Perspectives on Risk - 1/19/22

Returning to Normal; Lessons from Titans; What’s Going on in the Job Market?; Fastest route is not necessarily a straight line; Research Highlights You Can Use? Caveat Emptor; Upcoming Concerts

Returning after an extended holiday break; this collection is a little bit random; will work to do better next time…brian

Returning to Normal

The 5y5y real rate is now back above zero. The question is what the Fed’s and the Market’s response function is: does the Fed believe the real neutral rate is 0-0.5%? If the real rate rises above this level (implying nominal rates rising faster than reported inflation), does the Market sell-off?

The markets seem pretty sanguine about forward inflation; either that or the 10-year is in for a massive repricing. (hattip @LizAnnSonders)

Lessons from the Titans

A book review (and recommendation).

I picked up a copy of “Lessons from the Titans” thinking it was another version of a book like “Good to Great.” To my great pleasure, I found out that it is really a risk management book! The authors are from Melius Research and are former sell-side research analysts, and not the typical management consultant.

The book is about “risk management” at the highest level: the effect of culture, management choice and selection, incentives, external stakeholder pressure, process control. As with similar books, it is told through anecdotes and stories about unsuccessful and successful companies: GE, Boeing, Danaher, Honeywell, United Technologies, CAT, and others.

The wisdom starts right in the introduction:

[I]t’s important that senior managers focus on what they can actually control; fostering a humble culture that encourages continuous improvement, holding the line on corporate costs, driving towards manufacturing excellence, encouraging extreme customer focus, establishing disciplined capital allocation process, moving a portfolio towards higher return assets, all the while setting the incentives needed to keep employees focused on the task at hand.

Culture and incentives come in for greater scrutiny.

“There’s nothing that destroys a culture faster than wasteful spending and celebrity behavior among the executives.”

Mergers tend to bring about a clash of cultures; firms that are underperforming in the market tend to have their culture change away from things that matter to the core business to perhaps unrealistic financial metrics (managing to reported earnings rather than cashflow); sometimes firms become to beholden to success cultures of past leaders that are not what is needed to move forward; some cultures reward ‘heroics’ and not process discipline; ‘arrogance and complacency’ as the default culture that follows initial success.

Incentives drive organizational behavior. Sustainable success requires changing incentives on a semi-regular basis. The best incentives are dynamic and fuel long-term, systematic improvements. … Accountability and compensation systems are vital. It can take years to correct bad habits.

I would also add, and they imply this is important but do not state it as explicitly as they should: the measurable incentives tied to compensation need to reflect both business factors (production quality, scheduling commitments met, customer satisfaction) and simple financial metrics (around cashflow and earnings growth) that are easily understood. Complex goals breed confusion.

They also focus heavily on “lean” going so far as to state “it’s the basis for every successful business we know.”

I was attracted to the book in large part because of its discussion of Danaher. Danaher combines a number of my favorite topics: statistical quality control; mergers & acquisitions. Danaher actually applies SQC processes to its M&A process as a way to derisk and make better decisions. Federik Giescchen on twitter has a nice summary of the Danaher chapter.

This book is for CROs and CFOs, and those who want to be in one of these roles. My colleagues from the Federal Reserve and AIG will recognize many of these lessons, both from observation of successes and issues.

It’s also an easy read.

What’s Going on in the Job Market?

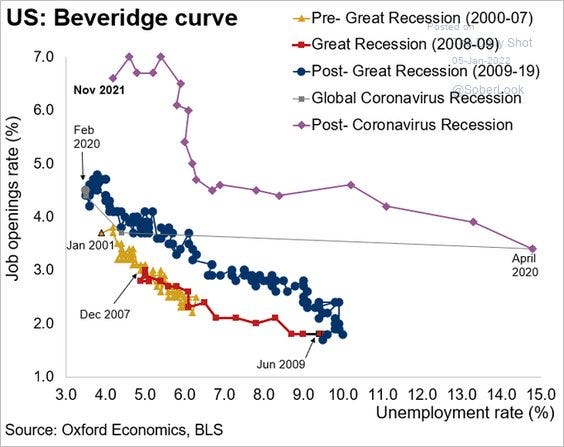

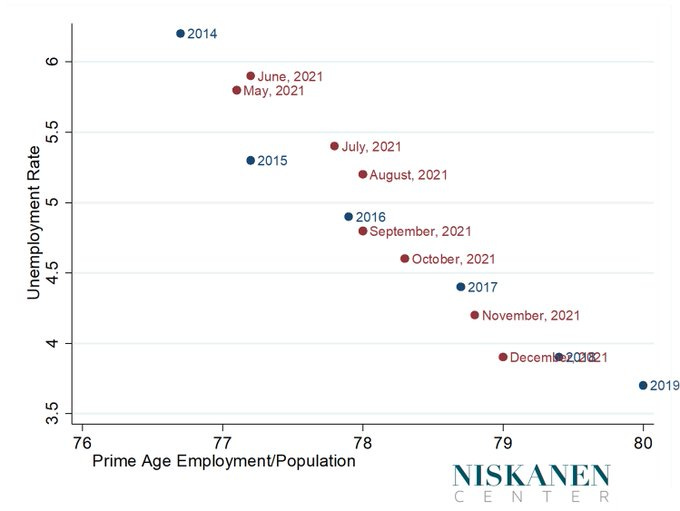

The Bev curve has clearly shifted out. Considerably more job openings than workers looking for jobs.

What seems to have happened is that there are less “prime age” employees relative to the total population than in the past.

The labor force participation rate registered its largest drop on record in 2020, falling from 63.2 percent in the fourth quarter of 2019 to 60.8 percent in the second quarter of 2020.2 By the second quarter of 2021, the rate had recovered slightly, to 61.6 percent, but was still 1.6 percentage points below its pre-pandemic level— indicating that as of that quarter, roughly 5.25 million people had left the labor force. The COVID Retirement Boom; Miguel Faria e Castro

What will it take to lure these people (like me!) back into the job market?

Increased immigration would help too.

Fastest route is not necessarily a straight line

Here's proof that the fastest route is not always a straight line👇🏼

Also known as the Brachistochrone curve, it’s always the quickest route between two points regardless of how strong gravity is or how heavy the object is. We should always remember this whenever we face challenges reaching our goals.

See Sid, non-linear thinking for the win!

Research Highlights You Can Use?

SMART AND ILLICIT: WHO BECOMES AN ENTREPRENEUR AND DO THEY EARN MORE?

The incorporated selfemployed have distinct cognitive and noncognitive traits. Besides tending to be white, male, and come from higher-income families, the incorporated—as teenagers—typically scored higher on learning aptitude tests, had greater self-esteem, and engaged in more disruptive, illicit activities. The combination of "smart" and "illicit" tendencies as youths accounts for both entry into entrepreneurship and the comparative earnings of entrepreneurs.

Cooperation, punishment and organized crime: a lab-in-the-field experiment in southern Italy

[R[esearchers tested the Prisoner's Dilemma on students, ordinary prisoners & imprisoned members of the Camorristi (Neapolitan Mafia). The Camorra are significantly more likely to solve the dilemma by cooperating, and also punish defectors more. @emollick

Caveat Emptor

Upcoming Concerts

Khruangbin - Radio City - March 10th

Snail Mail - Kings Theater - April 7th