Perspective on Risk - March 19, 2023 (more more more)

Pause, 25bp or 50bp?; UBS; Why Did The Fed Ignore Ordinary Liquidation Authority? No Firesale Externality; I Keep Coming Back to Commercial Real Estate; SVB; Real Interest Rates

I Have No Idea If It’s A Pause, 25bp or 50bp

I keep getting asked this question and I have no idea. But in general financial crisis’s are presumed to be deflationary. These guys know more than me, but they’re all over the place.

Pause

If Apollo is to be believed, perhaps the Fed should cut instead.

Don’t Pause

Niall Ferguson has a nice historical writeup in Bloomberg on the historical precedents when financial crises occur when the Fed is fighting inflation. History of Banking Crises Holds a Warning for Jay Powell. He writes:

Responding to bank failures in 1972 and 1984, the Federal Reserve pursued two very different paths, with very different consequences for inflation.

In 1984 regulators had to rescue of Continental Illinois, which at the time was the largest bank failure in US history.

Volcker was concerned that the troubles of Continental Illinois would spread to other institutions — including those with exposures to the then-intensifying Latin American debt crisis — if it was not rescued.

And while FOMC transcripts indicated that “we’ve run out of room for the time being for any tightening” the Fed nevertheless continued to raise rates after the Continental Illinois rescue when inflation was around 3.5%.

Back in the 1970s, the regulators saved Commonwealth Bank. As Ferguson writes:

regulators said they were “concerned with public confidence in the nation’s banking system if a billion‐dollar bank were to close,” even although Commonwealth was only the 50th-largest bank in the country and the fourth largest in Detroit. Bending the rules of that time, the FDIC ruled that Commonwealth was “essential” (the 1970s word for “systemic”)

The Burns Fed chose to hold rates steady at that time for the next few years.

Ferguson concludes:

If, like Arthur Burns more than 50 years ago, Powell combines the alleviation of financial distress with a premature pause in monetary tightening, he risks repeating one of the key mistakes of the Fed in the Seventies.

So don’t ask me what’s going to happen, I was just a lowly bank examiner. This decision is above my pay grade. This is also why I hoped that the regulators would hold off on pushing the ‘systemic risk exception’ button.

UBS

Swiss were always going to support their banking system. Shotgun marriage if ever there was one.

Please don’t sell the CDS

Maybe UBS really doesn’t want the deal, having inserted this easily manipulated clause.

UBS also insisted to have a material adverse change clause that voids the deal, if its credit default swaps spreads jump by 100 basis points or more.1

Why Did The Fed Ignore Ordinary Liquidation Authority?

