Perspective on Risk - Jan. 2, 2022

We Have To Start With Zoltan; On The Other Hand; Recession Probability Now 93%; Why Did The Fed Approve a Bank Serving Digital Assets & Cannabis

We Have To Start With Zoltan

I really didn’t want to, but while the rest of us were winding down for the year, CS’s Zoltan Poszar published another in his series on geopolitics, commodities and a possible change in the dominant currency regime. This one is titled War and Commodity Encumbrance.

We have discussed Zoltan’s work numerous times before. See this footnote for links1. It also touches on two of our three big drivers:

I will try and summarize his thesis for you and add some additional thoughts.

Zoltan’s central thesis is that

“the world is going from unipolar to multipolar,”

this multipolar alternative to the dollar based system is principally being built by the Chinese, and includes the Russians, other BRIC countries, the middle east oil nations (and I’d add parenthetically Africa),

this system will rely on a central bank digital currency project (m-CBDC Bridge) designed to bypass the U.S. dollar, as well as bilateral swap lines between China and the BRIC+ countries.

His evidence for this change includes:

“the special relationship between China and Russia,”

“President Xi’s visit with Saudi and GCC leaders marks the birth of the petroyuan

and a leap in China’s growing encumbrance of OPEC+’s oil and gas reserves” noting, importantly, that this was “s the very first China-Arab States Summit in history,”

“the U.S. is now less reliant on oil from the Middle East owing to the shale revolution, while China is the largest importer of oil; security relations are in flux”

He focuses on these comments by Xi:

In the next three to five years, China is ready to work with GCC countries in the following priority areas:

first, setting up a new paradigm of all-dimensional energy cooperation, where China will continue to import large quantities of crude oil on a long-term basis from GCC countries, and purchase more LNG.

We will strengthen our cooperation in the upstream sector, engineering services, as well as [downstream] storage, transportation, and refinery.

The Shanghai Petroleum and Natural Gas Exchange platform will be fully utilized for RMB settlement in oil and gas trade, […] and we could start currency swap cooperation and advance the m-CBDC Bridge project”.

A system of petrodollar recycling looks to be partnered or supplanted by petroyuan recycling.

Zoltan gives further detail on “fully utilized for RMB settlement in oil and gas trade”

The m-CBDC Bridge project … is a masterclass in plumbing: undertaken by the PBoC, the Bank of Thailand, the HKMA, and the Central Bank of the United Arab Emirates, the project enables real -time, peer -to -peer, cross -border, and foreign exchange transactions using CBDCs, and does so without involving the U.S. dollar or the network of Western correspondent banks that the U.S. dollar system runs on.2

He connects some interesting dots with some interesting observations:

since the beginning of this year, 2022, Russia has been selling oil to China for renminbi, and to India for UAE dirhams; India and the UAE are working on settling oil and gas trades in dirhams by 2023; and China is asking the GCC to “fully ” utilize Shanghai’s exchanges to settle all oil and gas sales to China in renminbi by 2025. That’s dusk for the petrodollar.

Russia, Iran, and Venezuela account for about 40 percent of the world’s proven oil reserves, and each of them are currently selling oil to China for renminbi at a steep discount.

