Happy Thanksgiving everyone.

I’m tired of writing about Fed speeches, etc.

And on Nov. 17 we breached the 2°C above pre-industrial levels that presages some pretty horrible climate outcomes. The UN says that current policies point to almost 3°C, and nationally determined contributions only get us down to about 2.3°C. So let’s skip that and let’s take a quick look at where we are in credit.

Credit

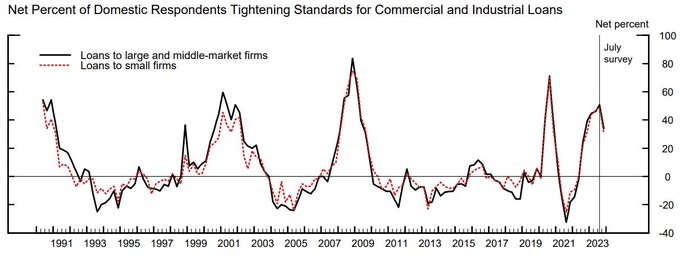

October SLOOS Remains Tight

Bank Credit Is Contracting

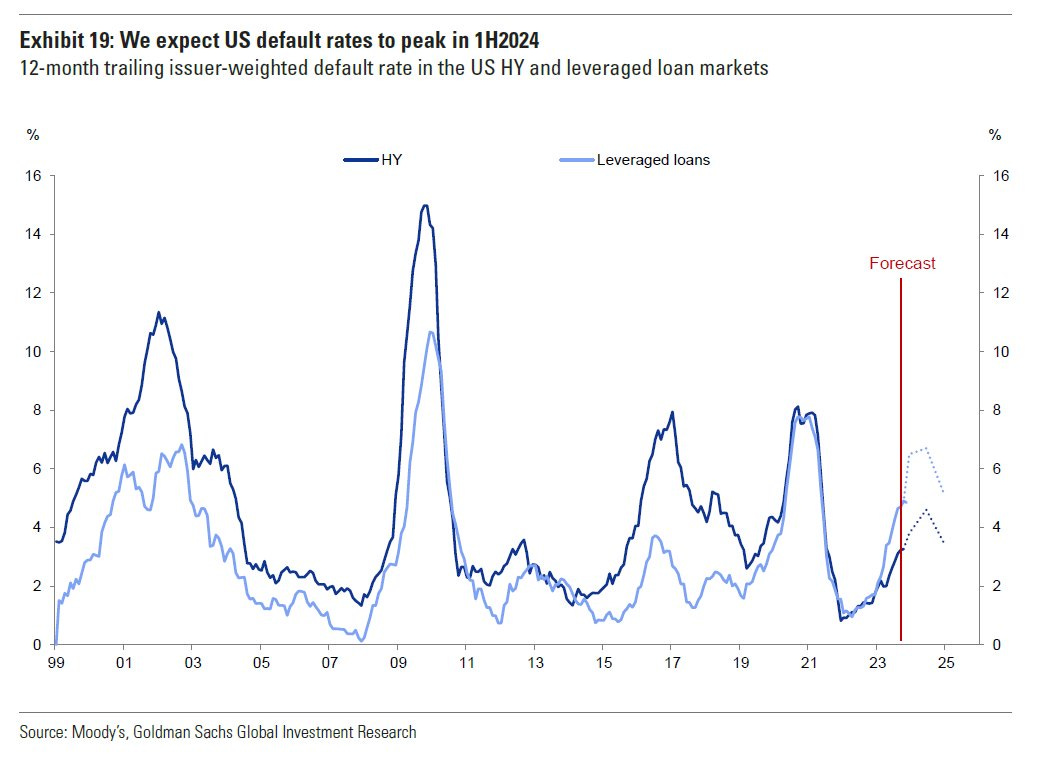

NY and Leverage Loan Default Rates Rising

Commercial Real Estate

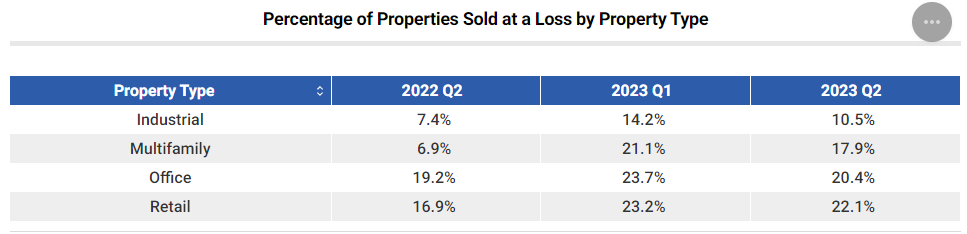

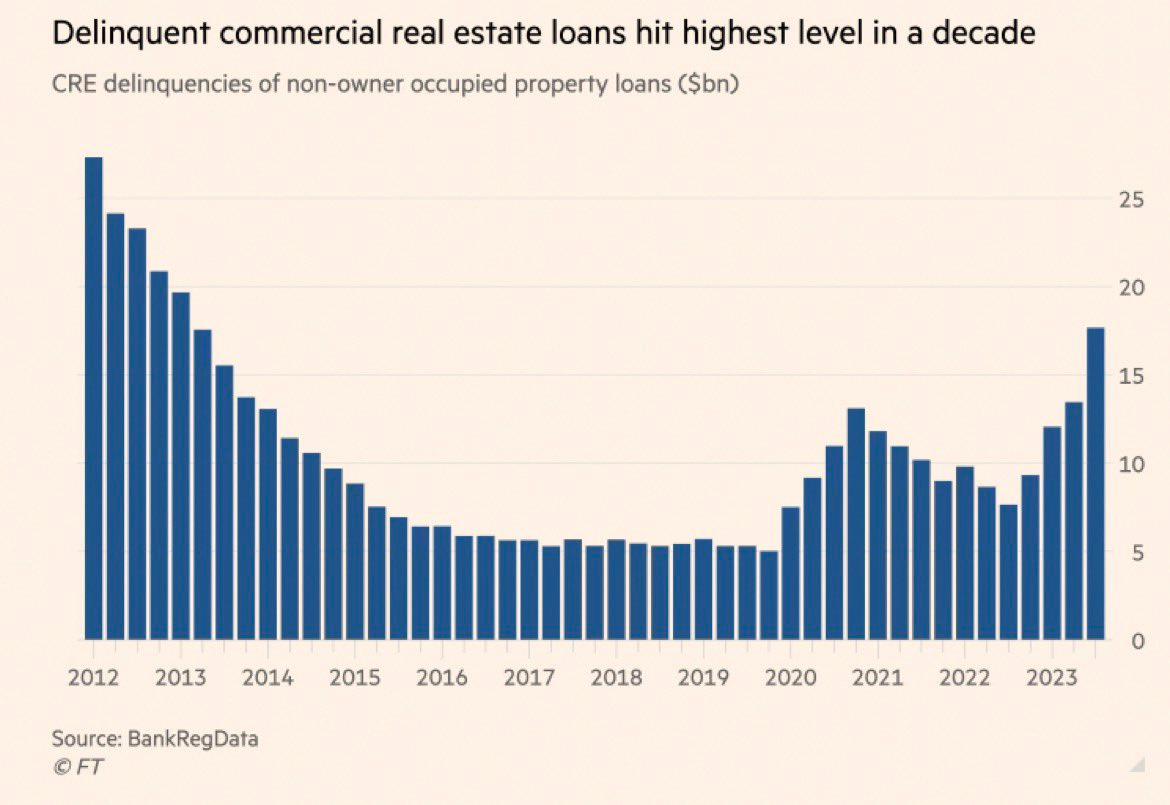

Things seem to be playing out as we expected. Cap rates have risen, prices have fallen, mezz is defaulting, and bank and CMBS foreclosures have begun to rise.

Trepp Property Price Index

Trepp publishes a repeat sales index. It peaked in June 2022, and is down 5.5% since then1. This is a composite index and likely lags price developments.

More than 20% of office and retail are selling at a loss.

Bank CRE Delinquencies Continue to Rise

CMBS Delinquency Has Tripled in Last Year

Office Landlords Can’t Get a Loan Anymore (WSJ)

The office sector’s credit crunch is intensifying. By one measure, it’s now worse than during the 2008-09 global financial crisis.

Only one out of every three securitized office mortgages that expired during the first nine months of 2023 was paid off by the end of September, according to Moody’s Analytics. … That is the smallest share for the first nine months of any year since at least 2008 and well below the nadir reached in 2009, when 47% of these loans got paid off. That share is also well below the rate before the pandemic, when more than eight out of every 10 maturing securitized office mortgages were paid back in some years.

The share of office CMBS loans that are delinquent has tripled over the past year to 5.75%, according to Trepp.

The CMBS Refi Wall Doesn’t Look Too Bad

Special Servicer

40 Wall. IYKYK. Former President Trump’s Office Building in Lower Manhattan Transferred to Special Servicing (CoStar)

Mezzanine is Signaling More Stress To Come

The Clearest Sign Yet That Commercial Real Estate Is in Trouble (WSJ)

[Commercial mortgage foreclosures] an take many months or even years between default and a traditional mortgage foreclosure, as cases inch through courts. … In contrast, foreclosing on mezzanine loans is often quick and easy because they aren’t technically mortgages.

The Journal analysis found [foreclosure] notices for 62 mezzanine loans and other high-risk loans this year through October. That is more than double the number for all of last year, and likely the highest total ever for a single year, as higher interest rates and rising vacancies punish the property sector.

