Perspective on Risk - August 17, 2023

China Troubles; The Wall of Worry; A Digression About Insurance; Macro-Prudential Stress Tests; Some Good Blogs/Substacks I’ve Read

China Troubles

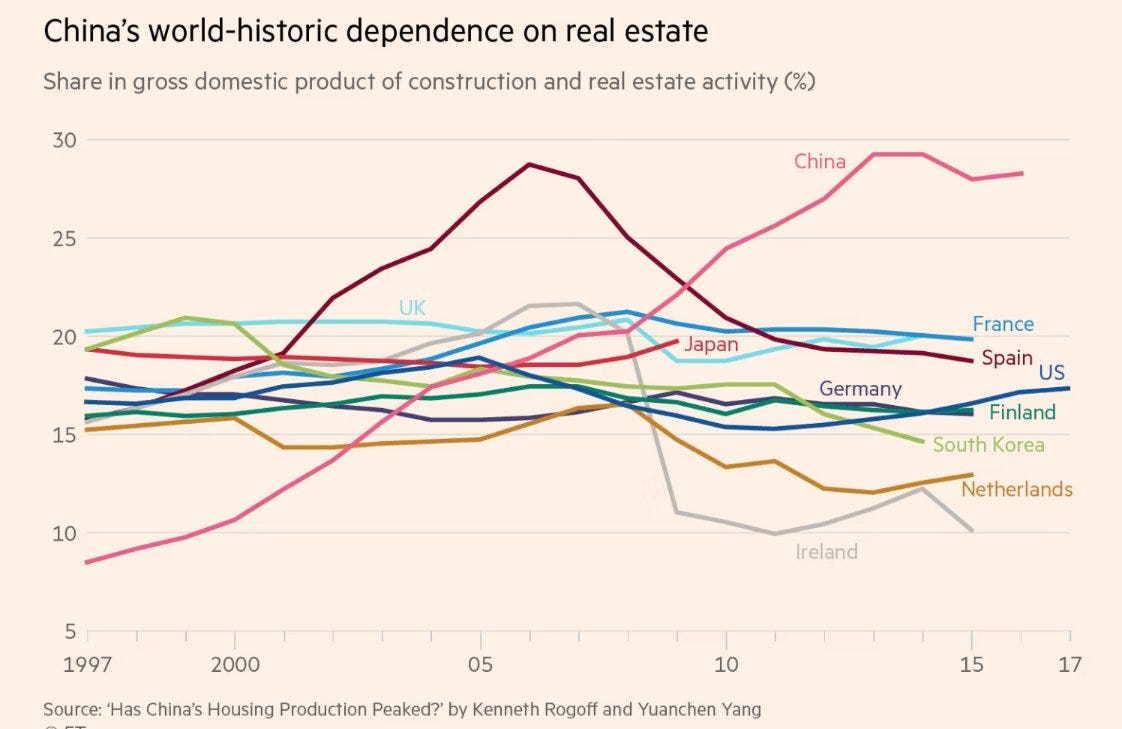

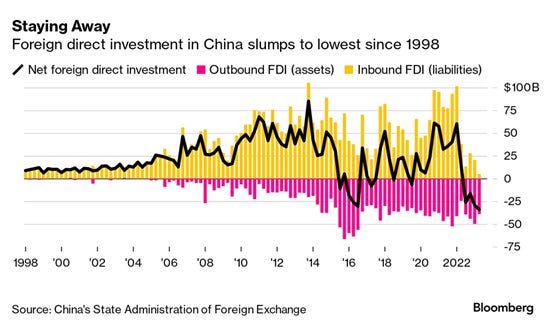

In three graphs

Incredible credit creation since the GFC along with decoupling driven halt to foreign direct investment. After the GFC, China responded with a credit-driven construction boom. As Brad Setzer notes “China became … a construction and export driven economy.”

On precipice of a financial crisis

We’ve heard or read for years about China’s overbuilding and real estate problems. The first to fall was Evergrande. Now Country Garden, the countries #1 private developer is faltering.

Distressed Chinese developer Country Garden Holdings Co. warned about “major uncertainties” in redemption of its bonds, as it said that trading in some of its local notes will remain suspended.

The builder, whose cash crunch threatens even worse impact than defaulted peer China Evergrande Group given it has four times as many projects, made the comments in a filing with the Shanghai stock exchange.

Country Garden, which was previously the nation’s biggest builder, is on the verge of default if it doesn’t make dollar bond interest payments missed earlier this month within a 30-day grace period.

As a result, Zhongrong International Trust has missed repayment obligations on maturing investments. Chinese Trust Companies are non-bank financial institutions that offer investment products. Some will use the scary term ‘shadow banks’ but these are large well-known institutions.

As to contagion to our markets, Blackrock and Allianz reportedly have some exposure to Country Garden.

Bloomberg reports that the major Chinese banks are undercapitalized (by upcoming BIS standards):

China’s big four state-owned banks, which are deemed globally systemically important, face a capital shortfall of as much as 3.7 trillion yuan by 2025 in order to comply with TLAC requirements, according to S&P Global Ratings. Fitch Ratings Inc. sees a smaller gap of 1.3 trillion yuan based on capital positions levels at end of last year.

