Perspective on Risk - April 28, 2024

Pay Incentives; Influence and Control; You're On Notice; Bistro2?; Net Asset Value Loans; BCBS at 50; Concerts & Collaboration

Incentives

Regulators Restart Bid to Curb Bonus Pay on Wall Street (WSJ)

Incentive-compensation rules are required by the 2010 Dodd-Frank law but have yet to be put in place

Banking regulators are planning to revive a proposal that would require big banks to defer compensation for executives and take back more of their bonuses if losses pile up, according to people familiar with the matter.

Officials from the six agencies involved in developing the restrictions, including the Federal Deposit Insurance Corp. and the Office of the Comptroller of the Currency—are pushing to propose the measure in the coming days, the people said. It would likely be substantively similar to a 2016 plan that was never completed.

The new proposal won’t include the Federal Reserve, whose chair Jerome Powell has expressed reluctance to consider the measure this year.

When last proposed in 2016, the rules would have required the biggest financial firms to defer payment of at least half of executives’ bonuses for four years. They also would have established a seven-year clawback period, during which executives would be required to return their bonuses if their actions hurt the institution or if it had to restate financial results.

Fascinating to me. Following the GFC, the NY Fed in particular did a lot of work on compensation incentives. I haven’t seen the proposed rule, so it’s hard to opine on whether the rules would create the proper incentives or not. But it is disheartening to see the Fed abdicate its responsibility here. Incentives are more powerful than constraints.

I remember Bill McDonough (former NY Fed President) making a little noted but controversial speech at Trinity Church following 9-11 when he unexpectedly went off on executive compensation.

I believe there is one issue in particular which requires corrective action. A recent study shows that, 20 years ago, the average chief executive officer of a publicly-traded company made 42 times more than the average production worker. … The same study shows that the average present day CEO makes over 400 times the average employee's income.

Sadly, all too many members of the inner circle of the business elite participated in the over-expansion of executive compensation. It was justified by a claimed identity between the motivation of the executives and shareholder value. It is reasonably clear now that this theory has left a large number of poorer stockholders, especially including employee stockholders, not only unconvinced, but understandably disillusioned and angry.

Influence and Control

The FDIC is worried that asset managers may exert undue influence over banks: FDIC ponders tighter checks on big ‘passive’ investors in US banks (Bloomberg)

The US Federal Deposit Insurance Corporation is working on proposals aimed at ensuring asset managers do not seek too much influence over the banks in which they hold large stakes.

… there appears to be growing bipartisan support for probing investors’ compliance with passivity agreements. BlackRock has 10 per cent or more of the shares in 38 bank holding companies that are supervised by the US Federal Reserve or the Office of the Comptroller of the Currency but which own FDIC-supervised banks; it also has similar-sized stakes in another 70-plus banks in which the FDIC does not have a supervisory role. Vanguard has crossed the 10 per cent threshold in at least one bank that is directly supervised by the FDIC, and it also has stakes of that size in institutions supervised by the OCC and Fed.

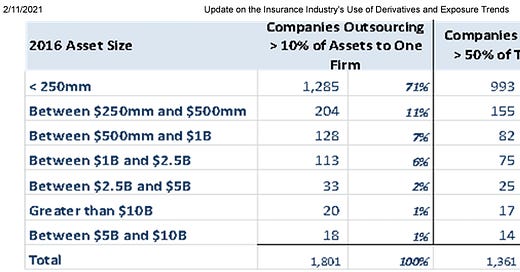

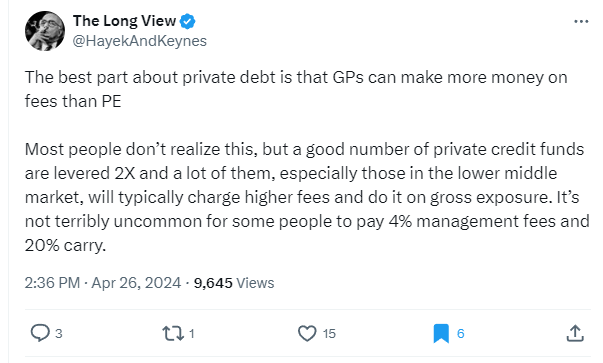

Maybe policymakers are looking at the wrong linkage: they might want to look at asset manager influence over insurers.1 One way to think about private credit is that it is further decoupling the value chain in lending; insurers are becoming the ‘balance sheet’ for asset manager private credit originations.

The NAIC looked at this phenomenon back in 2016 and 2017 when the trend was beginning to pick up speed.2 Perhaps they need to update their studies. Back then, it was predominantly driven by small insurers seeking expertise and access. Now the trend seems to have been reversed, with asset managers increasingly driving the train and the larger insurers becoming more involved.

Private Credit Is Top Choice for Insurers Managing $13 Trillion

Insurers remained aggressively allocating to private credit

Citi’s Fraser Wary of Insurance Giants’ Role in Private Credit

Citigroup Inc. Chief Executive Officer Jane Fraser warned that there’s a risk to the growing number of insurers piling funds into direct lending opportunities.

