Perspective on Risk - March 24, 2023 (more banking)

Credit Suisse Was Systemic; The Regulatory Strike? Not (Yet) In A Banking Crisis; Commercial Real Estate; Nickle Keeps On Giving; Minsky & Kindleberger; Incentives Are Powerful; Reform

The U.S. banking system is sound and resilient.

But last week, we almost had a systemic collapse

The systemic risk exemptions to Signature and SVB were not really about those specific banks but about the risk of contagion to other banks and financial markets more broadly (Jerome Powell)

Sorry, but one can have contagion WITHOUT it being systemic.

Leverage and hot money1 - this is banking (and bank supervision) 101.

As one former top British central banker told POLITICO, “They could have used bail-in; it would have worked; and banking would become part of a capitalist market economy” — a reference to the loss-absorbing processes regulators came up with after 2008 to ensure bank failures didn’t have to draw on public resources ever again. “The only stable equilibrium is one where bank resolution works, or socialism,” he added.2

Credit Suisse Was Systemic

It Wasn’t Just Credit Suisse. Switzerland Itself Needed Rescuing. (WSJ)

Finance Minister Karin Keller-Sutter, central bank head Thomas Jordan and financial regulator Marlene Amstad had dialed Colm Kelleher, the UBS chairman, to present two options that were really only one: Buy Credit Suisse without a chance to fully understand its vast and complicated balance sheet—or let it fold in a protracted unraveling that UBS’s own executives worried could shatter Switzerland’s credibility as a global banking center.

The U.S. ambassador last week said Switzerland was facing its most serious crisis since World War II. Foreign investors burned by Credit Suisse’s demise are rethinking their willingness to invest.

Swiss officials from the get-go would only consider a Swiss option to save Credit Suisse, people familiar with the matter said. They shot-down an informal approach from U.S. asset management giant BlackRock, Inc. to get involved, these people said.

We Are Not (Yet) In A Banking Crisis

Though it feels as if we are getting closer. One can argue that things are more stable with the resolution of CS. Concern has shifted to Deutsche Bank, as their credit default swaps have widened out. But DB is arguably stronger than it was a few years ago, and the CDS widening may just be hedging of DB’s AT1 securities as fear spread after losses on the CS AT1s.

Where is the Regulatory Strike?

The problem is that SVB, Signature and Credit Suisse all appeared well capitalized while insufficiently capitalized. When the market recognized this, the regulatory measure didn’t matter. Same thing happened with Lehman

Banks arbitrage the regulatory measure.

The bank capital regime has two key parts; the first is a risk-based regime that assigns different weights to assets depending on their riskiness. The weakness of a regime like this is that it allows you to massively leverage assets perceived to be low risk (this was Aaa CDOs during 2007/8). So regulators have a simple leverage ratio that is an additional constraint just in case they misestimated the risk of low-perceived-risk assets.

With SVB, we had problems with each of these measures: the risk-based regime does not include a charge for interest rate risk. And the leverage ratio did not apply to SVB. Strike 3 was poor liquidity management.

The question for regulators going forward is ‘where is the solvency strike?’ If they stick to regulatory measures of solvency, quite a few regional and smaller banks run the risk of appearing inadequately capitalized on an economic basis while remaining adequately capitalized on a regulatory basis. When they are not closed, this is a degree of regulatory forbearance.

There will be a hesitancy on the part of the regulators to close community banks that are regulatorily solvent. Community banks do perform a useful function, and they are very powerful politically. Regional banks may be pressured to halt dividends and raise capital, particularly if credit losses begin to impair the loan portfolios.

Given the creation of the BTFB, I can foresee additional lending programs for these banks should it be necessary.

Commercial Real Estate

I’ve written since the Fed began raising rates that I thought the big issue would be commercial real estate. The Fed and USG actions had inflated asset prices, and the reversal of quantitative easing would affect market multiples.

Commercial real estate, in a way similar to corporate lending, is mostly a story about refinancing. Sure there are new developments, but most loans merely restructure the capital structure on existing assets. With the ‘equilibrium rate’ rising, commercial real estate capital structures will need to be reset to reflect the new prevailing cap rates. The issue has started to get more attention in the press.

Scott Rechler is the Chairman & CEO of RXR, a major developer.3

The WSJ has a nice overview piece, Commercial Property Debt Creates More Bank Worries (WSJ)

A record amount of commercial mortgages expiring in 2023 is set to test the financial health of small and regional banks already under pressure following the recent failures of Silicon Valley Bank and Signature Bank.

This year will be critical because about $270 billion in commercial mortgages held by banks are set to expire, according to Trepp—the highest figure on record. Most of these loans are held by banks with less than $250 billion in assets.