Europe

Commercial property’s debt burden exceeds pre-2008 level in eurozone, warns ECB (FT)

The sharp downturn in eurozone commercial real estate is underlined by the 47 per cent drop in the number of transactions in the sector in the first half of this year, compared with the same period in 2022.

The share of bank loans to lossmaking real estate borrowers is expected to double to 26 per cent, the ECB said. But it warned this could rise to half of all loans if turnover in the sector fell by a fifth and the tighter financing conditions persisted for another two years.

Corporates

Nobody Defaults Anymore: Restructuring

Wall Street’s Favorite Bankruptcy Tactic Gets Loans Repaid in Cash (Bloomberg)

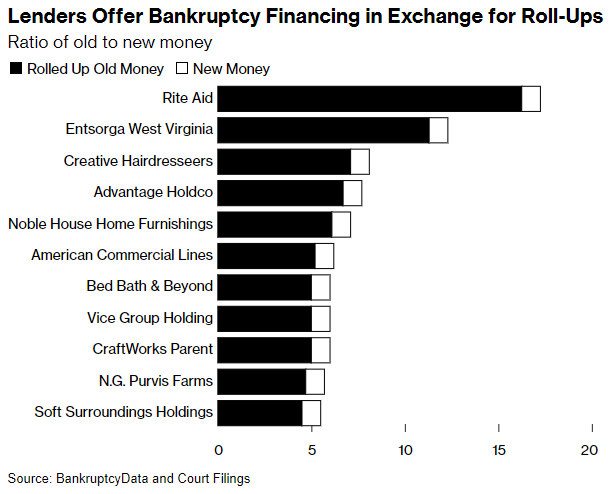

Lenders to bankrupt firms are increasingly demanding the use of a controversial contract clause that bolsters their investments in exchange for giving companies a chance at survival.

Known as a roll-up, the provision moves existing debt to the front of the repayment line in lockstep with newly lent money. Senior lenders often require the maneuver when no one else is willing or able to give a bankrupt company turnaround financing.

Lumen Debt Restructuring Draws Ire From Left-Behind Creditors (Bloomberg)

Banks Get Into Private Credit (lol)

Robin Wigglesworth Brings The Snark: Innovative banks eye hot new opportunity: corporate loans (FT)

In a radical break from their business model of paying fines, lobbying and advising CEOs how to wreck their careers through stupid M&A deals, several banks are looking to break into the hot new phenomenon of lending money to companies.

The likes of Citi, Barclays and Deutsche Bank are following in the footsteps of lending-to-companies-trailblazer JPMorgan, which earlier this year set aside a huge pile of greenbacks for this innovative new business avenue.

Of course, lending to companies is unfamiliar terrain for banks, so most are wisely looking for more experienced partners in the “alternative investment industry”, which have broad and deep contacts across their own buyout funds the business world and a record of treating their counterparties partners fairly. History repeats itself, first as tragedy, second as farce, and third as Citi blowing itself up on the Wall Street fad of the moment. So we’re sure this will end well.

