Perspective on Risk - Nov. 6, 2023

Recession; Lagged Effects; FDIC Shuts The Barn Door; When Hedging Is Punting; Griffin On Treasury Basis Trade; Demand For Regulation; The Slippery Slope; US Payments Glitch; Holiday Gifts

Recession Thinking

So there are three indicators worth watching, two of which we have discussed. The Estrella/Mishkin formulation of the Yield Curve Inversion rule, the Conference Board Leading Economic Indicators, and the Sahm Rule. The first two are more leading predictors, the Sahm Rule is more of a coincident confirmation.

The Yield Curve Inversion first occurred in Oct. 2022, and in May 2024 we hit a probability of a recession in the next 12 months of 71% (per NY Fed website). In other words, a strong probability, but not a certainty, that we will have a recession.

The Conference Board LEI is the second measure. The six-month growth rate of the LEI dips into negative territory before slowdowns and recessions, and the six-month diffusion index provides a clearer signal. The six-month growth rate is, and has been, negative, and the Conference Board projects that economic resilience “will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.”

We haven’t discussed the Sahm Rule, named after former Board economist Claudia Sahm. The Sahm Rule “ posits the start of a recession when the three-month moving average of the unemployment rate rises by a half-percentage point or more relative to its low during the previous 12 months.” The Sahm Rule has not yet triggered. A real-time Sahm Rule indicator can be found on the Fred website.

Claudia Sahm has written a tweet stream on the current indicator. Here is what she wrote:

The Sahm rule did not trigger in October 2023. The current value is 0.33 percentage point, which remains below the 0.50 percentage point trigger.

The Sahm rule is: when the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more relative to its low during the previous 12 months, we are in a recession.

Currently, a three-month moving average of the unemployment rate of 4% would trigger the rule. One month at 4% does not cut it.

(Really, truly, the averages matter. It's something to do with all data every month.)

The Sahm rule would have triggered early in every recession since 1970 and not outside or before recessions. It is an indicator, not a forecast. But clearly, rising unemployment is not a good sign. You don’t need a rule for that.

There are times when a 0.33 percentage point (or even larger) increase occurred outside of a recession. Nothing today suggests a recession is inevitable.

The Sahm rule triggers within the early months of a recession, so technically, we could be in a recession, and the rule is catching up. Looking at the totality of data in the past few months, it would be surprising if we were already in a recession.

The Sahm rule is an empirical reality, not a law of nature. It can break in that it triggers, and there is no recession. Up until last year in the US, two consecutive declines in GDP only had occurred within recessions. Not anymore.

I developed the Sahm rule for my proposal to send stimulus checks out automatically when a recession starts, not for forecasting. I've been asked repeatedly about a recession during the past two years. No one has asked me what we do if one arrives and inflation remains high

In closing.

The unemployment rate rising to 3.9% in October is not good news. But the fact that it has been below 4% for almost two years is very good. Let’s not forget that.

Lagged Effects of Tightening

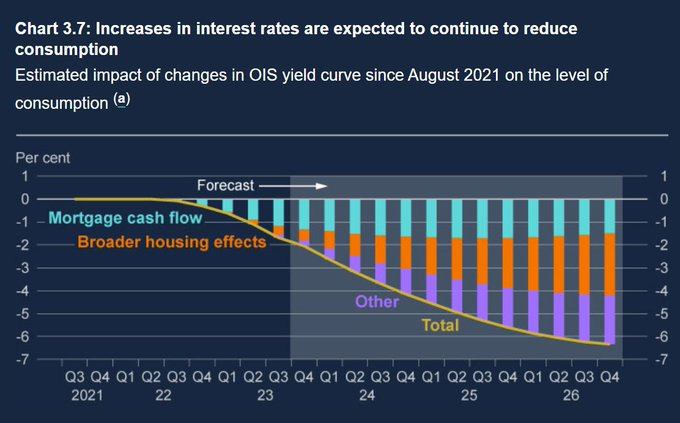

The Bank of England, in their Nov 2024 Monetary Policy Report, displayed this graph highlighted by @RaoulRuparel on Twitter. It focuses on the the effect of higher rates on elements of consumer demand. It is a good illustration of how the economists believe that lags affect demand. The effects of higher rates on housing costs dominates the “other” affects and are typically felt first.

