Perspective on Risk - Oct. 25, 2023

The Die Is Cast; CRE - Industrial Cap Rates Rising; Bank Credit-Linked Notes; Where Are All The Defaults? US Life Expectancy Has Dropped; Things Worth Reading

The Die Is Cast

Recessions Have Begun After Renormalization Of The Curve

Leading Economic Indicators Down For 18th Straight Month

The LEI for the US fell again in September, marking a year and a half of consecutive monthly declines since April 2022,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “In September, negative or flat contributions from nine of the index’s ten components more than offset fewer initial claims for unemployment insurance. Although the six-month growth rate in the LEI is somewhat less negative, and the recession signal did not sound, it still signals risk of economic weakness ahead. So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation. Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.”1

CRE - Industrial Cap Rates Rising

Pandemic Aftershocks Drive Industrial Cap Rates Higher

While industrial CRE had relatively strong fundamentals pre-pandemic, these developments supercharged industrial leasing demand. … Industrial cap rates also reached an all-time low of 5.1 percent in early 2022. However, these trends have since reversed – industrial vacancy rates are climbing, industrial property prices are falling, and cap rates are rising.

The industrial PCR (modeled potential cap rate)increased by 1.1 percentage points over the last year, rising from 4.9 percent in the third quarter of 2022 to 6.0 percent in the third quarter of 2023, primarily driven by increasing industrial vacancy rates and fewer industrial construction starts.

More On Bank Credit-Linked Notes

In the last Perspective, I noticed ……..

Bank Bonds That Cut Risk Draw Ares and Blackstone: Credit Weekly (Bloomberg)

Banks are reviving the sale of credit-linked notes … ahead of new rules that will require them to hold more regulatory capital.

The revival comes as banks wait to hear the latest terms of forthcoming Basel III regulations, under which they will have to retain more capital to cover losses if their liabilities soar. As a result, analysts at JPMorgan Chase & Co. see the mortgage-related CLN market alone growing to about $60 billion in the US in five years time, a 5,900% increase.

CLNs, also known as significant risk transfers, fell out of favor in the US after the credit crunch, with the recovery rate on one Lehman-referenced note less than 9%, according to a research paper.

Where Are All The Defaults?

Interesting question. Verlad Research published Where Are All The Defaults? . The article is actually more focused on high-yield bond spreads, but it is the subheading that gives away their conclusion on defaults:

Default rates, defined broadly, are spiking, just in new ways and new places.

They go on to say

The year-to-date default data tracked by Moody’s is informative. Where loan and bond amounts are available (54 of the 62), Moody’s has tracked $35 billion of loan defaults versus $26 billion of bond defaults. 30 were loan-only capital structures, 12 were bond-only capital structure, and 12 were capital structures with both loans and bonds. Of the 62 defaults listed, 37 were distressed exchanges and 19 of the distressed exchanges were for loan-only capital structures versus 10 for bond-only capital structures. Distressed exchanges, which are debt renegotiations conducted directly with lenders and outside the bankruptcy system, are often not captured by the default statistics and are not counted in the running count of Chapter 11s

There has been a significant shift of low-rated credits to the private credit markets.

As of September 30, Moody’s had 239 companies on its B3 Negative and Lower Corporate Ratings List, representing 16% of the sub-investment-grade universe and rising from its low of just over 10% in May 2022.

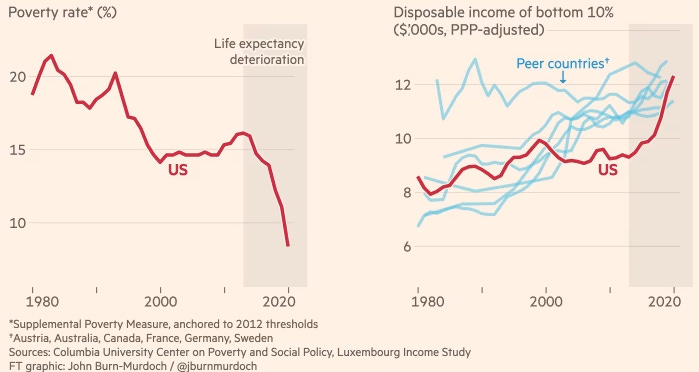

US Life Expectancy Has Dropped

IMO, the second biggest issue, behind the acceleration of global warming.

