Perspective on Risk - Jan 29, 2022

3, 4, 5, 6 or 7?; Is (VC) Winter Coming?; Inverse Selection; The Dog That Didn’t Bark; (Climate) Model Risk; Manhattan, we have a problem; Follow Ups;

Right now we have inflation running substantially above 2% and more persistent than we would like. We have growth … even in somewhat reduced forecasts … substantially higher than what we perceive to be the potential growth rate. (Chairman Jerome Powell)

3, 4, 5, 6 or 7?

Now that it is clear that the near-term direction of interest rates is up, there appears to be considerable uncertainty about what that means in practice. On the low end, UBS and Barclays think we will get three 1/4pt raises this year, and on the high end BAC thinks we will get seven. Not everyone has disclosed their two year projections, but those published range from six (by Standard Chartered) to eleven (!) at BAC.

The market and the median Fed dot plot centers around a 1.5% rate by the end of 2023, implying six hikes over that time. Beyond 2023, the Fed dot plots and the market implied rates diverge. Federal Reserve officials project that their main interest rate will reach 2.5 percent, which seems consistent with their goal of 2.0% inflation and a 50bp risk premium. Interestingly, however, is that the market’s implied rates are half a point lower than what Fed officials project.

Of course, neither the market nor the Fed dot plots have proven particularly accurate at predicting the future path of rates.

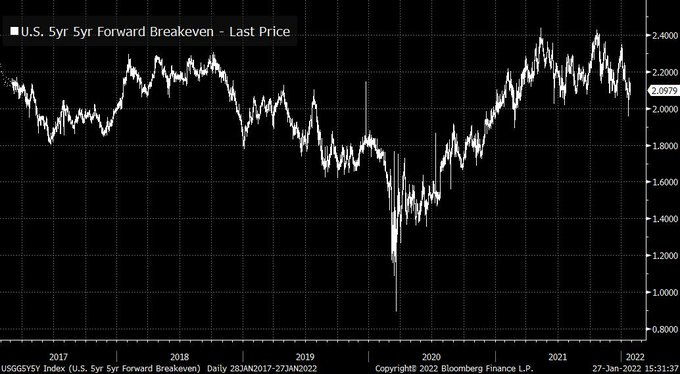

Through this uncertainty, and the recent spike in monthly inflation numbers, the 5yr5yr forward breakevens have hardly budged (and arguably have settled a bit lower). The 10yr10yr forward seems locked in around 2.1%. Inflation expectations (in the market) are not an issue.

One would think there may be some headwinds to the Chairman’s concerns: consumption has been elevated by government stimulus that is not being continued: this should put pressure on growth to moderate towards long-run potential, and if the market is correct the recent spikes in inflation will indeed be transient.

Is (VC) Winter Coming?

Time to watch your marks, folks.

We’ve seen tech, SPACs and IPOs all fall considerably in the last few weeks. What we haven’t seen yet is what is going on in the private markets. 4th quarter marks by the VC firms, that we haven’t seen yet, are likely to RISE. Meanwhile, real values have probably fallen by 30%. Some won’t take these marks until their portfolio firms are forced to raise their next round. There will be down rounds. There will be extended exits. Firm growth will come down as they emphasize minimizing cash burn relative to growth.

Peter Livingston has written an interesting take Is Winter Coming?

Inverse Selection

Here is a nice intersection from my Fed and AIG days. Marcus Brunnermeier was always a favorite economist when it came to thinking through issues like liquidity cascades and forced selling/unwinds. Insurance people are always worried about the risk of adverse selection.

In a new paper, Inverse Selection, Marcus and colleagues flip the question. They ask what happens when “[b]ig data, machine learning and AI inverts adverse selection problems.”

Traditionally mechanism design models of insurance assume that the agent (or insuree) has some private information about the probability of incurring a loss or meeting with an accident. This results in the proverbial rent-versus-efficiency trade-off wherein the principal (or insurer) gives up on efficiency and provides information rents in order to separate the high risk from the low risk agents. We depart from this standard model in one crucial way— we make the state of world that parametrizes the loss to be two dimensional, and allow the agent to posses information about one of these dimensions and the principal to know the statistical correlation between the two dimensions. This creates an informed principal problem where the principal too has private information.

Need to read this paper closely for its implications.

The Dog That Didn’t Bark

During the covid disruption, and even prior, there were some who were raising alarm about the CLO market - that it was a disaster waiting to happen. Looks like they were wrong. CLO Spotlight: U.S. CLO Defaults as of December 28, 2021 (spglobal subscription)

(Climate) Model Risk

Evaluating the Performance of Past Climate Model Projections that climate models published over the past five decades were generally quite accurate in predicting global warming in the years after publication, particularly when accounting for differences between modeled and actual changes in atmospheric CO2 and other climate drivers.