The UK has a floating rate mortgage market, so their ‘mortgage cash flow’ bars probably are more significant than in the US, with our revealed preference for fixed rate debt. It may also mean that our lag will be longer as the ‘broader housing effects’ take longer to kick in. Our housing market hasn’t broken yet,

FDIC Shuts The Barn Door

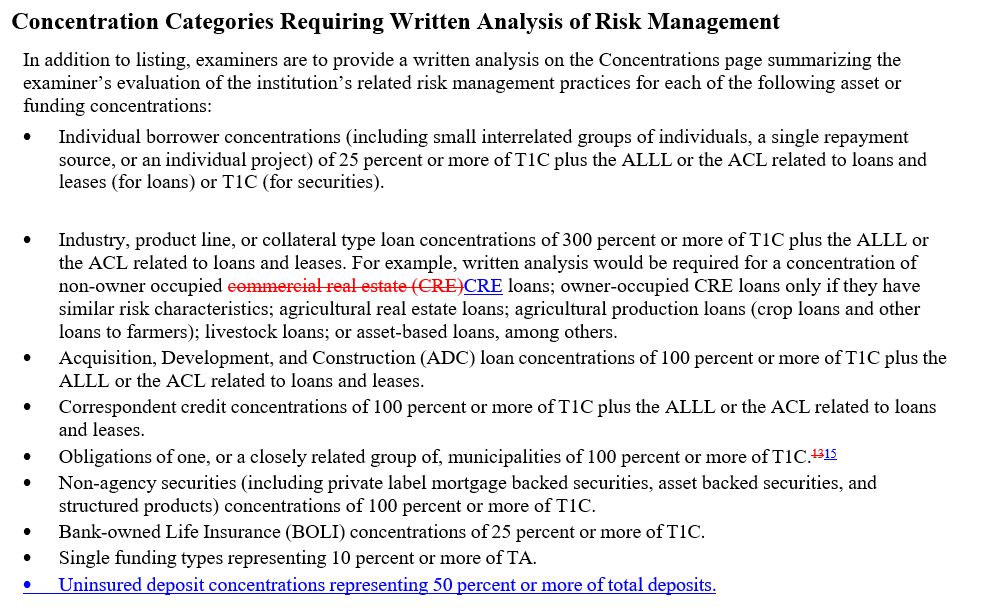

…after all the horses have left. Examiners now have to write up concentrations of uninsured deposits greater than 50% of deposit base. I’m amazed this wasn’t already in the guidance as it was a known risk factor. 50% also seems to be randomly plucked from the air. Hat tip to the Bank Reg Blog.

When Hedging Is Punting

SocGen Takes Hit From Backfiring Hedges (Bloomberg)

During late 2021 and early 2022, the Paris-based bank under then-Chief Executive Officer Frederic Oudea took out protection for its interest income as it expected the European Central Bank to keep interest rates low.

The hedging decision will erase 1.6 billion euros ($1.7 billion) off its topline this year

Umm. Fixed rate payers as a hedge? Maybe by the accounting rules, but it shore sounds like a leveraging punt to me.

Griffin On The Treasury Basis Trade

I’ve written about this quite a bit in past Perspectives. Citadel’s Griffin is now out with commentary in the FT: Citadel’s Ken Griffin warns against hedge fund clampdown to curb basis trade risk.

Regulators that they should focus their attention on banks rather than his industry if they want to reduce risks in the financial system stemming from leveraged bets on US government debt.

Griffin said they should focus on the risk management of banks that enable the trade by lending to hedge funds, rather than try to increase regulation of the hedge funds themselves.

The US Securities and Exchange Commission, which regulates hedge funds, has proposed a new regime for the Treasury market that would treat hedge funds like the broker-dealer arms of banks.

I’ve said before that the regulators have long taken a strong interest in dealer prime broker activities, and I have no reason to believe that is not still the case. However, the insight and perspective from any one prime broker is inadequate to get a complete picture of the risk. The hedge funds have incentive to be opaque on their trades, and to spread their trades across multiple dealers.

Even something as relatively simple as Archegos caught some dealers off-sides. That’s fine as long as it isn’t solvency-threatening. It IS in the public interest for the Fed to have an understanding of the risks of losses and unwinds in the Treasury market. Whether SEC regulatory oversight solves the problem is an entirely different problem; I doubt it does; I think this is much more of a Federal Reserve Primary Dealer oversight issue, or one better solved with instituting single borrower limits or leverage constraints. Understanding the risks involved in these books requires a high level of sophistication/ Let’s remember Meriwether, Scholes and Merton didn’t exactly get it right at LTCM.

He makes a cost/benefit argument that is a canard; this is not a cost/benefit issue but rather a tail risk mitigation approach.

Regulators should focus on the banks instead of requiring every hedge fund that’s going to partake in the Treasury market at any reasonable scale to be a registered broker-dealer,” Griffin said. “This is a much more cost-effective way to address any concerns that the SEC or other regulators in this space might have.”

