Perspective on Risk - July 20, 2022

I’ve Been Obsessing About This Graph; Check-In On Eurasia Group’s 2022 Calls; A Chat With Scott Alvarez; Crypto Update (Are You Getting Tired Of This Yet?); Compliance

Last post before I take a couple of weeks off for a vacation. Promise.

I’ve Been Obsessing About This Graph

I first saw this graph in a blog post by Ben Hunt titled Hollow Men, Hollow Markets, Hollow World. The hypothesis is that, over the long run,

[O]ur wealth as a people should grow hand in hand with the growth of our economy.

He asserts two possible reasons that the divergence might have occurred:

Maybe it’s … extracted … from people in other countries through colonial terms of trade.

Maybe it’s … pulled forward from future people in your own country through artificially low interest rates, monetized debt-driven stimulus, and an increasingly levered financial system supporting increasingly non-productive mal-investment.

He tends to discount the first possibility, concluding:

By keeping interest rates lower than what would have been considered ‘normal’ over the prior few decades and by relaxing regulatory constraints on derivative securities, banking regulations and the like, Greenspan believed that he could inflate home prices and financial asset prices without hitting wages and prices more broadly.

As a former Fedster, there are elements of this that ring true. I might label the chart differently, citing three distinct times when demand was stimulated (or pulled-forward).

9-11; before hand the Fed was trying to take some air out of the economy and the dotcom bubble, but after Greenspan had his return flight from Asia fly over the WTC site1 he vowed that we would not let Bin Laden destroy our economy.2

Following the 2008 commencement of the global financial crisis, there was a real fear that Main Street demand would collapse, paving the way for mass unemployment and a depression.

Covid; as we have discussed previously, there was a concerted fiscal and monetary effort that stimulated the economy (and in part resulted in some of today’s inflation).

Emmons from the St. Louis Fed included the following graph of the difference between the equilibrium rate (r-star) and Fed Funds in a paper examining Covid.3 You can readily observe the response in the prolonged under-shoot following 2000, 2007 and 2020, with the GFC mostly responsible for a prolonged undershoot.

Henry Mo, the excellent Chief Economist at AIG, did me a solid by recreating the data and showing it in a couple of different ways.

I particularly like this chart, which in essence shows us the ‘societal’ ROE on our wealth.

When we look at how total assets have broken down between financial and non-financial assets over time, the picture is perhaps less clear. The financial asset share clearly declined in the inflationary 70s, and the dotcom bubble is less pronounced. The period of the GFC through to today is dominated by financial asset wealth.

What does this all mean for the future? Well, there are only two ways that the above lines can converge.

Asset prices could quickly fall sharply (say 30-40%), or

Wealth can stay flat for an extended period allowing GDP to catch up. For perspective, the DJIA was flat for the 18 years between 1965 and 1982.

Henry estimated that if we hold wealth constant, it would take about 5.5 years for GDP to catch up. So if we wanted to achieve a full reset, we are in for a sustained period of returns near zero.

This, of course, is consistent with some of the historical measures, like the negative Shiller PE implied 10 year forward returns projections.

I hate this - going to have to think more about it - because in general everyone should normally have a long-bias with their money. This also likely means higher discount rates on financial assets and lower corporate profit margins. But I’m not sure I see what might reasonably (so let’s discount a Taiwan invasion, etc) be expected to cause this to occur.

Anyway, that’s been my recent obsession (even more than the crypto collapse).

Mid-Year Check-In On Eurasia Group’s 2022 Calls

Kudos to Ian Bremmer’s team, they got a lot correct (or close): Top Risks 2022

Their #1 call was No zero Covid. They directly stated

China's zero-Covid policy will fail.” - Nailed it.

Their #5 call: Russia stated":

President Vladimir Putin is trying to force the West to address Russian objections to the eastward expansion of NATO. He amassed at least 70,000 troops on the border with Ukraine to gain leverage on two issues: the nature of an agreement with Kyiv and the rules of the game on Russia's relations with its western neighbors. Putin has put his credibility on the line; if he doesn't get concessions from the US-led West, he is likely to act, either with some form of military operation in Ukraine or a dramatic action elsewhere.

But then they pulled the punch, and under-estimated US/Western success (and response from their populace):

Diplomacy will probably avert military confrontation by focusing on areas where compromise is possible.

If Putin directly invades Ukraine, Russia will at the least face a ban on US persons trading in the secondary market for new Russian sovereign debt, and NATO forces will move their forward positions closer to Russia's border, raising tensions to a degree not seen since the collapse of the Soviet Union.

