Perspective on Risk - May 22, 2023 (Liz, Sheila, Senate Banking, Michelle, and real stuff)

Warren, Bair, Senate Banking Hearings, more Fed Bowman, CRE, Lev. Lending, VC, plumbing, AI & Insurance, CS CDS, R*, Killer Whales)

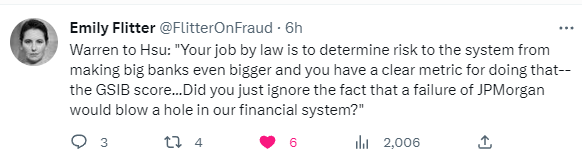

Warren Asking The Right Question

Generally not a fan of the Senator from Massachusetts, but when she’s right, she’s right.

I Can’t Believe I’m Agreeing With Sheila Bair

Sheila Bair on the Forward Guidance podcast

I did criticize the decision to use the systemic risk determination to bail out uninsured depositors as Silicon Valley and Signature bank. First of all, I didn't see it as systemic — they didn't really show their work that there was instability without insured deposits.

This is two Banks of 4100 banks; 300 billion in assets and the 23 trillion dollar system.

I don't think the case was ever made that they couldn't have used the usual process.

I think what ended up happening was there was all this drama around it because they did say it was systemic, they did say both of these banks were systemic, they did say they were worried about uninsured deposit runs and that's why afterwards you saw this precipitated uninsured deposit runs were, you know, and we'll probably debate that forever where they've been better if you just use the usual procedures. Get out there with a communication strategy: these are you know average banks, the whole system's fine, these are unusually bad banks - poorly managed this unique high reliance on uninsured deposits. I think they could have gone out with that and it would have been a lot a lot better.

That was my concern about why they use the systemic interest determination and now things are calming down now I think you can see people, as they look more thoughtful in these Banks …

There was a lot of drama out there so the press was focused on because the systemic risk determination is an extraordinary procedure — I mean it's it's a dramatic procedure and so that the Press was was perhaps understandably paying a lot of attention.

But later then, especially when First Republic failed, so then you're seeing these headlines you know second third and fourth largest banks in history fail and I did feel that was misleading because it made it sound like this is potentially even worse than the great financial crisis when a point of fact it was the very largest banks during the great financial crisis that were in trouble that were in truly imperiling our entire economy

U.S. Senate Committee on Banking Hearings.

Best summed up by this quote from Wharton’s Peter Conti-Brown’s remarks.

The failures at these banks were so basic as to be mystifying. The efforts by these bankers to displace blame to the macroeconomic, monetary, and even – perhaps most alarmingly – the social media context is sheer codswallop.

More Fed. Gov. Bowman on Supervision & Regulation

Fed. Gov. Bowman made some additional remarks, Considerations for Revisions to the Bank Regulatory Framework, at the Texas Bankers Association Annual Convention. You’ll remember that I highlighted her remarks in this Perspective where I suggested she took shots at both Quarles and Barr, while emphasizing supervisory action and toughness and perhaps was less inclined to major regulatory changes.

In this speech she talks about “the benefits of nimble supervision.” LOL. Supervision is anything but nimble. It’s a battleship that historically takes years to turn. But this becomes a useful argument against further regulation.

She continues to push back on the potential for new regulation:

we need to carefully consider both the strength of the current regulatory framework and the effective implementation of tailored supervision.

Not only is the current tailoring approach robust, it also results in efficiency. Tailoring distinguishes firms by size, risk, and complexity, and imposes appropriate regulatory requirements in light of these differences.

Fundamentally, we should be careful not to undermine tailoring and risk-based supervision.

Voices calling for broad, fundamental reforms of the U.S. banking system appear to advocate a shift away from tailoring and risk-based supervision. The view that we extend the reach of overly complex and outsized regulatory requirements to banks that are smaller and less complex ignores some likely results—doing so will lead to bank consolidation, and will potentially push banking activities outside of the regulated banking system. This could also lead to the elimination of all but the largest too-big-to-fail banks who would then be insulated from other competition. This is surely not the outcome that supporters of the 2008 financials crisis reforms were seeking.

