Perspective on Risk - Nov. 21, 2024

GAO Review of Supervision; Republic First Bank; EU Capital Req. Lower Than In US; A Stable Financial System, Or Criminal Collusion; Marc Rich’s Old Firm; Follow Up To Turning Pts; A Plug; Watching

GAO Ex-Post Review of Supervision

Following up on the handling and supervision of SVB and other institutions, the GAO conducted an independent review of the three Federal Banking agencies. One might even call this a “horizontal review” ;> This is probably a more honest assessment than any of the agency’s internal reviews published shortly after the events.

Fast Facts

Bank failures in 2023 raised questions about federal regulators' ability to promptly address unsafe banking practices.

For this report, we reviewed documents from 60 institutions, interviewed 109 bank examiners, and more. We found weaknesses in regulators' processes for addressing issues.

For example, Federal Deposit Insurance Corp. examiners told us managers sometimes altered their reports without consultation or documentation, potentially introducing risk of bias.

Also, the Federal Reserve hasn't fully implemented a 2010 law that was designed, in part, to promote early intervention.

Federal Reserve

Relative to Fed supervision, the GAO makes two important points:

Corporate governance and risk management. The Federal Reserve's lack of a regulation or enforceable guidelines under section 39 of the Federal Deposit Insurance Act on corporate governance and risk management issues may have contributed to delays in taking more forceful action against Silicon Valley Bank, which failed in March 2023. Such authority may assist the Federal Reserve in taking early regulatory actions against unsafe banking practices before they compromise a bank's capital.

Early remediation. The Federal Reserve has not finalized a rule required by the Dodd-Frank Wall Street Reform and Consumer Protection Act (with an effective date of January 2012). The rule was intended to promote earlier remediation of issues at financial institutions. Federal Reserve officials stated that other rules accomplish much of what the act intended but acknowledged that substantive items from the act remain unimplemented. By implementing the act's requirements, the Federal Reserve could align its supervisory tools with congressional intent that it take early action before an institution's financial condition deteriorates.

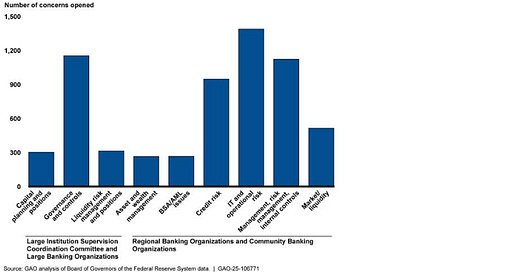

The first point is lame. Much of Fed supervision is predicated on corporate governance and risk management; unless the culture is drastically different in California, or has drastically changed since my days there, this wouldn’t be the reason for a delay. This can clearly be seen in Figure 8 that shows “governance and controls” and “management, risk management and internal controls” as collectively the largest category of findings.

The second point is pretty outrageous, that the Board staff have not promulgated a final rule on a law that is twelve years old. That is dereliction of duty. Guidance directing faster remediation would have a tangible effect; the typical exam report would then report on progress (or the lack thereof).

FDIC

They cited three points with regard to FDIC supervision:

The absence of a centralized system for tracking supervisory recommendations (!!!)

FDIC does not have a formalized process to ensure that large bank examination teams and relevant stakeholders are consulted before making changes or decisions, such as escalation decisions. (!!!)

FDIC does not require large bank case managers to rotate after a few years at one institution.

The lack of a system to track issues is shocking. And on vetting of issues they found:

Examiners from two selected banks cited concerns about managers altering conclusions without consulting the examiners

OCC

Some kudos to the OCC (a rare thing from a former Fed examiner! professional competition and all). From the GAO’s perspective, they were effective at consistently communicating with the institutions, at getting the organizations to close open items, and had solid escalation procedures.

GAO’s Approach

Interestingly, the methodology of the GAO review is probably superior to a typical bank examination. They conducted a stratified statistical sample of organizations, they consulted outside experts, they created checklists and scorecards to benchmark their findings, and they reviewed the statistical performance indicators from each regulator.

Some Other Interesting Observations

There was some interesting information that was not the subject of findings, but should be considered by the agencies.

First off, this table grabbed my attention: it highlights that there is a clear difference in how concerns are conveyed to organizations.

Look at the first three categories; the OCC is consistently more aggressive in classifying things as MRAs and/or moving to enforcement actions than the Fed and the OCC. This is consistent with impressions from my supervisory days. Still a bit shocking to put it on paper, and when you see it this way you understand bank management’s confusion at times. I was always a proponent of the Fed’s approach to minor issues, but seeing this the agencies should at a minimum all get on the same page. It’s embarrassing.

