Perspective on Risk - July 2, 2025 (Stablecoins, Part Troix)

Who needs stablecoins? The BIS doesn't like stablecoins; Will they like tokenized deposits?; How might the stablecoins/"tokenized deposit" market evolve?

Perspective on Risk - May 28, 2025 (Stablecoins)

Perspective on Risk - June 3, 2025 (Stablecoins, Part Deux)

Why Stablecoins?

So leaving aside the crypto casino, why would anyone want these things?

Commercial Firms

Faster, cheaper global payments. Reduced interchange fees. The possibility of tying the customer to your shopping experience with incentives, though I think the traditional Starbucks model is better (those retail funds can be used for general purposes whereas stablecoins will be segregated).

Financial Firms

Potential for a significant decrease in settlement risk (though legal and contract differences remain across countries that doesn’t totally eliminate Herstatt risk). Cost reduction from T+0 settlement. Potential custody business.

Retail Customers

Less clear beyond participating in the crypto economy. Lower-friction cross-border payments. Potential for USD exposure in high inflation countries.

So in short there is the potential for some real benefits for corporations and financial institutions. The extent of retail’s benefits will depend on how much is offered to them.

BIS on Stablecoins

III. The next-generation monetary and financial system (BIS)

Tokenisation represents a transformative innovation to both improve the old and enable the new. It paves the way for new arrangements in cross-border payments, securities markets and beyond.

platforms with central bank reserves, commercial bank money and government bonds at the centre can lay the groundwork for the next-generation monetary and financial system.

Stablecoins offer some promise on tokenisation but fall short of requirements to be the mainstay of the monetary system when set against the three key tests of singleness, elasticity and integrity.

Mapping the Next Market Structure

The week bank money went on-chain

“Last week, JPMorgan did something it had never done before: it put real bank money on a public blockchain.” 51insights.xyz

JPMorgan’s new JPMD deposit token now settles institutional payments on Base1, collapsing the gap between regulated deposits and crypto-speed settlement. The timing is no accident: the U.S. Senate has just passed the GENIUS Act, handing the market the clearest roadmap yet for who may issue dollar-backed tokens and on what terms. With corporates as large as Walmart and Amazon weighing their own coins—potentially saving “billions in transaction fees” by bypassing card networks pymnts.com—stablecoin finance has left the innovation sandbox and entered big-balance-sheet territory.

JPMD is a digitized bank deposit, not a GENIUS-Act “payment stablecoin.”

In the whole debate about whether stablecoins are money, this helps clarify things. Deposit tokens ARE money; regulated stable coins are more akin to tokenized Treasury-only MMMF, while the existing stablecoins like Tether are tokenized Prime MMMF.

In practical terms JPMD lets large Treasury and trading desks get blockchain-speed settlement without leaving the regulated banking system—and, because the underlying is still a deposit, it can in principle earn interest and (up to FDIC limits) enjoys deposit-insurance protection.

Consortiums: Stablecoin As a Service

Fiserv Launches Stablecoin for Banks (Finovate)

Fiserv is leveraging Paxos, Circle, and Solana to launch FIUSD, a new stablecoin integrated into its global banking and payments infrastructure.

For traditional banks, FIUSD offers a safe and controlled on-ramp into stablecoins. By partnering with a trusted infrastructure provider like Fiserv, banks can experiment with programmable money without needing to become crypto-native themselves.

But they are also interested in tokenized deposits!

… the company also said that it is evaluating the use of tokenized deposits as an alternative to stablecoins. Tokenized deposits offer many of the same advantages that stablecoins do, such as speed, interoperability, and programmability. However, tokenized deposits are designed to align more closely with regulatory and capital requirements.

Commercial Firms

The potential genius of GENIUS (Visa)

Visa seeks to act as a “service stack” providing an interface layer for stablecoin access to their merchant network.

Consumers and businesses across the globe see their 4.8 billion Visa credentials and the nearly 14 billion digital Visa tokens as the best way to pay and be paid by everyone, everywhere. Our stack delivers magical payments experiences, and we are constantly investing to make it the most cutting edge, secure and convenient way to pay.

Americans Will Put Money In Amazon And Walmart Stablecoins (Forbes)

Stablecoins could divert significant transaction volume—and core deposits—away from banks as retailers, fintechs, and Big Techs issue branded stablecoins that lead consumers to move cash into stablecoins for convenience, rewards, or programmability.