I don’t anticipate this will spillover materially into 1st world markets, and the CCP has a strong incentive to manage the situation. Foreigners will get screwed relative to domestic participants. Caveat emptor.

The Wall of Worry

The notorious wall of maturities revisited (FT)

Goldman Sachs … economists point out that a lot of companies have taken advantage of the low yield era to issue longer-maturity bonds, with a terming-out refinancing splurge particularly apparent in 2020-21. Goldman Sachs estimates that over the past three decades the duration of corporate debt has roughly doubled. That means the share of corporate bonds — both junk and investment grade — that need to be repaid or refinanced over the coming two years has fallen from 26 per cent in 2007 to 16 per cent today, despite a huge increase in issuance.

However, debt maturities jump from $790bn in 2024 to over $1tn in 2025, and that is when companies are really going to notice the bite of higher rates.1

Are lenders pulling back

New Lending by Mortgage REITs Has Dried Up (WSJ)

Blackstone Mortgage Trust and KKR Real Estate Finance Trust, two of the biggest mortgage real-estate investment trusts, have halted loans to any new borrowers. While these firms continued to provide financing related to existing loans, they didn’t originate any new loans during the first half of this year, according to the companies. Starwood Property Trust, another lender in the sector, has greatly decreased its appetite for new lending in recent quarters, securities filings show.

High-Yield Default Rate to Climb as Pressures Mount, Fitch Says (Bloomberg)

The credit grader expects the high-yield default rate to be as high as 5% by the end of this year, as banks pull back on lending and interest expenses weigh on company profits, according to a Tuesday report. Defaults by issuer count were 2.8% in July, up from 2.6% in June, the report said

Or is it time to buy?

Now Is the Time to Buy Private Equity Secondaries (Institutional Investor)

Asset owners — such as pensions, endowments, and foundations — became forced sellers of private equity stakes to return to their strategic weights.

Another source of forced supply is general partner sellers of PE positions. It may be the end of their fund lives, or sales could be driven by LPs clamoring for capital return, by unattractive M&A and IPO markets, or by an inability to launch a continuation fund. Last, there may be so-called zombie PE funds or firms where a position or vintage went awry, necessitating the unwinding of positions or entire funds, irrespective of the prospects.

A Digression About Insurance

What Is Insurance Telling Us About Climate Change?

Violent US Storms Have Racked Up Heavy Losses for Insurers in 2023 (Bloomberg)

Severe thunderstorms — the kind that come with lightning, hail and sharp changes in temperature — in the US accounted for nearly 70% of all insured global natural catastrophe losses in the first half of 2023, according to an annual midyear report from Swiss Re, the international reinsurance giant.

Total global insured losses from natural catastrophes were about $50 billion from January through June. That’s the second highest since 2011

Thunderstorms have historically trailed hurricanes and earthquakes when it comes to major insurance claims from natural disasters, and therefore are considered secondary perils. But the storms are becoming more frequent due to manmade climate change.

Delving deeper into the Swiss Re report:

a hard-to-revert combination of high value exposure in higher risk environments

Martin Bertogg, Head of Catastrophe Perils at Swiss Re, said: "With severe thunderstorms as the main driver for above-average insured losses in the first half of 2023, this secondary peril becomes one of the dominant global drivers of insured losses. The above‑average losses reaffirm a 5 – 7% annual growth trend in insured losses, driven by a warming climate but even more so, by rapidly growing economic values in urbanized settings, globally.

Jérôme Jean Haegeli, Swiss Re's Group Chief Economist, said: "The effects of climate change can already be seen in certain perils like heatwaves, droughts, floods and extreme precipitation. Besides the impact of climate change, land use planning in more exposed coastal and riverine areas, and urban sprawl into the wilderness, generate a hard-to-revert combination of high value exposure in higher risk environments. Protective measures need to be taken for insurance products to remain economical for such properties at high risk. It is high time to invest in more climate adaption."

As Private Investors Pull Out, The Public Steps In

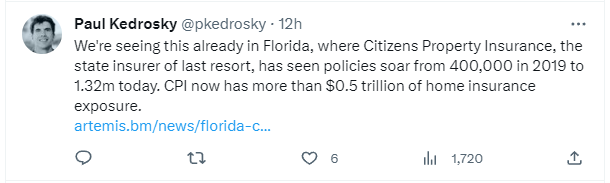

Florida’s ‘Last Resort’ Property Insurer Is Now State’s Biggest (Bloomberg)

As private insurers have folded under the weight of claims for earlier storms or curbed business in the state, Citizens Property Insurance Corp. has become Florida’s biggest property insurer. Since 2020, the number of properties it insures has tripled to almost 1.4 million. Citizens estimates it may add another 300,000 by the end of the year.

Unlike similar groups in other states, Citizens is required by law to charge premiums at below-market rates. Its surplus has dropped by more than a third since 2015 to $4.7 billion, according to its calculations, and its overall claims-paying ability is about $16 billion. To put that in context, Hurricane Ian caused more than $100 billion in damage last year, the highest toll in state history.

