Perspective on Risk - Feb. 28, 2023

Inflation; CRE; Resi; FDIC; Crypto; DB/Teal; Model Validation; Management; Brain Teaser

Inflation Paper

The FRBSF has an interesting analysis, Supply- and Demand-Driven PCE Inflation, that looks at the different components of the PCE deflator.

The data isolate the unexpected component of the change in prices and quantities because they are likely to represent a shift in demand or supply rather than longer-run factors such as technological improvements, cost-of-living adjustments to wages, or demographic changes.

Supply-factors appear to be driving inflation as much or more than demand-factors. Monetary policy is generally thought to be less effective at reducing supply-driven inflation than in reducing demand-driven inflation. 1 2

We have suspected that US/China decoupling would be inflationary. Perhaps (and I do not have evidence for this yet) decoupling/reshoring is occurring and new supply bottlenecks are being created.

If the Fed wants to get core PCE back to the 2.5% range, then it looks like they will need to raise rates until there is NO demand-driven inflation.

Commercial Real Estate

I have said on prior Perspectives (and in private email conversations with some of you) that I thought a major risk this time around was that we would see a downturn in commercial real estate, at least echoing what occurred in the 2001 period. We have also discussed what was happening at BREIT. Now we are beginning to see more headlines anecdotally indicating that the carnage has come home.

Anecdotal Headlines

Office Landlord Defaults Are Escalating as Lenders Brace for More Distress (WSJ)

The number of big office landlords defaulting on their loans is on the rise, fresh evidence that more developers believe that remote and hybrid work habits have permanently impaired the office market.

The giant investment manager Brookfield Asset Management recently defaulted on a total of over $750 million in debt for a pair of 52-story towers in Los Angeles, according to a February securities filing. Real-estate firm RXR is in talks with creditors to restructure debt on 61 Broadway, a 34-story tower in Manhattan’s financial district, according to people familiar with the matter. … an investment manager affiliated with Related Cos. and BentallGreenOak is in similar debt-restructuring talks over a $150 million warehouse-to-office conversion project in Long Island City, N.Y.

Five to 10 office towers each month join the list of properties at risk of defaulting because of low occupancy, expiring leases or maturing debt that would have to be refinanced at a higher rate, according to Manus Clancy, senior managing director with data firm Trepp Inc.

Loans backed by office buildings in Philadelphia, Denver and Charlotte, N.C., have also either been transferred to special servicers in recent weeks or have been parts of bond issues that have been downgraded by credit-rating firms.

Brookfield defaults on $784M on loans connected to DTLA office towers (The Real Deal)

Brookfield has defaulted on $784 million worth of loans connected to two of its trophy office towers in Downtown L.A.

The firm defaulted on a $465 million loan package connected to the Gas Company Tower at 555 West 5th Street and $319 million in loans connected to 777 South Figueroa Street, according to an SEC filing on Friday.

“An event of default has occurred” on both loans, a Brookfield subsidiary disclosed, adding “lenders may exercise their remedies,” which include foreclosure.

Pimco-Owned Office Landlord Defaults on $1.7 Billion Mortgage

An office landlord controlled by Pacific Investment Management Co. has defaulted on about $1.7 billion of mortgage notes on seven buildings, a sign of widening pain for the industry as property values fall and rising interest rates squeeze borrowers.

The buildings — in San Francisco, New York, Boston and Jersey City, New Jersey — are owned by Columbia Property Trust, which was acquired in 2021 for $3.9 billion by funds managed by Pimco. The mortgages have floating-rate debt, which led to rising monthly payments as interest rates soared last year.

Fed Minutes

Minutes of the Federal Open Market Committee, January 31–February 1, 2023

In particular, the staff noted that measures of valuations in both residential and commercial property markets remained high, and that the potential for large declines in property prices remained greater than usual.

It should be noted that the defaults observable in the CMBS market remain quite low. From the above WSJ article:

The delinquency rate for office loans that back commercial-mortgage-backed securities remains low, but it is heading higher. The rate last month rose by a quarter of a percentage point to 1.83%, its largest increase since December 2021, according to Trepp.

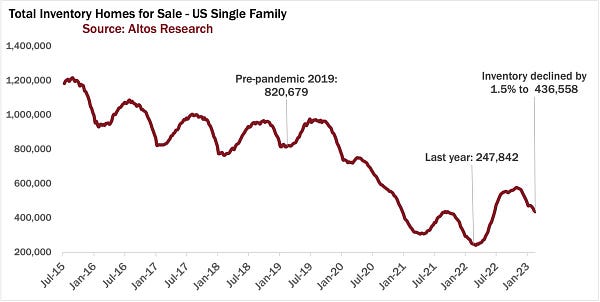

Residential Real Estate

Residential real estate (so far) has remained fairly robust. We’ll see how things develop as we move into the summer selling season.