Sorting Out The Headlines

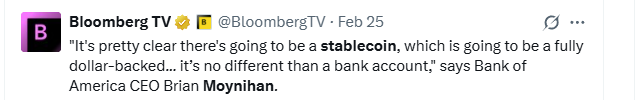

In the short run, there will not be one stablecoin archetype, but multiple possible approaches. There will be bank-issued stablecoins (JPM, BoA) competing with the existing non-bank-financial-institution issued stablecoins. There may be consortium-led stablecoins with multiple sponsor participants. Commercial firms like Walmart will issue their own stablecoins. Each will have specific customers, target specific needs and have advantages and disadvantages.

Over the past month we have stress-tested several frameworks for analysing stablecoin finance. The most resilient pairs a supply-side archetype with a demand-side cluster:

Demand sorts into three clusters:

Treasury-management cluster – corporates chasing intraday liquidity, FX netting, CCP margin.

Payments stable-value cluster – merchants and wallets seeking low-fee retail settlement.

Crypto-native / liquidity-seeking cluster – DeFi protocols, perpetual traders, cross-chain arbitrage.

Each issuer can, in principle, serve any cluster, but product-market fit—and future regulation—will push them toward natural pairings.

How each archetype is likely to evolve

Bank-issued / deposit tokens

Status: JPM Coin already processes $2 bn a day on Quorum, its private blockchain; JPMD, which is different from JPM Coin, opens the door to public-chain liquidity 51insights.xyz. Citi, BNY Mellon and Standard Chartered pilots are behind the curtain.

Edge: Ability to pay interest, offer intraday credit, and bundle cash-management services. Deposit insurance blunts run risk.

Headwinds: Heightened leverage caps once tokens exceed a percentage of insured deposits; potential anti-tying scrutiny if banks force clients onto bespoke rails.

Likely demand cluster: Treasury-management first, then crypto-native protocols that need “bank money with yield”.

Consortium-issued

Fnality (15 banks, on Hyperledger) and USDF (US community banks) target inter-bank settlement. Their value proposition is netting and PvP without surrendering deposits to a competitor. Participation thresholds and slower governance cycles make these tokens ideal for clearing-house plumbing rather than retail flow.

Non-bank financial (USDC, USDT)

Tether: $143.6 bn outstanding vs $149.3 bn in assets, $5.6 bn excess reserves, $1 bn quarterly profit—its first report under El Salvador oversight btctimes.com.

Circle: positioned as the compliant alternative, but must swallow the interest prohibition in GENIUS or lobby for a money-fund wrapper.

These issuers dominate the crypto-native cluster, providing the liquidity leg for perpetuals, CEX balance sheets and on-chain collateral. The Act’s extraterritorial reach means offshore coins will need U.S.-compatible blocking / freezing functions or risk being cut off from U.S. venues.

Commercial / merchant

Walmart and Amazon are in feasibility phase; their prize is $60-70 bn in annual interchange savings and real-time settlement across loyalty ecosystems pymnts.com. GENIUS caps direct issuance by non-financial public companies, but two work-arounds remain:

Spin out a qualified stablecoin issuer subsidiary heavily ring-fenced.

Partner with a white-label bank issuer (think Apple-Goldman but tokenised).

Expect pilots on popular L2s that already sit in consumer wallets.

Will bank tokens live on public chains?

Pre-JPMD, consensus assumed banks would stay on permissioned ledgers for legal finality and data privacy. By choosing Base, JPM signaled that public-chain settlement + private compliance layer may satisfy OCC examiners—provided wallets are permissioned. Other money-center banks will now weigh:

Scenario tree to 2030

Here’s one scenario I walked through with Claude Opus o3, which spent considerable time building models and accessing data. But I certainly didn’t validate the model.

Risks To Ponder

Barry Eichengreen worries that the Genius Act may “unleashed chaos and financial ruin.” He analogizes a stablecoin system to the pre-Civil War era of Free Banking.2

The problems that bedeviled 19th-century dollars are likely to be equally debilitating to the stablecoin ecosystem. … Every $1 stablecoin will be worth exactly a dollar only if the system operates infallibly.

If regulators have this much trouble keeping an eye on insured banks (SVB), how can they be expected to exercise perfect oversight of hundreds, if not thousands, of stablecoins issued not just by banks but by tech firms and crypto start-ups? … If regulators fall short, we will at best be stuck with myriad stablecoins all worth different amounts of money. … if the value of one or more different stablecoins collapses, panicked investors might rush to redeem their holdings of other tokens. Regulators would feel compelled to step in to prevent the collapse of the payment system.

In another paper, Stablecoin devaluation risk, Eichengreen worries about something I have previously brought up, namely that stablecoins will not always trade at par.

