Credit

Moody’s warns of ‘serious challenge’ to $1.4tn private credit market (FT)

The $1.4tn private credit industry faces its “first serious challenge” as tens of billions of dollars of loans underwritten at the top of the market in 2021 are strained by sharply higher interest costs and a slowing economy, analysts at rating agency Moody’s cautioned on Friday.

The warning from Moody’s, which singled out two of the largest players in the sector — funds managed by lenders Ares and Owl Rock — underlined the challenge facing lenders who raced to win new business before financial markets tightened in 2022.

The two entities lent to some of the largest buyouts in 2021, particularly software takeovers conducted by specialist private equity firms such as Thoma Bravo.

The Performance of Private Direct Lending, 2023 Update (advisor perspectives)

Over the past decade, there has been a fundamental shift in the fixed income landscape.

That changed after the great recession when new regulations limited the ability of banks to make traditional loans to U.S. middle-market businesses (generally defined as companies with EBITDA, or earnings before interest, taxes, depreciation and amortization, of between $10 million and $100 million and which are considered by many too small to access capital in the broadly syndicated market in a cost-efficient manner). “Shadow banking” emerged with independent asset managers funded by capital from institutional investors, replacing banks as providers of secured, first lien commercial loans.

The growth in direct middle-market loans originated by asset managers is partly explained by the growth in middle-market private equity. Those loans are referred to as “sponsor backed.” Private equity sponsors often prefer to borrow from asset managers rather than traditional banks because asset managers offer faster speed, certainty of execution and greater financing flexibility.

There are some useful performance statistics in the article, for those who need that stuff.

Historical Real Returns Are Impressively Uncorrelated

The Wisdom Of Crowds (of Economists)

Do Any Economists Have Superior Forecasting Skills?

To answer this question, we develop new testing methods for identifying superior forecasting skills in settings with arbitrarily many forecasters, outcome variables, and time periods. Our methods allow us to address if any economists had superior forecasting skills for any variables or at any point in time while carefully controlling for the role of “luck†which can give rise to false discoveries when large numbers of forecasts are evaluated. We propose new hypotheses and test statistics that can be used to identify specialist, generalist, and event-specific skills in forecasting performance. We apply our new methods to a large set of Bloomberg survey forecasts of US economic data show that, overall, there is very little evidence that any individual forecasters can beat a simple equal-weighted average of peer forecasts.

Reading List

Market-implied Equity Premium

I’ve long been a fan of using market prices to infer actual costs and premiums. On of my favorite papers in this vein was authored by a former Fed and AIG colleague Alan Malz A Simple and Reliable Way to Compute Option-Based Risk-Neutral Distributions

Now, Paul Tetlock has authored The Implied Equity Premium. I’ve highlighted in the past a paper by Martin What Is the Expected Return on the Market? The Tetlock paper expands on Martin by inferring higher-order moments of the distribution from options prices.

I propose and test a simple model of the equity premium implied by the prices of options on the stock market. The model assumes that markets for the stock index and its options are frictionless and complete to extract as much information as possible from their prices. Its forecasts of the equity premium are more accurate than those in prior work, especially when arbitrage costs are low. It offers new economic insights into why the premium varies, including why it increased for many years after the 2008 crisis. The model also provides a unified explanation of risk premiums for variance and higher-order moments of market returns.

I’m sure someone out there will find this interesting.

Forecasting Existential Risks

The Existential Risk Persuasion Tournament (XPT) aimed to produce high-quality forecasts of the risks facing humanity over the next century by incentivizing thoughtful forecasts, explanations, persuasion, and updating from 169 forecasters over a multi-stage tournament. In this first iteration of the XPT, we discover points where historically accurate forecasters on short-run questions (superforecasters) and domain experts agree and disagree in their probability estimates of short-, medium-, and longrun threats to humanity from artificial intelligence, nuclear war, biological pathogens, and other causes. We document large-scale disagreement and minimal convergence of beliefs over the course of the XPT, with the largest disagreement about risks from artificial intelligence. The most pressing practical question for future work is: why were superforecasters so unmoved by experts’ much higher estimates of AI extinction risk, and why were experts so unmoved by the superforecasters’ lower estimates? The most puzzling scientific question is: why did rational forecasters, incentivized by the XPT to persuade each other, not converge after months of debate and the exchange of millions of words and thousands of forecasts?

Forecasting: Theory & Practice

This is a pretty comprehensive resource. Forecasting: theory and practice

This article provides a non-systematic review of the theory and the practice of forecasting. We provide an overview of a wide range of theoretical, state-of-the-art models, methods, principles, and approaches to prepare, produce, organise, and evaluate forecasts. We then demonstrate how such theoretical concepts are applied in a variety of real-life contexts.

Financial Machine Learning

We survey the nascent literature on machine learning in the study of financial markets. We highlight the best examples of what this line of research has to offer and recommend promising directions for future research. This survey is designed for both financial economists interested in grasping machine learning tools, as well as for statisticians and machine learners seeking interesting financial contexts where advanced methods may be deployed.

Credit Training Is Good For Bond Managers

Like A Duck to Water: Do Credit Rating Analysts Outperform in Bond Fund Management?

This paper investigates whether bond fund managers with credit rating experience outperform their peers. We document that bond fund managers who previously worked in credit rating agencies on average create higher risk-adjusted returns than their peers by 11-16 bps per month, with better security picking and market timing skills. We further confirm that this outperformance is sourced from their industry-specific knowledge gained via rating experience (specialization), rather than information advantage provided by previous colleagues (network). Last, we document net inflows to funds managed by agent managers, indicating the investor awareness of analyst managers skill.

Op. Cit. US SEC scraps contentious pricing proposal in final money market fund reforms

Op. Cit. U.S. Takes Third Shot at Shoring Up Money-Market Funds (WSJ)