Perspective on Risk - July 4, 2023

Swoosh; WTF Is Going On At The Fed? Recession or not? Bank Capital; The Transmission of Risk; CRE Guidance; Big Picture Anecdotes; It’s Hard To Displace The Dollar; Miami's So Crowded; More Substacks

Happy 4th everyone.

The Original Swoosh

Here is a good article by Aaron Brown that explains why integrating Markowitz’s ‘modern portfolio theory’ with the ‘efficient market hypothesis’ was so crucial: Harry Markowitz Was a Misunderstood Economist

WTF Is Going On At The Fed?

It was bad enough when Barr basically blamed Quarles for laxity.

Now Bowman is taking further shots at Barr. Responsive and Responsible Bank Regulation and Supervision. Sounds like the Fed Board is in disfunction.

Much of this work was prepared internally, by Federal Reserve supervision staff, relying on a limited number of unattributed source interviews, and completed on an expedited timeframe with a limited scope. Although the report was published as a report of the Board of Governors, it was the product of one Board Member, and was not reviewed by the other members of the Board prior to its publication. Troublingly, other Board members were afforded no ability to contribute to the report's content. There is a genuine question whether these efforts provide a sufficient accounting of what occurred. A supplemental, independent review would help overcome the limitations of scope and timing of these initial efforts, and address concerns about the impartiality and independence of the reviews.

In part, she’s using this argument to slow the role towards higher capital requirements. The rest of the speech is pretty good, but nothing we haven’t discussed in the past.

Recession or not?

We Are In The Recession Zone

According to Estrella: We've had 7 months of inversion of 10y-3m. It takes time for the recession to start. Historically, it's 6-17 months after the first inversion.

The Central Bankers Are Telling You Rates Will Continue To Rise

Top Central Bankers Expect More Rate Increases Amid Stubborn Inflation

Although policy is restrictive, it may not be restrictive enough, and it has not been restrictive for long enough,” Jerome H. Powell, chair of the Federal Reserve, said.

…

“The only thing we decided was not to raise rates at the June meeting,” Mr. Powell said. “I wouldn’t take moving at consecutive meetings off the table at all.”

Student Loan Repayment Resumes in October

From the Office of Personnel Management: Student Loan Repayment

After three years, the pandemic-era freeze on federal student loan payments will end in October.

In this post, we provide a new update showing:

More than one-in-thirteen student loan borrowers are currently behind on their other payment obligations. These delinquencies are higher than they were before the pandemic, despite a small seasonal decrease in the most recent data.

About one-in-five student loan borrowers have risk factors that suggest they could struggle when scheduled payments resume.

Median scheduled payments on other debt obligations have increased by 24 percent for student loan borrowers likely returning to repayment. In percentage terms, these increases are especially large for younger borrowers (252 percent, or $65 to $229).

More than four-in-ten borrowers in our sample will return to repayment with a new student loan servicer.

The looming US student loan repayment shock in charts (FT)

Credit Will Tighten

In general, aggregate C&I loan growth lags changes in the net tightening % in the Fed’s Senior Loan Officer Opinion Survey (SLOOS). Here, the bottom graph normalizes the SLOOS data, and the top graph shows the % change in aggregate C&I balances. You will see from the arrows that the normalized net tightening begins several quarters before the effect is seen in loan balances. In fact, interestingly, peak tightness generally corresponded with the turn from growth to shrinkage in balances.

Employment Downturns Lag YC Inversion

Bank Capital

Big Banks Pass The (DFAST) Stress Test

Duh. And does it matter if the supervisory metric is flawed (doesn’t include unrealized losses on HTM portfolios or charge for interest rate risk, and allows the banks to benefit from the presumption of falling rates)? Fed press release; results

Since nobody cares about these stress tests anymore, how about dropping the mandate? They are not providing useful information and are a burden.

Love This Take From Matt Levine

A general feature of the Fed’s stress tests is that, when the Fed serves up a “severely adverse” stress scenario to the banks, the banks go off and model the effect it would have on their business, and if they come back to the Fed and say “actually this would be good for us,” the Fed gets mad at them. You’re not supposed to say that! Goldman Sachs Group notably did this in 2020, arguing that its trading business was countercyclical, and that in a stressful scenario it would simply make a ton of money trading derivatives; the Fed was not amused. But sometimes it is true! Some hypothetical scenarios would be very bad for the big banks, other hypothetical scenarios would be good for the big banks, and it’s perfectly plausible that some scenarios would be bad — for the world, for the economy, for the banking system — while also being good for the big banks.1

Perhaps They’ll Listen To Larry Summers

More turbulence likely ahead after bank collapses (Harvard Gazette)

It would not have happened if bank regulations were better directed at reflecting market values rather than purchase prices of assets held by banks.

