Perspective on Risk - Apr. 13, 2025 (Critical Trade Theory)

Trump '87; War By Any Other Name; Stagflationary Shock; UST; USD; Triffin World; Superforecasting Tariffs

Critical Trade Theory. Any trade imbalance between two countries is de facto evidence of systemic unfair trade practices.

I have a lot of other things to write about (a new AI/LLM update, a Climate Update, GSEs, insurance developments, some bank regulation stuff), but given the changes underway I feel compelled to keep writing here. Sorry.

Trump, 1987

Some of you might be aware, but Trump took out a full page ad in the NYT in 1987 to espouse his position, which doesn’t appear to have changed over time.

For decades, Japan and other nations have been taking advantage of the United States. … It's time for us to end our vast deficits by making Japan, and others who can afford it, pay. … "Tax" these wealthy nations, not America. End our huge deficits, reduce our taxes, and let America's economy grow unencumbered by the cost of defending those who can easily afford to pay us for the defense of their freedom. Let's not let our great country be laughed at anymore.

Who says Trump isn’t consistent - his policies never change!

Full text in the footnotes1

War By Any Other Name

OK, this is going to sound harsh, speculative, and many of you will disagree with this framing. I’m being very deliberate here in articulating a boundary condition of my thinking. Remember, I’m no fan of the current President.

The US has chosen violence. Tech war, trade war, whatever you want to call it short of a hot shooting war.

In October 2022, during the 20th Party Congress, Xi Jinping called for accelerating the Chinese military's transformation into a "world-class force" by 2027, which aligns with his other rhetoric about unification with Taiwan.

China is entering its demographic “last chance window” before the country’s dependency ratio deteriorates to the point that conflict is not longer feasible. It’s population ages rapidly. Military experts suggest the window is from 2025 to 2035.

The US has tried but been unable to “pivot to China” for several administrations. Trump is making the pivot happen (reshoring industrial base, deescalating with Russia, forcing “allies” to choose sides) in the most painful way possible.

The United States can no longer produce enough antibiotics to treat our sick. If anything ever happened from a war standpoint, we wouldn’t be able to do it.” — Trump on April 2.

The US has chosen violence. China is already in a deflationary spiral. We are using our best weapons (economy and reserve currency status). We are looking to exacerbate the Chinese deflation. Kick them when they are down. Geopolitics trumps economics.

The US has chosen violence.

Trump and Xi Are Preparing for a War Nobody Wants (Bloomberg)

Even after Trump announced a 90-day pause, it’s become clear that the US and China are reshaping the global economy to prepare for a war with each other that neither actually wants. Everyone else on the planet must deal with the fallout, while thinking long and hard about whether to trust either country — or to arm up themselves.

It was now or never for this approach. US economic dominance is shrinking; Asia is growing. If this theory is correct, we probably bomb the hell out of Iran or some other country sometime in the next year to “prove” that we’ve got the backbone to fight.

Of course, this does feel too smart by half (or more), giving Trump credit for being a geopolitical Machiavelli.

A Huge Stagflationary Shock

Part of the problem with being a central banker, bank supervisor, or risk manager, is that generally we weren’t alive the last time major things occurred. Endogenous financial crisis’s happen when history is forgotten and needs to be relearned. That was the case in the GFC, too many had forgotten the lessons of the Great Depression, and that appears to be the case now with tariffs.

The Trump/Bessent/Miran approach is a version of “optimal tariff theory” that was, in part, used to justify the Smoot-Hawley Tariff Act. This theory asserts that a large country (one that can affect world prices through its trade policy) can improve its terms of trade by imposing a tariff.

Miran’s A User’s Guide to Restructuring the Global Trading System is an explicit embrace of optimal trade theory - no nuance here - but there are differences.

In fact, Miran goes further than traditional theory by making currency depreciation in the exporting country (e.g. China) the key mechanism through which the U.S. gains. He repeatedly stresses that tariffs, if paired with currency offset, act as a non-distortionary revenue source. He even argues that marginal deadweight loss from tariffs could be less than that of income or corporate taxes.

