Perspective on Risk - Oct. 14, 2024

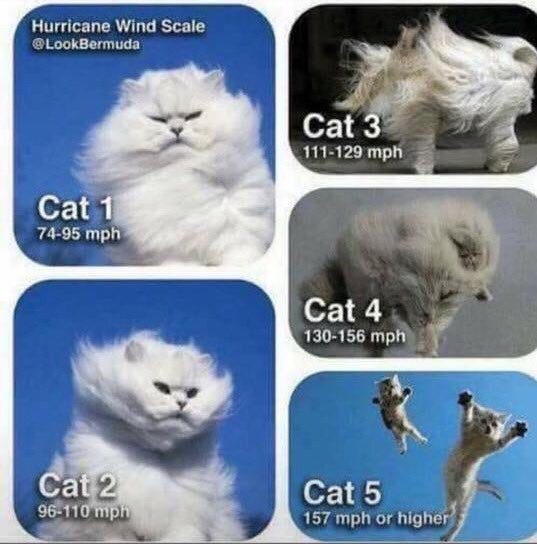

TD Goes Boom; Risk Shifting; Repo Spikes; Private Credit; More Draghi; Cat Five

TD Bank Goes Boom

As part of the plea agreement, TD Bank has agreed to forfeit $452,432,302.00 and pay a criminal fine of $1,434,513,478.40, for a total financial penalty of $1,886,945,780.40. TD Bank has also agreed to retain an independent compliance monitor for three years and to remediate and enhance its AML compliance program.

Federal Reserve: Order to Cease and Desist

OSFI: Statement from the Superintendent of Financial Institutions Regarding Toronto-Dominion Bank

TD Bank Agrees to $3 Billion in Penalties and Growth Restrictions in U.S. Settlement (WSJ)

TD’s U.S. entity also pleaded guilty to criminal charges to resolve a Justice Department investigation.

… the Office of the Comptroller of the Currency, imposed an asset cap barring the bank’s retail business from growing above its current level of assets in the U.S.

The settlement, announced Thursday … included the Justice Department, FinCEN, the OCC and the Federal Reserve. The Justice Department will receive the biggest slice of the penalties, some $1.8 billion, with FinCEN getting $1.3 billion and the OCC taking $450 million.

This is a LANDMARK case, marking a continued, significant escalation in the regulatory approach to money laundering.

This level of criminal admission is more severe than many past cases.

It's the largest bank in U.S. history to plead guilty to BSA program failures.

It's the first U.S. bank to plead guilty to money laundering conspiracy.

The case involves direct employee participation in money laundering schemes.

The bank admitted to failing to monitor 92% of transaction volume from 2018-2024.

It's somewhat comparable to HSBC (2012) willfully failing to maintain an effective AML program and violating sanctions laws, and Wachovia (2010) failing to maintain an effective AML program.

However, TD Bank's guilty plea to money laundering conspiracy is more severe than these cases, making it more akin to Danske Bank (2023), which pleaded guilty to bank fraud conspiracy related to money laundering.

FinCEN’s $1.3 billion part of the overall $3 billion settlement is the largest civil penalty against a bank in Treasury’s history.

TD Bank's case is indeed notable because both TD Bank N.A. and TD Bank US Holding Company pleaded guilty to criminal charges. This is relatively rare for major banks, especially for BSA/AML violations. The guilty pleas, particularly for a conspiracy charge related to money laundering, make this case more severe than many previous BSA/AML enforcement actions against large banks. This also continues the new approach of having the firm plead guilty to criminal charges (something we were hugely scared of doing during my Fed tenure).

What Did TD Do?

The bank's admissions paint a picture of systemic compliance failures spanning nearly a decade. From 2014 to 2023, TD Bank operated with a fundamentally flawed AML program, prioritizing growth and cost containment over regulatory compliance. Most egregiously, the bank failed to monitor 92% of its transaction volume between 2018 and 2024, leaving a staggering $18.3 trillion in activity unscreened for potential illicit activity.

This lax oversight enabled at least three major money laundering operations to move over $670 million through TD Bank accounts. In one scheme, the bank processed more than $470 million in suspicious cash deposits, with employees accepting over $57,000 in gift cards to facilitate the transactions. Another operation saw a high-risk jewelry business transfer $120 million through shell accounts before the bank filed a suspicious activity report. Perhaps most damning, five TD Bank employees actively conspired with money launderers, issuing dozens of ATM cards used to funnel $39 million to Colombia.