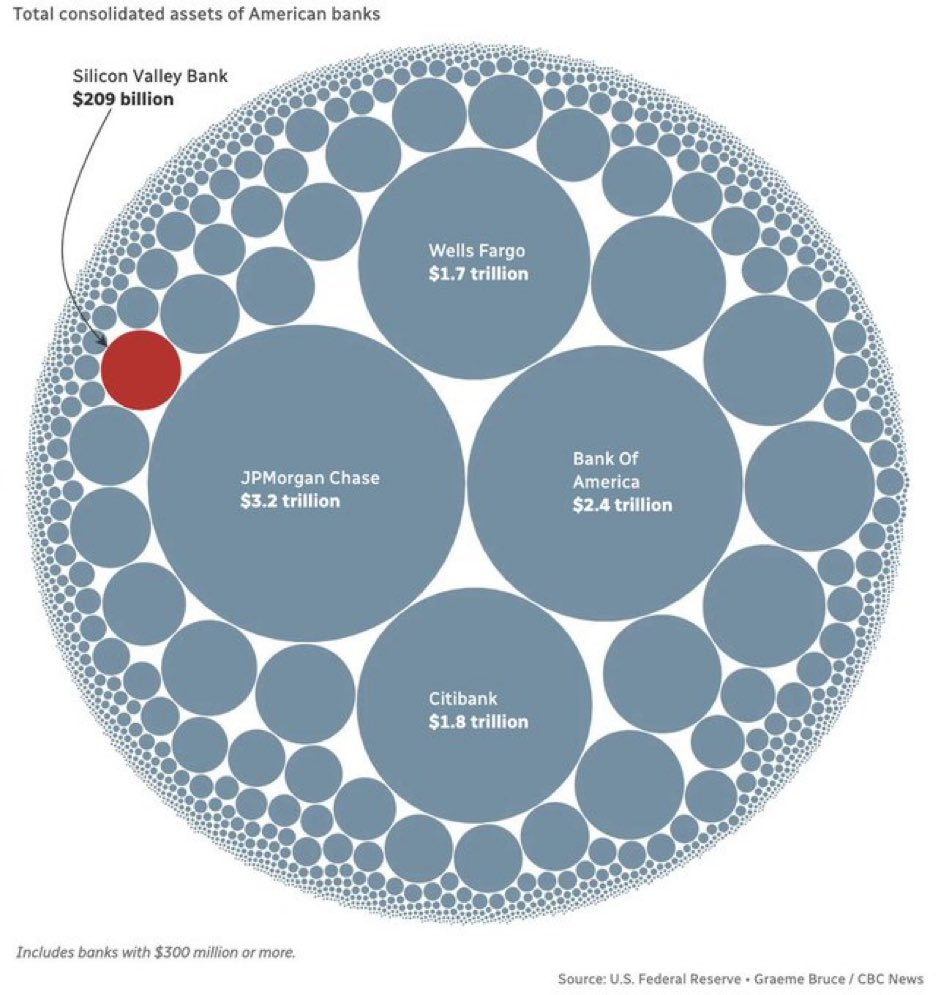

I keep coming back to the question of why the Fed panicked. Neither SVB nor Signature were systemically important. They were also quite different from each other, so there wasn’t a common driver other than bad management and rising rates.

Was the concern Credit Suisse (doubt it), firesale externality (doubt it too) or something else?

Paul Kupiac, former Fed Board economist, asks the same question in Why did regulators ignore Dodd-Frank and orderly liquidation for failed banks? (The Hill)

Banks and Congress should be asking why the administration’s financial regulators did not use Orderly Liquidation Authority (OLA).

The odd thing about this rescue is that the Dodd-Frank Act prescribed an entirely different method for resolving a failing systemically important bank without using taxpayer funds. The Dodd-Frank solution is to protect the failing bank’s depositors by taking over the failing bank’s parent holding company using a special resolution power called OLA.

OLA permits the FDIC to seize the resources of the failing bank’s parent holding company and use them to support the failing bank’s operations. OLA empowers the FDIC to keep the failing bank open and operating without any depositor losses and ideally without the use of any deposit insurance funds.

The administration should explain to Congress why a blanket FDIC insurance guarantee that mitigated losses for SVB Capital shareholders and bondholders was the cheapest resolution approach for the FDIC deposit insurance fund even though it will impose new insurance costs on banks and ultimately on their depositors. There needs to be a mechanism to hold an administration’s financial regulators accountable for actions they take when they invoke an emergency systemic risk exception.

David Henderson also questions the need to use the systemic risk designation, and cites some of the problems this has caused in Why Bailing Out SVB Is A Bad Idea (Hoover).

Imagine what would have happened if the federal government had stuck to the rules. Yes, there would have been pain. Yes, several Silicon Valley companies would have had trouble meeting their payrolls. But the reason that SVB was not counted as a “too big to fail” bank was that the federal government had judged that there would not be a system-wide run on banks if SVB’s depositors had taken a large haircut. The impact would almost certainly have been regional, not national. In short, “contagion” likely would have been limited. Then banks, depositors, and others would have thought much harder in the future about what to invest in.

He adds

Yellen et al. have added to the regime uncertainty.

Economic historian Robert Higgs introduced the concept of “regime uncertainty.” What he meant by that phrase is an economic system in which people aren’t sure of the rules, mainly because the rules keep changing and in unpredictable ways.

He then goes on to try and make political points that I will ignore, as the core of his argument stands on its own.

No Firesale Externality

I mentioned above the risk of a firesale. In the financial stability literature this is referred to as a firesale externality. Brunnermeier and Pederson wrote the paper that popularized the term: Market Liquidity and Funding Liquidity. Since the GFC of 2008, this has been the big bugaboo.

Based on the facts as we know them, I doubt there would have been a firesale this time around. The SVB portfolio totaled $60 billion. Once the FDIC closed the bank, they would no longer be a ‘forced seller’ and have every incentive to maximize their return.

In addition, the Fed’s quantitative tightening program is reducing the Fed’s balance sheet by $95 billion per month, split as $60 billion of Treasuries and $35 billion of MBS. If the Fed was worried about markets, they could have just paused their program.

