Perspective on Risk - Feb. 7, 2024 - (Commercial Real Estate)

CRE Developments; Economists Run Some Stress Analysis

** Note: I wrote this on Saturday and updated it last night. Going to send out now as it seems timely. I’m going to Costa Rica tomorrow so no updates for a bit.

Perhaps we should consider this piece as a background setter for what is to come. By all accounts the economy is humming, equity markets are elevated and extended, and credit spreads and VIX premia are very low. Recession still hasn’t shown its face. But the office (and maybe multifamily) CRE problems are starting to hit

Commercial Real Estate

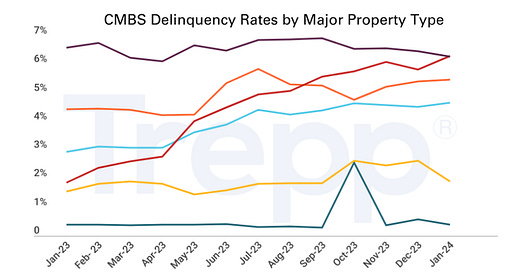

Delinquency rates are mostly flat over the last year, with the well-known exception of office properties.

Barry Sternlicht on Real Estate Losses

The office market has an existential crisis right now... it's a $3 trillion dollar asset class that's probably worth $1.8 trillion [now].

There's $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is...

There are buildings in New York that were bought for $200 million... the loan was $100 million... and we [personally] thought it was worth $30 million.

There's a building for sale right now in San Francisco. It was bought for $850 per sq ft. The loan was $450 per sq ft. They'll [probably] sell it for $250 per sq ft... that's $0.25 on the dollar.

That would mean we lost three-quarters of the total asset class...

But there is a bright spot - the office situation is a completely US phenomenon.

…

Everyone's back to work except for Americans.

We've gone off the deep end. We don't show up for work, we don't apply for jobs, and we don't feel like we have to go back to the office."1

Losses Are Beginning To Be Realized

Commercial Property Losses Bruise Banks Around the Globe (WSJ)

New York Community Bancorp stock fell 11% Thursday, extending a steep slide that began a day earlier when the company disclosed troubles in its commercial property book and piled away millions of dollars for potential future losses.

Shares of Tokyo-based Aozora Bank fell more than 20% Thursday … after it said losses in its U.S. office-loan portfolio will likely lead to a net loss for the year ending in March.

In Switzerland, the private bank Julius Baer said Chief Executive Philipp Rickenbacher resigned after the company took a roughly $700 million provision on loans it said it might not get back from Austrian property landlord Signa Group.

The risks are particularly acute for small and regional lenders, which have far higher chunks of their loan portfolios in commercial real estate than big banks do. The SPDR S&P Regional Banking ETF fell more than 3% and the KBW Nasdaq Regional Banking Index shed about 2% Thursday. U.S. markets broadly were up.

Deutsche Bank said it increased loss provisions in its U.S. commercial loan book nearly fivefold from 2022’s fourth quarter to €123 million, equivalent to $133 millio

CRE Maturity Wall

US office owners face $117bn wall of debt repayments (FT)

There are $117bn of commercial mortgages tied to offices which either need to be repaid or refinanced in 2024, according to data from the Mortgage Bankers Association.

Colliding with CRE’s maturity wall (Alphaville)

Thanks to deterioration in property-level financial performance, only about 25 per cent of conduit and single asset/single borrower CMBS loans will be able to refinance in the next two years, GS found. For the broader CMBS market, that figure is just 40 per cent.

Real Estate Loans to Equity Back Near 2008 Levels

Aggregate banking system commercial real estate loan are back at 130% of aggregate equity capital, as was the case in 2008

Bank CRE delinquency rates through 3Q2023 remain low, but show the first signs of deterioration; expect rapid deterioration from here.

