Perspective on Risk - May 15, 2023

I’m back; Some People Think Everything Is Terrible; Credit Standards Are Tightening; Commercial Real Estate; CMBS Pain Has Begun; Parallels to the S&L Crisis; A Sucker Is Born; HehHehHeh; Funnies

I’m back (much to your delight or chagrin). The trip to Egypt and Jordan was amazing, and I highly recommend it. We did the Viking Cruise up the Nile, followed by 4 days in Jordan (Petra, Dead Sea, Wadi Rum). Here’s a Flickr link if you’re interested in the sights.

Now that I’m back, it appears that most agree we are not (yet) in a systemic crisis. But that doesn’t mean the coast is clear. Credit conditions are tightening, and it’s not clear that monetary conditions will offset the coming contraction. Pretty much everyone is now on board with the recession call (but unclear whether it iwill be mild, normal or deep). I’m seeing a lot more coverage of potential CRE issues, and there is quite a bit of sovereign debt chatter behind the scenes (that’s for another issue of the PoR).

Some People Think Everything Is Terrible

Paul Singer, the Man Who Saw the Economic Crises Coming (WSJ)

“Valuations are still very high,” he says. “There’s a significant chance of recession. We see the possibility of a lengthy period of low returns in financial assets, low returns in real estate, corporate profits, unemployment rates higher than exist now and lots of inflation in the next round.”

Flows and Fundamentals Make Man Group Suspicious of Stock Rally (Bloomberg)

Jones, the deputy chief executive officer of the world’s largest publicly traded hedge-fund manager, joined the What Goes Up podcast to give his outlook on markets and explain what strategies have been working well at his firm.

“The risk-reward in equities is very, very tough at the moment,” he said on the podcast.

Credit Standards Are Tightening

Tightening credit standards lead bankruptcies by 6 months

Commercial Real Estate

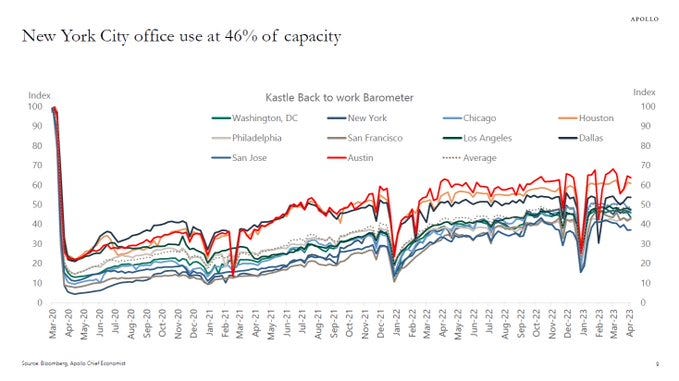

Manhattan Office Vacancy Hits Record as Landlords Add Space (Bloomberg)

More than 16% of space was empty as of the first quarter, according to brokerage Jones Lang LaSalle Inc., which tracks about 470 million square feet (44 million square meters) of Manhattan offices. Leasing is at its lowest levels since the second quarter of 2021.

The market was inundated with more than 1.5 million square feet of office space in the first quarter with the completion of 660 Fifth Ave.’s redevelopment.

Office vacancy in San Francisco climbs to 30% (The Real Deal)

The office vacancy rate in the city spiked to 29.5 percent in the first quarter, up nearly 2 percent since the end of last year and nearly 10 percent from a year ago, the San Francisco Business Times reported, citing data from the brokerage CBRE.

Available space, including offices not yet vacated, rose to nearly 35 percent.

The city’s empty offices now span 26.6 million square feet, or eight times the vacant offices in early 2019 before the pandemic.

Are Offices Truly Worth as Little as REITs Imply? (Bloomberg)

The NCREIF Office Property Index has lost just about 5.4% from its peak in mid-2022. …

The Bloomberg REIT Office Property Index is down by about half from its 2022 highs on a total return basis. …

The performance gap between REITs and physical real estate can’t endure forever, of course. REITs include leverage that magnifies returns, but that alone doesn’t explain away the gaping performance gap. As Bloomberg Intelligence Senior Analyst Jeffrey Langbaum told me last week, REIT shares have potentially “overshot the actual decline in property values that’s coming.” That would be consistent with 30 years of history, in which REITs tend to overcorrect. From 1993 until around 2017, the long-term total returns of office REITs have closely tracked the NCREIF index.