Climate modeling efforts have advanced substantially since the first modern single-column (Manabe & Strickler, 1964) and general circulation models (Manabe et al., 1965) of Earth's climate were published in the mid-1960s, resulting in continually improving model hindcast skill (Knutti et al., 2013; Reichler & Kim, 2008).

We find no evidence that the climate models evaluated in this paper have systematically overestimated or underestimated warming over their projection period.

The paper is easily readable, and should interest both model developers and validators, and folks interested in ESG/climate.

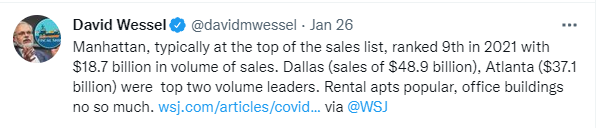

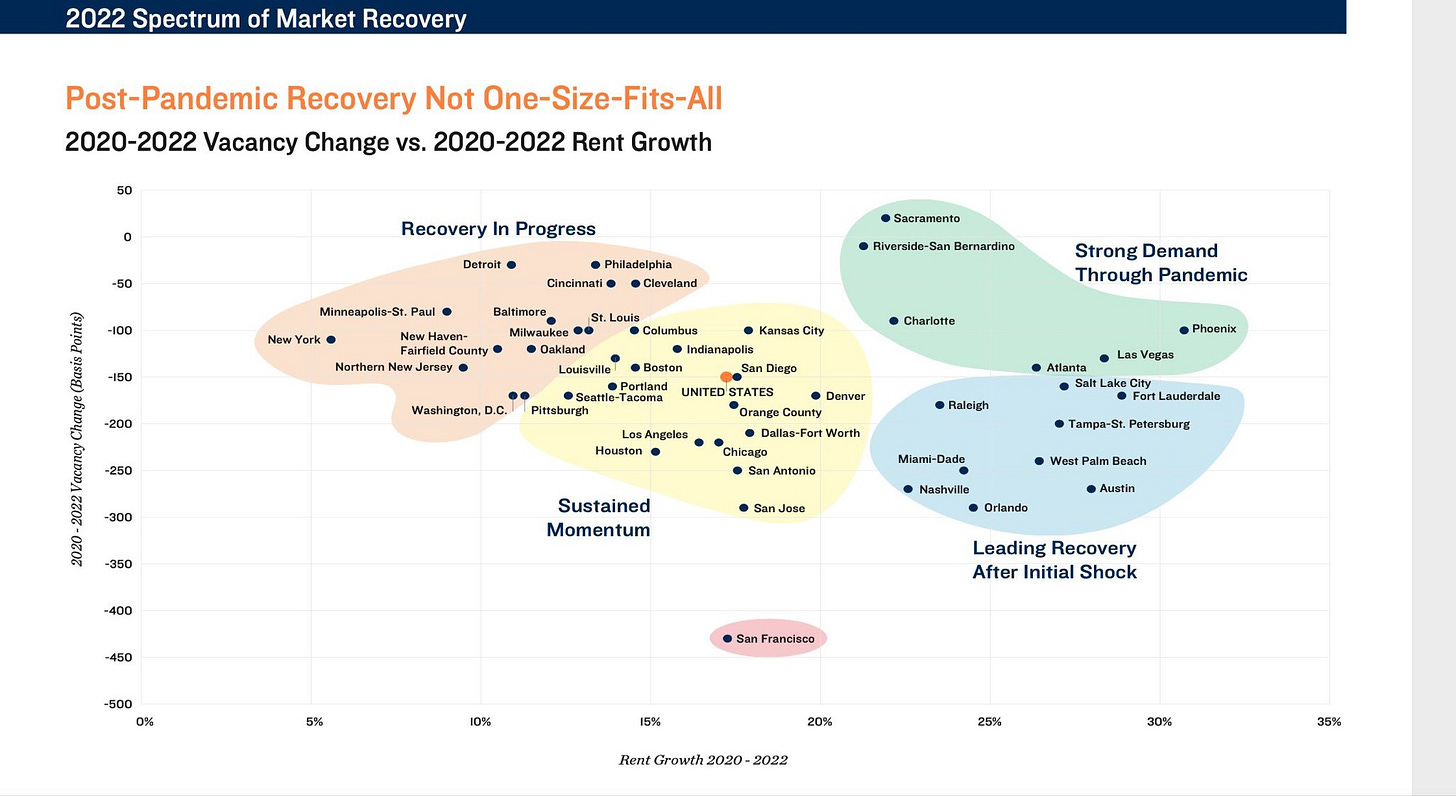

Manhattan, (do) We Have a Problem

Two small anecdotes of evidence that Manhattan may have a problem:

