Perspective on Risk - August 15, 2024

Yen Carry Trade; Reserving For Loan Losses; Private Credit; Commercial Real Estate; Secondary Market Liquidity

Back from vacation. Had a nice 12 days in Portugal and on the Spanish Galatian coast. First post back will start with the basics.

Yen Carry Trade

So while I was on vacation I missed the whole, brief Yen carry trade unwind saga. Rather than rehash, let me use this as an example for some junior folks.

The way most non-finance people look at things is idiosyncratic - one stock or market at a time. (“The Dow went down”). With a little more sophistication you begin to think about correlation - sometimes markets move together (“Today was ‘risk-off’ across markets”) or in opposite directions (“bonds and stocks tend to diversify over longer horizons because their returns move in opposite directions.”)

As risk managers of leveraged institutions, we need to think about assets and liabilities as linked, and we need to think through the causality that would cause trouble. Stress tests and scenario analysis are the tools for this.

Hedge funds are typically the marginal determinant of prices in markets. Their standard MO is to find the cheap funding source and pair it with the higher expected return assets. In general, for a very long time (say since 2016 - 2017), this has been to use Yen liabilities (and short volatility positions1) to fund asset positions, recently in big tech (Nvidia, Google, Meta, Amazon, etc) and emerging markets debt.

A few things came together that told the hedge fund community it was time to close out their trades. The asset markets were fully valued, but the catalyst for the unwind was on the liability side. Not only did the Japanese allow short term interest rates to rise, but simultaneously here in the US chatter turned to a US recession and that the Fed was falling behind the curve in lowering rates.

The shrinking spread between US and Japanese short-term interest rates has significant implications for the Yen/$ basis, which is the difference between the interest rate swap in one currency versus the other. A narrowing interest rate spread generally implies that the currency with the decreasing rate (USD) might weaken relative to the currency with the increasing rate (JPY). This anticipated strength in the Yen versus the USD would be reflected in a stronger spot exchange rate and potentially a tightening of the basis.

Anticipating these changes, hedge funds closed out their funding legs and sold the assets this funding was for. There are reports that some HF started unwinding in March, but those that weren’t ahead of things were caught and needed to unwind once things were clearly against them - so we see a correlated move between the Yen/$ exchange rate and the US stock market. Honestly, the reaction so far has been more muted than I expected, which suggests that either an earlier unwind successfully occurred, or there is more to come.

Ironically, much of Wall Street was calling for the Fed to do an emergency rate cut - this would have only exacerbated the Yen/$ basis issue and made the FX move more violent. Ron Insana almost pulls a Cramer here.

For those that like their information in podcast form, OddLots has a nice piece Lots More on Solving the Mystery of the Big Market Selloff (Spotify). For those looking for an academic treatment I’d recommend Carry (Journal of Financial Economics).

Hyun Song Shin on Twitter has a nice big-picture writeup on the market.

Reserving For Loan Losses

When I started in banking and supervision, there was a fair degree of discretion over setting up the ALLL. Over the years, much of the discretion has been replaced by firmer accounting rules. This is probably a good thing, but it does lead to more correlated and procyclical results.

CECL Provides A (Somewhat) Consistent Framework

US banks may (or may not) be bracing for a hard landing (FT)

Anticipated US loan portfolio credit losses have been shooting higher, according to figures from Barclays. Its analysis of 14 US lenders shows a recent increase in their worst-case-scenario loan provision estimates of 33 per cent on average. … Barclays uses data disclosed under the Current Expected Credit Losses framework

… using their own figures, most banks will easily absorb reserve additions as the US economy weakens. Only at Fifth Third Bancorp is capacity stretched to meet the potentially higher reserves

European Banks Are Fooling Themselves

ECB Finds Weaknesses in How Banks Value Commercial Real Estate (Bloomberg)

The euro region’s top financial regulator has warned of widespread issues in how banks value the collateral underpinning tens of billions of commercial real estate loans, highlighting the potential for lenders to underestimate their vulnerability to a property crash.

The European Central Bank has been undertaking on site inspections of banks’ processes since 2018, including asking property valuers for details of how they do their work, and has found “a range of problems in how banks commission or carry out valuations.”

Let’s dive in.

Commercial real estate valuations: insights from on-site inspections (ECB)

Market value is the basis of value specified for immoveable property collateral in the Capital Requirements Regulation (CRR), yet it is frequently misunderstood or wrongly applied.

The inspection teams have frequently found these definitions being misapplied, leading to incorrect reporting figures. Some examples include:

Following a default, some banks interpret market value as being the figure that they would expect to achieve when they are actually in a position to sell, which could take months or even years in the event of disputes with the borrower or adverse possession. ….

