Perspective on Risk - Nov. 11, 2023

Banking Sector Vulnerability; Handling A UST Default; Bowman (Again); Fed Sup & Reg Report; CRE; FHLB; Lots More Good Stuff

NY Fed’s Liberty Street on Banking Sector Vulnerability

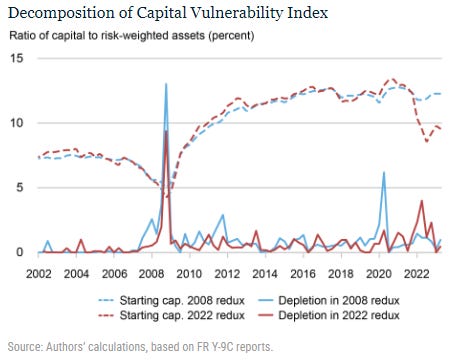

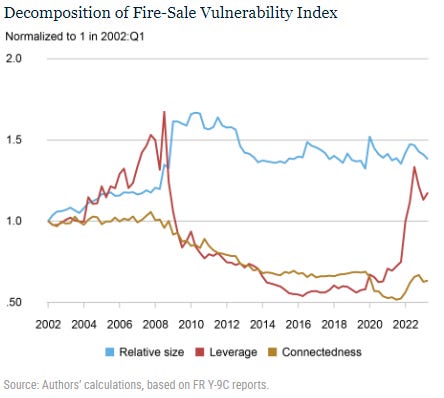

Economists at the NY Fed began in 2018 estimating four variables that correlate to banking sector stress: capital vulnerability, fire-sale risk, liquidity stress and vulnerabilities to runs. Their methodology in the past failed to include unrealized gains and losses on the securities portfolio, and they have improved their methodology to address these weaknesses. They’ve just published their Banking System Vulnerability: 2023 Update (Liberty Street). They conclude:

Our measures, adapted to this recent shock, suggest a moderate increase in systemic vulnerability compared to the low levels of the previous ten years. However, systemic vulnerability still remains below the high levels preceding the 2008 crisis, especially because the largest banks tend to be less exposed to capital shortfalls, fire sales, liquidity mismatches, and run risk compared to smaller institutions.

The Capital Vulnerability Index based on the 2008 crisis is currently at historically low levels, … [however the] Capital Vulnerability Index based on the 2022 scenario is currently still somewhat elevated by recent historical standards. Such vulnerability originates from banks’ exposure to a sudden drop in the value of securities following a hypothetical further increase in interest rates.

While fire-sale vulnerability has retraced some of the spike seen in 2023, it remains elevated compared to the low levels of the past ten years.

We see that the marked increase in the [Liquidity Stress] ratio since early 2022 is driven by a shift from liquid to less-liquid assets and from stable to unstable funding.

We see that the increase in the [Run Vulnerability] index since early 2022 is mainly due to an increase in leverage, but that the other components— unstable funding and illiquid assets—have also increased over this period.

The Liberty Street writeup seems to be underplaying the real increase in leverage that has occurred due to unrealized losses at the largest banks. Not the end of the world, but worth attention.

Handling A UST Default

Nathan Tankus FOIA’s the Fed about a 2011 memo discussed in an FOMC transcript that discussed the Fed’s options for handling a default by the US Treasury: I GOT THE FED TO RELEASE ITS 2011 “TREASURY DEFAULT” PLAYBOOK. HERE’S WHAT IT SAYS AND WHY IT MATTERS. (Notes On The Crisis)

The memo in question, Potential Policy Responses to the Debt Ceiling, was authored by two of the most senior staff at the Fed, Bill English and Brian Sack.

Cutting to the bottom line:

The staff’s recommendation is to make no changes to our current procedures, thereby treating defaulted Treasury securities in these transactions on the same terms that apply to other (non-defaulted) Treasury securities.

This means that the normal functions of outright purchases of Treasury securities, the rollovers of maturing Treasury securities, securities lending activity, repurchase agreements and discount window lending would continue mostly unaffected.

The memo then focuses on areas of potential risk.

The first is pressures on the Bill rate and, especially, repo rates due to technical supply and demand constraints. However, the memo makes clear that the Fed could handle pressures in these markets rather easily.

A second area of risk is the potential for runs on Treasury-only Money Market Funds. The memo recommends considering a Fed lending facility should these pressures arise.

