Perspective on Risk - Nov. 17, 2023

Recession or Not; Bank Examiner Culture; Intersection of Operational & Financial Risk; The Fed Won’t Shut Up; Follow-ups; Research

Recession or Not

Mark Zandi says he was wrong and that ‘this time is different’:

Economists loathe uttering the words “this time is different” because more often than not, it isn’t. But there are times when it is, and while there’s more script to be written, this appears to be one of those times. Inflation is moderating without recession or even a slowdown.

What the pessimists got most wrong was thinking the inflation was due to strong demand, and to rein it in required much higher rates and a recession. Instead, the inflation was due to the pandemic and Russian war. As these supply shocks fade, so does inflation, without recession.

There are other reasons why this time is different. Excess saving built up in the pandemic has supported consumer spending. And businesses won’t layoff given how difficult the pandemic made it to find and retain workers. Without spending cuts and layoffs, recessions won’t happen.

I can go on, but the lesson in how wrong the consensus has been, is that while history is a useful guide to the future it isn’t a prescient soothsayer. We should consider the models and heuristics based on history to understand where we are headed, but not be slaves to them.

Arturo Estrella notes that the Fed rate rises have yet to materially affect demand

Bank Examiner Culture

The WSJ wrote an interestingly timed1 article, Strip Clubs, Lewd Photos and a Boozy Hotel: The Toxic Atmosphere at Bank Regulator FDIC, that describes a culture of misogyny and sexual harassment at the agency. This article hit pretty hard, and I want to comment on the findings.

I want to be cautious, as the press treatment of examination matters has been wrong in the past. Here I am specifically thinking about the Pro Publica article highlighting the comments by Carmen Segarra who claimed a chaotic atmosphere at the NY Fed where the examiner-in-charge (EIC), Mike Silva, squashed her findings of misconduct on the part of GS. That reporting had things completely backwards, likely as a result of a narrative they wanted to push.

That said, the WSJ article reminded me of aspects of the NY Fed culture back in the early 1990s when I joined. At that time, women weren’t even allowed to wear pants. It took decades of pressure, in large part by promoting women based on merit in what was an old-boys culture.

The article describes ‘a heavy drinking culture,’ strip clubs, d*ck pics, a ‘wild-west’ culture of examiners on the road, and sexual harassments.

When I joined the NY Fed in the early 1990s, I was in perhaps the second or third class of hires with graduate degrees. Before this time, bank examiners were a lifetime career. Men (and they were almost entirely male) joined the Fed after college, and spent years working their way up the ladder to more senior examiner positions. You kept your head down and genuflected to the EIC to get positive reviews. The EIC was God. Do this for a couple of years and you’d get a promotion and a raise.

Many jobs were on the road, lasted 6-8 weeks, and were often staffed by a mix of junior and senior examiners. Examiners prided themselves on knowing where the happy hours were best in each town, both for the drinking, but equally for the cheap food that enabled them to pocket more of their per-diem allowance. As with any environment where single young people are together for an extended time, there was a bit of fraternization. There were also certain male examiners that the female examiners clearly tried to keep at a wider berth.

Buffalo was popular for some of the male examiners because it enabled them to attend the ‘Canadian follies’ - strip clubs on the Canadian side of Niagara Falls.

One of the jobs a junior examiner would be assigned was Report Administrator. They were responsible for helping the EIC prepare the final report. The key ability appeared to be the ability to type, as a major part of this job was typing the hand-written notes of the EIC. I suspect women were disproportionately assigned to this role; I know many of my female peers were assigned this job; interestingly I never was. Women were often drafted on the side by their male peers and asked/cajoled into typing up their findings for them.

To the NY Fed’s credit, they understood that the culture in bank supervision needed to change (the culture in other areas that were NYC-based and had a higher proportion of graduate-level hires to begin with were probably a bit better). The cultural change needed to come from the top. The men at the top, such as the head of supervision Chet Feldberg, took the issue seriously, wouldn’t stand for bad behavior, and made it a habit of insuring that promotions were fair and based on talent and not gender. Women were promoted into more senior positions of authority and their became consequences for misogynistic behavior. Women such as Barbara Klein deliberately broke the silly dress code. All examiners were forced to learn to type, and to type up their own work. I believe similar efforts were taken at the Board of Governors and at the other Reserve Banks as well. Changing culture is hard.

I am also reminded of an incident when I was at AIG. When I joined AIG, it too was a male-dominated industry and firm, particularly at the top. AIG owned an aircraft leasing company, ILFC, whose CEO Henri Courpron had had an affair with an employee under his supervision. Bob Benmosche was the CEO of AIG at the time, and instead of burying the scandal or letting Courpron off, he demoted Courpron and docked him $1 million in salary. And he was very public about the actions that were taken. This had a hugely positive effect on the culture of the firm, Changing culture requires leaders who will make hard decisions.

As CROs, we like to talk about how culture and incentives trump limits. Here it is certainly true; who would want to not be able to attract half of the workforce?

I wish the FDIC well in their efforts to change their culture. The ‘culture of the road’ is probably stronger in that agency than it was at the Fed as they supervise many small rural banks.

The Intersection of Operational & Financial Risk

ICBC’s broker-dealer, ICBC Financial Services unit, China’s primary venue for trading US Treasuries, was the subject of a ransomware attack that affected their ability to settle Treasury trades. The attack was reportedly carried out using Lockbit 3.0 which has ben used in attacks on other financial institutions. This is associated with a known Citrix vulnerability referred to as “CitrixBleed.” The disruption required Fedwire to be held open. According to a Reuters report, the blackout at ICBC's U.S. broker-dealer left it temporarily owing BNY Mellon $9 billion, an amount many times larger than its net capital. ICBC reportedly paid the ransom.