Trepp reported earlier this month that the delinquency rate for commercial mortgage-backed securities increased 0.18 percentage point in February to 3.12%, the second-largest increase since June 2020.

Similarly, the Odds Lot podcast recently interviewed Rich Hill of Cohen & Steers: Where Stress Is Showing in the $20 Trillion Commercial Real Estate Market. This is terrific and gives some timely information (note: I have reordered some of the quotes to make it flow better)

Transaction volumes are down significantly on a year-over-year basis, almost 70% down.

Distressed sales are very low right now. I don't think they're going to stay low; I think they're going to increase. But the reason distressed sales are low right now is that banks haven't started foreclosing on their loans, and the spread between buyers and sellers is pretty wide. Distressed sales are low, and while we can talk about delinquencies, like CMBS delinquencies and bank delinquencies, distressed sales are the first thing I look at. It's showing signs of ticking up, and I think it's going to rise.

Publicly traded REITs, is always a leading indicator for the private market. They go down before the private market and they go up before the private market. … The REIT market was down 25% in 2022

[It] can historically take 12 to 24 months for private property valuations to correct to what the listed market is pricing in. … I think the correction in private valuations will be much quicker than what we've seen previously, maybe for one of the reasons you mentioned at the beginning, like the rise in financing costs. … The listed market, on average across property types, is trading at a high 5% implied cap rate, while the private market, as measured by the NCREIF ODCE Index, is still at 3.9. That's a significant difference between public and private values.

Usually, cap rates decline into a rising interest rate environment because historically, that rising interest rate environment is symptomatic of an improving economy at a time when financing costs are rolling down. So, levered returns expand, which allows cap rates to contract. This time is different because financing costs are significantly higher, not just because of the risk-free rate and widening credit spreads, but also because growth is slowing.

Most of the debt coming due in 2023 were loans originated in 2013 or 2018. Property prices have risen since 2013, so the effective LTV is actually lower than 50-60% for those who originated a loan in 2022 when buying a property. … Even if valuations fall 10-30% next year, there's a good chance these loans are not underwater yet. This is not the case for office properties or malls.

The public markets are signaling that office valuations will be down significantly due to three reasons: uncertainty about NOI growth, refinancing risks, and potential recessionary headwinds.

One additional indication of the distress comes from the recent sale of a portion of Signature Bank to NYCB. After Signature Bank Deal, FDIC Is Left With $11 Billion in ‘Toxic Waste’ Loans (Bloomberg)

Signature Bank’s partial takeover by a competitor is notable for what it doesn’t include: $11 billion of loans against a class of New York City apartments whose values have tumbled in recent years. … Left behind is the commercial real estate debt portfolio, weighted heavily toward multifamily buildings bound by a law that restricts landlords’ ability to raise rents.

Now, the Fed has been criticized for not stress testing rising rates in their latest stress test. But they did stress test commercial real estate prices.

Now the just need to run the scenario against the regional and smaller banks.

Again, from the above WSJ article:

This year will be critical because about $270 billion in commercial mortgages held by banks are set to expire, according to Trepp—the highest figure on record. Most of these loans are held by banks with less than $250 billion in assets.

Liquidity

And people always asked why I was so obsessed with Treasury operations as a risk manager…

Inside SVB’s Treasury scramble for funding

How the Last-Ditch Effort to Save Silicon Valley Bank Failed (WSJ). Waited too long.

Inside Silicon Valley Bank, executives were trying to navigate the U.S. banking system’s creaky apparatus for emergency lending and to persuade its custodian bank to stay open late to handle a multibillion-dollar transfer.

Banks leave collateral such as mortgages with FHLBs in exchange for credit lines. To advance the money, the FHLBs have to issue debt, which means they can generally only lend when the market is open. … It was already midday in California, and SVB’s unusually large request came too late for the San Francisco FHLB to process that day

SVB turned to plan B, asking the San Francisco FHLB to move $20 billion of collateral to the Federal Reserve’s discount window, where it could get emergency funding, the people said. … The transfer required procedural steps. SVB had outstanding loans at the San Francisco FHLB, which had to determine how much collateral it needed to hold, the people familiar with the matter said.

SVB also tried to get $20 billion in assets to the Fed through Bank of New York Mellon Corp., one of its custodial banks. SVB was too late—it had missed BNY Mellon’s daily cutoff for instructions for Fed transfers from custodial accounts. … SVB’s then-chief executive, Greg Becker, called Robin Vince, CEO of BNY Mellon, to ask for an extension. BNY Mellon agreed to try. Over the next few hours, BNY Mellon worked with SVB and Fed officials in Washington and New York who are responsible for the securities wire and entered all of the transfers to the Fed. … The Fed needed a test trade to be run before the actual transfer could occur. That took time and the Fed didn’t extend its own daily deadline of 4 p.m. PT for collateral transfers to help SVB.