Finally, the memo recommends NOT pursuing two approaches, purchase operations to remove defaulted Treasury securities from the market and outright CUSIP swaps to remove defaulted Treasury securities from the market, as these actions:

would insert the Federal Reserve into a political situation and could raise questions about its independence from debt management issues faced by the Treasury.

Both the memo and Nathan’s writeup make for an interesting read.

Bowman (Again) On Sup & Reg

Remarks on the Economy and Prioritization of Bank Supervision and Regulation

Bowman gives a substantive speech covering the Basel 3 Endgame, CRA, Interchange Fees, the climate guidance, and supervisory priorities. I’ll summarize the comments on the capital proposal and supervisory priorities. Please note that these comments are NOT the consensus opinion within the regulatory community and, in fact, challenge the consensus.

Basel 3 Endgame

A solid critique of the Basel Endgame Proposal. I’m going to quote Bowman, but reformat and rearrange the order of the comments:

It is essential that our actions are driven by data and are specifically designed to address core banking risks or existing shortcomings in our bank regulatory framework.

[The Basel Endgame Proposal] is not designed to address identified regulatory deficiencies and shortcomings and gives insufficient attention to the potential unintended consequences and harm that could result if finalized and implemented in its current form.

In drafting the Basel III capital proposal, it seems clear that the agencies made broad assumptions that the current capital framework is insufficient to support bank and financial market activity.

To begin, the U.S. banking system remains strong and resilient.

The system is much better capitalized than after the 2008 financial crisis, with substantially more liquidity.

The current level of capital in the U.S. banking system is a strength, not a weakness, which is complemented by liquidity regulations and other prudential requirements that have contributed to the resilience of U.S. banks.

U.S. banks are also subject to a range of new supervisory tools that did not exist prior to 2008.

On a simplistic level, higher capital levels make the banking system safer

The complete elimination of risk would transform a bank into a public utility. Assuming this is not the desired end state… we must evaluate … the balance between these benefits and the resulting costs.

[In] the aggregate, those costs—including the direct costs experienced by banks, and the indirect costs experienced by bank customers and the U.S. economy—would be substantial.

Ultimately, bank customers will bear the cost of these increases.

I will note several areas that will be necessary to address:

The proposal does not include an analysis of the appropriate aggregate level of capital requirements.

The revisions to the market risk rule alone … are significant, with broad-based impacts

A "dual-stack" capital calculation … will add complexity to the capital calculation for all firms… and likely resulting in costs that outweigh the benefits of this provision.

The proposal adopts a punitive treatment for noninterest and fee-based income …[that] can deter banks from diversifying revenue streams

The proposal does not address or propose changes to leverage requirements… Treasury market intermediation can be disrupted by constraints imposed by the eSLR, as occurred during the early days of market stress during the pandemic. It seems prudent to address this known leverage rule constraint before future stresses emerge that would likely disrupt market functioning.

In this proposal, the calibration … far exceeds the Basel standards mandate … [and] is driven by deliberate policy choices to significantly increase capital requirements for U.S. banks over $100 billion, even for those that are not internationally active.

This last point is important. I have always characterized the Basel capital proposal as an agreement between banking organizations, negotiated through their national supervisors. Most banks would prefer to have some advantage in their capital rules for their national markets, but at a minimum seek to have a level playing field.

Prioritization of Regulation and Supervision

[It] is essential that regulators appropriately calibrate and prioritize their supervisory and regulatory actions. Failing to do so could distract banks, bank management, supervisors, and regulators from focusing on key risks.

[The] primary focus of supervision should be to address a bank's critical shortcomings in a timely way. To effectively support a well-functioning and stable banking system, bank supervision must not simply pinpoint compliance issues, failed processes, or rule violations. Instead, bank supervision must focus on a bank's risk exposures

We have seen several complex and lengthy proposals, rules, and guidance that do not relate to core banking risks and many other regulatory actions that do not appear to be designed to address shortcomings in our existing bank regulatory framework.

We have seen a significant number of regulatory and guidance changes this year compressed into a very short time frame. These changes do not appear to be prioritized based on known shortcomings or deficiencies in our existing regulatory framework. Several of the rules I just discussed demonstrate that we have missed the mark on prioritizing our regulatory agenda. Instead, some of our actions could distract bank management from focusing on important and key risks.