I have also heard calls for broad, fundamental reforms for the past several years, shifting away from tailoring and risk-based supervision. I believe this is the wrong direction for any conversation about banking reform.

Commercial Real Estate

We all know about Manhattan office, but we are seeing price deterioration in multi-family now.

Moody’s Analytics

Commercial Real Estate Prices in the US Fall for First Time Since 2011 (Bloomberg)

US commercial real estate prices fell in the first quarter for the first time in more than a decade, according to Moody’s Analytics, heightening the risk of more financial stress in the banking industry.

The less than 1% decline was led by drops in multifamily residences and office buildings, data culled by Moody’s from courthouse records of transactions showed.

Worth checking what Mark Zandi has to say: Lot’s more CRE price declines coming.

CoStar

Mixed Performance In The Latest CoStar Composite Price Indices (CoStar)

The value-weighted U.S. Composite Index, more heavily influenced by high-value trades common in core markets, fell for the eighth consecutive month to 277, a decline of 1.3% over the prior month. The index also slumped 5.2% during the 12 months ending in March 2023.

The equal-weighted U.S. Multifamily Index fell by 2.4% in the first quarter of 2023 and dropped 2.2% in the 12 months ending in March 2023. The U.S. Multifamily Index showed the sharpest annual decline in values since the interest rate hiking cycle began in the first quarter of 2022

The U.S. Office Index sagged 2.4% in the first quarter of 2023, taking its cumulative decline to minus 5% during the previous three quarters. Office prices were down 1.4% in the 12 months ending in March 2023, marking the first annual decline since the second quarter of 2012.

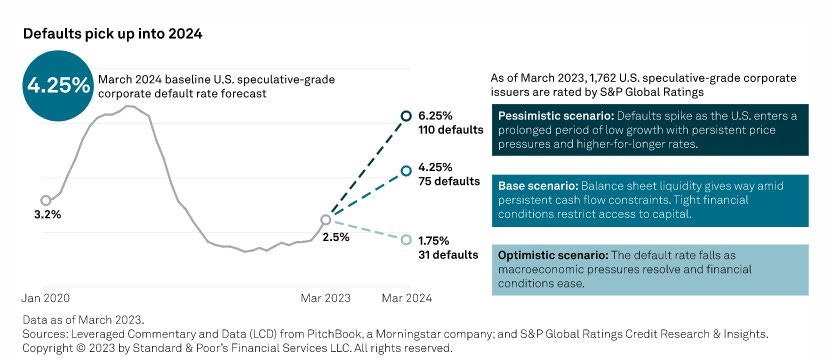

Leveraged Loans

S&P Expects Defaults To Accelerate

Consumer Causing Rise In Covenant Defaults

Private loan covenant defaults in Lincoln index rise to 4.5% in Q1 (Pitchbook)

Covenant defaults of private loans in the Lincoln Senior Debt Index (LSDI) continue to increase, ticking up to 4.5% in the first quarter of 2023, from 4.2% in the fourth quarter of 2022.

Consumer loans led the rise, with defaults in that sector increasing to 6.4%.

“This trend follows historical recessionary periods wherein consumer companies are often the first domino to fall during a decline in discretionary spending,” according to a statement from Lincoln International.

The Consumer sector also showed the weakest performance versus other sectors, with the lagging twelve-month revenue growing 12% year-on-year while LTM EBITDA fell 2%.

Venture Capital

VC/PE returns typically are a lagged P&L variable for banks and insurance companies. Marks only flow through a quarter or two after we see price changes in observable markets. It’s a property that CFOs love (because they can plan for and manage other elements of earnings around the disclosure) and CROs hate (because the real markdowns should be reflected in your forward risk appetite).