CRE During Tightening Cycles

US Commercial Real Estate Remains a Risk Despite Investor Hopes for Soft Landing (IMF)

… the sharp decline in prices during the current US monetary policy tightening cycle is striking. As the Chart of the Week shows, contrary to the current policy cycle, commercial property prices remained generally stable or saw milder losses during past Fed rate hikes. Some of the earlier rate hikes, though, such as in 2004-06, were subsequently followed by a recession during which commercial property prices recorded notable declines as demand fell.

Bank Exposure

The Federal Financial Institutions Examination Council (FFIEC) hosts the National Information Center where you can get information on individual bank holding companies, or aggregated Bank Holding Company Performance Reports (BHCPR). The data tends to be a bit stale (current data is as of 3rd quarter of 2023). I ran a BHCPR for Tier 1 banks. These are the (currently) 141 banks with over $10 billion in assets. As of 9/30/2024:

Commercial Real Estate Loans = 25.2% of assets, broken down as 4% construction, 4.2% multifamily & 15.8% “nonfarm nonresidential.” This last component includes office as well as others like industrial and hospitality.

Importantly, they give information on the distribution as well, since we are interested to know about the tails.

At the 90%tile, banks had 44% of their assets in CRE; at 95%tile its 52%.

Nonfarm nonresidential were at 30% (90th) and 35% (95th) respectively.

As a share of Tier 1 equity + allowance for loan losses, CRE averaged 249%, with nonfarm nonresidential at 156%

Again looking at the tails

CRE was 460% (90th) and 540% (95th)

Nonfarm nonresidential was 295% (90th) and 357% (95th)

Finally, lets look at the delinquency and nonaccrual stats (as a % of loan category)

I downloaded some data to see if there were any particularly interesting “tail” banks. Two banks that looked to have nonfarm nonresidential exposure to Tier 1 capital + ALLL near or above the 295% 90th threshold were the $62 billion Valley National (365%) and the $45 billion Southstate Corporation (293%). M&T has the highest ratio of any BHC over $100 billion, but they are below the average at 138%.

Interestingly, NYCB, the current poster boy, came in at 110% on the nonfarm nonresi score. Their coop loans may be classified as residential.

I may have made calculation errors, so do your own homework before using any figures.

NYCB

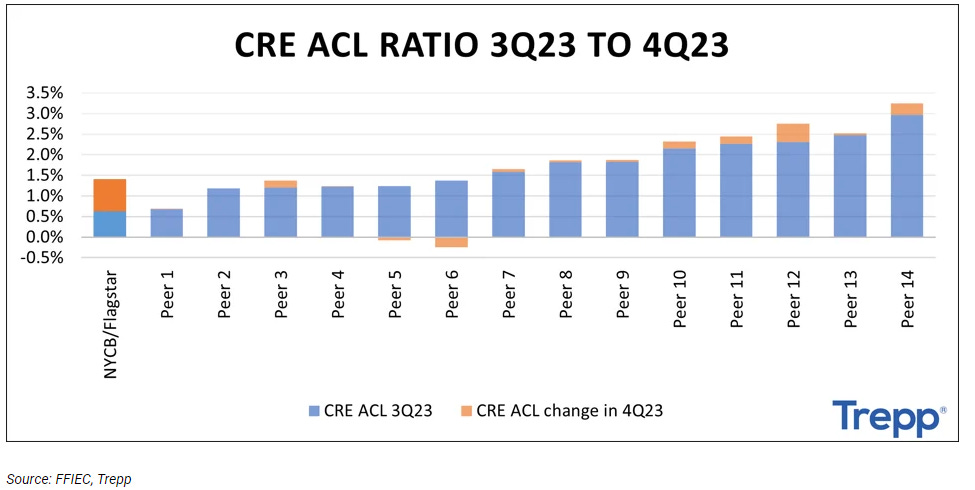

NYCB became the latest poster-boy for regional bank problems. [Full disclosure: I was vetted for the Board of NYCB back when I was at AIG and vetoed by the Fed because of interlock concerns. I also own a small equity position] NYCB had to make a substantial build to their allowance for credit losses.