Robbin Wigglesworth comes to a similar conclusion in Taming the Treasury basis trade

For example, he suggests that if regulators want to reduce the size of Treasury basis trades the best way to do so is through banks that help finance them. That doesn’t seem entirely wrong to us, even if it is obviously self-serving.

the value of saving the US government a few theoretical basis points needs to be stacked up against the very real dangers that a huge Treasury basis trade entails.

We seem to have lost the space between laisse-faire and full regulation. Policymakers need to know what is going on, but it does not need to always come with overbearing regulation.

Demand For Regulation

Regulation for thee, but not for me.

Pimco Sounds Alarm on Under-Regulated Private Credit Markets (Bloomberg)

Risks are building inside the $1.6 trillion private credit market and regulators aren’t doing enough, according to two Pimco executives.

Private credit … poses a risk to investors because it’s under-regulated and lacks transparency, according to Jamie Weinstein, who helps lead Pimco’s $170 billion alternative-investment business and Christian Stracke, Pimco’s president and the global head of the credit research group.

Calls for the market to be more heavily regulated are growing and the dangers of investors not being able to exit their positions in private debt has been highlighted by watchdogs such as the European Union. The majority of investment managers at pension funds, insurance companies, family offices and wealth managers surveyed by Aeon Investments said they planned to increase allocations to private credit in the next year, Bloomberg reported

Umm, no. I don’t see a basis here for regulation. Do your own damn jobs and due diligence. And if you are concerned, don’t increase your allocation to investments lacking transparency.

Don’t be like Sequoia

But it might be good for a prominent policymaker to give a speech that says just this.

Regulation Starts Down The Slippery Slope

Something happens; policymakers tend to over-react; then the cycle of loosening begins again. Looks like the half-life of regulatory concern is 13 years. Not that I’m against this; making policy in the immediate aftermath of a crisis tends to lead to bad policy.

Wall Street Brokerages Near Win in Bid to Ease Post-MF Global Rule on Collateral (Bloomberg)

US regulators are moving to ease some of the restrictions put in place after MF Global Holdings Ltd.’s implosion — a win for brokerages that have for years pushed to unwind them.

The Commodity Futures Trading Commission will propose as soon as this week letting dozens of firms invest the margin they collect from clients in sovereign debt from some G-7 countries, according to people familiar with the matter. The regulator initially proposed restricting the practice in 2010 as a response to the financial crisis.

US Payments Glitch

Wrote previously about Japan having an issue with their payments system. Now it is the US’s turn.

Banking System Glitch Delays 900,000 Payments on a Big Pay Day (WSJ)

A spokesman for The Clearing House said it experienced "a processing issue with a single ACH file" and is "working with impacted financial institutions on the matter."

On November 3, 2023, a processing issue at EPN, the private sector ACH operator, resulted in a number of ACH entries having certain data elements obscured (file dated for November 1, 2023, processed on November 2, 2023, with effective dates from November 2-3). This error was contained in a single interoperator file that was distributed by EPN to its participants during the November 2 6:00 p.m. processing window. These entries contain valid Nacha syntax, but obscured account information and recipient information.

EPN has informed us that these items are not able to be processed by receiving depository financial institutions (RDFIs) because of the obscured data. EPN has instructed its participants to initiate returns, and originating depository financial institutions (ODFIs) will need to be prepared to initiate new items to complete the payments.

EPN stands for Electronic Payments Network, which is a service offered by The Clearing House.

Holiday Gifts For Financial Stability Nerds

Barry Eichengreen exceedingly briefly reviews Two Books on Financial Crises for Foreign Affairs. He covers some of the leading researchers recent books: A Crash Course on Crises: Macroeconomic Concepts for Run-Ups, Collapses, and Recoveries by Brunnermeier and Reis, and Macroeconomics and Financial Crises: Bound Together by Information Dynamics by Gorton and Ordoñez.

Brunnermeier and Reis … explain concepts used to analyze economic and financial crises, such as bubbles, leverage, and contagion. The authors then put these concepts to work, showing how they shed light not just on the 2008–10 and 2010–13 episodes but also on the German banking crisis of 1931, the East Asian financial crisis of 1997–98, and the Argentine crisis of 2001, among others.

Gorton and Ordoñez’s more technical approach focuses on the roles of credit and information in financial turbulence. In contrast to Brunnermeier and Reis, they reject the emphasis on psychological factors in certain interpretations of crises, arguing that credit booms and busts are intrinsic to the operation of market economies.

I hate to admit they I may have to read these books; maybe I’ll get Christmas gifts.