Venture-Fund Returns Show Worst Slump in More Than a Decade (WSJ)

For the first time in more than a decade, returns for venture funds were negative for three consecutive quarters last year, according to research firm PitchBook Data, as investors finally began to mark down startups that had ballooned in value. Initial data for the fourth quarter also show a negative quarterly return.

The data also show that the yearly internal rate of return hit minus 7% in the third quarter—the latest data available for that measure—the lowest value for those three months since 2009. The internal rate of return is used to measure the profitability of venture funds on an annual basis and is a key performance metric used by the industry.

Fundraising for new venture funds hit a nine-year-low earlier this year, The Wall Street Journal reported.

In 2022, Tiger Global marked down the value of its startup investments by about 33% across its venture-capital funds, the Journal reported, erasing $23 billion in value. The firm was the most active U.S. startup investor in 2021 and developed a reputation for paying high prices to win competitive deals.

This last quote shows the importance of having a portfolio that is balanced across different origination years: concentration risk can hurt.

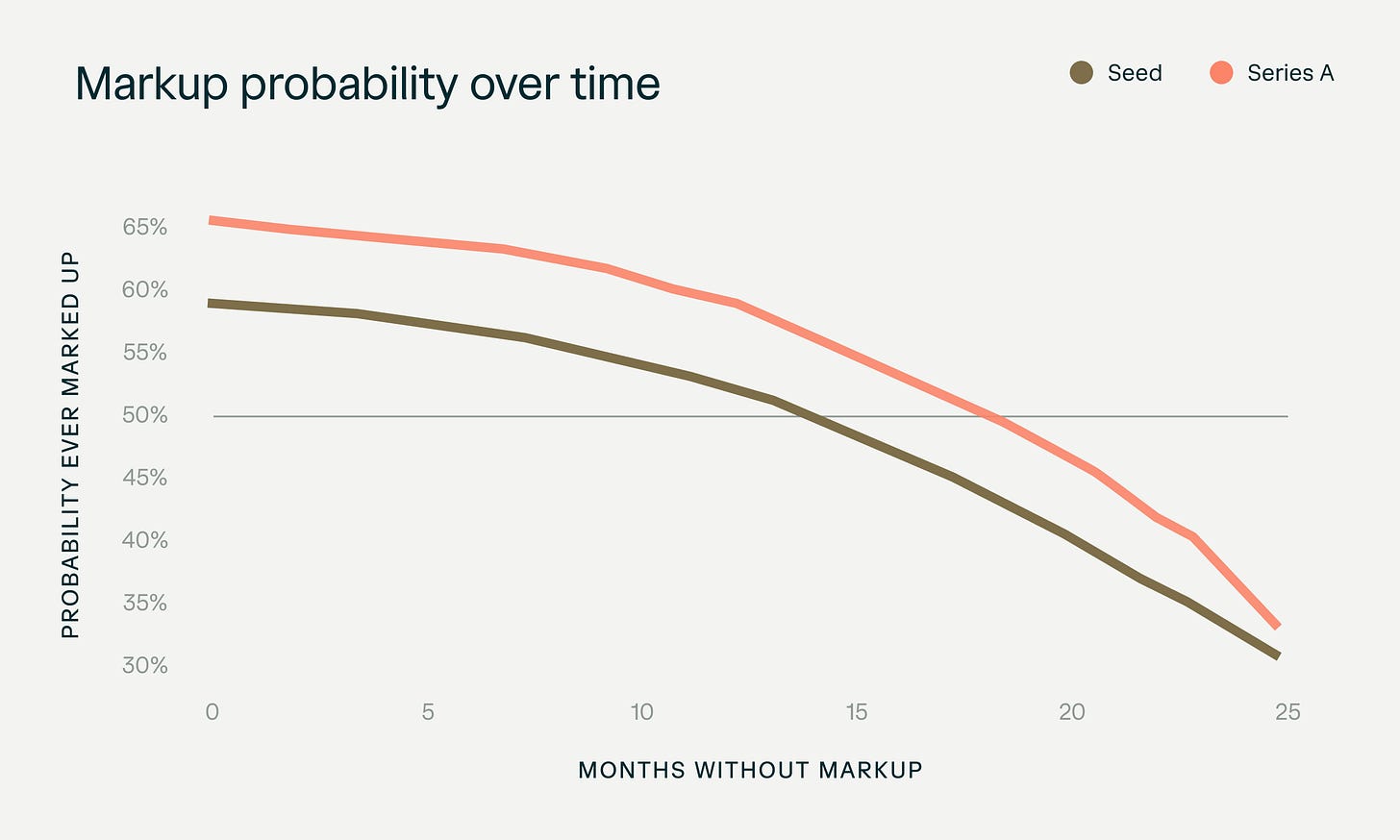

After 18 Months, Your Investment Probably Isn’t Getting Marked Up (AngelList)

When you invest in a startup, one of two things is likely to happen: at some point, the startup investment will be marked up (i.e., raise a subsequent priced round at a valuation increase or exit at a gain, which we will call a “winning” investment), or it will be a losing investment and never get marked up. Of course, you don’t know which category your investment will fall into. If you did, you’d never make a losing investment.

However, the odds that an investment will be a winner decline with each passing month that the investment is not marked up. That’s because some fraction of winning deals get marked up with each passing month—while a losing investment is never marked up.

18 months after closing, a Series A investment that hasn’t been marked up yet is more likely to never be marked up than to be marked up. Seed investments, because of their higher baseline rate of failure, cross this threshold even faster—at just 12 months.

Thinks Your Venture Investments Probably Aren't Getting Marked Up

Paying Attention To The Plumbing

Most of you think little about how money moves, or securities or derivative trades settle, and the risks that arise. But this is something the Fed and others obsess over. The SEC has proposed enhanced rules on Covered Clearing Agency Resilience and Recovery and Wind-Down Plans. Jim Hamilton’s World of Securities Regulation does a good job covering these topics, and he has written Commission proposes to strengthen risk-management rules for covered clearing agencies. He writes:

