Perspective on Risk - Next

Podcasts; Deglobalization; Recession Probability Update; Corporate Defaults; Private Credit Bypassing the Banks; Equity Risk Premium; Operational Risk; Career

Podcasts

First time I’ve led off with podcasts - they’re usually in that part of the Perspective that you never quite get to. Anyway, two terrific podcasts worth your consideration:

Fabio Natalucci on How to Think About Financial Risk Right Now

Fabio authors the IMF’s annual financial stability report. This is a nice overview on how regulators think about financial stability risk. Here is the Spotify link for those who listen that way.

Money Talks: The king of quants

It’s always fun and worthwhile to listen to Cliff Asness, the co-founder and chief investment officer of AQR, one of the world’s biggest quant fund managers1. No deep insights, but a nice listen. You can skip ahead to ~9:50. Here is the Spotify link

Deglobalization

This is the presentation material from a recent speech given by the BIS’s Hyun Song Shin on Global Value Chains. Definitely worth clicking on that link. The underlying paper is here.

He goes on to argue:

Global trade relative to GDP has fluctuated with financial conditions, as measured by the broad dollar index

Annual growth of trade finance from banks follows closely the movements in

the broad dollar index

Real broad dollar index shows a decline after October 2022 [so just maybe the trend will prove to be an artifact.]

So I would view this as evidence against the thesis that it is US/China geopolitical tension that is leading to a decline in globalization; the timeframes do not align well.

Recession Probability Update

(From Arturo Estrella)

Model details are at financeecon.com/DPs/DP2301.pdf.

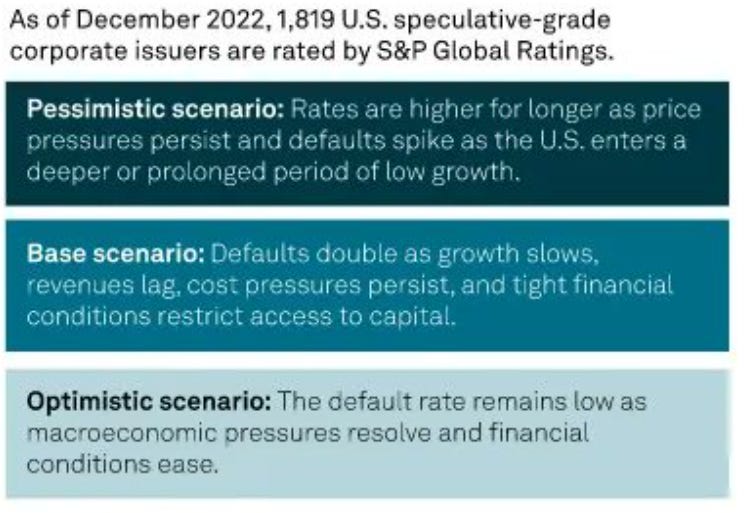

Corporate Defaults

Private Credit Bypassing the Banks

Apollo, HPS Pile Into Record $5.5 Billion Private Credit Deal (Bloomberg)

Apollo Global Management Inc. and HPS Investment Partners are among lenders that have offered to help provide a $5.5 billion loan supporting the buyout of health-care technology firm Cotiviti Inc., in what would be the largest buyout financing ever arranged by private credit firms, according to people with knowledge of the matter.

Several banks have been pitching such a syndicated solution as an alternative to the private credit deal, though Carlyle and Veritas have so far preferred to pursue the private funding route, the people said.

Equity Risk Premium

(Not Jim’s)

Follow-up on Deutsche Bank

Deutsche Bank’s Regulators Criticize Its Internal Probe

The European Central Bank and German regulator BaFin have told Germany’s largest bank that the probe, known as Project Teal, took too long, wasn’t broad enough, and was too slow to take remedial action

Well duh. That’s why you either supervise the probe very closely, commission it yourself, or do it yourself.