Reliance of stablecoin issuers on centralized custodians introduces devaluation risk similar to that observed in traditional currencies under pegged exchange rate regimes. We construct market-based measures of stablecoin devaluation risk using spot and futures prices for Tether. Conditional on full default, our estimates suggest an average devaluation probability of 60 basis points annually, rising to over 200 basis points during the 2022 Terra-Luna crash. In contrast, the probability of a partial default, defined as a 5% devaluation (trading at 95 cents), is approximately 12 percentage points on an annualized basis. Key risk factors include market volatility and transaction velocity. While elevated interest rates suggest heightened devaluation risk, deviations from covered interest parity indicate segmentation between traditional and stablecoin markets, reflecting the effects of leverage trading and arbitrage costs. To mitigate these risks, our findings suggest the importance of greater transparency and regulatory oversight.

Telis Demos argues that a stablecoin regime will make the problems of large uninsured deposits and TBTF banks worse.3

Strictly speaking, stablecoins don’t take funds out of the banking system. One way or another, these dollars will usually end up back in banks. What banks wind up with, though, could be something very different: the kinds of big, uninsured deposits that make some people nervous.

Udaibir Das is worried about a fragmented and divergent international system of stablecoins.4

Diverging approaches to regulating stablecoins risk fragmenting the global digital finance landscape: a dollar-based stablecoin system in the U.S., a state-backed European digital euro regime, and a mix of regional approaches elsewhere. These competing models risk disrupting the transmission of monetary policy, cross-border capital flows, and regulatory coherence

Ma, Zeng and Zhang analyze the possibility of panic runs on stablecoins.5 They argue that:

… that policies designed to improve stablecoin price stability may have the unintended consequence of increasing stablecoin run risks.

Steven Kelly walks through the hierarchy of stablecoin reserves.6 He argues that bank reserves (that would back JPMD but not Genius Act stablecoins) are the safest, and that Treasury securities, Treasury-backed repos and bank deposits all have some financial stability risks associated with them.

… material Treasury bill demand would strain the existing supply of Treasury bills [and] Shortages of Treasury bills relative to organic demand for such can lead the financial sector to manufacture private substitutes—which are prone to breaking down under financial stress. … If Treasury bill supply expanded dramatically … there’s some disintermediation in the sense of the shift in the curve of total demand for Treasury assets.

The greater financial stability risk here is tying the supply of funding in money markets to crypto market cap. When cryptoasset market cap goes up, the supply of stablecoins needs to grow—and vice versa.

That means that when crypto assets fall, money market funding is at least rearranged. This is likely manageable in “normal” times for, though less so if the stablecoin market does indeed grow substantially. And certainly less so if it happens alongside a systemic event.

The greater financial stability risk here … [is] the tying of senior financial system funding (deposits in this case) to crypto market cap.

Here are some other risks I have not yet seen mentioned:

Financial market participants tend to optimize to the rule set. Under the Genius Act that means there will be a concentration in <93-day T-bills that creates rollover cliffs every FOMC date.

Deposit tokens have discount-window access (via parent), GENIUS coins do not; stress scenarios may echo money-fund reform 2016.

As banks tokenize yield-bearing deposits and/or non-banks wrap yield externally, expect cannibalisation of prime MMFs.

When a bank-issued token—such as a tokenized deposit or other “regulated” stablecoin—needs to move onto a public blockchain, it is first deposited into a bridge contract on the bank’s permissioned ledger. The bridge, which is simply two linked smart contracts with a messaging layer, locks the original asset and simultaneously mints an equivalent wrapped token on the destination chain. That wrapped token is nothing more than a claim-ticket redeemable for the real asset held in escrow. From that moment on, settlement finality relies on three things: the source ledger, the destination ledger, and the bridge’s code. If the number of wrapped tokens ever exceeds the tokens actually locked, the 1-for-1 parity breaks and the shortfall becomes an on-balance-sheet liability for the issuing bank. In effect, bridging bank deposits to open DeFi ties a bank’s balance-sheet to smart-contract code—so a software exploit can crystallize into a credit loss just like a defaulted loan.

Closing thought

Stablecoins began as a crypto plumbing fix. Five years on, they sit at the fault-line between regulated banking, Big Tech commerce and decentralised finance. The GENIUS Act narrows the permissible design space, yet the sheer diversity of issuer archetypes—and the willingness of a global user base to chase 24/7 dollars—means evolution will not halt, only redirect. Tokenized deposits are a game-changer.

For risk managers, the key is to treat each token not as a monolith called “stablecoin” but as a claim embedded in a specific balance sheet, liability hierarchy and legal regime. Once you map those vectors, the path-dependency of the next liquidity crisis—or opportunity—comes sharply into focus.

How tokenization networks could transform the banking industry (Deloitte)

Companies Want Interchange Fees

Here is an interesting review of the Base Commerce Payments Protocol (Robonomics).

The Genius Act Will Bring Economic Chaos (Eichengreen)