Perspective on Risk - March 21, 2025

Asset Volatility; Regulators; OG Rogue Trader AMA; Humanity & Behavioral Economics; What I'm Reading

Higher Asset Volatility Is Not Good For A Country

Why is the USD a super-power currency. Because things in the US are predictable. We have an advanced and stable legal system, generally less business corruption, and markets that establish observable prices.

The volatility of assets in a country plays a crucial role in shaping banking stability and broader economic performance. This is through three main channels: banking sector stability, credit availability, and macroeconomic spillovers.

Higher asset volatility would require the banking sector to hold higher levels of capital and liquidity; less overall leverage.

High volatility leads to wider risk premiums. Small and medium enterprises (SMEs) and households/consumers, which rely heavily on bank financing, face higher borrowing costs or outright credit rationing, reducing investment and economic growth.

Volatile asset markets create wealth effects — if stock or real estate prices collapse, households reduce consumption due to lower perceived wealth.

Foreign investors tend to pull capital from countries with high asset volatility, causing currency depreciation, inflationary pressures, and higher sovereign borrowing costs. Governments may be forced to intervene through monetary or fiscal policy, but if mismanaged, such interventions can worsen economic instability.

Switzerland and Singapore are two countries that pay considerable attention to insuring that there is low asset volatility in their countries; Turkey and Argentina are on the other extreme.

The UK is an interesting example; Brexit clearly forced the country into a higher asset volatility regime than when they were in the EU.

The pound sterling (GBP) experienced its largest one-day drop in history following the 2016 referendum, falling over 10% against the USD. The currency's beta (a measure of volatility) increased significantly relative to pre-referendum periods.

Domestically-focused companies (particularly in financial services, real estate, and retail) experienced much higher share price volatility,

London commercial real estate values experienced their most volatile period since the 2008 financial crisis, and residential property transaction volumes declined amid uncertainty, creating liquidity-driven price volatility,

UK bank shares experienced roughly twice the volatility of their European counterparts during 2016-2020

Perhaps most significantly, Brexit created persistent policy uncertainty that affected investment and capital allocation. The Bank of England's policy became more difficult to predict, with interest rate expectations showing higher volatility and fiscal policy uncertainty increased risk premiums across asset classes.

Unlike acute financial crises that eventually stabilize, Brexit created prolonged uncertainty that maintained elevated volatility levels across multiple years.

This case demonstrates how even advanced economies with strong institutions can experience significant asset volatility when undergoing fundamental economic regime changes.

I suspect (fear) we are in (or approaching) a similar situation now in the USA. While the VIX has risen, it certainly has not exhibited concern yet. VIX tends to imbed about a 4% spread to observed volatility over the subsequent period.1

