Perspective on Risk - July 24, 2024

Time To Go Long Stress? Insurance; Private Credit; A Diversion Into Crypto; More Stuff

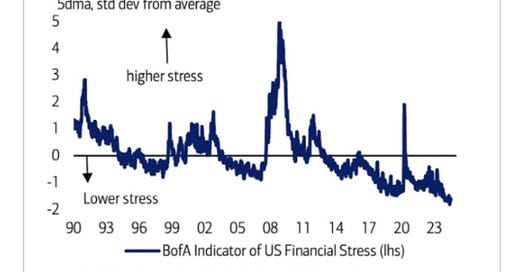

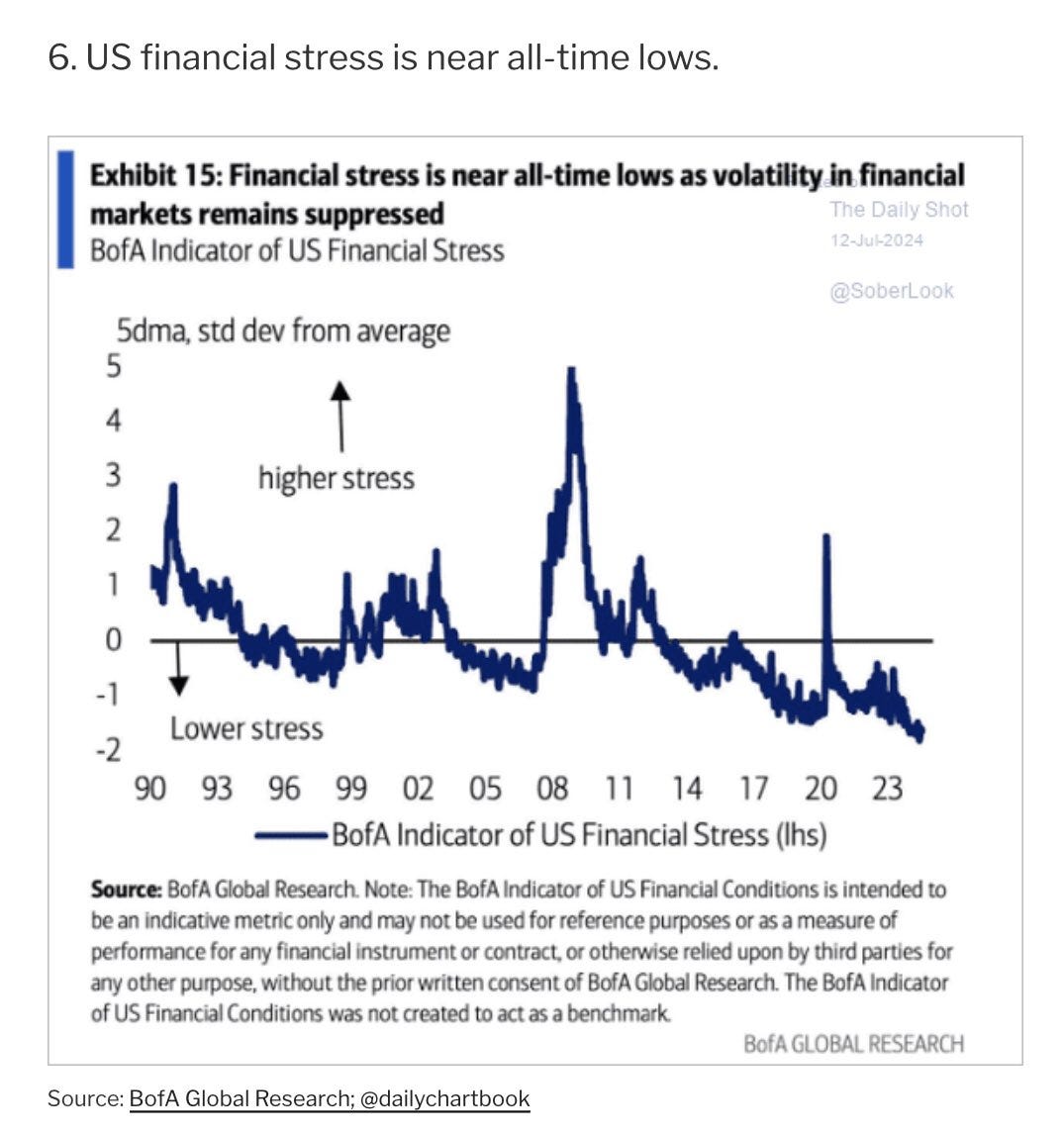

Time To Go Long Financial Stress?