Operational Risk

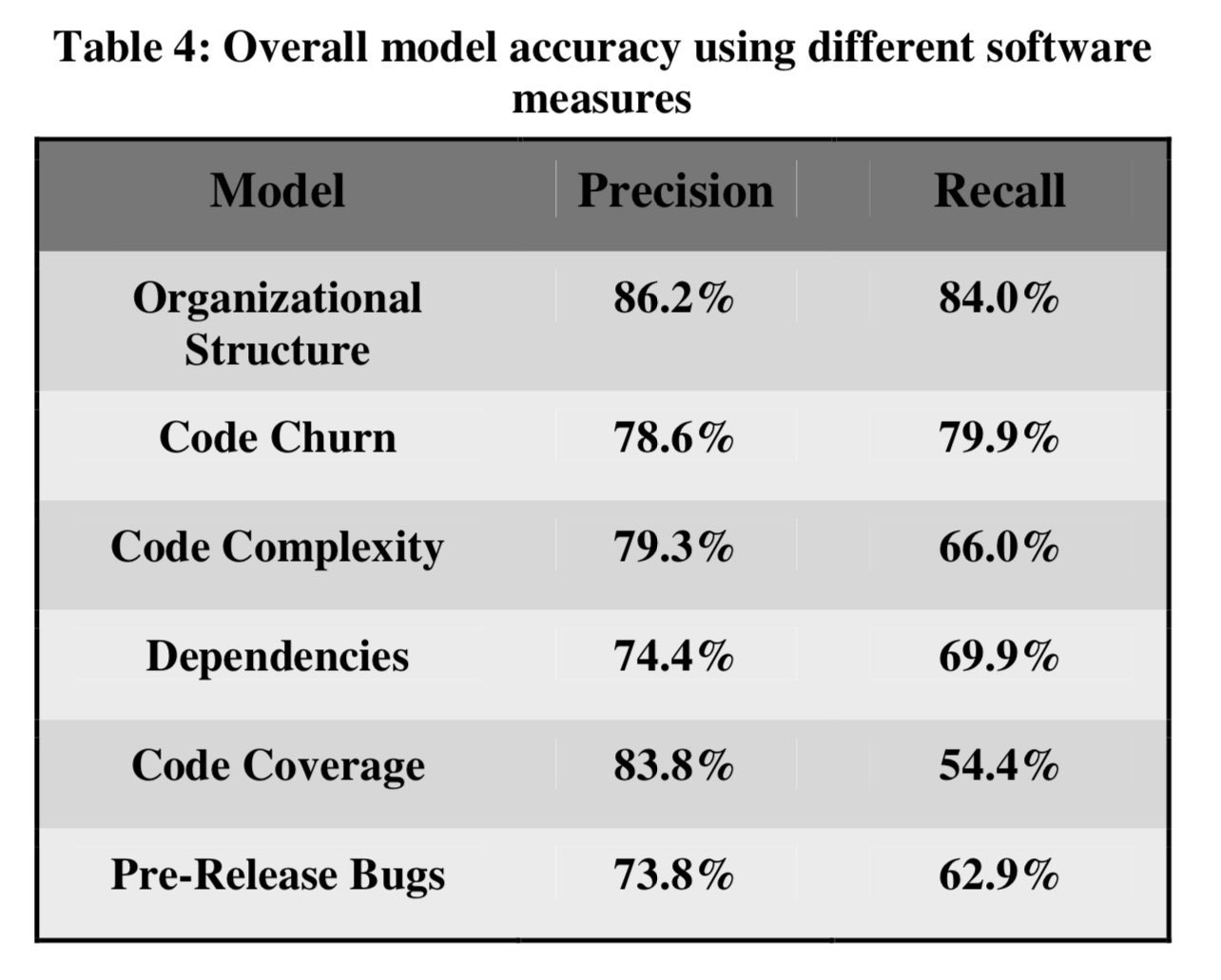

THE INFLUENCE OF ORGANIZATIONAL STRUCTURE ON SOFTWARE QUALITY: AN EMPIRICAL CASE STUDY (Microsoft)

Brooks states in the Mythical Man Month book that product quality is strongly affected by organization structure. Unfortunately there has been little empirical evidence to date to substantiate this assertion. In this paper we present a metric scheme to quantify organizational complexity, in relation to the product development process to identify if the metrics impact failure-proneness

Our results provide empirical evidence that the organizational metrics are related to, and are effective predictors of failure-proneness.

[Here’s the key: organizational structure was responsible for more bugs than any single technical aspect.]

Why Corporate America Still Runs on Ancient Software That Breaks (Odd Lots)

On this episode of the podcast we speak with Patrick McKenzie, an expert on engineering and infrastructure, who writes the Bits About Money newsletter and recently left payments company Stripe after six years. We talked about the challenges of keeping any software system alive after years of upgrades and updates, the distribution of tech talent across industries, and whether non-tech companies can close the gap with Silicon Valley.

And then some customization happens.

Here is the Spotify link.

Deep Tail Risk

Bird-Flu

Eagles Are Falling, Bears Are Going Blind (Atlantic)

The virus has been steadily trickling into mammalian populations—foxes, bears, mink, whales, seals—on both land and sea, fueling fears that humans could be next. Scientists maintain that the risk of sustained spread among people is very low, but each additional detection of the virus in something warm-blooded and furry hints that the virus is improving its ability to infiltrate new hosts.

Deadly strains of avian flu have been ferried onto North American shores multiple times before, and rapidly petered out.

This time, though, the dynamics are different. … American scientists have detected the virus in more than 150 wild and domestic avian species and at least a dozen different types of mammals. It’s by far the longest and most diverse list of victims the virus has ever claimed on this side of the world.

Most Will Say I Failed The 2nd Part Too

Here is a nice Cliff rant on volatility laundering