The same issue arises with respect to market downturns. … Values have to be based on the market reality at the time, not on a previous date when conditions were more favourable or on what might be hoped for in the future when the market improves.

Some banks adopt what they consider to be a “through-the-cycle” value by reducing the market value at inception if the market is strong. … However, this does not remove the need to monitor actual market values if the market deteriorates over the term of the loan because there are currently no models that can reliably predict future values for a specific property.

Most common shortcomings:

using outdated or inappropriate market data

ignoring current market sentiment and expectations of market participants

accepting valuations based on unrealistic special assumptions

failing to define special assumptions clearly

accepting valuations estimated using inappropriate methods or inappropriate inputs

not ensuring that current market conditions were reflected in inputs to valuations of development projects

insufficient data collection on climate risks and energy efficiency for CRE assets

inadequate inclusion of capital expenditure needed to improve energy efficiency to an acceptable standard

the valuer not checking the extent of the property against the title plans or cadastral maps;

the property being valued as vacant when there were long-term squatters in the property;

significant interior (and even exterior) disrepair not being reported.

insufficient allowance made for risks to collateral value due to time lag and changing occupier requirements, especially for office and retail buildings

use of automated valuation models without sufficient oversight or consideration of abnormalities in portfolio

funding buyers of securitised loans without adequate investigation or understanding of CRE assets in portfolio

Quite a laundry list. Nice job by the ECB.

Private Credit

Private Credit Fund Burned by Risky Bets Is Bleeding Cash (Bloomberg)

Prospect’s investments generated cash flows that were $200 million less than the amount the fund distributed in dividends last year, the biggest shortfall in at least seven years, analysts say. What’s more, the price investors are willing to pay for a stake in the fund, known as Prospect Capital Corp., has plummeted to more than 40% below the value of its underlying assets.

Financing Private Credit (NY Fed Staff Report)

Using data on balance sheets of both financial and nonfinancial sectors of the economy, we use a “demand system” approach to study how lender composition and willingness to provide credit affect the relationship between credit expansions and real activity. A key advantage of jointly modeling the demand for and supply of credit is the ability to evaluate equilibrium elasticities of credit quantities with respect to variables of interest. We document that the sectoral composition of lenders financing a credit expansion is a key determinant for subsequent real activity and crisis probability. We show that banks and nonbanks respond differentially to changes in macroeconomic conditions, with bank credit more sensitive to economic downturns. Our results thus suggest that secular changes in the structure of the financial sector will affect the dynamics of credit boom-bust cycles.

Late cycle financial innovation: Are private credit funds the new MBS CDOs? (Synthetic Assets)

There are then two principle ways that the risk of a private equity downcycle can be transferred to the bagholders.

Concentrate the risk borne by LPs

… the goal is to get the LPs to bear more of the losses, so the challenge is to think of ways to make the risk of the LP’s equity position more concentrated. The solution is to make the LP (and GP) interest subordinate to additional claims on the assets that sit in the PE fund. … This can be done by borrowing at the PE fund level and giving the lender a senior interest in the fund’s assets … a net asset value or NAV loan.

Create a product that packages subordinated debt into ‘cliff risk’

Where can the ‘cliff risk’ of the MBS CDO show up? Private credit funds are the most likely candidate. … A private credit fund can lend directly to a private equity fund in the form of a NAV loan, or it can lend directly to private equity portfolio companies. … private credit funds that focus on lending directly to portfolio companies are likely to end up owning a bundle of subordinated debt obligations.

Recall also that the equity in many of the debtor companies have been used as collateral for NAV loans, so that these debt obligations cannot be treated as independent: one company’s default can have knock on effects on a sister company. Thus, while the private credit funds should perform better than the equity in PE funds, because they hold claims that are senior to the equity, they are also very much at risk of incurring significant losses in the event that bankruptcy rates on private equity portfolio companies are unusually high

Furthermore, the LP interest in the private credit fund is often a subordinated interest, because of borrowing at the fund level. Thus, instead of bearing risk pari passu across all of the assets in the private credit fund, the risk is concentrated as there is a senior creditor with an interest in the fund.

Blackstone has used the assets in its private credit fund, BCRED, to raise money using a collateralized loan obligation (CLO). The credit fund investors then hold the equity interest in the CLO. Thus the LP investors in Blackstone’s BCRED private credit fund now hold an interest in the assets that is subordinated to the other CLO investors. They hold concentrated risk.

Furthermore, if it turns out that a bank has been convinced to fund the super-senior tranche of the BCRED CLO or a similar product, then the analogy with MBS CDO will be complete.