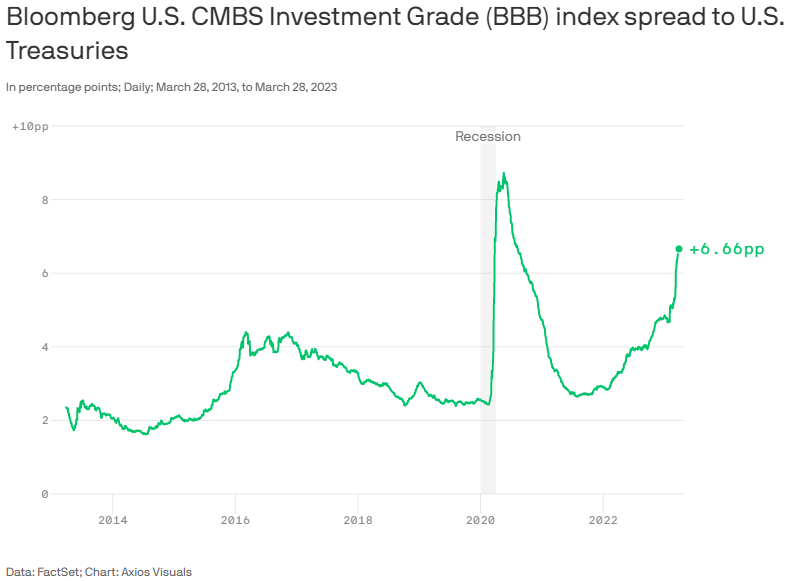

CMBS Pain Has Begun

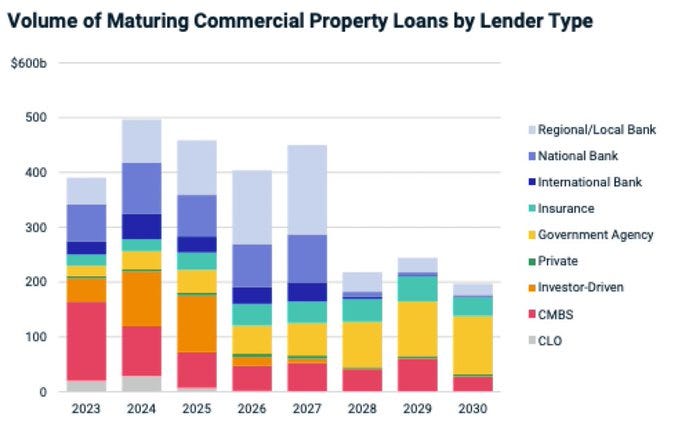

One of the new features of this CRE downturn, as opposed to the one in the late 1980s, is the prevalence of securitization. Last time, banks and pension funds held 80% of the exposure. Pension plan’s direct share has fallen, and has been replaced by CMBS. This will affect the timing and accounting of loss recognition, as well as possibly changing the restructuring dynamic.

The CMBS Index is down mostly due to interest rate risk.

However, there has been a notable deterioration in the weaker tranches

At this point, there does not appear to be a parallel to the 2007/8 problem with residential CLOs where the rating agencies mis-rated the senior tranches. The bulk of maturing volume in 2023 is CMBS.