FHLB as the Lender-of-Next-to-Last Resort

FHLB Issues $304 Billion in a Week as Banks Boost Liquidity (Bloomberg)

The Federal Home Loan Bank System issued $304 billion in debt last week, according to a person familiar with the matter, who asked not to be identified discussing non-public data. That’s almost double the $165 billion that liquidity-hungry lenders tapped from the Federal Reserve.

Total outstanding advances from the FHLBs now likely exceed $1.1 trillion, according to Barclays PLC. strategist Joseph Abate. That’s likely a record, surpassing the system’s lending during the 2008 financial crisis.

At least they chose to use some term funding

The debt issued last week included notes, which mature in less than a year, and $151 billion in longer-term bonds. The bond issuance eclipsed the nearly $55 billion supplied for the entire month of February and roughly $130 billion for January.

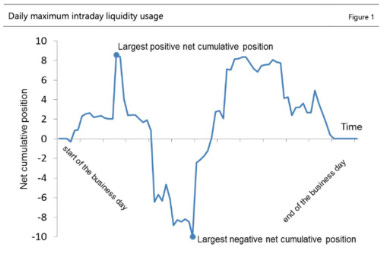

Intraday Liquidity

Banks not only have to manage their end-of-day liquidity, but there is also considerable variance in intraday liquidity as payments are made and received at different times from different markets.

Izabella Kaminska recently tweeted this chart to illustrate what she claims is a heightened intraday volatility environment (I’m not sure of her source):

All else equal, this will cause firms to hold higher cash and reserve balances.

Meyrick Chapman has an interesting post in his ExorbitantPrivilege substack titled The Liquidity Vacuum. He notes that the volatility we all observe

adds up to massive, instantaneous liquidity drain of the financial system as margin calls are made by clearing houses.

Individual firms are not the only ones exposed to intraday risk; in fact, the central clearing organizations are perhaps the most critical players that face this volatility. As providers of this liquidity, they bear intraday counterparty risk.

The emergence of central clearing, to contain systematic stress will almost certainly made things worse when a sudden stop occurs. The Fed wrecking ball has been joined by the garotte of the margin call.

The shocking moves in fixed income markets mean clearing houses will remain wary of market volatility. In fact, clearing houses are preparing to impose more margin penalties. The DTCC's subsidiary, National Securities Clearing Corporation (NSCC) announced on Tuesday that from the end of March it will be able to call for extra margin intra-day for volatility in addition to intra-day calls for mark-to-market changes.

It is worth considering if, by seeking to contain stress, the Fed’s innovations simply mask true stress.

Risk is never eliminated, only transferred and transformed into other risks

What Do Regulators Say About Volatile Liability Dependence?

This is from the Fed’s Bank Supervision Manual:

Management should look not only at deposit growth but also at the nature of the deposit structure. To invest deposited funds properly in view of anticipated or potential withdrawals, management must be able to determine what percentage of the overall deposit structure is centered in core deposits, in fluctuating or seasonal deposits, and in volatile deposits.

Examiners must analyze the present and potential effect deposit accounts have on the financial condition of the bank, particularly with regard to the quality and scope of management’s planning

Policy guidelines should employ both quantitative targets and qualitative guidelines. These measurements, limits, and guidelines may be specified in terms of the following measures and conditions, as applicable:

Volatile liability dependence and liquid-asset coverage of volatile liabilities under both normal and stress conditions. These guidelines, for example, may include amounts of potentially volatile wholesale funding to total liabilities, volatile retail (e.g., high-cost or out-of-market) deposits to total deposits, potentially volatile deposit-dependency measures, or short-term borrowings as a percent of total funding

Funding concentrations that address diversification issues, such as a large liability and dependency on borrowed funds, concentrations of single funds providers, funds providers by market segments, and types of volatile deposit or volatile wholesale funding dependency. For small community banks, funding

concentrations may be difficult to avoid. However, banks that rely on just a few primary sources should have appropriate systems in place to manage the concentrations of funding liquidity, including limit structures and reporting mechanisms

Early-warning signals may include but are not limited to—

rapid asset growth that is funded with potentially volatile liabilities;

Liquidity is rated based upon, but not limited to, an assessment of the following evaluation factor

the level of diversification of funding sources, both on- and off-balance-sheet

the degree of reliance on short-term, volatile sources of funds, including borrowings and brokered deposits, to fund longer-term assets

Refinancing Channels

Prof. Dan Nielson’s Soon Parted subtask has a post titled Plugging the leaks

To stop a panic from becoming systemic, depositors have to be convinced to stop asking for their money back. One financial mechanism that can do that is refinance—creating new financial channels to replace the channels that are failing. In this post, three refinancing mechanisms that seem to be active in the SVB panic. (the private, securities and public channels)

Oops

In Oops. How the FDIC Guaranteed the Deposits of SVB Financial Group, Adam Levitin describes how the blanket guarantee of deposits actually accrued value to SVB’s holding company.