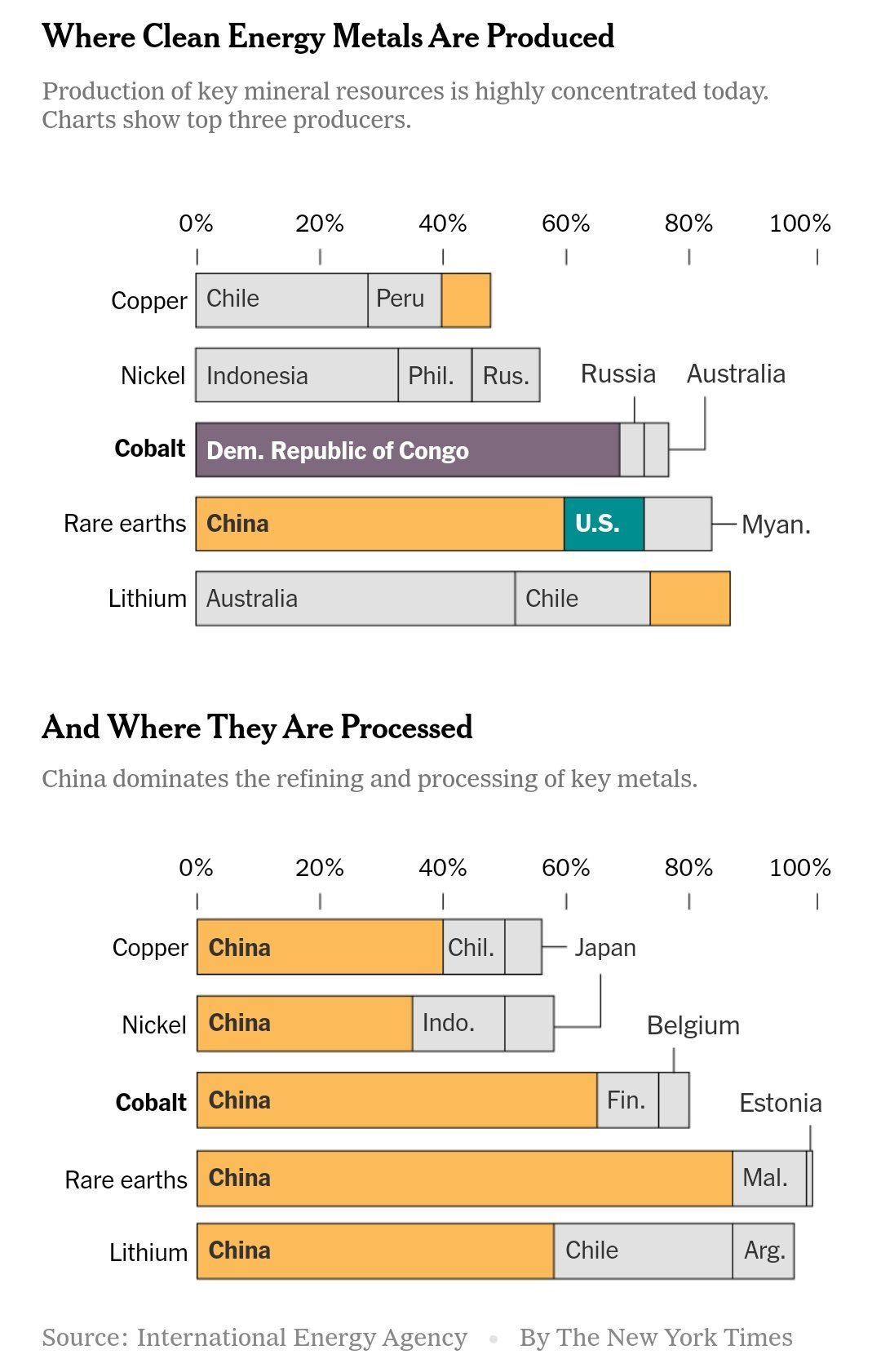

This feels pretty compelling to me. It aligns with the interests and incentives of the various parties. The middle east, which has less confidence in security guarantees, hedges by strengthening ties to Russia and China. India gets cheap energy to facilitate growth. Indonesia and the Congo align with China to create a battery-ingredient cartel.

It is not without challenges, and maybe 3-5 years is too short for this to occur, but there was a reason I led with the Dornbusch quote.

So now let me add some other observations.

Foreign Affairs magazine published The End of the Age of Sanctions? How America’s Adversaries Shielded Themselves. This is a nice compliment to the Poszar piece.

