12/13/2021

Some Demographic Developments; Liquidity Driven Markets; Remember When Pension Underfunding Was A Problem?; Abstract Diss of the Week

Some Demographic Developments

Demographics (along with technology) are the big drivers of long-term geopolitical developments and economics. In simplified terms, the narrative has been that China is still growing but has reached their minimum ‘dependency ratio’ and will now face headwinds, Europe and Japan are old and getting older, the US is in-between mostly due to beneficial effects of immigration, India is young and growing rapidly, and sub-Saharan Africa is on-deck.

In the US, “Based on provisional CDC data on US births and deaths, and using a reasonable “guesstimate” on Net International Migration based on available immigration data, it appears as if the US resident population from 7/1/2020 to 7/1/2021 grew by just 486,290, or 0.15%. That growth would be the lowest in over a century.” (from Tom Lawler via @calculatedrisk). Catherine Rampell (@crampell) looks at immigration in the Washington Post and shows the effect Trump’s policies have had on immigration. Bottom line: US economic performance will not benefit from population growth.

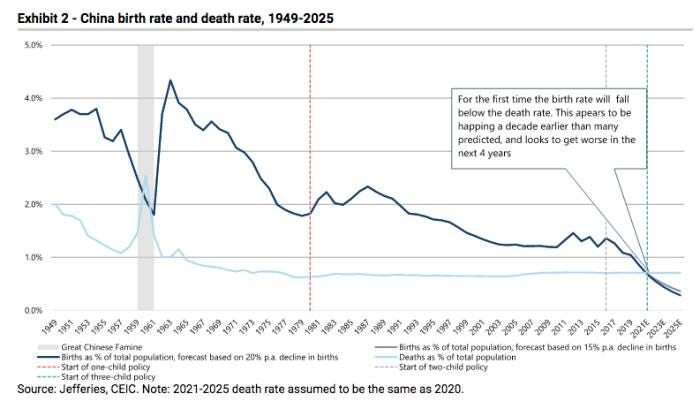

FT Alphaville has highlighted that China’s population is shrinking, fast. They are highlighting a report (that I have not read directly) from Simon Powell of Jeffries. The money quote from the FT article “We estimate China’s population will peak in 2022, which is almost 10 years earlier than the United Nation estimates.” They analogize China to Japan in 1989 (rapidly deflating property bubble fuelled by debt, stocks massively underperforming foreign counterparts, a population materially declining in size).

In India, the fertility rate has dropped below replacement earlier than expected. India’s fertility rate drops below 2.1. This is a 10% drop in fertility from the last survey 5 years ago.

So Why Does This Matter?

Demographics, particularly in the developed world, will affect GDP and inflation. I found a couple of interesting charts from EPB Macro Research:

At least in the US, Europe and Japan, as the elderly share has increased, GDP growth has swooned. EPB Macro asserts a strong relationship between 20 year dependency ratio change and 10 year CPI (seems to have a bit of data mining going on here; I’d have preferred a consistent use of population to employment ratio).

Liquidity Driven market

One hypothesis for the current elevated level of markets is that they are being driven predominately by liquidity. David Merkel’s Aleph blog first brought this to my attention in his post Estimating Future Stock Returns in 2016. His model seems to outperform CAPE when estimating 10 year forward nominal total returns. The Aleph model posits that forward returns are negatively correlated with the current % that investors hold in equities. He’s published updated estimated returns several times:

2.92% a/o 3Q’19

1.29% a/o 4Q’20

-0.91% a/o 2Q’21

I re-estimated his model based on data from 4Q’51 through 1Q’11 and get even more negative estimates. Based on 7/1/2021 data, my estimate of 10 year forward nominal returns is -5.00%.

For fun (yes, I have a strange definition of fun), I decided to combine the Aleph cashflow variables with Shiller’s CAPE variables to see how this model would work. Two and three variable linear regressions yielded r-squared of between 0.65 and 0.69.

The simpler 2-variable regression worked out to:

F-ret = .284 - (.800 * Inv%_All_EQ) + (.0020*CAPE10)

The 3 variable version is:

F-ret = .213 - (.758 * Inv%_All_EQ) + (.0037 * CAPE10) + (.6579 * CPE_excs_sprd)

All variables were significant, but the Aleph investor allocation to equities dominated the Shiller variables, and perhaps concerningly the CAPE10 variables have the wrong sign.

A different but similar chart from @pkedrosky shows how high the equity tilt has become:

So what, historically, has been the market P/E when inflation has been above 5% and real yields negative? Research Affiliates looked at this in King of the Mountain: Shiller PE and Macroeconomic Conditions. It’s ugly.

Now, if you are interested in one man’s view on some further details of what is going on, I HIGHLY recommend watching/listening to Lunch at the Club - Mike Green. He discusses the impact of passive investments on markets. He argues that passive investing is based on assumptions of how markets work that are ‘just not correct.’@7:45) - he is essentially challenging the assumptions behind Sharpe. In particular, regulatory changes involving Qualified Default Investment Alternative (and target date funds). He argues

On a flow basis, the marginal activity is now passive, and hence weakens the role of ‘active’ management in relative price discovery.