… She noted many players in the space are using insurance vehicles and the long-term capital they provide to invest in private debt.

As I’ve stated before, this may be a good thing from a financial stability point of view. Matching longer-term debt with private credit eliminates (in this specific case) much of the economic interest rate risk when compared to funding with short-term bank deposits.

“The piece I’ve noticed a lot of late that does worry me is there’s an arbitrage between banking and insurance that is going on,” Fraser said. “We all need to keep an eye on that one.”

“Arbitrage” is a loaded word that is often thrown around. Different capital treatments for identical instruments exist because the perceived risk to the institution is different. If regulatory capital matches the capital the market would independently require, then I don’t believe there is an arbitrage. And this can be different for different institutional types. But to the extent that regulatory capital does not align with economic requirements, then we have an arbitrage opportunity.

You’re On Notice

UK bankers warned of ‘severe losses’ if they fail to monitor private equity exposures

UK banks are leaving themselves open to “severe, unexpected losses”, by failing to properly measure how exposed they are to the $8tn private equity industry, the Bank of England has warned.

In a speech on Tuesday, Rebecca Jackson, a senior executive at the central bank, said there was a “creeping sense of complacency” among lenders, who – despite a boom in loans and financing to the sector – had almost no ability to put together data “or even appreciate its crucial importance”.

Worth clicking through to the Rebecca Jackson letter.

Due to the size and importance of these activities to the banking sector as a whole, and their potential impact on its safety and soundness, the PRA has carried out a thematic review of banks’ risk management practices in this area. As your firm was included in our study and analysis, we are bringing to your attention the findings from our review.

Most recently, we have seen an increase in exposures to various ‘non-traditional’ forms of financing linked to financial sponsors and the PE fund sector in general, such as Net Asset Value (‘NAV’) based loans secured against PE fund assets and facilities backed by Limited Partner (‘LP’) interests. This emerging trend in newer forms of financing has taken place alongside notable structural changes within markets that support banks’ existing and longstanding base of PE related financing businesses. These structural changes include the growth of private credit markets and a degree of consolidation in banks that provide subscription financing credit facilities to PE funds globally.

Then the PRA did what I consider to be a regulatory best-practice - they gave the banks a self-assessment tool in the annex encompassing their risk management expectations.

… your assessment should highlight any gaps between the PRA’s expectations set out in Section C of the Annex below and your internal risk and governance frameworks. Please confirm that you have shared the output of your benchmarking exercise with your Board Risk Committee and provide this analysis, together with your detailed plans to remediate any gaps in your processes to your supervision team by Friday 30 August 2024.

Kudos to the PRA

BISTRO 2

In 1997, heritage J.P. Morgan kickstarted the credit derivatives market in size when they executed the first BISTRO transaction.3 It was a $700mm bond that they used to hedge the credit risk on their balance sheet. Importantly, perhaps critically, this transaction also enabled JPM to free up capital that was trapped supporting low ROI balance sheet positions.

The credit derivatives market morphed for a time into the synthetic trading of single name CDS with all of the problems that came along with it. Glad to see that the market has moved back toward credit hedging and capital relief: JPMorgan Is Talking With Investors About Two Synthetic Risk Transfers (Bloomberg)

JPMorgan Chase & Co. is sounding out investors about a pair of large synthetic risk transfer deals ahead of looming changes to capital rules, according to people with knowledge of the matter.

The biggest US bank is in early discussions with investors for two SRTs that could total about $2 billion in bonds combined … at least one of which will be tied to a portfolio of corporate debt — are expected to hit the market during the fourth quarter of this year...

While European banks have been the biggest users of such transactions in previous years, the largest increase in SRT volumes is now likely to come from Wall Street banks ahead of the so-called Basel III Endgame rules.

The scale of their use will depend on how stringent US supervisors decide those requirements should be. Ahead of their introduction, Wells Fargo & Co. and other lenders are also considering tapping the market later this year.

Now this, of course, is capital arbitrage, and it may be worthwhile or it may be harmful. We’ll see the next time things blow up.

Net Asset Value Loans

The last time we had a PE winter, we saw firms making capital calls on their investors, and constrained investors frequently selling their exposures at deep discounts in the secondary market. The PE sponsors, of course, didn’t like this; nobody likes to tell their investors to take a loss or pony up more money.

So how do I, as a PE sponsor, get around this? Private Equity Firms Are Borrowing Against Their Funds’ Assets

Private equity firms are attempting to get blanket permission to borrow against their funds’ assets — a trend that’s exasperating some investors.

Stone Point Capital … included language in its fund agreement allowing it to borrow against the vehicle’s assets at any time

Private equity’s reliance on NAV loans has exploded in recent years as traditional sources of financing — such as selling portfolio firms or leveraged loans — have become harder to access. Private credit firms are raising funds to offer the loans as banks rein in lending amid a regulatory crackdown in response to last year’s regional bank crisis.