More insurers exiting California's home insurance market (PC360)

Berkshire Hathaway’s AmGUARD as well as Falls Lake Fire & Casualty are pulling out of the state’s beleaguered home insurance sector.

This news comes just months after State Farm, Allstate and Farmers Insurance announced they would stop writing new home policies in the state. Additionally, Liberty Mutual recently pulled its business owner policy (BOP) line from the state starting this fall.

While the state’s high natural catastrophe risks have been making for a challenging market, it is not the only force weighing on California insurers. Also driving a large portion of this market turbulence is inflation and its effect on construction material and labor costs, which in turn drive up claims costs and that eventually works out to higher rates.

The state’s insurance regulator has worked to keep premium growth in check. However, the suppression of home insurance rates has made it difficult for insurance companies to collect the necessary premiums to overcome growing losses.

Allstate’s Reinsurance Didn’t Capture This ‘Secondary Peril’

Allstate is a BBB credit now (FT)

Allstate’s 2Q underwriting results (as measured by its “combined ratio”) highlights what can happen when weather and economic conditions turn against property and casualty insurers.

They then quote the S&P release:

The homeowners line of business saw the steepest erosion with the company’s reported combined ratio increasing to 132.3% for the first six months of 2023 from 95.9% for the same period in 2022 with Property-Liability year-to-date catastrophe losses of $4.4 billion, greater than the $3.1 billion loss in all of 2022.

So not only did Allstate swing to a steep loss for the first half of this year in its homeowners’ insurance business, it also saw greater catastrophe losses than it did for all of last year.

It turns out that this year’s inclement weather has been especially bad for insurers rather than reinsurers (at least until last week’s disaster in Hawaii).

Since losses stemmed from a higher frequency of events there were minimal recoveries from reinsurance.

There is a real art to shaping a reinsurance program, and I am certainly no expert. Sounds like Allstate’s program bought coverage for single large storms, but did not have cover for aggregating losses.

Historically, in my mind, climate change was about more severe hurricanes, but as we have seen, it is also about more frequent storm events.

How a Small Group of Firms Changed the Math for Insuring Against Natural Disasters (NY Times)

Reinsurers’ increased prices have accelerated changes in an industry grappling with a new sense of uncertainty. The world is warming; storms are getting more intense; inflation has increased the cost of rebuilding after a disaster; and a global increase in interest rates is making money itself more expensive.

When State Farm announced in May that it would stop accepting new applications for certain policies in California, it cited “a challenging reinsurance market.” Allstate also cited reinsurance costs when it paused some of its activities in California. Last month, reinsurers specializing in agriculture insurance announced that they were pulling out of Iowa, where, three years ago, a severe windstorm caused nearly $4 billion in damage.

Also: NAIC Looks For More Conservative Ratings

Insurance Watchdog Weighs Overriding Credit-Rating Companies (Bloomberg)

The National Association of Insurance Commissioners is gearing up to challenge credit graders by overruling ratings on certain assets bought by insurance companies.

Macro-Prudential Stress Tests

In past Perspectives, I highlighted that the Bank of England was moving towards conducting more holistic stress tests of their financial system. I viewed this as a positive development as policymakers would better understand linkages and behavior in the entire system. It is also consistent with my view that the CCaR-style micro-prudential stress tests have outlived their usefulness, and is consistent with the observation that risks are increasingly outside of the regulated banking sector.

With that in mind, I was pleased to see the BoE issue Macroprudential stress‑test models: a survey

We survey the rapidly developing literature on macroprudential stress‑testing models

Our aim is twofold:

first, to provide a reference guide of the state of the art for those developing such models;

second, to distil insights from this endeavour for policymakers using these models.

In our view, the modelling frontier faces three main challenges:

our understanding of the potential for amplification in sectors of the non-bank financial system during periods of stress,

multi-sectoral models of the non-bank financial system to analyse the behaviour of the overall demand and supply of liquidity under stress and

stress‑testing models that incorporate comprehensive two-way interactions between the financial system and the real economy.

This is a huge piece of work. It provides a comprehensive literature review, discusses different direct and indirect contagion channels, discusses sector-specific stress tests and liquidation strategies, feedback to the real economy, empirical evidence, and different modeling techniques.

The concluding ‘lessons’ are valuable because they focus on the knowledge created by the research and where further effort is needed. These start on page 38.

Some Good Blogs/Substacks I’ve Read

Accounting Form vs. Economic Substance in Banking (uopnfurtheranalysis)

Discusses examples of choosing accounting form over economic substance.

An Analysis of Apple’s Strategy in Banking: Memojis, Marketing & Next Moves (The Financial Brand)

Apple is not a bank. It just offers many of the functions of one.

Federal Reserve Bank of San Francisco Moves to Dismiss PayServices Master Account Case (Bank Reg Blog)

Only for the nerds who like to discuss the requirements for obtaining a Fed Master Account

Risk and Regulation - Learning from the EHR Experience (Risk Musings)

An interesting discussion about the boundaries of “failures of regulation” where a poorly crafted or outdated regulation actually increases risk in the system.