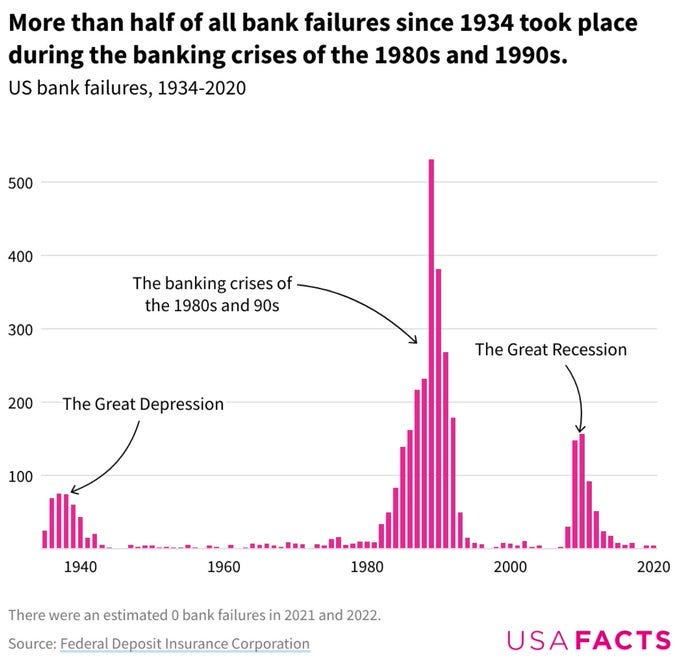

Parallels to the S&L Crisis

There are considerable parallels to the S&L crisis. The S&L industry was decimated by the deregulation of interest rates and the evolution of securitization as a better way to distribute the risk.

The S&L crisis was in effect 2 bailouts. The S&Ls had lost their raison d’être between banks being able to pay interest on cash deposits and new money market funds and the banks themselves being disintermediated by capital markets

So the S&Ls were dying but they still had longterm mortgage assets and played a big role in local housing markets. So the regs were super loosened and their ability to avoid federal regulator via state charters gave them a false new lease on life. 1

During the S&L crisis, regulators used quite a few methods of forbearance to avoid closing the thrifts. Regulators allowed troubled thrifts to continue operating despite being undercapitalized, thereby avoiding the need to close them down or merge them with healthier institutions. Net worth certificates were issued by the Federal Savings and Loan Insurance Corporation (FSLIC). FSLIC would take on the illiquid assets of the troubled thrift in exchange for the certificates, which the thrift could then count as regulatory capital. Regulators also allowed thrifts to count supervisory goodwill, or the excess of the thrift's book value over its market value, as regulatory capital. In some cases, regulators allowed thrifts to defer interest payments on their liabilities to alleviate immediate funding pressures.

Now, the Federal Reserve has allowed firms to borrow at term against the face, rather than market, value of their held-to-maturity securities. This both allows the banks to avoid recognizing an accounting (and regulatory capital) loss and lengthens the firms liabilities (stabilizing in the face of runs). It also confers at least the appearance of regulatory support.

A Sucker Is Born Every Day

Heh Heh Heh

Non-Disparagement Clauses Are Retroactively Voided, NLRB’s Top Cop Clarifies

The general counsel of the National Labor Relations Board issued a clarifying memo on Wednesday regarding the “scope” of a February ruling by the federal agency’s board that said employers cannot include blanket non-disparagement clauses in their severance packages, nor demand laid-off employees keep secret the terms of their exit agreements.

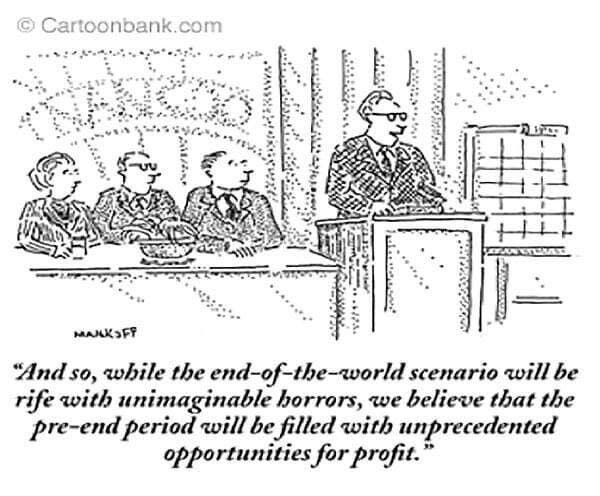

Funnies

@nadezhda04 on Twitter. Have to show the links this way now because Elon is a petulant child.