Second, the fact that there is not a common set of supervisory guidance across agencies makes no sense. The fact that the GAO has to look at three different sets of guidance, comment on the guidance, and see if the agencies are each adhering to their own bespoke guidance seems kind of silly.

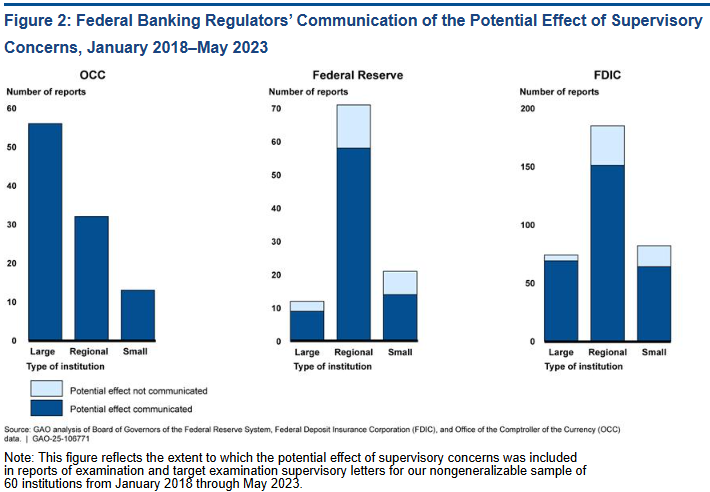

Third, there are some interesting charts in the appendix:

Figure 1 shows that the FDIC did not include supervisory concerns in a large number of their reports.

Figure 2 showed that the Federal Reserve and the FDIC didn’t convey why an area of concern was important, particularly at regional firms.

Figure 3 shows that the Fed was weak at insuring the institutions committed to remediate concerns by a certain date.

Interestingly, despite the Federal Reserve’s more lax requirements, the Fed’s performance in getting findings remediated is slightly superior to the OCC. One would expect considerable overlap in these statistics as the Fed and the OCC might have similar high-level findings at the large national banks.

The proof of the pudding is in its tasting, I gather.

Republic First Bank

Material Loss Review of Republic First Bank (FDIC OIG)

Sikich CPA LLC (Sikich) found that the direct cause of Republic First Bank’s failure was its determination that it could no longer hold its “held-to-maturity” debt securities to maturity, requiring the Bank to reclassify them as “available-for-sale” securities. Because of insufficient liquidity, the Bank then further determined it was “more-likely-than-not” that it would have to sell these securities before the recovery of the amortized cost, thereby requiring the Bank to recognize significant fair value losses in its net income. Once this occurred, the Bank became critically undercapitalized for prompt corrective action (PCA) purposes and was closed by the Pennsylvania Department of Banking and Securities on April 26, 2024. Sikich also determined that the dysfunctional Board and management team was a significant contributing factor to the Bank’s troubled condition, its inability to adjust strategies and address increasing risk, and its eventual failure.

EU Capital Requirements Lower Than In US

ECB split over report showing big EU banks’ capital requirements lower than US rivals (FT)

The European Central Bank is debating whether to publish sensitive research showing capital requirements for big EU lenders would rise by a double-digit percentage if they had the same rules as large Wall Street rivals.

The ECB report, which was completed last year but has never been published, examined what would happen to EU bank capital requirements if they were subjected to current US prudential rules.

The report was compiled to challenge the EU banking industry’s push to show that it already had higher capital levels than its US counterparts, as part of the sector’s lobbying efforts to water down the new rules, which it claims put it at an even bigger disadvantage to American rivals.

One reason EU banks have higher capital ratios is a greater use of their own models, which can be used to downplay the riskiness of their assets. A lower level of these so-called “risk-weighted assets” boosts their relative capital levels.

I’m of two minds here - first, I think everyone is well served if there is a level playing field - this does not lead to institutions in a particular jurisdiction building up concentrations in areas with preferred capital treatment.

But on the other hand, as a Basel II originalist, and with effective supervision, I would prefer to see a financial system where the capital is more directly proportional to the risk, and that is what effective and proper modeling would entail.

A Stable Financial System, Or Criminal Collusion

Archegos Banks That Unwound Bets Face Criminal Antitrust Probe (Bloomberg)

Prosecutors in the Justice Department’s criminal antitrust division have kicked back to life a dormant probe examining how Hwang’s lenders unwound more than $150 billion in bets placed by his family office, Archegos, according to people familiar with the matter.

Since Hwang’s trial, the department’s San Francisco office has made fresh inquiries, zeroing in on emergency talks the banks held in March 2021, where participants floated proposals to coordinate an orderly liquidation of their client’s portfolio to minimize their own losses, the people said.