Would the Europeans remain as aligned with the United States in such a scenario, with all the economic consequences (and energy shortages this winter) that would result? It's harder to imagine. Absent this alignment, the episode would be an embarrassing failure for the Biden administration and deeply divisive for US-Europe relations.

Their #4 call: China at Home

US-China relations won't reach crisis levels this year, and domestic conditions within China won't undermine the country's political stability—or derail Xi's bid for a historic third term. … Xi's policies increase the risk of stagnation at a time when the Chinese economy is on weak footing.”

#9 Corporates losing the culture wars highlighted an issue that was being underplayed.

The world's biggest brands are earning record profits. But they're going to have a more difficult year navigating politics. Consumers and employees, empowered by “cancel culture” and enabled by social media, will put new demands on multinational corporations (MNCs) and the governments that regulate them. Multinationals will have to spend more time and money navigating environmental, cultural, social, and political minefields.

Eurasia was more focused on supply chains, child labor, Chinese Ughers and missed the bigger domestic issues.

Finally, there is one big call that has yet to play out. #3 US Midterms. I’d encourage everyone to reread this section. Here’s the concluding paragraph:

A nationwide crisis of political legitimacy could provoke domestic terrorism and create autonomous zones of protest around the country. The resulting political instability would make the insurrection of 2020 (and social unrest of 1968) look tame. The federal government would become structurally dysfunctional. Secessionist movements would gain steam in states such as California. Deeply and perhaps permanently consumed at home, the US would fail to project influence abroad, opening the door for Russia, China, and others to challenge the status quo in areas of their core national interest.

A Chat With Scott Alvarez

Scott Kelly had a chance to sit down with Scott, who was the Board’s GC from 2004 to 2017. Here is his substack post Transcript: former Fed General Counsel Scott Alvarez and here is a link to the transcript YPFS Lessons Learned Oral History Project: An Interview with Scott Alvarez. It’s a really good discussion that gives flavor to the nuance of setting up liquidity facilities. They get kind of deep on some issues; Kelly knows his history and really probes Alvarez in a couple of insightful directions.

So many commenters assume that the Fed could just do what it wanted/needed to do to bail out firms and establish liquidity facilities. This discussion shows how intensely the Fed follows the letter of the law, as well as some other operational aspects.

Nice discussion of the structuring of Maiden Lane I (I actually learned a few things I didn’t already know), the use of SPVs, the need for a first-loss layer, and ring-fencing. I do wish they had spoken a bit more about derivatives, and about whether the changes to the laws provide the Fed with sufficient powers to stabilize the financial system in the next crisis. I’ll close this section with some of Scott Alvarez’s closing remarks:

…the law makes a big difference in what the government can do in response, and the constraints we were under really shaped the response that we gave. And the Lehman Brothers situation, for example, there's nobody that wanted it to happen like it did. But, in the end, we just didn't feel we could take the losses that would be associated with that, given the authority that we had. And so, I hope that when folks read through the material, they understand not so much, “oh those lawyers were too stodgy, and they didn't give their decision-makers enough flexibility.” I hope they come away with the idea that, look, it does matter what you write down in the statute!

Crypto Update (Are You Getting Tired Of This Yet?)

If anyone cares for an update on 3AC, Celsius and Voyager, Crypto collapse: Celsius’ real liabilities and fake assets, Voyager still bankrupt, 3AC owns CryptoDickButt #1462 (Attack of the 50’ Blockchain) provides a nice sequential summary with links.

Also The Latecomers Guide To Crypto Crashing by Amy Castor has a nice summary.

Frances Coppula has a nice decomposition of the hole in Voyager’s balance sheet. (The sinking of Voyager).

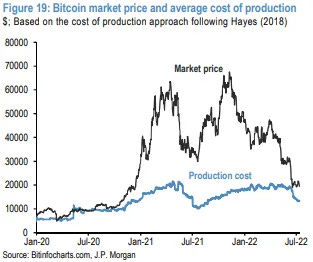

How Much Does It Cost to Mine 1 Bitcoin?

JPMorgan estimates that the production cost to mine one Bitcoin has dropped from $24,000 at the start of June to just $13,000. Bitcoin’s production cost is an estimate of the average cost for mining one Bitcoin per day. This cost depends primarily on the electricity costs incurred by miners for running their machines, but there are other variables.

My main interest these days is the vast interconnection of the ponzi’s players.

Celsius’ largest creditor, at $81.1 million owed, is Pharos (Lantern Ventures), whose founder Tara Mac Aulay is an Alameda co-founder and several employees have various ties to Sam Bankman-Fried of Alameda and FTX. Everyone in crypto is in each other’s pockets. [Bloomberg]

We found our first connection to the world of traditional finance. EquitiesFirst, an Indianapolis-based specialist lender best known for lending against stock, failed to return crypto Celsius had pledged for a loan in 2021, acc to court filing. EquitiesFirst owes Celsius $439m.