That last sentence is interesting; wonder how much of that is going on?

One of investors’ big concerns is that NAV loans can increase portfolio companies’ exposure to potential weaknesses in other investments. By contrast, when a particular company takes on debt, it’s exposing only itself to default and other risks instead of an entire portfolio of firms.

50th Anniversary of the Basel Committee on Banking Supervision

The BIS held a conference celebrating (?) the BCBS turning 50. I’m sure you’ll all want to watch the full 9 hour Youtube video. But in case you don’t, I thought I would provide a summary of a panel discussion featuring Jane Frazier of Citi, Bill Winters of Standard Chartered, Anil Kashyap of the University of Chicago and Nicholas Véron of Bruegel and the Peterson Institute. This panel discussed (yet again) the lessons learned from recent bank failures and the future challenges facing the banking industry and its supervisors.

Kashyap and Véron disagreed on whether the existing resolution framework worked. Kashyap saw the failure of Credit Suisse as a failure of the framework; Véron defended the existing resolution framework, arguing that it was a policy choice, not a failure of the framework, to pursue a government-sponsored takeover of Credit Suisse. He saw the US regional banking crisis and its handling as a more significant failure.

My comment here would be that BOTH the approach to Credit Suisse and the US regional banks were policy choices, both to some degree worked, and to some degree failed. Systemic spillovers were contained, but policymakers are angry that the right participants weren’t disciplined (either through contingent capital conversion in the CS case, or losses on uninsured depositors in the US case).

Frazier and Winters both focused more on the practical liquidity aspects. Both thought that there was significant stigma concerns about access to liquidity.

Frazier: 'How do you destigmatize the window?' And everyone says, 'As if insolvent—' I don't know how on Earth you do. I—I think there's a piece where we keep saying, 'Well, we've got to—we've got to get rid of the stigma.' I don't think you can."

Winters: "I think what's changed is that the level of confidence in the market that liquidity is available to solvent banks has plummeted... which means that the confidence has to be in place before the bank run; it can't be addressed afterwards."

Winters then advocates something I have been saying:

Winters: For this to work successfully, to me, it's very basic: if we're going to have a fractional reserve banking system … then we have to have liquidity mechanisms in place that provide the confidence ex ante, not ex post.

I'm afraid at the moment that's not in place.

Every central bank … [must] be very explicit: "These are the terms on which I will provide liquidity to banks who have demonstrated solvency." And there will be no questions asked, there will be no hesitation, and there will be no market second-guessing.

IMO, that only happens with ex-ante paid and priced contracting.

When asked to think forward about risks, Frazier and Winters highlighted the following:

Cybersecurity: All panelists agreed that cybersecurity is a major concern, surpassing credit risk in terms of attention and resources. Fraser and Winters called for collaborative efforts between banks and regulators to address this threat.

Geopolitical Risks & Sanctions: The panelists discussed the increasing complexity of sanctions regimes and the potential for unintended consequences, such as pushing illicit activity elsewhere.

Private Credit: The rapid growth of the private credit market raised concerns about potential risks and a lack of transparency. Fraser highlighted the arbitrage between banking and insurance and the need for careful monitoring of this space.

Basel III Endgame & Regulatory Balkanization: The panelists expressed concerns about the inconsistency and complexity of Basel III implementation across different jurisdictions. Winters warned of the potential extinction of global banks due to the lack of harmonization and advocated for a streamlining of the Basel Committee membership.

Concerts & Collaboration

So in the past 8 days I attended two of the better concerts in my life. A week ago last Thursday I attended a Snarky Puppy concert at Kings Theater in Brooklyn (gorgeous if you’ve never been there). This was not a typical Snarky Puppy concert; instead it was a tribute to Susanna Baca, with Snarky performing with four South American Latina singers, Silvana Estrada, Silvia Perez Cruz, Gaby Moreno and Fuensanta.

Then this last Friday I attended Jacob Collier’s concert at Radio City.

Now both of these concerts featured virtuosos at their craft. Snarky Puppy is typically about a 10 person band, but it is more of a collaborative as there have been 40+ different members of the ensemble in their 17 years. As a group, they’ve won five Grammy awards, and in total their members have won over 17. They are known for their highly complex rhythmic structures. The 29 year old Jacob Collier is a musician’s musician, a protégé of Quincy Jones, and has himself won six Grammy’s already. Jacob is known for his use of the chromatic scale.

But what was notable about both concerts was the degree to which these artists were collaborating with their guest performers and bandmates. In Snarky’s case they used their talents to enhance the performance of their guests. In Jacob’s case, he not only let many of his bandmates lead the songs, but his collaboration, as usual extended strongly into “playing the audience.”

For those interested, here is a Youtube link to the Snarky Puppy concert and here is Jacob getting the entire audience harmonizing at an incredible level.

Masters of their craft know how to bring out the best in those they work with.