SEC commissioners on Wednesday unanimously approved proposed changes to certain rules governing covered clearing agencies (CCAs), amending requirements applicable to CCA risk-based margin systems, and adding new requirements to CCA recovery and wind-down plans.

The latest proposal gives specificity to rules adopted by the Commission in 2016 that required CCAs, registered clearing agencies that act as a central counterparty, to have plans for recovery and wind-down.

The proposed rule also identifies nine elements that a CCA would need to include in its recovery and wind-down plan (RWP)

The proposal also amends existing rules regarding intraday margins and the use of substantive inputs to a CCA’s risk-based margin system.

The latest proposal builds on an existing requirement that a covered clearing agency have policies and procedures reasonably designed to cover its credit exposures to its participants by establishing a risk-based margin system that, among other things, includes the authority and operational capacity to make intraday margin calls in defined circumstances.

Specifically, the proposed rule amendments would require that a covered clearing agency’s risk-based margin system monitor intraday exposure on an ongoing basis and make intraday margin calls as frequently as circumstances warrant, including when risk thresholds specified by the covered clearing agency are breached or when the products cleared or markets served experience elevated volatility.

The proposal also requires a CCA to establish a risk-based margin system that addresses the use of substantive inputs to its risk-based margin system, specifically, when such inputs are not readily available or reliable. Substantive inputs could include, for example, portfolio size, volatility, and sensitivity to various risk factors that are likely to influence security prices.

Settlement nerds (like me) take note.

AI & Insurance

Duncan Minty writes The EU AI Act is full of Significance for Insurers. The Europeans have been at the forefront of writing legislation to restrict how artificial intelligence may be used. He writes:

The four significant implications for insurers in the compromise text are...

the use of AI systems in life and health insurance markets is to be classified as high risk;

the use of AI systems for the detection of fraud in financial services is not in itself to be classified as high risk, but will still be affected by other requirements;

some uses of biometric data are to be classified as high risk, while other uses will be prohibited altogether;

a ban on social scoring is significant for underwriting in several markets.