Required Remedial Actions

The settlement's remedial actions are comprehensive, reflecting regulators' diminishing patience with AML program deficiencies. TD Bank faces an asset cap, reminiscent of the restrictions placed on Wells Fargo in 2018, and must obtain regulatory approval for new branches, markets, and higher-risk products. The bank is required to overhaul its entire BSA/AML program, conduct a suspicious activity lookback, and establish a dedicated U.S. Remediation Office. Additionally, the bank must relocate its global BSA/AML compliance function to the United States, a move that signals regulators' intent to maintain closer oversight.

The activities here already contributed to the denial of TD’s acquisition of First Horizon, and to TD’s CEO Bharat Masrani stepping down (even if not explicitly stated or required).

A criminal conviction, as in this case, also imposes by law significant restrictions on the firm’s activities. For national banks like TD Bank, N.A., 12 CFR § 5.26(g)(2) states that a bank may not exercise fiduciary powers if the bank, its directors, or its senior executive officers are subject to criminal convictions. There are numerous other restrictions, such as the ability to enter into Golden Parachute contracts or contract to provide services to the US government that may come into affect.

TD had managed to aggregate the 10th largest US banking franchise. Those days are over for half a decade or more. Just ask Wells.

It’s not clear to me whether the OCC identified the concerns and brought them to Fincen and the Southern District, or whether Fincen and DOJ identified the frauds. On the one hand, the Consent Order indicates that the OCC had previously identified concerns with transaction monitoring. On the other hand, given that TD Bank failed to file accurate CTRs and SARs in many instances, it's possible that FinCEN's analysis of the reports they did receive could have flagged discrepancies or suspicious patterns. Finally, there is some possibility of a whistleblower going directly to DOJ.

Risk-Shifting

The NY Fed documents a pretty obvious finding in Payout Restrictions and Bank Risk-Shifting. Probably a tool that should be used with more frequency.

… we show that, when share buybacks are banned and dividends restricted, banks’ equity prices fall while their CDS spreads and bond yields decline. These results indicate that payout restrictions shift risk from debtholders into equityholders. … These results indicate that payout and risk-taking choices are complementary and that regulatory payout restrictions endogenously affect bank risk-shifting incentives.

Anatomy of the Repo Rate Spikes

Anatomy of the Repo Rate Spikes in September 2019 (Journal of Financial Crises)

This is a really good paper for those who want to understand repo market dynamics. Folks new to the space will get a nice understanding of the market, while professionals will gain a glimmer of insight.

This paper … [examines] the potential causes of the dramatic spike in repo rates in mid-September 2019. We conclude that, in large part, the spike resulted from a confluence of factors that, when taken individually, would not have been nearly as disruptive. Our work highlights how a lack of information transmission across repo segments and stickiness in customer-to-dealer markets most likely exacerbated the spike.

We conclude that, in large part, the spike resulted from a confluence of factors—large Treasury issuances, corporate tax deadlines, and an overall lower level of reserves—that, when taken individually, would not have been nearly as disruptive. In addition, we highlight how a lack of information transmission across repo segments and internal frictions within banks most likely exacerbated the spike. These findings are instructive in the context of repo market liquidity, demonstrating how the segmented structure of the market can contribute to its fragility

I particularly like that second highlighted sentence “a lack of information transmission across repo segments and internal frictions within banks most likely exacerbated the spike.” In my experience as a supervisor, information frictions are often the biggest issue.

On 9-11, a critical issue was getting accurate information out of BONY to its customers on their settled trades. With Lehman, settling on a consensus on the size of the whole in their real estate book was critical path. In resolving the GFC, publishing the supervisory stress tests results in a transparent manner both helped supervisory credibility and allowed the market to solve the capitalization issue.

Private Credit

The rush continues

Citigroup, Apollo Join Forces in $25 Billion Private Credit Push (Bloomberg). Apollo plans to double assets by 2029 as it lays down challenge to banks (FT). Apollo’s (214 page (!!)) Investor Day deck is a long and boring read, but some of you may be interested.