And suggests this causes the following effects:

Increased correlation between securities

Increases in the valuation of securities regardless of fundamentals, as passive share grows

Reduced market elasticity raises risks of extraordinary price movements

Increase in market concentration as momentum leads to largest companies becoming larger

Reduced ability for new firms to become public

Now, some of this may be storytelling and fitting his theory to already observed phenomena (a form of data mining), but it is an interesting take that you might want to consider.

Remember When Pension Underfunding Was A Problem?

The equity run has pretty significantly reduced the degree of underfunding. Milliman maintains the Milliman 100 Pension Funding Index (PFI). In their latest report, they show that the funded ratio has improved to 98.1%, a deficit of ‘only’ $36 billion. One less thing to worry about.

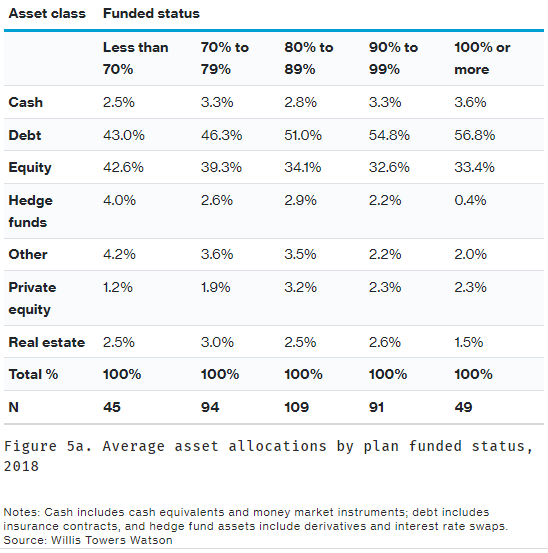

I wonder in pension plan risk appetite changes? A 2020 Willis Towers Watson article implies higher funding ratios lead to lower equity allocations:

There is a clear correlation between a pension plan’s status and its portfolio’s risk profile, with frozen plans holding more liability-hedging investments compared with closed and open plans. On average, frozen pension plans held almost 60% of their assets in fixed income and cash, versus only 49% for sponsors of open plans.

Over the past nine years, the shift from equities to fixed-income investments has been consistent. Since 2009, average allocations to public equities declined by roughly 16 percentage points, while allocations to debt increased by close to the same amount. Sponsors show a gradual search for returns via low equity beta investments, with allocations to alternatives (including hedge funds, private equity and real estate) increasing from 6.6% in 2009 to 8.6% in 2018.

Our 2018 analysis shows a correlation between funded status and asset allocations (Figure 5a). As sponsors get closer to full funding levels, their portfolios tend to become more conservative in nature, typically as a result of investment de-risking strategies such as liability-driven investment (LDI) and asset glide paths.

Recently, Institutional Investor published Pension Fund Stabilization and the Evolution of LDI. Jared Gross, Managing Director and Head of Institutional Portfolio Strategy for JP Morgan Asset Management, says:

I think we have seen two broad phases of pension de-risking with liability driven investments, and I believe we are about to enter a third. …

The first phase, which I refer to as LDI 1.0, involved moving from shorter to longer duration bonds during the period immediately following the global financial crisis. With LDI portfolios offering high levels of yield, this was an unusual opportunity to reduce risk while also increasing return. …

[W]e have seen a long process of patient de-risking that I refer to as LDI 2.0 or the “Glidepath Era,” in which plans have just been waiting for incremental improvements in funding before shifting capital from return-seeking strategies to LDI strategies. …

Today, however, we need to reconsider the glide path approach for two reasons. First, higher funding levels and lower volatility asset allocations have reduced pension risk to a very low level already. …

[Plan sponsors have] already done an enormous amount of de-risking – consider that volatility is dramatically reduced even in plans that are only 50% hedged. Pushing further down the glide path rapidly becomes inefficient. …

LDI 3.0, or … “Pension Stabilization”, is a more balanced approach than traditional LDI. It aims for a long-term blend of modest excess return and low volatility – but not the lowest possible volatility. … A stabilization strategy begins when a plan approaches full funding and adopts a sensibly de-risked and diversified asset allocation, allowing for the gradual improvement in funding across time while preserving numerous positive financial benefits for the sponsor.

Abstract Diss of the Week

A Response to Economics as Gauge Theory (Timothy Nguyen)

We provide an analysis of the recent work by Malaney-Weinstein on "Economics as Gauge Theory" presented on November 10, 2021 at the Money and Banking Workshop hosted by University of Chicago. In particular, we distill the technical mathematics used in their work into a form more suitable to a wider audience. Furthermore, we resolve the conjectures posed by Malaney-Weinstein, revealing that they provide no discernible value for the calculation of index numbers or rates of inflation. Our conclusion is that the main contribution of the Malaney-Weinstein work is that it provides a striking example of how to obscure simple concepts through an uneconomical use of gauge theory.

What I’m Watching:

A Wish For Wings That Work (how did I not know there’s a Opus and Bill the Cat Christmas special?)

What I’m Listening To: