Perspective on Risk - Feb. 8, 2025

Bowman on Bank Regulation; The Swiss Get Tough; Unanchored; US vs Canada; Existential Risks

Bowman on Bank Regulation

Bank Regulation in 2025 and Beyond (Federal Reserve)

Bowman, who is the likely next Gov. in charge of supervision, gave the above speech. There is more than the usual amount of coded language in this speech. There are lots of interesting things to potentially read from between the lines.

More local/regional supervision over centralized control

More examiner discretion over rigid frameworks

More tailored approaches over one-size-fits-all regulation

She starts the remarks advocating for more aggressive tailoring of supervisory guidance (large vs small banks). This, of course, is popular political phrasing in this environment (as well as being warranted). What this tells me is that for an opening gambit she is reminding people that the Fed supervises banks large and small, and is not “giving away” the supervision of smaller State-member banks.

Problem-based Solutions

The next section, Problem-based Solutions really caught my eye. I may be reading too much into this, but I read a number of things between the lines. A layman’s reading would suggest that this is just about repeating the need for accountable, well-trained supervisors. But I read much more.

She's questioning the current division of supervisory responsibilities between the Federal Reserve Board in Washington and the 12 Regional Federal Reserve Banks. Specifically, she seems concerned about:

Unclear lines of accountability when supervision is split between Board and Reserve Bank staff

The need for more empowerment of front-line examiners rather than centralized control

She appears to be advocating for:

More authority and autonomy for Reserve Bank examiners who are closer to the banks they supervise

Less centralized control from the Board of Governors in Washington

More reliance on examiner judgment rather than rigid checklist approaches

These, of course, are some of the insights from the SVB failure that we discussed, but were unstated by policymakers at the time.

The political subtext seems to be pushing back against what she views as too much consolidation of supervisory power at the Board level in Washington DC, especially after various bank failures in 2023 led to calls for more centralized oversight.

Another subtle aspect is whether these comments above apply to the supervision of the largest, systemically-important banks. Clearly they apply to smaller banks, but what about the big boys?

Fed supervision changed after the GFC from a Reserve Bank led approach with loose collaboration across Districts and the Board to an increasingly centralized approach with more Board control through a more formal Large Institution Supervision Coordinating Committee. I can read her remarks two different ways:

Supervision for non-systemic banks will be more fully delegated to the Reserve Banks, but the systemically-significant banks need a more efficient and effective structure than the current LISCC, likely directed centrally, or

Less reliance on DC-led supervision. She writes the “largest banks are currently supervised directly by the Fed Board under the Large Institution Supervision Coordinating Committee (LISCC).” If Bowman believes supervision should be less centralized, this could imply a push to give more authority to regional Reserve Banks, even for large banks.

This section can also be seen as pushing back, or at least stating a firm starting position, against regulatory consolidation.

Treasury Market Functioning

In the next section she strongly advocates for excluding Treasury securities from the calculation of the Supplemental Liquidity Ratio. She does this under the guise of financial stability risks and Treasury market function:

Where we can take proactive regulatory measures to ensure that primary dealers have adequate balance sheet capacity to intermediate Treasury markets, we should do so.

In practice, Bowman suggests enabling banks to hold more Treasuries. This is a natural response when the government is running a large deficit. Banks, after all, are private-sector extensions of the sovereign.

Letting the banks take Treasuries onto their balance sheets during periods of stress reduces the likelihood that the Fed would need to conduct repo operations or asset purchases during this stress, moving the responsibility back to the private sector.

Stress Testing

I don’t read much new here. Contrary to my preferred outcome, I don’t see any indication that she is considering sunsetting this requirement. Instead, her key concern appears to be how stress tests create variable capital requirements for large banks. Reading between the lines, she seems to want stress testing to be more of a standardized, predictable exercise rather than what she characterizes as an "opaque test hidden from public scrutiny."

Which of course is my argument for why it should be eliminated.

Fraud

It is highly unusual and notable for a Fed Governor to highlight fraud, particularly check fraud, as a major policy issue. Particularly in this speech.