Celsius has $467 million in ETH, tied up in Staked ETH — a bet on the future launch of the Ethereum 2 proof-of-stake network. StETH is illiquid even by crypto standards, but currently generates 5% annual interest.

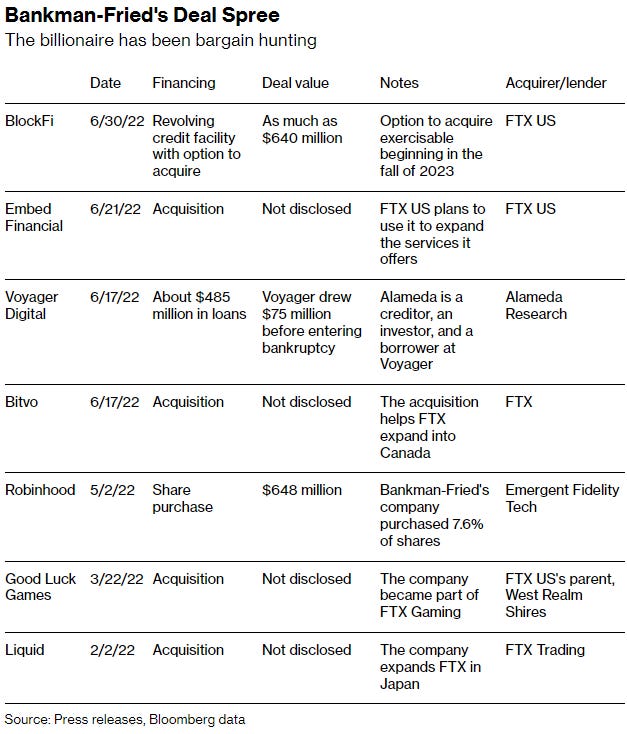

Sam Bankman-Fried appears to be attempting to roll-up much of the industry according to Bloomberg.

In June he bought Bitvo Inc., a Canadian crypto trading platform, and Embed Financial Technologies Inc., a brokerage services firm. As the crypto selloff intensified in the wake of the collapse of the TerraUSD stablecoin and amid the implosions of Celsius Network and Three Arrows Capital, Bankman-Fried made two of his biggest moves yet, lending embattled crypto broker Voyager Digital $485 million, and bailing out digital-asset lender BlockFi with a $400 million revolving credit facility that came with the option to purchase the company outright.4

The Tale of The Whale That Took Solend’s Money (Amy Castor)

In October, Solend raised $6.5 million from Coinbase Ventures, Solana Ventures, and Alameda Research, among others. The following month, the firm raised another $26 million worth of USDC in an initial coin offering, selling its SLND token. Investors and insiders got a percentage of SLND. [Crunchbase; SLND distribution]

Solend is one of the largest DeFi lending protocols on Solana. You deposit assets as collateral and take out loans against those assets, generally in the form of stablecoins.

Nexos and Coinbase rumors abound. If you hold crypto, get your tokens off-exchanges.

Climate Change Anecdote of the Week

Talking Bubbles

A CRISIS HISTORIAN HAS SOME BAD NEWS FOR US, Lowery, The Atlantic

Compliance

Wall Street Texting Habit Sticks Banks With Rare $1 Billion Bill (Bloomberg)

Finance firms are required to scrupulously monitor communications involving their business to head off improper conduct. That system, already challenged by the proliferation of mobile-messaging apps, was strained further as firms sent workers home shortly after the start of the Covid-19 outbreak.

Earlier this year, Deutsche Bank reminded employees that deleting messages is forbidden, and the German lender is rolling out new software on corporate mobile phones that archives WhatsApp messages, Bloomberg has reported.

''When we reached U.S. airspace,'' he said, ''two F-16's came up to verify who we were. We had gotten permission to fly over the World Trade Center at 30-odd thousand feet. I could see a plume of smoke; that's about all.

Stevenson, WHERE THEY WERE: Frozen in Memory, the First Moments of a Transformed World -- Alan Greenspan; Chairman of the Federal Reserve, NY Times

Greenspan, ALAN GREENSPAN REMEMBERS 9/11, Global Wealth Partners

Emmons, Measuring the Fed’s Monetary Policy Stance during COVID-19, St. Louis Federal Reserve

Miller, Kharif, Sam Bankman-Fried Turns $2 Trillion Crypto Rout Into Buying Opportunity, Bloomberg