Insurance

Bank of England scrutinises risk transfers in insurance sector (Reuters)

The Bank of England (BoE) said on Tuesday it would increase scrutiny of risks such as bulk purchase annuities, or insurers taking over company defined benefit pension schemes

It’s important to understand that insurance isn’t protection against hazards like flooding, wind, fire, or hail. It’s a financial contract to reimburse property owners for the cost of repairing structures only after events that are predictably rare. If hazards stop being rare, stop being predictable, and/or produce damages that aren’t easily reparable (or suggest that a building should not be rebuilt in that location), the existing market structures for both property insurance and property more broadly won’t work.

Today’s insurance markets are full of quirks that derive from assumed stability:

Virtually all property insurance is annual. There is no term structure.

After a claim, the insured is expected to rebuild the same building in the same place.

Insurance is only available for damages to a structure, not to the value of the land.

Regulators often insist on the use of backward-looking data, prohibiting the use of climate models and climate-aware catastrophe models.

Regulators also regularly limit the amount by which insurance rates can rise year-to-year.

Climate change undermines all of these assumptions.

Beryl’s Effect

The Fund Managers Modeling Catastrophe Keep Winning Bets (Bloomberg)

Last month, amid reports that Hurricane Beryl would become the earliest Category 5 hurricane in history, a group of money managers were busy trying to figure out whether their highly calibrated bets centered on natural catastrophes were about to take a major hit.

… despite the entire Caribbean island [of Jamaica] being declared a disaster area after Beryl hit, cat bond investors won’t be called on to cover any costs. That’s because “the air pressure required for a payout of the cat bond wasn’t reached,” according to an advisory sent to investors by Plenum Investments.

Beryl also didn’t trigger cat bonds for named storms in Mexico or Texas.

TWIA Posts 2024 Rate Adequacy Analysis

TWIA’s 2024 Rate Adequacy Analysis indicates that TWIA’s current rates are inadequate by 38 percent for residential coverage and 45 percent for commercial coverage. … The 2024 Analysis shows that TWIA’s rates are less adequate than a year ago. This can be attributed to an increase in the Association’s policy count, inflation in the cost of labor and materials for construction, and the need for more reinsurance coverage.

TWIA Committee Advises 10% Rate Hike; Actuary Says Beryl Could Cut Its $450M Cat Reserve by Half

Category 1 Hurricane Beryl could cost the Texas Windstorm Insurance Association about half of its more than $450 million Catastrophe Reserve Trust Fund, according to Chief Actuary Jim Murphy. . . .

Hurricane Beryl could cost TWIA half of its catastrophe reserve

Category 1 Hurricane Beryl may cost the Texas Windstorm Insurance Association (TWIA) about half of its over $450 million Catastrophe Reserve Trust Fund, according to chief actuary Jim Murphy.

According to a report by AM Best, the committee voted 5-1 to recommend that the TWIA board seek a 10% rate increase from the Texas Department of Insurance for residential and commercial policyholders

I wonder what the over/under is on a big problem at one of the state insurers?

Private Credit

The Valuation Advantage Is Gone

Ratings

A couple of Perspectives ago, when I gave the note about the Financial Stability Conference I attended, I wrote:

But one cannot escape the analogies to subprime with banks holding the super-senior position. There is no mis-rating by the rating agencies because these are unrated, and we don’t know if there are incentive issues like we saw in the origination and securitization chain. Don’t know whether there are any of the “liquidity put” type structures that burned Citi (among others).

Well, we are starting to see rating agency involvement. No sense yet that there is mis-rating going on, and this should certainly be easier to rate than complex waterfall structures that rely on correlation assumptions, but nevertheless, here we go.

Citi seeks ratings to take loans to private credit funds mainstream (IFR)

Citigroup is working on securing credit ratings for senior loans it makes to direct lenders to create more of a syndicated market where the bank can distribute these exposures to a wider range of investors.

“We believe most of the senior lending market [to private credit funds] will become a rated market. It won’t be a full-scale public market like Triple A CLOs. But you’ll see more of these deals getting syndicated to clients,” Bhatia said.

Private Credit Is Driving Profitability

Inside Goldman Sachs' expanding but risky financing engine (Reuters)

A Goldman Sachs (GS.N), opens new tab bet put in place in 2021 on lending to private funds has helped drive record revenues in fixed-income financing. Now, the Wall Street bank is pushing even deeper into the growing but risky market

[Goldman] offers loans against different kinds of assets, ranging from the net asset value (NAV) of a private equity fund and cash commitments from fund investors to real estate and private credit loans.