You may remember that I highlighted a discussion of fraud at the FDIC Community Bank Advisory Committee meeting in Perspective on Risk - Nov. 13, 2024.

She's criticizing regulators' (including the Fed's) slow response to increasing fraud and explicitly questions why this hasn't received more attention from regulators and law enforcement. She's also implying regulatory coordination problems may be hampering fraud prevention.

This is an indication to the banks that the environment is more supportive of their concerns than in the past.

The Innovation Imperative

While this section is very much about the regulator’s conservative approach to crypto, it goes further. While crypto and digital assets are part of the picture, Bowman’s remarks extend well beyond that to include fintech partnerships, AI in banking, and regulatory barriers to financial innovation overall.

The crypto angle is implied, but not specifically addressed. I certainly believe this is a result of reading the political tea leaves. To their own accord, the Fed’s view would be closer to that of law enforcement - that crypto is mostly about money laundering and flight capital.

Fintech partnerships is one place where the Fed has been more restrictive than both the OCC and the FDIC. This indicates a change in Fed approach.

There is also the inevitable response to Congressional interest in “de-banking.” A typical regulator approach would be to have the banks risk-rank their customers, and in certain businesses, like international money remittance (and crypto) there is much greater risk of money laundering and the like. Some other industries, like marijuana, might be considered high risk because there are Federal laws still in place against the business. So bank regulators would correctly expect higher levels of due diligence and compliance controls over these businesses.

In fact, this area points out a significant contradiction in her approach: more examiner discretion, but hands off the risky crypto business!

Meanwhile Regulation In Switzerland Gets Tougher

Former colleague Stefan Walter, now at the helm of FINMA,

Switzerland’s Finma Pushes Back Against Calls to Protect UBS (Bloomberg)

With the Swiss government likely to substantially raise the capital requirements for its largest bank in the coming months, UBS executives and lobbyists have been arguing that doing so will hurt a national champion.

Switzerland’s financial watchdog signaled it’s opposed to giving UBS Group AG any special treatment to aid its competitiveness against global rivals …

Finma’s Stefan Walter insisted that the best way to ensure the Swiss finance industry stays competitive is to strengthen the sector’s stability and reputation by good oversight.

Walter said it was important that the regulator can work “independently and without undue pressure” from politics or the financial institutions it supervises.