Bloomberg has a nice table in Banks Pump Billions More Into Private Credit as Frenzy Grows (Bloomberg).

Relearning Why Banks Exist

Private credit, touted as a revolutionary alternative to traditional banking, is undergoing a significant transformation that challenges its original value propositions. As Steven Kelly astutely observes in Private Credit's Shifting Identity, the sector is slowly undermining the very characteristics that set it apart from conventional finance.

It’s now a well-trodden joke to note that as the crypto markets grew, they relearned every lesson that traditional finance had learned decades and centuries ago—with the ultimate lesson coming with the “runs” and failures in 2022. As private credit hits its own growing pains, it seems to be increasingly understanding why we have to structure banks the way we do.

Initially, private credit promised a haven of stability: limited leverage, matched funding, stable valuations, and exclusivity for sophisticated investors. However, recent developments paint a different picture:

Leverage Creep: Despite claims of conservative practices, private credit funds are increasingly employing complex financing structures to amplify returns, mirroring the leverage seen in traditional banking.

Liquidity Shift: The introduction of "evergreen funds" and "interval funds" signals a move away from locked-up capital, potentially introducing maturity transformation risks reminiscent of banking crises past.

Market Dynamics: The emergence of secondary trading desks for private loans, as evidenced by efforts from JPMorgan, Golub, and Apollo, is bringing market-based volatility to a previously insulated sector.

Retail Rush: Perhaps most tellingly, the industry's push to tap retail investors – exemplified by Apollo and State Street's ETF filing – marks a departure from its institutional roots.

Matt Levine in Private Credit Wants Everyone’s Money (Levine) adds several important dimensions to our storytelling about private credit. As Levine points out, the push for retail access through ETFs ironically reintroduces the very liquidity mismatches that private credit initially sought to avoid. As Levine puts it, with a fair amount of snark:

Modern finance definitely makes it possible to make long-term loans funded by money that can vanish in a day, but I thought private credit had found a way not to do that.

This development, along with the complex partnerships forming between banks and private credit firms, suggests that the sector is not so much replacing traditional finance as it is merging with and transforming it.

Private Credit Credit Quality

Draghi Commentary

The always thoughtful Martin Wolf writes Draghi is trying to save Europe from itself (Wolf in FT)

Today’s world, notes the report, is particularly ill-suited to the EU. The era of dynamic trade and multilateralism is dying. The bloc has lost its most important supplier of cheap energy, Russia. Above all, it is moving into an era of geopolitical conflict in which economic dependencies risk turning into vulnerabilities.

Worse, the EU is entering this new world with many frailties.

What comes out most clearly from this report are the common threads that connect these various ailments. The most important are fragmentation, over-regulation, inappropriate regulation, insufficient spending and undue conservatism. Of these, fragmentation is the most damaging.

… the single market does not truly exist, in terms of outputs or inputs, especially capital. The university sector is fragmented, too, as is public support for R&I. The lack of scale and risk-taking means that US sources of funds are far greater than those of the EU. As a result, “many European entrepreneurs prefer to seek financing from US venture capitalists and scale up in the US market”.

… attention is being paid to Draghi’s measured and sophisticated embrace of more interventionist trade and industrial policies.

[Draghi’s] radical solutions are unlikely to be adopted. As he notes, “successful industrial policies today require strategies that span investment, taxation, education, access to finance, regulation, trade and foreign policy, united behind an agreed strategic goal”. For the EU to achieve this will require radical reforms.

Today’s surging nationalism will make implementing such reforms harder still. Europeans are at risk of forgetting the lessons of their past: only if they act together can they hope to shape their future. The British forgot that. Can the others remember — and act?

EU Builds Team to Avoid Draghi’s Warning of ‘Slow Agony’ Ahead (Bloomberg)

Ursula von der Leyen announced an ambitious restructuring of her European Commission, adopting some of former European Central Bank President Mario Draghi’s proposals aimed at making the bloc more competitive. … Von der Leyen, who is German, announced key roles in the European Union’s executive arm for France, Spain and Italy to lead a fresh industrial strategy aimed at digitalizing the bloc’s economy and making it more climate-friendly at a time of increased rivalry with the US and China.

This reminds me that the reason you hire consultants, Draghi in this case, is to give you air-cover for changes you already plan to implement.