A fair amount of this appear that they were unprepared to move from AA ball up to AAA. Let’s dissect a bit of the earnings call transcript. I’ve reordered a few of the points for clarity. Here’s a link to their earnings deck.

…this acquisition also meant we would become $100 billion-plus bank sooner than we had anticipated

They had to file a capital plan, and it was clearly inadequate. They probably got the feedback that they would not get a grace period to build to the new levels. Consistent with examiner reaction function post SVB.

… as we prepare for our first capital plan submission in April of this year, we have pivoted quickly and accelerated some enhancements that come with being a Category IV bank.

… building our reserve levels, which brings our ACL coverage more in line with peer banks, including Category IV banks, and adding on balance sheet liquidity as we prep for Regulation YY compliance.

During the fourth quarter we began preparing to be Regulation YY compliant. While this was earlier than we originally anticipated, we thought it is prudent to be ready to meet the enhanced liquidity requirements that apply to Category IV banks.

Matthew Breese with Stephens drilled in a bit on the regulatory drivers.

Matthew Breese: … Has something changed on the regulatory front in terms of overall standing or timeline to be ready for new stress testing. … I know you mentioned April, a submission in terms of being prepared for the first stress test.

Thomas Cangemi: Matt, we’re obviously we’re not going to speak specifically about regulatory conversations. … But the reality is that we do have an April submission. We’ve adjusted our capital position significantly as well as ACL. Those are big steps as we forecast our submission to the Reg. Y. That’s an important milestone. As John indicated, we’re doing significant work on Reg. Y for unbalanced liquidity.

… We’re in a different category. There’s eight of us that we benchmark to and we want to get those ratios in line to a group that makes sense going forward as we run our business, I think the market will understand what’s in front of us. … And now we have to make sure that we’re in place to be honorable of the fact that we are a Category IV bank and that’s a regulatory obligation.

Interesting use of the phrase “criticized loans” here. Not common CEO phrasing; “criticized” loans are a regulatory category, not a typical accounting category. They also used “classified” a lot - again not typical CEO language.

During the fourth quarter, we significantly built our reserves to address office sector weakness and an expected increase in criticized loans due to repricing risk in the multi-family portfolio, which better aligns NYCB with our relevant peer banks, including Category IV banks.

… there hasn't been a whole lot of change in respect to the NPAs and delinquencies. However, we had moved some of these loans into a status of criticized [positions] because of the nature of looking – thinking about the office sector and the reserve build out with the anticipation of office still having difficulties within the marketplace.

Trepp published a chart comparing their ACL with their peers.

NYCB (sort of) stressed their CRE portfolio. I don’t think Til or Kevin or David would find the stress nearly satisfying. Sounds more like a mark to current market that a stress.

We did a deep dive in Q4 and we assume rates that are at the current level in Q4. We did not anticipate the SOFR curve adjusting downward. So we took that into account when we looked at the ACL to establish the risk in respect to repricing.

… we assume they all went to the SOFR option. So the more punitive option, because there was an [air] of conservatism there. We did not take the fixed rate option as an option. So we went more conservative and looked at assume everyone wanted to ride the SOFR curve until they decide to lock in the next round of refinancing, which also stressed that debt service coverage ratio for SOFR versus the fixed rate option is more punitive.

Their Chief Risk Officer is no longer employed by the bank. Some will remember the scapegoat that Sabra Purtill sent around after I commented that CROs are hired to be fired.