The classical “optimal tariff theory” (OTT) mechanism is that tariffs reduces import demand, which in turn lowers the world price leading to improved terms-of-trade. Miran’s mechanism is that tariffs causes currency depreciation abroad, reducing exporters’ real purchasing power and shifting burden to foreign nations.

OTT requires that the tariffing nation be ‘large;’ Miran asserts that the U.S. has unique power as reserve currency issuer and largest consumer market.

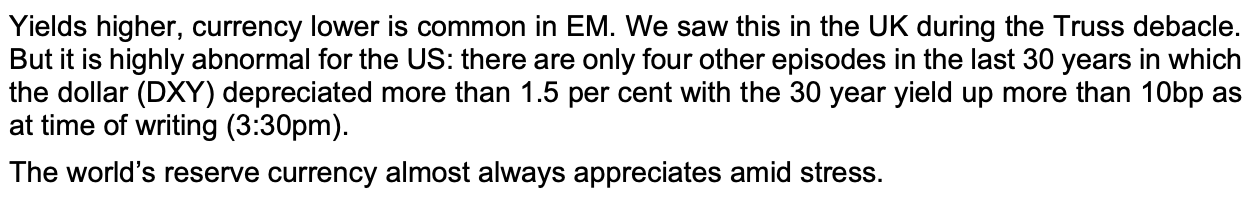

Miran’s approach breaks if tariffed nations do not devalue, the dollar weakens and the Fed cannot remain passive in the face of price shocks.

The central question I have is whether we are making a bad deal with the devil. Are we trading the dollar’s reserve currency status for a resetting of the trade balance. It may be necessary, but this needs more thought.

Who Was Selling UST?

China, or our allies? Most reports (which certainly can be wrong) say it wasn’t China. Japan is frequently mentioned (which would be consistent with the unwind of a portion of the Yen carry trade)

Interesting speculation from Dean Blundell Carney’s Checkmate: How Canada's Quiet Bond Play Forced Trump to Drop Tariffs — it was Mark Carney of Canada. I’m all one for a good conspiracy theory!

While Trump was gearing up his trade war machine, Carney, Canada’s Prime Minister, wasn’t just sitting in Ottawa twiddling his thumbs. He’d been quietly increasing Canada’s holdings of U.S. Treasury bonds—over $350 billion worth by early 2025, part of the $8.53 trillion foreign countries hold in U.S. debt.

Carney didn’t stop there. He took his case to Europe. … The pitch was simple: if Trump went too far with tariffs, Canada wouldn’t just retaliate with duties on American cars or steel. It would start offloading those Treasury bonds. Not a fire sale—nothing so crude. A slow, steady bleed. A signal to the markets that the U.S. dollar’s perch wasn’t so secure.

And here’s the kicker: Canada wasn’t alone. Japan, holding over $1 trillion in U.S. debt, signed on and started to sell those US Treasury bonds which scared Trump shitless. Key EU countries—collectively sitting on another $1.5 trillion—nodded in agreement. This wasn’t a bluff. It was a silent pact.

Always thought those Canadians were sneaky smart (hi Richard!)

If this is true, look for some walk-back from the administration this week.

USD Is Weakening

This is not what Bessent/Miran wants.

(from EvercoreISI)

The EUR is strengthening, indicating that money is flowing back to Europe. But simultaneously, European banks US subsidiaries may be facing the same liquidity pressures that US investors and hedge funds are observing. I don’t have access to the data, but I’ve read reports that cross-currency basis swaps are under pressure. US problems are not just US problems; they quickly become global problems. This raises the possibility of the activation of the Fed’s swap lines with the ECB.

Exclusive: Some European officials weigh if they can rely on Fed for dollars under Trump (Reuters)

Some European central banking and supervisory officials are questioning whether they can still rely on the U.S. Federal Reserve to provide dollar funding in times of market stress, six people familiar with the matter said, casting some doubt over what has been a bedrock of financial stability.

The sources told Reuters they consider it highly unlikely the Fed would not honour its funding backstops — and the U.S. central bank itself has given no signals to suggest that.

I suspect Powell would choose to die on his sword rather than renege on the lines should they be needed, regardless of what the administration may want.

Are We Really In a Triffin World

Remember, a central argument of Miran is that we are living in a Triffin world.