Life Expectancy in the U.S. Dropped for the Second Year in a Row in 2021 (CDC)

Life expectancy at birth in the United States declined nearly a year from 2020 to 2021, according to new provisional data from the CDC’s National Center for Health Statistics (NCHS). That decline – 77.0 to 76.1 years – took U.S. life expectancy at birth to its lowest level since 1996. The 0.9 year drop in life expectancy in 2021, along with a 1.8 year drop in 2020, was the biggest two-year decline in life expectancy since 1921-1923.

The data are featured in a new report, “Provisional Life Expectancy Estimates for 2021.

The US is an outlier among developed countries

It Is Predominantly Poorer Young Adults Without Advanced Degrees

Unless they’re in the top 1 percent, Americans are dying at higher rates than their British counterparts, and if you’re part of the bottom half of income earners, simply being American can cut as much as five years off your life expectancy. At every age below 80, Americans are dying more often than people in their peer nations.

Americans with college degrees do substantially better than those without, but that second group represents almost two-thirds of the country.

Where They Are Dying

Causes:

Opiates

Overdose deaths have been increasing in the United States for decades, but the introduction of fentanyls has led to a staggering rise, accounting for the vast majority of overdose deaths in recent years.

Around 77,000 Americans died from overdoses involving synthetic opioids like fentanyl in the 12-month period ending in April of this year, according to provisional estimates from the Centers for Disease Control and Prevention.

It was responsible for a third of deaths among Americans 25 to 34 in 2022

Wealthy Americans who live in the parts of the country with high opioid use and gun violence live just as long as those who live where fentanyl addiction and gunshot incidents are relatively rare. But poor Americans live far shorter lives if they grow up surrounded by guns and drugs than if they don’t.

Guns

Nationwide, there were 4,752 firearm deaths of American children and teens (ages 0 to 19) in 2021, translating to a rate of 5.8 gun deaths per 100,000 people. The deaths represent a nearly 9 percent increase from 2020 (4,368 or 5.4 deaths per 100,000).

Trends and Disparities in Firearm Deaths Among Children (Journal of Pediatrics)

In 2021, firearms continued to be the leading cause of death among US children. From 2018 to 2021, there was a 41.6% increase in the firearm death rate.

Geographically, there were worsening clusters of firearm death rates in Southern states and increasing rates in Midwestern states from 2018 to 2021. Across the United States, higher poverty levels correlated with higher firearm death rates (R = 0.76, P < .001).

In 2021, firearm mortalities were largely concentrated in Southern states," the authors wrote. "Louisiana had the highest death rate per 100,000 persons (17.0), followed by Mississippi (14.8), Alabama (11.4), Montana (11.1), and South Carolina (10.2).