What we have therefore is a market being address (life and health), a technology being addressed (biometrics), a function being address (counter fraud) and a practice being addressed (social scoring). Yet while each of these seems stand-alone, dig a little deeper and the interconnections become apparent. One example of this is the growing use of biometric data in counter fraud. That will now have to meet the high risk criteria.

I’d recommend reading this article even if you are not a European insurer, in Europe, or even an insurer. Restrictions like these will be coming to AI systems everywhere. One needs to think prudently about how your developers are finding and using data; reputation damage and lawsuits may happen even before regulation and compliance hits.

More on the Credit Suisse CDS Saga

From FT Alphaville Schrödinger’s swap: the audacious plan to trigger Credit Suisse’s CDS.

It’s pretty complicated, even for those of us who (claim to) understand the CDS settlement rules. It bears on structural vs contractual subordination, HoldCo vs bank structures, pari passu requirements, whether there was a technical ‘government intervention event’ and a 1918 NY court decision that classified perpetual bonds as debt.

No amount of extracting I could do would give justice to the argument, so if you’re into this kind of thing, click through.

Bloomberg has a primer on the Credit Derivatives Determinations Committee in What’s the CDDC, Whose Rulings Can Unlock Billions?

Credit Suisse CDS: déjà vu all over again (FT)

Unfortunately the all-powerful CDS determinations committee did not agree. On Wednesday, the panel of market participants peered inside the box marked “Credit Suisse Group AG subordinated credit-default swap contract” and unanimously decided that the cat inside was very much alive:

… shortly after we to put pen to paper on this, another CS CDS question hit:

Has a Bankruptcy Credit Event occurred with respect to Credit Suisse Group AG?

In particular, the Eligible Market Participant who submitted the question has requested that the EMEA DC consider whether a Bankruptcy Credit Event has occurred with respect to Credit Suisse Group AG under Section 4.2(b) or 4.2(h) of the 2014 Definitions.

Firstly, this one concerns both the senior and subordinated CDS contracts, rather than only the latter.

Secondly, this is concerns whether a “bankruptcy credit event” has occurred, rather than a “governmental intervention credit event”.

Hot Credit Suisse CDS Trade Risks Being Wrecked by Hedge Funds (Bloomberg)

Hedge funds looking to trigger payouts on derivatives tied to Credit Suisse Group AG are clashing with investors that piled into a different hot trade.

The hedge funds have piled into a longshot wager that a derivatives industry panel will determine that the shotgun takeover of Credit Suisse by rival UBS Group AG was effectively the equivalent of a default event. Such a ruling would hand them a windfall score on their derivative positions, but the panel has already decided against the group once.

If the hedge funds succeed, another set of money managers stand to lose out. They’ve bet that Credit Suisse’s credit quality will converge with that of its rescuer’s as UBS essentially assumes its competitor’s obligations.

Stay tuned.

R* Is Back

Those of you who have been readers for a while know I used to write about developments in R*, the equilibrium real rate of interest. The NY Fed, which publishes useful graphs of the main estimations, and whose President is a prominent researcher in this area, suspended publishing their estimates during the Covid pandemic. Well, they’ve resumed publishing, coincident with a conference honoring Thomas Laubach, one of the other intellectual founders of the measure.

NY Fed Williams presented some remarks where he suggests R* will remain low going forward.

Estimates indicate that r-star today is about where it was before the pandemic.

One way to gauge how forecasters perceive the future of r-star is to use forecast data to estimate it. … The May 2023 Blue Chip forecasts for inflation, GDP, and interest rates are used as proxies for data from the second quarter of 2023 through the fourth quarter of 2024. …The resulting estimate of r-star is about ½ percent in the first quarter of 2023, and subsequently falls to slightly below zero. Evidently, the value of r-star implied by private forecasts is, if anything, even lower than today's estimate.