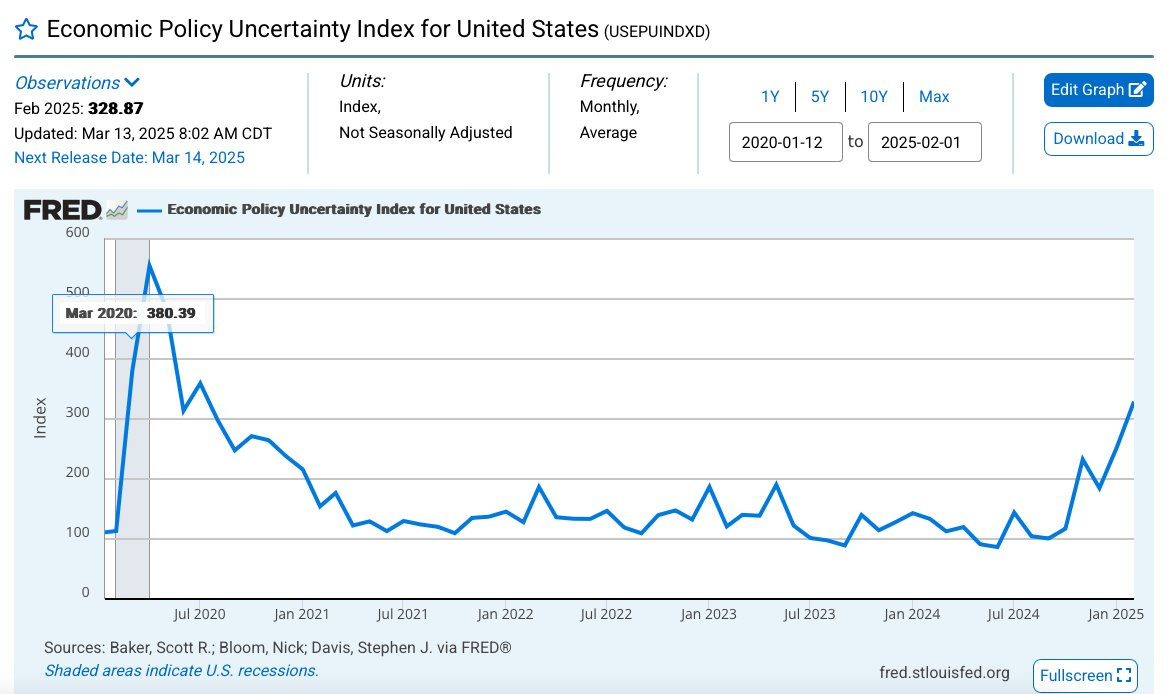

A measure of economic policy uncertainty based on newspaper articles is showing more risk aversion.2 But this isn’t really predictive.3

Regulators

Mount up.

An Economic Capital Approach to Liquidity Risk

A very interesting paper by two of my former FRBNY colleagues, Bev Hirtle and Matthew Plosser with the easily overlooked title Bank Economic Capital. It is more than it’s title suggests.

Using public regulatory data, we develop a novel measure, economic capital, that jointly quantifies the impact of credit, liquidity, and market risk on bank solvency

Perhaps in simple terms, it addresses the run-risk of uninsured deposits by assuming that they all immediately reprice to the risk-free rate. It has a strong theoretical and empirical foundation. I’ll quibble with some of the assumptions in a bit, but let’s talk about the methodology and strengths first.

They calculate a stressed version of economic capital that they call R-EC (Run-Economic Capital). R-EC is used as the “binding” solvency constraint in a stress event. R-EC simulates a scenario where uninsured depositors withdraw their funds immediately, forcing the bank to replace them with higher-cost funding. The core idea is that if a bank is poorly capitalized under R-EC, it is more vulnerable to depositor runs.

The paper shows that EC is a strong predictor of failure and explains more variation than traditional measures. Banks with low EC failed earlier/more often than those with high EC.

One area that would be controversial is the calculation of idiosyncratic firm-specific liquidity betas. The deposit modeling in this paper is quite sophisticated—it accounts for time-varying betas, historical rate cycles, and depositor behavior. The authors use long-horizon betas estimated from past tightening cycles, conditional modeling on deposit growth, bank characteristics, and rate environments, and a standard drawdown rate assumption (5% per annum). These are not static and allow for cross-sectional variation (which will be the controversial part). This approach is at least time-consistent for normal conditions. Their liquidity calculations appear to be well-supported, and I should emphasize this would be a huge step forward in the supervisory approach to liquidity modeling.

Ok, now for the quibbles.

One major assumption we tend to make is that there is causality between economic capital and failure. Sure it is a predictor and intuitive, but we should always remember that this is an assumption. The paper doesn’t explicitly state causality, but rather that their EC measure is a superior predictor of failure.

Repricing uninsured liabilities to the prevailing risk-free rate seems generous. It doesn’t add a credit spread, or use some sort of "‘penalty rate’ such as repricing to the Discount Window rate. This would be more consistent with real world failure behavior.

While it mentions off-balance sheet commitments like credit lines, it doesn’t fully incorporate them. This could underestimate liquidity risks for some banks. I’m thinking of the liquidity puts during the GFC.

Karen Petrou seems to like the paper as well. She uses is to lay the ground to argue for lower Solvency Capital Buffers for the largest banks. A New, Unified Theory of Effective Bank Regulation (Petrou)

The current bank regulatory paradigm creaks of complexity and too many requirements built to address too many anachronistic markets and often-inexplicable models. It’s time for something simple, clear, credible, and accountable.