For NAV loans, Goldman has been writing large checks, mostly in the $500 million to $1 billion range, the source familiar with the business said. But the source added that the bank provides low loan-to-value NAV loans, typically 5% to 15%.

De-democratization of Finance

In The Black Hole of Private Credit the Odd Lots team discuss this paper The Credit Markets Go Dark.

Private credit should instead be understood as heralding a sharp reversal in the democratization of debt, which will have transformative impacts on corporate governance and corporate finance along three dimensions.

The Odd Lots team focuses on the implications:

… private credit could lead to a situation where companies are both more able and more incentivized to stave off bankruptcy for as long as possible. … private credit-backed firms may file for bankruptcy later, and arrive sicker and with fewer options as a result.

… less information is available overall

… the growing concentration in owners of corporate debt and equity — where a single investment firm could be both money lender to a company and also own substantial stock in it — raises some interesting questions about the wider economy.

Overall, it seems there are a number of corporate governance, informational, and behavioral impacts form the boom in private credit that we are only just beginning to think about.

A Brief Crypto Divergence

The Silvergate Enforcement Actions, and FTX

Really kind of interesting. I’ve been avoiding crypto like the plague, but this piece Silvergate settles with WEC, DPI, and Federal Reserve over FTX money laundering (Amy Castor) brings together some interesting pieces.

SEN was a speakeasy, a money laundromat. Just what FTX and the wider crypto bubble needed!

Silvergate Bank, of La Jolla, California, was the main US dollar bank for crypto exchanges from 2017 to 2022. The Silvergate Exchange Network (SEN) operated 24/7 — not just during normal banking hours — and was essential to US dollar crypto and inter-exchange liquidity. By 2021, 58% of Silvergate deposits were from crypto firms.

In March 2023, Silvergate finally announced it would be unwinding. The assorted regulators promptly dived in to work out what on earth had happened here.

The SEC is suing Silvergate for making false or misleading claims to investors … The Federal Reserve and California’s Department of Financial Protection and Innovation (DFPI) have also brought state and federal charges against Silvergate. [DFPI; Consent order, PDF]

The only detail in the consent order of the Fed and DFPI’s concern is regarding Silvergate’s SEN:

An investigation by the Department identified deficiencies with respect to Silvergate’s monitoring of internal transactions.

Crypto firms flocked to Silvergate for its Silvergate Exchange Network. Unlike bank wires, SEN let crypto exchanges move dollars between exchanges at all hours of the day, including nights and weekends.

Silvergate claimed in its original 2019 S-1 filing that it had “proprietary compliance capabilities,” which constituted “policies, procedures and controls designed to specifically address the digital currency industry.”

[But from April 2021 onward Silvergate] didn’t bother checking transactions on the SEN!

The coverage assessment concluded that [Silvergate] had not been monitoring SEN transactions “as expected because [Silvergate] does not consider internal transfers as risky activity within any financial crime typologies.”

Oops. There’s more; click over to read it if you’re interested.

State Street Wants In To Crypto Settlement

State Street Said to Explore Creating Stablecoin, Deposit Token (Bloomberg)

Financial services and banking giant State Street Corp. is exploring ways to get involved in settling payments on blockchain, according to a person familiar with the matter.

The Boston-based asset manager, which reported higher-than-expected revenue and interest income on Tuesday, is exploring creating its own stablecoin — a cryptocurrency that runs on a blockchain and is pegged to an asset such as the dollar. It’s also considering creating its own deposit token, which would represent customer deposits on a blockchain

Introduction of a deposit token by State Street would require approval from US banking regulators.

As the third-largest exchange-traded fund manager, State Street is already providing services like fund-administration and accounting for crypto ETFs. And it’s further expanded its digital-asset efforts recently via a partnership with Galaxy Asset Management to develop digital assets ETFs.

In the coming months, State Street has said it’s focusing on tokenizing assets such as funds.

More Stuff

Size, Complexity, and Polarization in Banking

OCC’s Hsu on “Size, Complexity, and Polarization in Banking”

I would like to talk about three key long-term trends that are reshaping banking. The first trend is the growing number and size of large banks, the second is the complexity of bank-nonbank relationships, and the third is polarization.