I Keep Coming Back to Commercial Real Estate

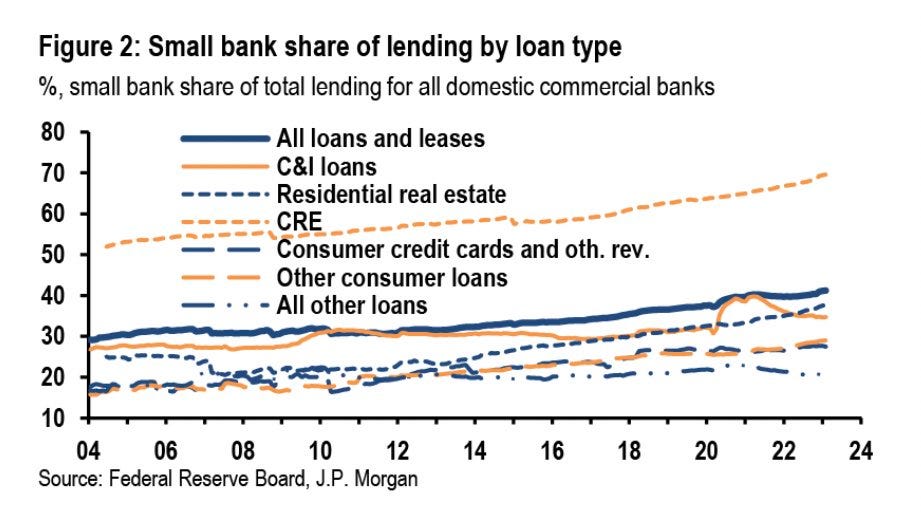

I’m over-thinking this, and maybe giving the Fed policymakers more credit than I should, but if the systemic risk is not Credit Suisse, is it CRE? I have thought for a while (and written) that my fear is that we were going to have a late 1980s style CRE recession, where cap rates rise and capital structures on existing buildings need to be restruck at loan maturity. The WFH trend exacerbates the situation in major city office space. CRE lending of late has moved from larger to smaller banks.

Signature Bank is a big multi-family lender in the NYC market. From Signature Bank’s real estate loans under scrutiny

Signature was one of the largest lenders to rent-stabilized buildings, which have seen their values drop since New York state lawmakers passed reforms in 2019 limiting rent increases. The legislation drastically reduced the amount of money that lenders could make from these loans — and increased the risk of delinquency.

“Loans that were taken out through the end of 2018 were at peak valuations. Values are down 25 to 55 percent since then,” said Michael Weiser, president of GFI Realty Services

Signature was the third largest commercial real estate lender in New York City. About 46 percent of its commercial real estate loans went to rent-stabilized multifamily, according to data analysis by Maverick Real Estate Partners.

The market is waking up to the fact that mid-sized banks have become larger lenders to the real estate sector. According to Goldman and JP Morgan:

Banks with less than $250bn in assets account for … 60% of residential real estate lending, [and] 80% of commercial real estate lending

In recent months, close to 70% of [commercial real estate] loans were held at smaller banks .. we think it will be important to monitor related activity moving forward. Will CRE lending .. be curtailed significantly or will it shift from smaller banks to larger banks?

SVB Risk Management

These things always come out after the fact.

Risk Management

Compliance

Regulators

I hate that this leaked. The Fed is becoming no better that the other sieves.

The Fed Was Too Late on SVB Even Though It Saw Problem After Problem (Bloomberg)

Just over a year before Silicon Valley Bank’s collapse threatened a generation of technology startups and their backers, the Federal Reserve Bank of San Francisco appointed a more senior team of examiners to assess the firm. They started calling out problem after problem.

As the upgraded crew took over, it fired off a series of formal warnings to the bank’s leaders, pressing them to fix serious weaknesses in operations and technology, according to people with knowledge of the matter.

Then late last year they flagged a critical problem: The bank needed to improve how it tracked interest-rate risks, one of the people said, an issue at the heart of its abrupt downfall this month.

This is just CYA.

Excellent post. I concluded they will hike this week 0.25. Can give you a gift subscription to see behind the paywall if you like. https://open.substack.com/pub/measuringpolicyvolatility/p/macrovs1-yes-they-will-raise-rates?r=1yz4l6&utm_campaign=post&utm_medium=web Am less mystified by the SVB and Signature Bank interventions. I agree with Barney Frank that the Fed is at war with crypto and they were laying the foundation to launch FedNOW. My guess is that the policy team focused on the crypto issues and they failed to talk with the Sup & Reg team so they were blindsided when SVB started liquidating HQLA.

The stunning thing about the new bank support structure is that the Treasuries will be accepted as collateral at par. The even more stunning thing was to see the Fed actually saying in writing that they were asking banks not to sell their Treasuries. This tells me there's a big HQLA problem which goes well past SVB....particularly since the new lifeline was already at 50% capacity after just a few days.