A February report by Redfin, U.S. Homeowners Have Lost $2.3 Trillion In Value Since June Peak, asserts

The total value of U.S. homes was $45.3 trillion at the end of 2022, down 4.9% ($2.3 trillion) from a record high of $47.7 trillion in June. That’s the largest June-to-December drop in percentage terms since 2008. While the total value of U.S. homes was up 6.5% from a year earlier in December, that’s the smallest year-over-year increase during any month since August 2020. This is according to an analysis of Redfin Estimates on more than 99 million U.S. residential properties.

The total value of San Francisco homes fell 6.7% year over year to $517.5 billion in December (a $37.3 billion decline)—a larger drop in percentage terms than any other major U.S. metropolitan area. Next came two other Bay Area markets: Oakland (-4.5%) and San Jose (-3.2%). Only three other metros saw year-over-year declines: New York (-1%), Seattle (-0.4%) and Boise, ID (-0.3%).

Redfin’s value estimates “use MLS data on recently-sold homes to calculate your property's current market value.”

A Bloomberg article, US Housing Market Posts $2.3 Trillion Drop, Biggest Since 2008, that covers the Redfin report notes:

To be sure, home prices are not collapsing. In December, the total value of US houses was still 6.5% higher than it was a year earlier.

That was especially true in Miami, where the total value of homes ballooned 20% year-over-year to $468.5 billion in December, the largest annual percentage increase among the top metro areas. While the overall US housing market is down, Miami’s market has about the same value as when it peaked at $472 billion in July. Meanwhile, homeowners in North Port-Sarasota, Florida, Knoxville, Tennessee, and Charleston, South Carolina, all saw annual gains above 17% in 2022.

Why is the market still so firm? Mike Simonsen of Altos Research tweets the answer.

In his tweet stream he makes these additional points:

Sellers are reluctant to list. New listings are down 24% from last year.

More potential sellers with low interest rate mortgages are looking to rent out, rather than sell, their homes.

7% mortgages haven’t significantly hit the market yet

Home price appreciation has at least stalled, but is not coming down materially, yet.

Bill McBride provides an interesting data point on how the market is changing. First time ever more "Built-for-Rent" Units started Quarterly than "Built-for-Sale".

FDIC

Top Management and Performance Challenges Facing the Federal Deposit Insurance Corporation (FDIC)

The Office of Inspector General (OIG) presents its annual assessment of the Top Management and Performance Challenges facing the Federal Deposit Insurance Corporation (FDIC).

The FDIC’s Top Challenges include:

Preparing for Crises in the Banking Sector

Mitigating Cybersecurity Risks at Banks and Third Parties

Supervising Risks Posed by Digital Assets

Fostering Financial Inclusion for Underserved Communities

Fortifying IT Security at the FDIC

Managing Changes in the FDIC Workforce

Improving the FDIC’s Collection, Analysis, and Use of Data

Strengthening FDIC Contracting and Supply Chain Management

Implementing Effective Governance at the FDIC

Interesting read for us geeky bank supervisory types.

Crypto & Regulation

This statement is clearly a response to the fact that Silvergate Bank and other crypto-linked banks have been using the FHLB to fund runs.

Matt Levine on DB/Project Teal

The banks regulate themselves, and the regulators do sort of meta-regulation of the banks’ regulatory work. It is more efficient to delegate the regulation to the banks: The banks have bigger budgets, so they can hire more compliance staff, and the compliance staff sit in the same building and probably have better access to the business units than the regulators do. On the other hand they probably have slightly less incentive to be aggressive than the regulators do.

Model Validation

There is no such thing as a validated prediction model

Management

Brain Teaser

Are there more hedge funds or Burger Kings in the world? Answer

Gali and Gertler found monetary policy can be more effective in reducing supply-driven inflation when it has high credibility and acts aggressively.

Gali, J., & Gertler, M. (1999). Inflation dynamics: A structural econometric analysis. Journal of Monetary Economics, 44(2)

Baumeister and Peersman found that monetary policy effectiveness is limited when the shock is large and persistent.

Baumeister, C., & Peersman, G. (2013). The role of time‐varying price elasticities in accounting for volatility changes in the crude oil market. Journal of Applied Econometrics