Follow up on Lessons From the Titans

In the Jan 22nd Perspective on Risk I reviewed Lessons From the Titans (I enjoyed in thoroughly and wrote that it is actually a risk management book). If you prefer to consume your knowledge in podcast form, Frederik Gieschen interviews Rob Wertheimer of Melius Research on Conversation with Rob Wertheimer: Studying Great Industrials & Searching for Compounders

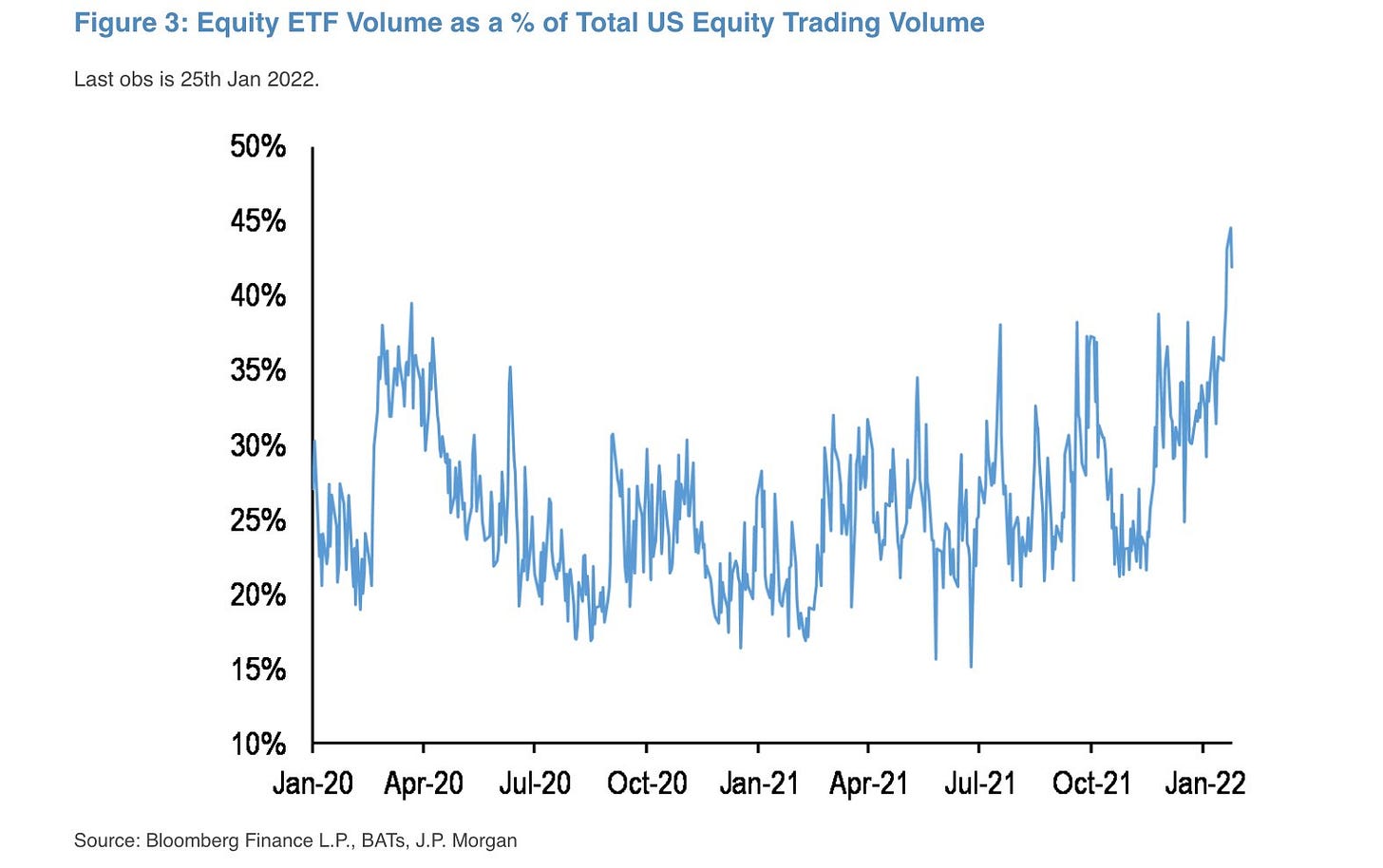

Follow up on Liquidity Driven Markets

In the Dec. 13 Perspectives on Risk I wrote a bit about liquidity driven markets and highlighted listening to Lunch at the Club - Mike Green. This increase would be consistent with his observations and concerns.

Follow up on Demographics

Germany Needs Immigration of 400,000 Workers Per Year, FDP Says

Crazy Stuff