There seems to be a gap in the Federal Deposit Insurance Act that is going to protect some investors in Silicon Valley Bank’s holding company, SVB Financial Group. The holdco’s equity in the bank will be wiped out in the FDIC receivership, but the FDIC doesn’t have any automatic claim on the holdco. This is basic structural priority/limited liability: creditors of a subsidiary have no claim on the assets of a parent.

What's worse is that the holdco, which filed for bankruptcy today, has substantial assets including around $2 billion on deposit with SVB. Almost all of that $2 billion deposit at SVB would have been uninsured, but by guarantying all the deposits, FDIC accidentally ensured that the holdco’s bondholders would be able to recover that from that full $2 billion deposit.

BTFP and FHLB advances

Nickle Keeps On Giving

Brian, why do you keep writing about the nickel market? BECAUSE IT’S FUN!

First, Zoltan Poszar started positing a new commodity-led FX regime. Then we had the LME halt trading and cancel trades to ‘stabilize’ markets and benefit a major trader, China’s Tsingshan Holding Group, and the lawsuits that have followed.

Matt Levine gives us some background on the market4:

If you are in the business of building batteries or cars, you might want to hedge your exposure to global nickel prices by trading nickel futures on an exchange like the London Metal Exchange. Or if you are a hedge fund or bank with a view on commodity prices, you might want to trade nickel futures to express that view. These futures do not, in the first instance, involve any nickel. If you buy nickel futures, it is purely a financial trade: If the price of nickel goes up between now and when the futures expire, you get paid money; if it goes down, you pay money. You buy the nickel for the batteries or cars through normal industrial channels — your nickel merchant delivers nickel in the types and quantities you need — and the point of the futures is just to have a financial hedge to your cost of buying actual nickel.

But for the futures to work they need to have some connection to actual nickel, which means that the futures are deliverable: If you own nickel futures that are about to expire, instead of cashing them out you can instead pay the money and take delivery of the nickel. … the system is that there are certain warehouses affiliated with the LME that store a certain amount of nickel on behalf of nickel futures traders, and “delivery” of nickel when a contract expires consists of changing the ownership of some of the nickel in one of the warehouses.

Now we have a new bit: some of the nickel traders thought they owned were just a bag of rocks.

After the LME was alerted about issues with some shipments, the exchange oversaw an inspection of all the nickel held at the Rotterdam facility. It found that bags of material backing nine LME contracts, equivalent to 54 tons, contained stones rather than nickel.

Trafigura Group, one of the world’s biggest metals traders, was among the companies that received bags of stones from a London Metal Exchange warehouse instead of the nickel briquettes they had paid for.5

JPMorgan Chase owned bags of material kept in a Dutch warehouse that were supposed to contain nickel but turned out to be full of stones, people familiar with the matter said.6

Minsky and Kindleberger

Minsky and Kindleberger (Mehrling)

So Minsky and Kindleberger are the Patron Saints, along with Bagehot, of the financial stability religion. Perry Merhling, who you’ll remember from our discussion of Zoltan Poszar’s work, is a scholar of their work, and there is probably no one better positioned how their work builds off their life experience.

In biographical context, we can understand the Minsky-Kindleberger connection as one of mutual support. Kindleberger, finally free to go his own way after 1976 retirement, used Minsky as a steppingstone for his own renewed scholarly agenda. And then Minsky subsequently used Kindleberger as a respectable ally for his own activist agenda of structural reform. Both men shared origins in pre-war American institutionalism, and indeed both also were New Dealers of a kind, representing respectively the anti-globalist (Minsky) and globalist (Kindleberger) wings of that movement. Even more, both shared the long ancestry of authors who identify the inherent instability of credit as a central feature of the market economy, a feature that had become invisible to the orthodoxy that dominated economic discourse after World War II.

If you have studied Minsky’s The Financial Instability Hypothesis and read Kindleberger’s Manias, Panics and Crashes, you will appreciate this paper. If not, don’t bother with this; read the source material first.

Incentives Are Powerful Things

Banking Reform

Note:

I’m taking a vacation (Egypt and Jordan) so I won’t be harassing you for a few weeks. Unless of course I do.

Graph courtesy of The Extraordinary Failures Exposed by Silicon Valley Bank's Collapse

10 days that shook the financial world, Politico

disclosure: I briefly worked for the Rechler’s predecessor firm, Reckson Assoc., when in high school

JPMorgan Had Some Fake Nickel, Bloomberg