Three events over the past decade in particular have convinced [our adversaries to harden their financial system against sanctions]. In 2012, the United States cut Iran off from SWIFT, the global messaging system that enables virtually all international payments, in a bid to isolate the country financially. Other U.S. enemies took note, wondering whether they might be next. Then, in 2014, Western countries imposed sanctions on Russia after it annexed Crimea, prompting Moscow to make economic autonomy a priority. Finally, in 2017, Washington started a trade war with Beijing, which soon spilled over to the technological sector. By restricting the export of U.S. semiconductor know-how to China, the United States put its adversaries on notice that their access to crucial technology could be severed.

One way that countries have made themselves more sanctions resistant is through bilateral currency swaps, which allow them to bypass the U.S. dollar. Currency-swap deals connect central banks directly to each other, eliminating the need to use a third currency to trade. China has embraced this tool with gusto, signing currency-swap agreements with more than 60 countries, including Argentina, Pakistan, Russia, South Africa, South Korea, Turkey, and the United Arab Emirates, worth a total of nearly $500 billion. (BP1: Note the UAE; BP2: I would add Ghana to the list for reasons that will become apparent)

Another way that countries have sanction proofed themselves is by developing non-Western payment systems. … China’s alternative, known as the Cross-Border Interbank Payment System, is not yet a match for SWIFT. … But the very existence of CIPS is a victory for Moscow and Beijing: their goal is to have a working alternative to SWIFT, not the biggest payment system. What matters to Russia and China is that around 1,300 banks in more than 100 countries have joined the framework. If Russia and China were to be cut off from SWIFT, their backup is ready.

The rise of a fragmented financial landscape threatens both U.S. diplomacy and national security. … All this means that within a decade, U.S. unilateral sanctions may have little bite.

Gold buyers binge on biggest volumes for 55 years (FT)

Central banks are scooping up gold at the fastest pace since 1967, with analysts pinning China and Russia as big buyers in an indication that some nations are keen to diversify their reserves away from the dollar.

Russia Doubles Yuan, Gold Share in Wealth Fund Holdings (Bloomberg)

The potential share of yuan was raised to 60% of the National Wellbeing Fund and gold to 40% to make investments in the National Wellbeing fund “more flexible,” the Finance Ministry said in a statement on Friday.

Remember I mentioned Congo? The reason is that the Chinese m-CBDC Bridge seems aligned both to today’s petro-circulation, as well as to the emerging electrification of everything.

Remember when we played Putin or Poszar?

A former boss was always good at having us think through what the end-state looks like, and then work back the probabilities of things occurring.

The end state that we can envision is a bipolar world; one block led by the US and the other by China. This can be seen in the actions being taken by both parties.

The China block has a subservient Russia, strong ties and control over battery commodity countries. The US has an expanded NATO pushing to Russia’s borders, low-cost manufacturing base in Mexico.

The Middle East moves towards its biggest source of demand, China (and with US/European energy dependence we no longer what/need to act as the protector). Put it in the China camp.

India probably maintains its neutrality, playing both sides. Indonesia may be contested; China will want it in its sphere and it is a major Nickle producer (for batteries) as well as a large growing economy; the US should probably fight pretty hard to prevent this. Africa3 has ties to both camps; China has the edge economically, while the US currently has the edge militarily.

South America is interesting; except for Columbia, China is now the largest trading counterparty for the other countries (China wants to supplant reliance on US foodstuffs4 with products from Brazil and Argentina; Venezuela is OPEC+). Thomas Barnett, a respected military strategist that thinks about the relationship between grand strategy and globalization, has laid out why the US strategy (and China’s strategy) will inevitability change from a horizontal to a latitudinal perspective. Here is a link to a 2015 video specific to this development (I’ve recommended and shared this ‘grand strategy’ video with some of you before on a bilateral basis; highly recommended; broken into 4 parts. A more current 2019 version is here ). The specific video on foodstuffs is here.

The crisis takes a much longer time coming than you think, and then it happens much faster than you would have thought.

In the next three to five years, China is ready to work with GCC countries in the following priority areas: [… the] Shanghai Petroleum and Natural Gas Exchange platform will be fully utilized for RMB settlement in oil and gas trade, […] and we could start currency swap cooperation and advance the m-CBDC Bridge project.