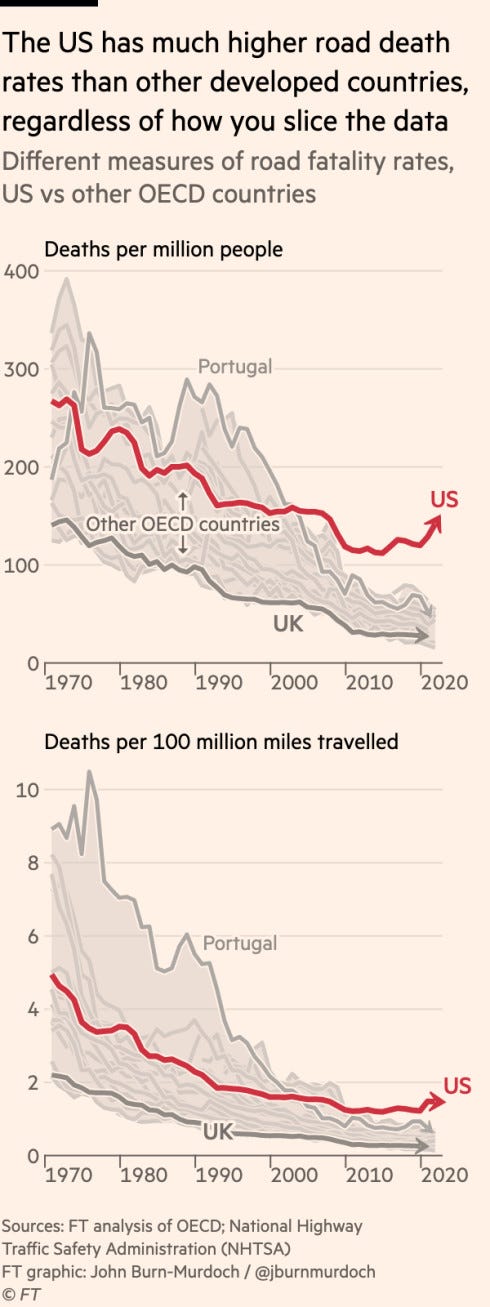

Cars

Obesity

Chronic diseases — obesity, liver disease, hypertension, kidney disease and diabetes — were also on the rise among people 35 to 64, The Post found, and played an underappreciated role in the pre-pandemic erosion of life spans.

In 1990, 11.6 percent of adults in America were obese. Now, that figure is 41.9, according to the CDC.

The rate of obesity deaths for adults 35 to 64 doubled from 1979 to 2000, then doubled again from 2000 to 2019.

Obesity is one reason progress against heart disease, after accelerating between 1980 and 2000, has slowed, experts say. Obesity is poised to overtake tobacco as the No. 1 preventable cause of cancer

If You Want To Do Your Own Research

The Center for Disease Control maintains a site where you can drill into causes of death: CDC WONDER. For instance, here I ran the leading causes of death for ages between 20 and 55, showing the top 10 causes.

Things Worth Reading

Federal Reserve issued their Oct. 2023 Financial Stability Report. I asked Chat-GPT4 to concisely compare this report with the May report.

Memo on Changes Observed in Federal Reserve's Financial Stability Reports (May to October)

Asset Valuations: While both May and October reports noted significant valuation pressures across various assets, the October report highlighted specific volatility in Treasury yields and a modest correction in the equity market in September. The robust IPO activity present in May wasn't a focal point in October.

Borrowing by Businesses and Households: Business leverage was a consistent concern across both reports, with October emphasizing its historically high nature. While May emphasized improved credit quality for large corporations, by October, the focus had shifted to the robust pace of household borrowing, even though household finances were still seen as positive.

Leverage in the Financial Sector: Banks maintained strong capital positions in both reports. The October report introduced a new observation about increased leverage among broker-dealers but noted it was within historical norms. Life insurers' challenges, especially from prolonged low-interest rates, persisted in both reports.

Funding Risks: Both reports conveyed consistent liquidity in the banking sector but also pointed out funding pressures in certain banks. Prime MMFs' vulnerabilities remained a concern. The October report further underlined the decline in the market value of stablecoins and introduced liquidity risks in bond mutual funds.

Near Term Risks: While the May report was broader in its concerns, emphasizing pandemic-related setbacks and global debt vulnerabilities, the October report zeroed in on specific risks. These included persistent inflation in advanced economies and potential repercussions from a slowdown in China's economic growth.

Bank Policy Institute writes on The Long-Term Debt Shortfall and the Liquidity Coverage Ratio

The federal bank regulatory agencies have proposed a rule requiring issuance of long-term debt by U.S. banking organizations with assets exceeding $100 billion that are not deemed global systemically important banks (GSIBs). In this post, we identify two significant problems with the proposed rule that may have been unintended, and in any event were not considered by the agencies in assessing its cost.

More Thoughts

If you have a boy that you want to learn to like Broadway shows, run, don’t walk, to get tickets to Sweeny Todd - The Demon Barber of Fleet Street. Dark, bloody, body count to rival the original Rambo movie. Terrific show.

What I’m listening to ATM: Jacob Collier - Live in Lisbon 2022. He’s playing Radio City in April, Genius.

LEI for the U.S. Continues to Fall in September (Conference Board)