Is the boom in private credit losing steam? (FT)

The history of banking suggests that, on the contrary, another wave of bank disintermediation is likely.

In all, banks’ share of private lending in the US economy has fallen from 60 per cent in 1970 to 35 per cent last year, according to a new National Bureau of Economic Research paper.

What we are seeing is the re-tranching of the banking system where banks parcel the riskiest slice to private credit, providing less risky lending themselves.

They should have credited Steve Kelly for that last line - he’s been saying it for a while now.

Commercial Real Estate

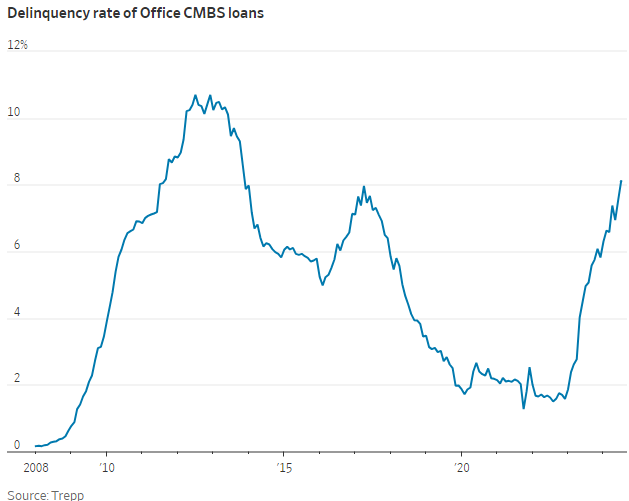

Surge in Commercial-Property Foreclosures Suggests Bottom Is Near (WSJ)

Banks and other lenders are seizing control of distressed commercial properties at the highest rate in nearly a decade, a sign that the sector’s punishing downturn is entering its next phase and approaching a bottom.

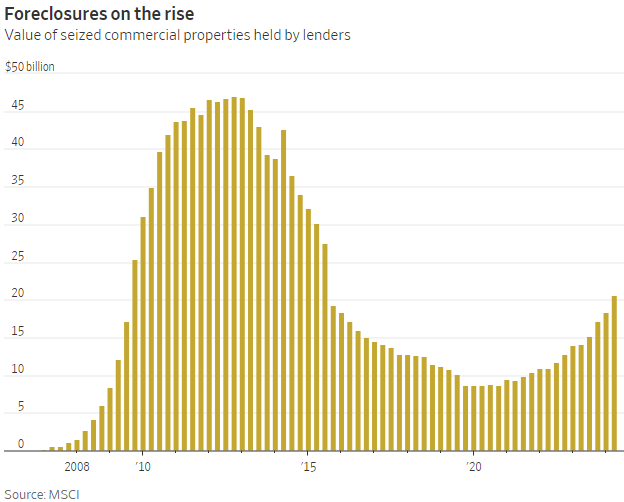

In the second quarter, portfolios of foreclosed and seized office buildings, apartments and other commercial property reached $20.5 billion, according to data provider MSCI. That is a 13% increase from the first quarter and the highest quarterly figure since 2015.

I mean, meh. That really doesn’t sound particularly high. Could have a long way to go.

UBS to Close Legacy Real Estate Fund on Office Market Woes (Bloomberg)

UBS Group AG will liquidate a flagship real estate fund in the latest sign of the turmoil caused by investors pulling money out of slumping commercial real estate markets. … It had over 80% of its 1.9 billion Swiss francs ($2.2 billion) in assets in office properties, and the US and Germany were its biggest markets, according to UBS.

The CS fund paid out 2022 redemptions in April of this year and the process to raise that cash demonstrated “the limited depth of real estate markets,” UBS said, justifying the decision to liquidate.

Secondary Market Liquidity

Back at the start of the GFC, in the six months before Bear Stearns High Grade had its problems, when we spoke with risk managers it wasn’t clear that subprime was their first concern. Many CROs cited balance sheet cloggage as they were stuck with syndications on their books that they couldn’t sell. Don’t sense we are near that yet (and the banks are much better capitalized so a crisis is unlikely), but watch this space

US junk debt investors cautious of leveraged loans as economy slows (Reuters)

A total of six leveraged loans worth $3.3 billion sold last week, which falls well short of the $10 billion weekly average this year and is the worst week for issuance outside the holiday-shortened first week of July, according to PitchBook LCD data.

More

Two more Wirecard executives charged over accounting scandal

Alexander von Knoop, who served as finance chief of the now-defunct online payments company, and Susanne Steidl, its board member for product development, have been charged with several counts of embezzlement, the state prosecutor's office said.

You will note that the VIX blew out as well, with some/many/all of these trades unwinding as well.