Although liquidity and capital are inexorably linked when it comes to preserving bank solvency, the need to comply with two contradictory standards forces banks to change their business model to meet both ends in the middle at considerable cost to profitability and long-term franchise value.

[A] FRB-NY paper … crafts an economic-capital construct … which can then be tested under various stress scenarios that start with illiquidity and end in insolvency and vice versa. This leads to a robust measure of survivability that combines the impact of credit risk, liquidity, and the real-world market conditions current rules ignore. In essence, economic capital is derived from the hard-nosed, real-time factors that wise investors and counterparties use to determine market capitalization and the cost at which banks gather funds. This is clearly preferable to the backward-looking, book-value way each bank regulatory requirement comes up with a different measure of resilience …

The economic-capital approach has … value as a way to make sense of the stress capital buffer (SCB) … [that has] proved a burdensome, problematic, capital standard. And, as with the basic capital rules, the SCB takes no account of liquidity risk even though stress often starts there, not in the “fortress” capital the Fed also admits banks have even without resorting to the SCB.

U.S. Regulatory Reform

Will Bessent Do It Better? (Petrou)

Karen is spot on. De-facto coordination if not de-jure consolidation.

There are two ways to consolidate federal bank regulation. First, you can change the law and, as detailed in my memo a few weeks back, transform agency responsibilities to reduce duplication and regulatory arbitrage. The other way is for one federal entity to assert all the power it has under law and maybe more simply to take de facto charge of significant Fed, OCC, and FDIC supervisory and regulatory policy. … the Trump Administration will open Door Number Two, setting key policy goals and “coordinating” among the agencies.

Secretary Bessent said he will also use the FSOC and President’s Working Group to corral bank regulators. Odds on that he’ll focus not only on the banking agencies, but also on the SEC and CFTC.

… the President has claimed via executive order that there are no more independent agencies exempt from Executive Branch control. This covers the OCC and FDIC, which were in any case sure to do what was asked of them in this Administration, but it also covers Fed supervisory and regulatory responsibilities.

What would Treasury-led banking standards look like?

… new merger policies from the OCC, FDIC, and – at long last – the Fed will include shorter timeframes, better quantitative and qualitative decision criteria, and a lot less of the community-group consideration …

… the SLR revised to exclude central-bank deposits and short-term Treasuries

Treasury at the helm will not mean no regulation; it will in fact mean a lot of regulation, but new rules will also be a lot different than those the Biden Administration talked up, proposed, and occasionally even implemented.

U.K. Regulatory Reform

UK financial regulators in retreat as prime minister piles on pressure (FT)

The race to the bottom continues.

Britain’s financial regulators are in retreat. Only hours after Prime Minister Sir Keir Starmer announced plans to abolish one of the country’s financial regulators, the City of London’s main watchdogs announced they were ditching or delaying several of their most controversial proposals.

BIS Focuses on Synthetic Risk Transfers

US NAIC Focuses on Risk-Based Capital

NAIC Establishes the Risk-Based Capital Model Governance (EX) Task Force in 2025

Capital modeling for insurance is very different from capital modeling in banking. Where the focus in banking is trending towards readily observable liquidation values (through EC modeling), the focus in insurance is on the ability of insurers to meet their long-horizon obligations.

Where failed banks are resolved ‘over the weekend’ through assisted sale or liquidation, insurance firms are resolved through a prolonged receivership where the regulators manage the business through a runoff.

In many ways, one needs to go back to ‘first principles’ in thinking through a capital regime.

Add to this that IMO the regulatory capital regime is more captured by the firms in insurance than it is in banking. Many firms have tailored their business models around the existing NAIC rules, a subtle thing close to regulatory arbitrage.

Anyway, the NAIC has begun an effort to review its capital rules, the key goals of which is to

Complete a comprehensive gap analysis and consistency assessment to identify and inventory gaps that exist and establish a plan for addressing identified gaps and potential inconsistencies that improve the framework.

OCC Eliminates Reputational Risk From Handbook

OCC Ceases Examinations for Reputation Risk

Somebody in the know tell me, were their actually targeted exams focused solely on reputational risk? I can’t believe there were many, if any. As I’ve said before, looking at BSA/AML, money transfer providers and crypto controls are certainly fair game for exams.