The DOJ is probing if there was collusion or a conspiracy to collude to control prices in those chats. At least three banks — Credit Suisse, Nomura Holdings Inc. and UBS Group AG – reached a managed liquidation agreement to sell down parts of their Archegos exposure. Others like Goldman Sachs Group Inc., Morgan Stanley and Deutsche Bank AG explored such an agreement before deciding against it.

During the Lehman collapse, the Fed had the banks actively work to tear up contracts and square their books in advance of a formal bankruptcy designation. Was that illegal? Is it only illegal if done without explicit Fed cover? Actually pretty difficult questions.

Marc Rich’s Old Firm Strikes Again

Trafigura Paid Bribes Via ‘Mr. Non-Compliant,’ Swiss Prosecutors Say

Trafigura was accused by Swiss prosecutors of channeling bribes to an Angolan official through a network of former employees, including one nicknamed “Mr. Non-Compliant” by the company’s late founder.

A 150-page indictment released on Monday detailed how the bribes were allegedly paid and for the first time claimed that Trafigura’s late founder and Chief Executive Officer Claude Dauphin was a central participant in the scheme.

Yet another mess at a Swiss trading house. Giving the appearance of a den of iniquity.

Follow Up To Last Week’s Turning Points Post

In last week’s Perspective on Risk - Nov. 14, 2024 (Turning Points) I listed the Collapse of Communism (and the rise of China) as a major Turning Point. If you’ve heard me talk about this in the past, I have typically referred to the 2000 decision to grant China Permanent Normal Trade Relations status as the ringing of the bell.

Now, in November 2024, we may be un-ringing the bell.

Moolenaar Introduces Legislation to Revoke China's Permanent Normal Trade Relations (The Select Committee on the CCP)

Chairman John Moolenaar (R-MI) of the the House Select Committee on the Chinese Communist Party introduced the Restoring Trade Fairness Act today, a bill that would revoke China’s Permanent Normal Trade Relations (PNTR). In 2000, as China prepared to enter the WTO, Congress voted to extend PNTR status to the People’s Republic of China (PRC), hoping that the Chinese Communist Party would liberalize and adopt fair trading practices. … This gamble failed.

A Plug

A former colleague, Guoqiang (GQ) Li from AIG, has written a book Risk, Capital and Value-Based Management. While I haven’t yet read the book, I must say that GQ is highly qualified to write on this subject. If anyone can have war stories in this area, it’s GQ. Perhaps a holiday book for the CFO or CRO in the family!

Order the book now from Riskbooks.com and save 25% with code: RCVAUTHOR25. This discount code is valid until December 14, 2024.

What I’m Watching

Germany!

New era for German debt as swap spread turns negative (IFR)

German 10-year bond yields are trading above euro interest rate swaps for the first time in history, a watershed moment for these markets that underlines just how much investors have soured on government debt.

the prospect of an increase in debt issuance to plug budgetary holes … is coinciding with a buyers' strike from some crucial investors, including the most prominent player in these markets over the past decade: the European Central Bank.

“The Bund/euro swap spread has moved into negative territory because liquidity continues to decline, as the ECB becomes less active in bond markets, while the supply of government bonds looks set to increase significantly in the future,” said Pablo Zaragoza, head of European macro and sovereign strategy at BBVA.

Also, in Bumps in the Autobahn, Howard Davies, former chairman of the UK’s Financial Services Authority, reviews Wolfgang Münchau’s new book Kaput: The End of the German Miracle.

Kaput is about the problems facing Germany … Münchau is very pessimistic about his native land. It can do little right, in his view.

The core of his argument is that the German economic model is broken.

For decades it has been built on engineering excellence driving exports of manufactures, particularly cars and machine tools. Now that Germany’s Asian rivals have enhanced their productivity, that model increasingly depends on access to cheap energy. The Germans placed two large bets to sustain this model.

The Russian bet has now gone south. The Nord Stream pipelines are closed, and unlikely to reopen any time soon, if at all. … The China bet has gone south too. China is now a larger car exporter than Germany.

Furthermore, Germany has fallen behind in new technologies.

[His] overall case is strong: Germany has backed itself into a corner and the numbers confirm that. Growth has stalled and populist parties on the left and right are reaping the whirlwind. The far-right AfD, as recent elections have confirmed, is especially popular in the eastern states.

More Reading

The literature on long-run asset returns has continued to grow steadily, particularly since the start of the new millennium. We survey this expanding body of evidence on historical return premia across the major asset classes-stocks, bonds, and real assets-over the very long run. In addition, we discuss the benefits and pitfalls of these long-run data sets and make suggestions on best practice in compiling and using such data. We report the magnitude of these risk premia over the current and previous two centuries, and we compare estimates from alternative data compilers.