Emerging Markets

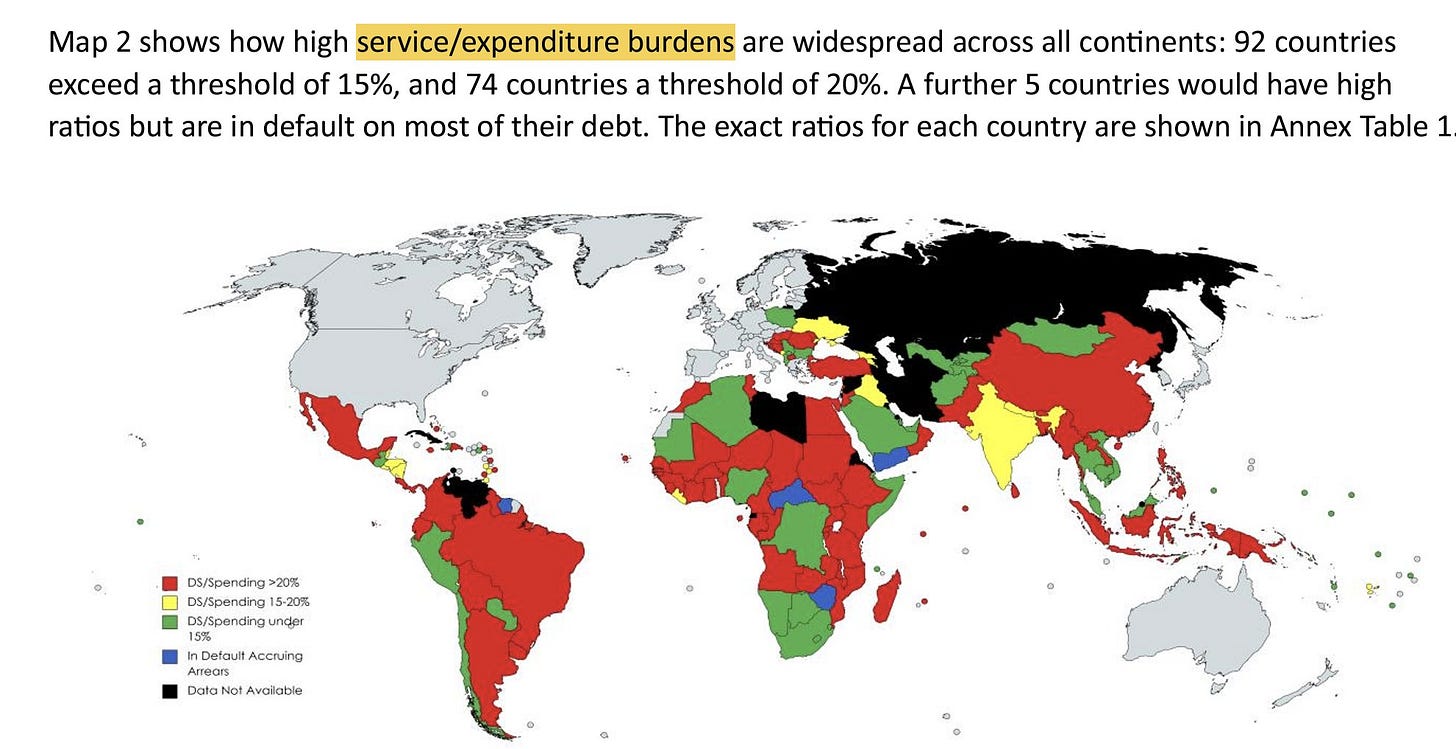

Debt Service Watch: the worst-ever global debt crisis (Policy Commons)

This policy briefing, based on the new Debt Service Watch database, shows that the citizens of the Global South now face the worst debt crisis since global records began. Debt service1 is absorbing an average 38% of budget revenue and 30% of spending across the South, rising to 54% of revenue and 40% of spending in Africa. Spread across all continents, 35 countries are paying more than half of revenue, and 54 over one third. These figures are more than twice the levels faced by low-income countries before HIPC and MDRI debt relief; and slightly higher than those paid by LAC countries before the Brady Plan in the 1980s.

I’m not even going to write about Argentina. Just ask McGinn.

Consumer

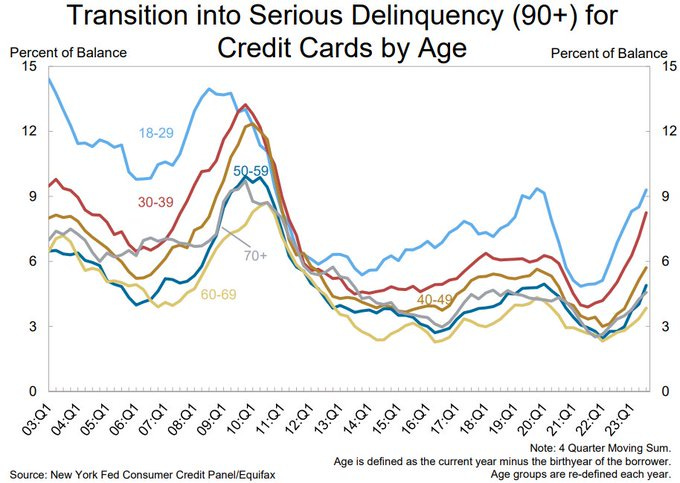

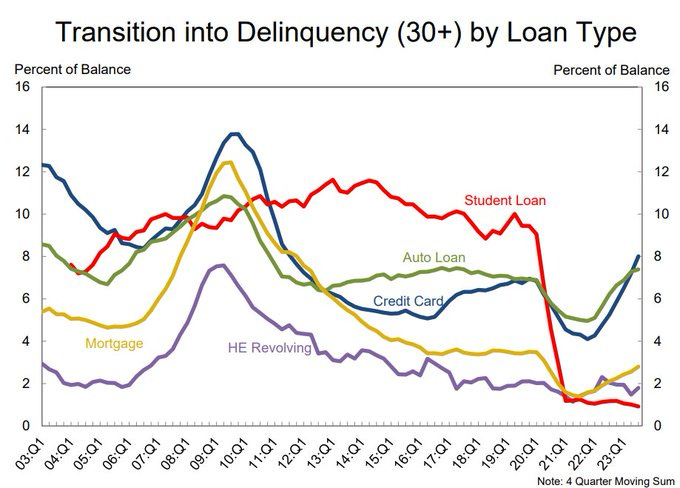

Card Delinquency Rising

Auto Past Due Rising Too (But Still OK)

Finally (as God is my witness)

I thought Turkeys could fly.