The Transmission of Risk

Interesting paper from Fed Board staff: The Transmission of Global Risk. The paper does three things:

It shows that the Gilchrist and Zakrajsek (2012) excess bond premium (EBP) leads some other measures of financial stress in a statistically significant way,

It shows that changes in global risk sentiment, as measured by the excess bond premium (EBP) on US corporate bonds, have significant correlations to subsequent world inflation GDP over the year following the shock.

The paper also proposes a mechanism based on the differentiated demand for safe assets to explain how global risk shocks affect macroeconomic variables across countries.

The paper shows that a 1.5 percentage point increase in the EBP can reduce world inflation by 1% and world GDP by 2% over the year following the shock.

Economists, stress test validators and modelers will be interested in the paper

Commercial Real Estate Guidance

Another joint release by the bank regulators, this time on Prudent Commercial Real Estate Loan Accommodations and Workouts. As is typical, the new guidance is a bit more rigorous and proscriptive. My first reading would be that the language is a bit more neutral on the whole when compared to the 2009 language. The press tend to agree with headlines like US regulators ask lenders to work with stressed commercial real estate firms

Portfolio Stress Testing

Reiterated the importance of portfolio-level stress testing or sensitivity analyses, especially for CRE concentrations, and provided more specific guidance on the scope, frequency, assumptions, and reporting of such tests or analyses.

Market Analysis

Expanded the scope of market analysis to include not only the lending areas, but also the relevant regional and national markets, as well as the potential effects of the pandemic and other factors on CRE market segments and property types.

Underwriting Standards

Emphasized the need for sound underwriting standards that reflect the current and expected market conditions, the borrowers’ capacity and willingness to repay, the adequacy of the collateral, and the level of risk appetite and risk tolerance of the financial institution.

Appraisal and Evaluation Programs

Updated the appraisal and evaluation guidance to reflect the issuance of the interagency statement on appraisals and evaluations for real estate related financial transactions affected by the coronavirus in 2020, which allowed temporary deferrals of appraisals and evaluations for certain eligible transactions.

Loan Review Systems

Affirmed the recommendation for loan review systems, and added that such systems should also provide for regular validation of risk ratings, assessment of risk management practices, evaluation of workout strategies, and identification of emerging risks and trends.

Internal Controls

Reinforced the importance of internal controls, and highlighted the role of internal audit in independently testing and monitoring the effectiveness of the risk management framework, including the areas of portfolio stress testing, market analysis, underwriting standards, appraisal and evaluation programs, loan review systems, and loan modifications or workouts.

Big Picture Anecdotes

Chip Wars

China Restricts Export of Chipmaking Metals in Clash With US (Bloomberg)

Beijing will limit gallium and germanium exports from Aug. 1. Both metals are indispensable for producing some chips

The War For India

What Did Prime Minister Modi’s State Visit Achieve? (CFR)

For India, the honors bestowed on Modi—a man who just a few years ago was denied entry to the United States for his role in the 2002 communal riots in Gujarat—showed to the world that far from being a pariah, he is now the powerful and accepted leader of a valued partner country.

The United States too made symbolic and material gains. In terms of symbolic wins, the United States was able to showcase its close partnership with India—a country that also shares its deep anxiety about the specter of a rising China—and highlight the exchange of effusive warm statements between President Biden and Prime Minister Modi a mere two days after the former labelled President of China Xi Jinping a “dictator.”

Perhaps most importantly, both countries scored wins in their defense and strategic partnership.

It’s Hard To Displace The Dollar

Argentina Pays The IMF (in Part) With Yuan

UPDATE 3-Argentina, short of dollars, to use yuan in $2.7 bln IMF payment (Reuters)

Argentina, battling an acute scarcity of dollars, will pay part of $2.7 billion due to the International Monetary Fund (IMF) this week with Chinese yuan, a government spokesperson confirmed on Thursday.

One of the sources said the plan would deplete the country’s $1.6 billion in SDRs while tapping a $1.1 billion equivalent of yuan “without touching dollar reserves.”

The Drew On Their BiLateral Line, And Then Reupped

Argentina doubles China currency swap access to $10 bln (Reuters)

The bank said that the two countries had agreed to renew the total 130 billion yuan ($18.4 billion) swap line for three more years, and eventually double the freely accessible part of the swap from 35 billion yuan to 70 billion yuan ($9.9 billion).