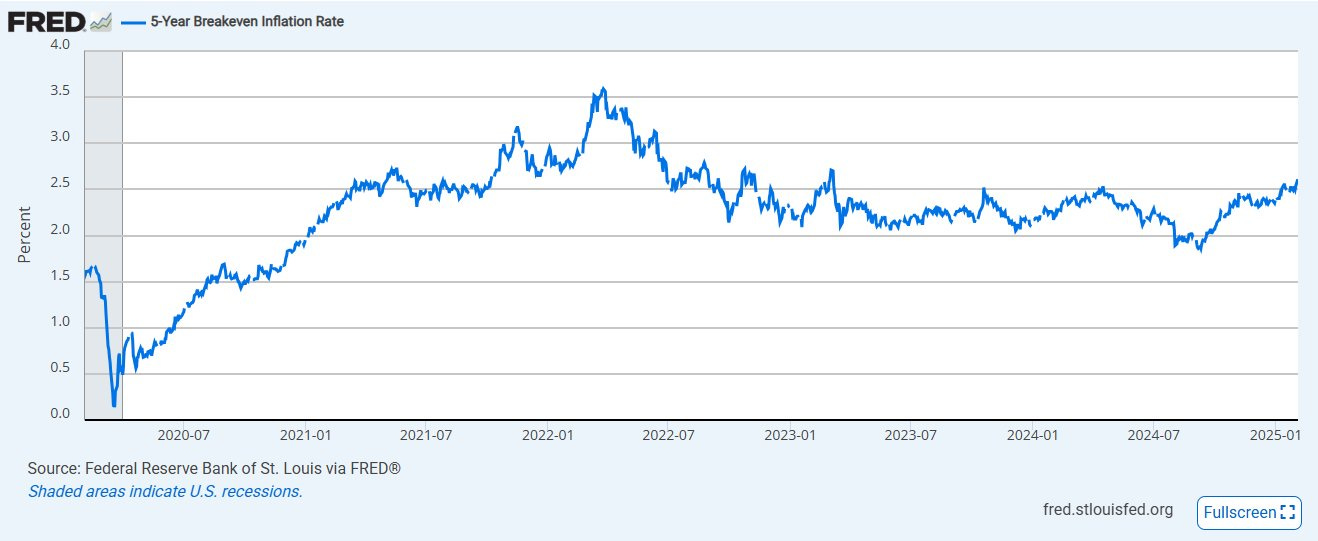

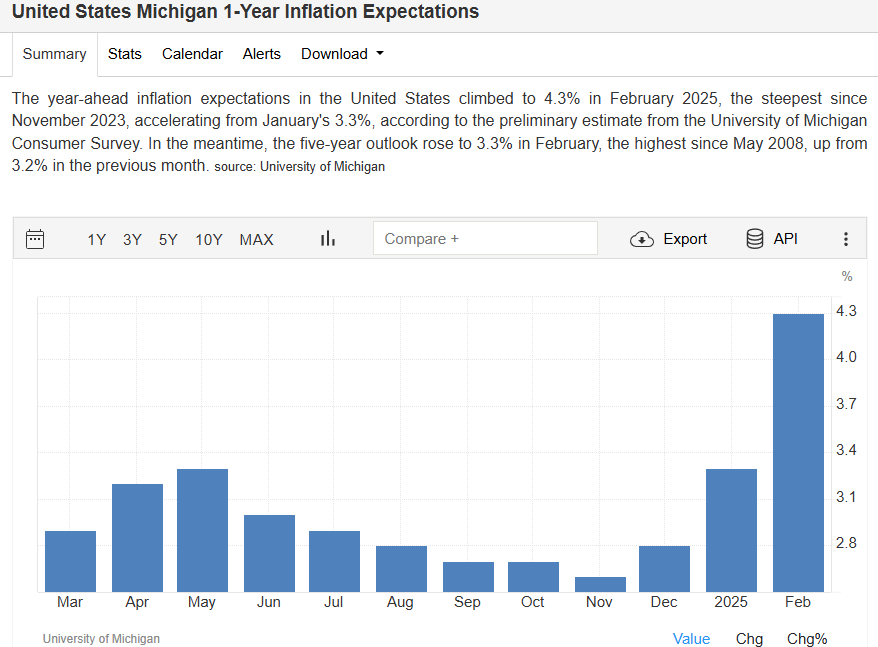

Unanchored

No, I’m not talking about Trump. Are inflation expectations becoming unanchored? Sure looks like it.Watch this space.

US vs Canada

Some Existential Risks

Asteroids

Don’t panic, but an asteroid has a 1.9% chance of hitting Earth in 2032 (Ars Technica)

NASA's Center for Near Earth Object Studies estimated a 1.9 percent chance of an impact with Earth in 2032. The European Space Agency (ESA) put the probability at 1.8 percent.

Scientists estimate that 2024 YR4 is between 130 to 300 feet (40 and 90 meters) wide, large enough to cause localized devastation near the impact site. The asteroid responsible for the Tunguska event of 1908, which leveled some 500 square miles (1,287 square kilometers) of forest in remote Siberia, was probably about the same size.

Astronomers use the Torino scale for measuring the risk of potential asteroid impacts. Asteroid 2024 YR4 is now rated at Level 3 on this scale, meaning it merits close attention from astronomers…

The Torino scale goes to 10, and a 3 indicates the potential for localized devastation. A 4 is regional devastation, and a 6 is required for the potential for global devastation.

Quantum Vacuum

The universe could undergo a 'catastrophic change' that could alter absolutely everything, quantum machine shows (The Independent)

About 50 years ago, quantum physicists suggested that the universe could be trapped in a so-called false vacuum, where it appears stable but could be about to move into a true vacuum. That could lead to a total change in the structure of the universe.