Ransomware attack on ICBC disrupts trades in US Treasury market (FT)

Gang says ICBC paid ransom over hack that disrupted US Treasury market (Reuters)

Understanding the Ransomware Attack Fallout on China’s ICBC (Information Week)

The Fed Won’t Shut Up

Supervision and Regulation (Barr)

Barr explains and defends the Basel Endgame capital proposal, the Long-Term Debt requirement, and the changes to CRA.

Elevated Economic Uncertainty: Causes and Consequences (Fed VC Jefferson)

A moderately interesting speech on a topic close to my heart, the difference between risk and uncertainty. I don’t particularly like the way the speech is written as it discusses “measuring uncertainty.” As Knight writes:

It will appear that a measurable uncertainty, or 'risk' proper, as we shall use the term, is so far different from an unmeasurable one that it is not in effect an uncertainty at all.

Welcoming Remarks at the 5th Annual Conference on "Nontraditional Data, Machine Learning, and Natural Language Processing in Macroeconomics" (Fed Gov. Cook)

In the current environment, we employ a wide variety of tools and techniques to best distill useful signals related to inflation and the labor market from the vast array of information we have at our disposal. Of course, that includes the standard econometric toolkit. But we have also been increasingly relying on text analytics and machine learning.

On the methodological side, machine-learning techniques have also had a profound effect on how we think about modeling complex macroeconomic outcomes. This morning, Philippe Goulet Coulombe will discuss how neural networks help model the volatility of various macroeconomic variables, and Joël Marbet and Yucheng Yang will discuss how new methods are being used to solve models with heterogeneous agents, which are crucial to assess the distributional consequences of economic policies. Advances in natural language processing and machine learning have also improved our ability to forecast and nowcast a wide range of macroeconomic and financial indicators, a topic that will also be covered in a few sessions tomorrow.

Follow-up Commentary

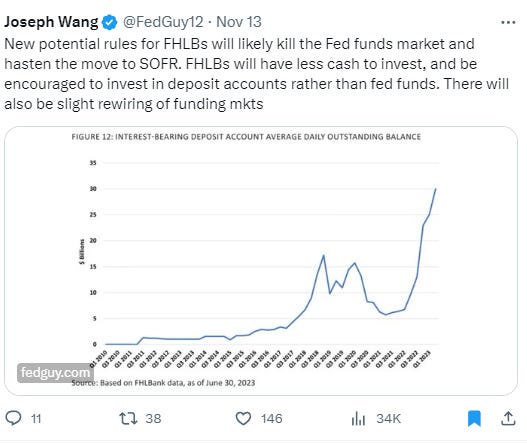

FHLB

Robin Wigglesworth writes Reforming America’s lenders of second-to-last resort (FT)

… over the years they have morphed into unofficial de facto lenders-of-second-to-last-resort to the US banking industry.

That’s arguably destabilising in a crisis: it lets troubled lenders mask problems, undermines the Federal Reserve formal backstop role, and increases the cost of the clean-up if the borrowing bank collapses (because the FHLB advances get repaid before everyone, even the Fed). Viz, Silicon Valley Bank.

[However] analysts at Barclays have raised some fascinating but potentially major unintended consequences of the proposals. For example, if tottering banks cannot tap their local FHLB for funding — and the stigma of going to the Fed’s discount window remains undimmed — this could exacerbate ructions in funding markets as they scramble for alternatives.

The Unraveling of the Federal Home Loan Banks (SSRN: Judge)

The proliferation of other federal housing programs, implemented by entities such as Fannie Mae, Freddie Mac, Ginnie Mae and the Federal Housing Agency, have largely obviated the capacity of the Federal Home Loan Banks to meaningful enhance the availability of mortgage credit in accordance with their original design. Accentuating the disconnect, the typical mortgage today is issued by a nonbank with no access to the Federal Home Loan Bank system.

Yet even as the public benefits of the Federal Home Loan Bank system have declined, the scale of the system, the private benefits it bestows on members and the distortions that flow from its operations have grown. The Federal Home Loan Banks now have a long track record of helping weak financial institutions, from the S&Ls of the 1980s to Silicon Valley Bank in 2023, limp along far too long. This essay explains why it is past time to overhaul the Federal Home Loan Bank system and it uses the history of the system to illuminate the best path forward.

Climate Change

Assessing the Global Climate in October 2023

January–October 2023 ranked as the warmest such period on record, and there is a greater than 99% chance that 2023 will be the warmest year in NOAA’s 174-year record. For the seventh consecutive month, global ocean surface temperature set a record high. Antarctica had its sixth consecutive month with the lowest sea ice extent on record.

Recent Research

Momentum: Evidence and Insights 30 Years Late

This one’s for Jim Conklin.

Calibration of transition risk for corporate bonds (British Actuarial Journal)

Transition and default risk are typically modelled using transition matrices. To model this risk requires a model of transition matrices and how these can change from year to year. In this paper, four such models have been investigated and compared to the raw data they are calibrated to.

You read that right.

Why do I say interestingly timed? Well the WSJ dropped it on the day of Congressional hearings on bank regulation and the Basel End-Game.

A subsequent series of WSJ articles attack FDIC Chair Gruenberg/

FDIC Chair, Known for Temper, Ignored Bad Behavior in Workplace (WSJ)

FDIC Chairman Denies Being Investigated, Then Changes Testimony (WSJ)

Republicans Heap Pressure on FDIC’s Gruenberg Over Claims of Toxic Workplace (WSJ)