But What Would The IMF Do With The Yuan?

Sell Them Back To The PBOC, of Course

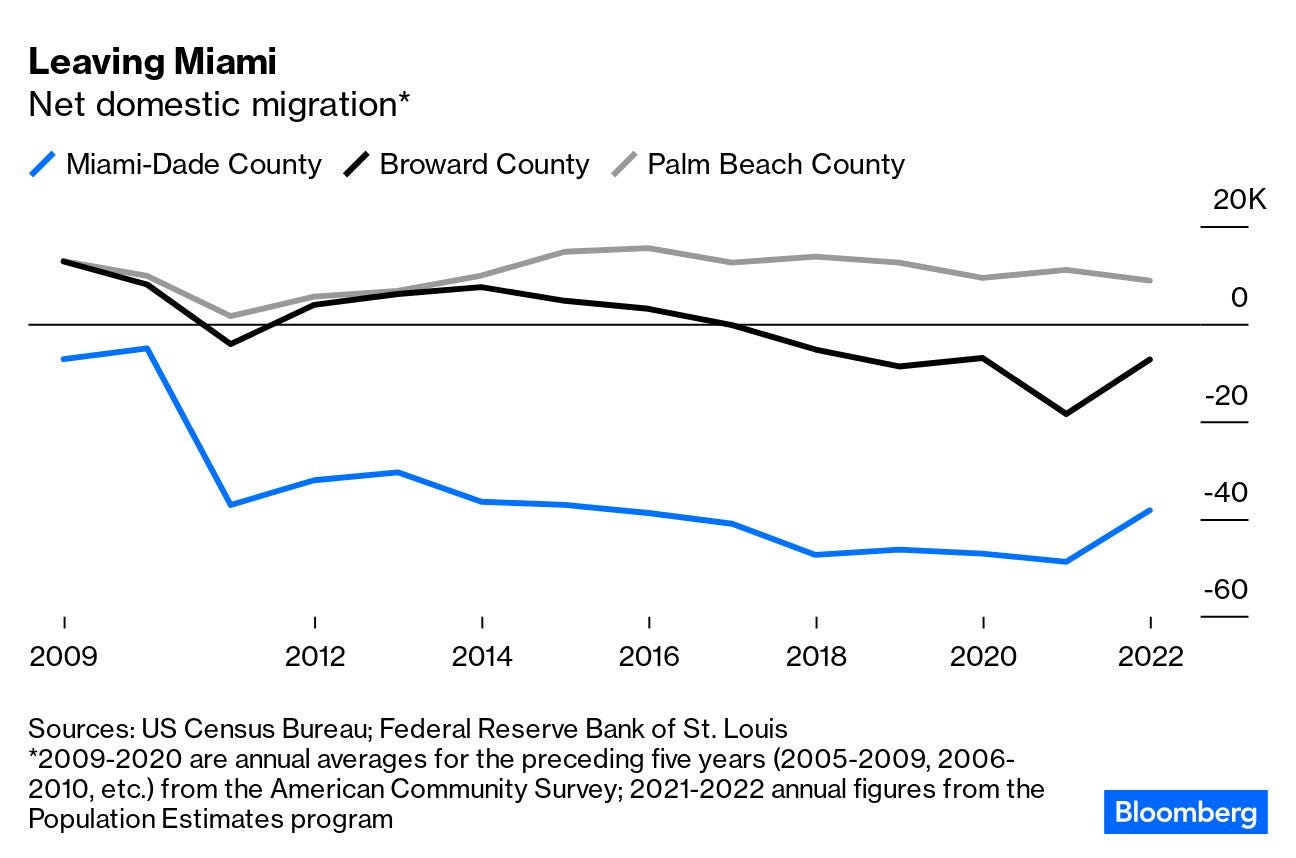

Miami’s So Crowded, Nobody Wants To Live There Anymore

Some Other Supervisory Substacks

Supervisory Guidance & Selective Amnesia (UponFurtherAnalysis)

Most attribute recent bank failures, at least in part, to a lack of quick and effective actions by bank supervisors. How much of the blame lies with Congress, senior regulators, or the banking industry lobby is more open to dispute. Attempts to absolve the latter groups rely on some selective amnesia. Actions that bank regulators took to clarify and deemphasize the role of supervisory guidance provide a good case in point.

Anatomy of a Regulation - Case Study (Risk Musings)

This week’s essay will compare a single regulation against my list of principles for effective regulation of emerging technology.

Levine, The Big Banks Aren’t Stressed, Bloomberg