I suspect this is mostly for show. The more things change the more they stay the same. Hit me up if I’m wrong here.

The removal of references to reputation risk from OCC handbooks and guidance issuances does not alter the OCC’s expectation that banks remain diligent and adhere to prudent risk management practices across all other risk areas.

The OG Rogue Trader

Nick Leeson singlehandedly brought down the venerable Barings. The Report of the Board of Banking Supervision inquiry into the circumstances of the collapse of Barings is perhaps my favorite ‘lessons learned’ document. You can get so much out of reading it, and all of your junior risk managers should be required to thoroughly understand it.

Mr, Leeson served four years in a Singapore prison for his indiscretions.

Anyway, now, years later, he has held an AMA on Reddit.

There’s not anything new here, but it is an accessible way into his story. There was no real oversight of his trading positions, and he was allowed to trade and handle the settling of his trades. In addition, being in Singapore he was far away from head office oversight. Finally, as with most rogue traders, he admits that he never had a risk mindset, emphasizing that his actions were about hiding losses, not making reckless bets.

Humanity

Behavioral Economics and Assisted Suicide

The Last Decision by the World’s Leading Thinker on Decisions (WSJ)

A fascinating article on the decision by Danny Kahneman to end his own life via assisted suicide while still in relatively good health. The article relates his decision to identified aspects of behavioral economics: loss aversion and hedonistic calculus, the “peak end” rule, avoiding sunk costs, anchoring, the inside view vs outside view, and finally rational vs emotional decision-making.

If you knew or met Danny I think it’s a must-read. If you have an interest in behavioral economics, it is a useful illustration.

Have Humans Passed Peak Brain Power

Maybe it’s good the computers are poised to take over.

Have humans passed peak brain power? (FT)

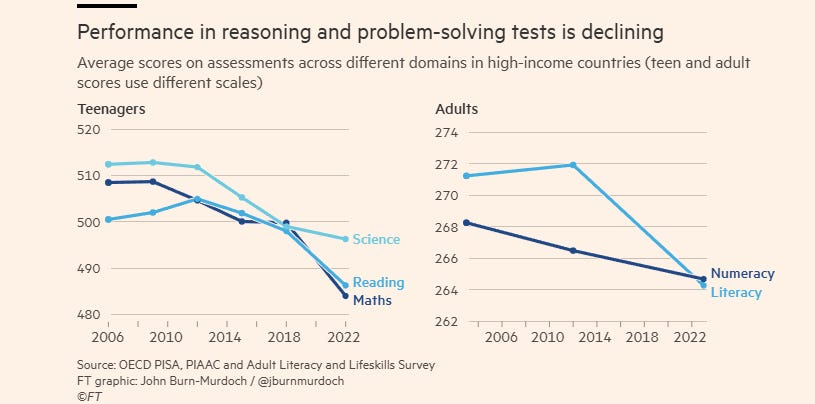

… across a range of tests, the average person’s ability to reason and solve novel problems appears to have peaked in the early 2010s and has been declining ever since.

In one particularly eye-opening statistic, the share of adults who are unable to “use mathematical reasoning when reviewing and evaluating the validity of statements” has climbed to 25 per cent on average in high-income countries, and 35 per cent in the US.

… we appear to be looking less at the decline of reading per se, and more at a broader erosion in human capacity for mental focus and application.

What I’m Reading

There’s a new book out by Duncan Maven. Meltdown: Greed, Scandal, and the Collapse of Credit Suisse . It’s a well-done history of the firm and an easy read. Many of my favorite players: Rainer Gut, Alan Wheat, Lucas Muhlemann, Andy Stone, Frank Quatronne, John Mack, Brady Dugan, Ossy Grubel, Colm Kelleher, the Flaming Ferraris, and many more.

How Well Does the Market Predict Volatility? (CFA Institute)

The average S&P 500 Index realized volatility on a 30-day forward basis was 15.50% over the 35-year period. The average VIX (30-day forward estimate) was 19.59% over the same period. There is a 4.09% spread between the two measures.

Regressing the Economic Policy Uncertainty (EPU) index against VIX shows a moderate positive correlation (0.48). There is limited forward predictive power and, in fact, the VIX tends to be slightly predictive of the EPU rather than the other way around.