Miran, we're not in Triffin land anymore (CEPR)

The idea that foreign officials are imposing trade deficits on the US is the rationale offered for proposals for the US Treasury to swap century bonds for Treasury notes held by foreign officials (Financial Times 2025b), or to tax their Treasury holdings. Does this rationale hold water?

From 2003 until 2014, the observed flows of goods, services, and finance across the US border gave support to – or at least were consistent with – Miran’s claims …

From 2015 on, things changed. … Global foreign exchange reserves, mostly held in dollars, hardly grew from a local peak of $12 trillion in mid-2014 to the most recent observation of $12.4 trillion at end-2024. 3 Over this period, global reserve managers have concentrated on buying gold, not dollars.

At the peak after the Great Financial Crisis, foreign official holdings reached a share of no less than 40% of the Treasury securities held outside the Fed. … Now the share has fallen to 16%, about the level during the Asian Financial Crisis 27 years ago.

Are we in Triffin land anymore? Certainly not.

If you spend 13 minutes a year on economics, you've wasted 10 minutes. — Peter Lynch

Superforecasters & Tariffs

Regular readers know I value the research Phillip Tetlock and crew have done into improving forecasting. His group of trained “superforcasters” regularly outperforms experts in various industries. So I wondered what they thought about tariffs:

You mean to tell me that the success of my program and my re-election hinges on the Federal Reserve and a bunch of fucking bond traders? — Bill Clinton

Cultural Catchup

Saw two plays recently. Recommend both. Buena Vista Social Club is less ‘great theater’ and more a bangin’ party you are attending. Glengarry Glen Ross with Culkin, Odenkirk and Burr is a short but very funny play. Bill Burr is a great Moss.

And if you’ve had a chance to catch Coachella, there have been some great acts. Dare I say it’s been better than Glastonberry. Green Day with a solid set, Lady Gaga was overtop. Bernie Sanders is getting all the social media for his appearance. Brian May, back after a stroke, joined Benson Boone for a pretty decent version of Bohemian Rhapsody. My favorite so far is a surprise: Marin Morris with the LA Phil turning it into Chuchella. They don’t have official clips up yet on Youtube, so I can’t share these.

To The American People:

For decades, Japan and other nations have been taking advantage of the United States.

The saga continues unabated as we defend the Persian Gulf, an area of only marginal significance to the United States for its oil supplies, but one upon which Japan and others are almost totally dependent. Why are these nations not paying the United States for the human lives and billions of dollars we are losing to protect their interests? Saudi Arabia, a country whose very existence is in the hands of the United States, last week refused to allow us to use their mine sweepers (which are, sadly, far more advanced than ours) to police the Gulf. The world is laughing at America's politicians as we protect ships we don't own, carrying oil we don't need, destined for allies who won't help.

Over the years, the Japanese, unimpeded by the huge costs of defending themselves (as long as the United States will do it for free), have built a strong and vibrant economy with unprecedented surpluses. They have brilliantly managed to maintain a weak yen against a strong dollar. This, coupled with out monumental spending for their, and others, defense, has moved Japan to the forefront of world economies.

Now that the tides are turning and the yen is becoming strong against the dollar, the Japanese are openly complaining and, in typical fashion, our politicians are reacting to these unjustified complaints.

It's time for us to end our vast deficits by making Japan, and others who can afford it, pay. Our world protection is worth hundreds of billions of dollars to these countries, and their stake in their protection is far greater than ours.

Make Japan, Saudi Arabia, and others pay for the protection we extend as allies. Let's help our farmers, our sick, our homeless by taking from some of the greatest profit machines ever created — machines created and nurtured by us. "Tax" these wealthy nations, not America. End our huge deficits, reduce our taxes, and let America's economy grow unencumbered by the cost of defending those who can easily afford to pay us for the defense of their freedom. Let's not let our great country be laughed at anymore.

Sincerely,

Donald J. Trump

Thanks for the shout out Brian. And the compliment . . I think.

Never thought of myself as "sneaky", just discrete.

Blundell forgets that the central bank here is still independent. But then again so much gets done in our federal government through the informal sharing of thoughts. Maybe that's why he interpreted correlation as causation.

Keep up the great work in your substack.

I look forward to reading it every week.

R.