Lastly, the ratings agencies have decided to pile on. Sad. They knew of NYCB’s CRE concentration and ACL levels. They could have either acted earlier or shown the courage of their convictions. Moody's downgrades NYCB

Economists Run Some Stress Analysis

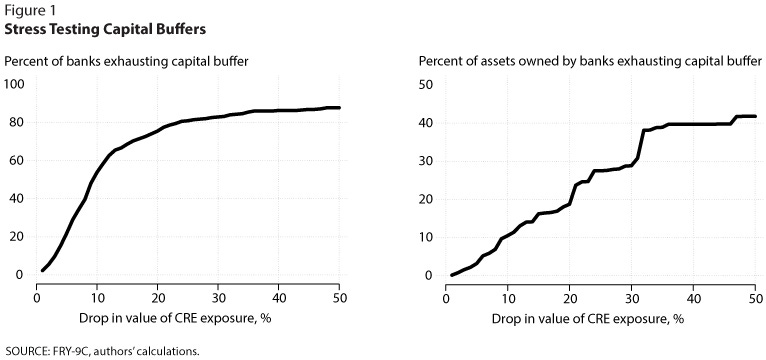

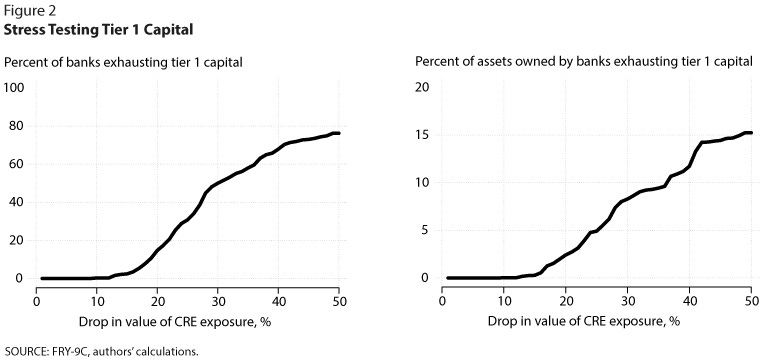

Both studies suggest a large number of smaller banks could fail.

CRE Losses & Bank Fragility

Monetary Tightening, Commercial Real Estate Distress, and US Bank Fragility (NBER)

we develop a framework to analyze the effects of credit risk on the solvency of U.S. banks in the rising interest rate environment. We focus on commercial real estate (CRE) loans that account for about quarter of assets for an average bank and about $2.7 trillion of bank assets in the aggregate.

Using loan-level data we find that after recent declines in property values following higher interest rates and adoption of hybrid working patterns about 14% of all loans and 44% of office loans appear to be in a “negative equity” where their current property values are less than the outstanding loan balances. Additionally, around one-third of all loans and the majority of office loans may encounter substantial cash flow problems and refinancing challenges. A 10% (20%) default rate on CRE loans – a range close to what one saw in the Great Recession on the lower end -- would result in about $80 ($160) billion of additional bank losses.

Our analysis, reflecting market conditions up to 2023:Q3, reveals that CRE distress can induce anywhere from dozens to over 300 mainly smaller regional banks joining the ranks of banks at risk of solvency runs.

St. Louis Fed Stress Tests Small Banks

“Stress Testing” Banks on Commercial Real Estate (FRB-St. Louis)

We run a simplified stress test that includes all US bank holding companies (BHCs) that file the FR Y-9C form, which is a requirement for all BHCs with $3 billion or more in assets and BHCs that meet a number of other requirements.5 The simplified stress test was simulated on 374 US BHCs—substantially smaller financial institutions than the ones eligible for DFAST.

Figure 2 shows that a 10% drop in the value of CRE exposures would result in 2.7% of banks exhausting their tier 1 capital and becoming insolvent; these banks constitute 2% of total assets in the banking system.

We credit guys don't look at an issue like CRE in isolation. We'd also analyze the rest of the B/S. Do they have residential mortgage loans or retail loan problems, as many of these institutions lend to lower income clients most subject to a dip in employment levels. In addition, do they have losses in the bond portfolio that they are funding with ST liabilities. And what's the term structure of deposits, making them vulnerable to a flight to quality.

My understanding is CRB also has a large portfolio of RV loans that are souring fast.