On The Other Hand

It is great having Brad Setzer back on Twitter. Brad is the best at tracking funds flows and reserve bank balances. Brad notes:

The global [2022] BoP surplus is dominated by China, Russia and the Gulf, proxied by Saudi Arabia -- They collectively run a huge surplus.

Compared to the past, a relatively low share of their combined surplus is showing up as central bank reserves ($100b of a bit over $800 -- which would rise to a trillion if all of the GCC is included), and thus the direct flow into global (and US) bonds is modest

The Russian and Saudi surplus is almost all going into the international banking system (with some equity purchases by the Saudi PIF) --

But at least in q3 the large bond purchases of the Chinese state banks seem to appear in the global data ...

So, if my adjustment for the euroclear account (Belgian treasuries = China) is correct, I can account a portion of the large financial flow from the world's big autocracies to the world's biggest democracy.

That is the net flow needed for the '22 global BoP to balance!

Summarizing a few of his other posts (he’s really killing it):

There is no doubt that the foreign bid for US bonds remained strong in 2022.

The big reported fall in the market value of foreign holdings of Treasuries has masked a far more important fact: foreign demand for US bonds has in fact been strong this year.

China has continued to buy (surprising, but that is what is in the US data if Belgium/ Euroclear is included)

The BoP data doesn't show any gold purchases through q3. The PBOC's reserve disclosure (using the IMF template) has a line item for gold -- tiny jump in November. But nothing big has happened here for a while (at least in the disclosed numbers)

The increase in Russian claims on foreign banks for the year is close to $150b (and that is increased assets, not reduced liabilities) -- so a substantial sum relative to the roughly $300b in reserves frozen by the G-7 countries and their close allies.

Foreign demand for US bonds has remained exceptionally strong over the last 4qs -- and it hasn't been correlated with bond market valuation, US rates or (most surprising to me) global reserves. Japan sold, others did not.

it is primarily a private bid ... (big contrast with '20)

The Saudi surplus is still basically going into equities (via the Saudi SWFs) and deposits -- with nothing going to reserves or bonds.

The fall in reserves in emerging Asia [ex-China] has not translated into Treasury sales. That is in part b/c India drew down its deposits rather than selling securities

So, current actions don’t seem to match the fears that have been articulated.

Recession Probability Now 93%

Why Did The Fed Approve a Bank Serving Digital Assets & Cannabis?

The Fed responds to the Moonstone Bank mystery (Protos)

Protos spoke to the Fed’s Lead Financial Institution Policy Analyst, Melissa Clark, … who:

acknowledged that she was unfamiliar with Farmington State Bank or Moonstone. Regarding the acceptance process of a new bank as a member to the Fed regulatory system, she told Protos: “You look at a lot of different factors. You look at all the statutory factors… financial, managerial, ownership, legal, permissibility, business plans, future prospects.

Based on the information gathered, we’d move forward.

“The fact is,” she said, “you learn new things about people after taking action. You act based on available information you have at the time, and that’s not to say that something might not be known later.”

“I’ve been doing this for 38 years,” said Clark. “Bad things can happen, even when you think all things are in order.”

Hmm.

Zoltan has a number of other interesting points, such as the fact that the yuan is now convertible into gold in H.K., and an interesting thought on oil rehypothecation.

Interestingly, China currently has one military base in Africa, located in Djibouti, and is reportedly seeking to establish a permanent military installation in Equatorial Guinea.

There are five US military bases in Africa[1][2], located in Djibouti, South Sudan, Somalia, Niger and Burkina Faso[. AFRICOM's map shows a network of 29 US military bases across the continent. On any given day, the US has 3-5,000 troops in Africa.

Barnett, “Food is water turned into human energy in a more transportable mode.”

A tour de force to start the new year, Brian. Fabulous post. I think the digital dollar and the digital euro will give the m-CBDC bridge a run for its money, however.