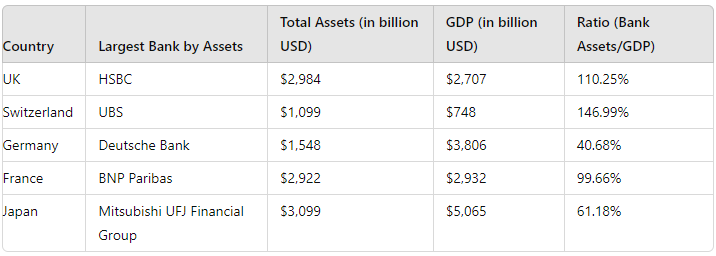

While he is correct that the size of the largest US bank has grown relative to GDP, it is not particularly worrying to me as it is still a relatively low fraction of GDP compared to other countries:

In 2020:

The second long-term trend relates to the increasing complexity of bank-nonbank relationships. This trend is creating greater interdependencies between banks and nonbanks, including fintechs. Further, it is blurring the line between banking and commerce.

a … transformation is occurring in payments. Advancements in technology, combined with the inexorable rise of online and mobile commerce, have been driving the digitalization of banking, with most of the innovation being led by nonbank financial technology firms (fintechs).

The continued evolution and proliferation of bank-nonbank arrangements, however, has highlighted the need for more granular approaches and greater engagement between the FBAs and nonbank fintechs. … Customer-facing nonbank fintechs generally are regulated as state-licensed money services businesses (MSBs). None are supervised prudentially at the federal level

It is interesting that he has focused on payments technology, traditionally something the Fed has worried about more. I think there are two reasons: first his focus on MSBs, and second, with how these MSBs align with Fintech and crypto (as discussed in the prior Silvergate section).

At the OCC, we have been carefully monitoring banking law developments at the state and local level. A worrisome trend of fragmentation is emerging. … Critical to national banking is the concept of preemption. … The OCC has and will continue to vigorously defend preemption, as it is central to the dual banking system and cuts to the core of why we exist and who we are.

Was DB Cooking The Books?

Deutsche Bank flouted international accounting rules, says watchdog (FT)

Deutsche Bank’s 2019 financial report did not meet international accounting standards because it lacked key details about the lender’s historic US losses, Germany’s financial watchdog BaFin said on Tuesday.

BaFin said the bank failed to disclose in 2019 that €2.1bn of deferred tax assets were linked to multiyear losses at the US operations, which were unprofitable at the time.

Banking & Corporate Law

Battle Over Shareholder Pacts Strains Delaware’s Business Courts (WSJ)

Sweeping changes to Delaware corporate law could give more power to influential shareholders, letting them make more deals on behalf of the company without board oversight.

Rebuilding Banking Law: Banks as Public Utilities (Yale Journal on Regulation)

This paper offers a blueprint for … a New National Banking system.

American Political Violence

Update On The CS Mozambique Tuna-Bond Fraud

Ah, the extraterrestrial1 reach of the Southern District.

Ex-Mozambique Minister Faces US Trial in Tuna-Bond Bribe Case (Bloomberg)

In 2021, Credit Suisse paid almost $475 million to resolve multiple investigations — including in the US — for its role in the bond scandal.

Mozambique’s former Finance Minister Manuel Chang faces a criminal trial on Monday in New York over his role in a $2 billion bond fraud scandal that embroiled Credit Suisse Group AG and created a financial crisis in the east African nation. … Chang allegedly pocketed $5 million in bribes and facilitated the laundering of $200 million in money funneled to Mozambican officials

Fighting A Financial Crisis

The Yale folks are putting on a conference. Here is the agenda and speakers. And here’s the link to register. I’ll be on vacation, otherwise I’d attend. If anyone does go, I’d be interested in any takeaways.

Money DOES Buy Happiness

Money and Happiness: Extended Evidence Against Satiation (Happiness Science)

Contrary to past research and thinking

In recent research, I found that happiness rose steadily at least up through incomes of hundreds of thousands of dollars per year. But what happens beyond that – does happiness plateau, decline, or continue rising?

The results show a sizable upward trend, with wealthy individuals being substantially and statistically significantly happier than people earning over $500,000/y. Moreover, the difference between wealthy and middle-income participants was nearly three times larger than the difference between the middle- and low-income participants, contrary to the idea that middle-income people are close to the peak of the money-happiness curve. Finally, the absolute size of the difference in happiness between the richest and poorest people was large.

Cross-Over Of The Year

From the producers that brought you Sharknado, and Cocaine Bear, comes the summer’s hottest movie: Cocaine Shark

for Al Rubbo. IYKYK