Finally, regulatory reform can also pose significant financial stability risks. The cumulative effects of recent proposed and final rules remain to be seen, but these significant regulatory changes could present ongoing risks to the health of certain institutions and the U.S. banking system.

Federal Reserve Sup & Reg Report

By even the low bar set for regulatory reports, the Federal Reserve Nov. 2023 Supervision and Regulation Report is awfully boring reading. Most of it can be ignored, seriously.

Current Supervisory Priorities

Doesn’t really tell you much. Examiners should be in the institutions insuring that the ratings and loan loss reserves are current and accurate.

The Federal Reserve is also monitoring for potential credit deterioration, particularly within the consumer and commercial real estate (CRE) lending segments. Additionally, the Federal Reserve has implemented a new novel bank supervision program to improve oversight of banks engaged in nontraditional and financial technology-related activities.

During 2023, the Federal Reserve intensified examination efforts on assessing banks’ preparedness for managing liquidity, interest rate, and credit risks. In addition, supervisors initiated continuous monitoring for a small number of firms with a risk profile that could result in funding pressures for the firm.

In August, the Federal Reserve established a Novel Activities Supervision Program … [that] focuses on novel activities related to crypto-assets, distributed ledger technology, and complex, technology-driven partnerships with nonbanks to deliver financial services to customers.

Kinda late on this stuff folks. I imagine a large part of the liquidity review’ was making sure the banks had good Discount Window posting procedures.

Ratings of the Biggest Banks

Only half of the Large Financial Institutions are rated fully satisfactory. But talk about not being clear: is this the 8 domestic LFIs? Or does it include the Large Foreign Banking Organizations? I presume this is based upon a count of organizations and not total assets (but it is not clear).

Outstanding supervisory findings at large financial institutions have increased over the last year (figure 12). Governance and controls findings represent approximately two-thirds of outstanding issues (figure 13). More recently, matters requiring attention related to liquidity and interest rate risk management have increased. This stems from the effects of higher interest rates on the market value of banking organizations’ asset holdings, particularly investment securities. Because unrealized losses diminish the ability of banks to sell securities to meet liquidity needs without incurring losses, these unrealized losses can increase liquidity risks and require closer management of contingency funding arrangements.

So, interestingly, the supervisors appear to be looking at the large unrealized losses at BAC and others as a “liquidity and interest rate risk management” issue, and not as a capital deficiency.

And in contrast to the stated desire to focus more on risks, the focus of exam findings continues to be on “governance and controls.”

Examiners conducted (past tense) horizontal reviews (these are reviews that look at the same topics across a number of institutions) on:

interest rate risk management

CRE practices

Ang going forward, the examiners are going to focus on … everything. Well almost everything: I didn’t see anything about stress tests!

Commercial Real Estate

Delinquencies are starting to pile up.

Overdue commercial property loans hit 10-year high at US banks (FT)

The volume of past-due loans in which owners of properties rented to others have missed more than one payment jumped 30 per cent, or $4bn, to $17.7bn in the three months to the end of September, according to industry tracker BankRegData. The figure had risen by $10bn in a year.

Bank lending remains in historically good shape and even after the recent jump, just 1.5 per cent of commercial property loans were past due.

Federal Reserve Nov. 2023 Supervision and Regulation Report

FHLB

I’ve written about the FHLBs numerous times before. In addition to their normal role of providing funding to promote housing, certain FHLBs have become crucial sources of liquidity for banks facing distress. In this way, the banks avoid the stigma and publicity of borrowing from the Fed’s Discount Window.

I’ve stated that they should be designated as a systemic institution by the FSOC and subject to enhanced Fed oversight, and their super-priority lien status should be removed.

Now, policymakers have begun to raise questions as well. In this case, the Federal Housing Finance Agency, the FHLB’s supervisor, has published FHLBank System at 100: Focusing on the Future.

FHFA undertook detailed analysis to form a vision for the FHLBanks’ future that will allow them to advance their mission in a safe and sound manner.

Clarifying the mission of the FHLBanks and updating how FHFA evaluates their performance in achieving that mission is a central theme of the initiative. Over the 90 years of the System’s existence, its membership base, the types of collateral that can be pledged for advances, and the FHLBanks’ product offerings have expanded. As these shifts have occurred, the connection of the FHLBank System to housing and community development has become less direct.

[In] March 2023, … because of banking sector volatility and the failure of several regional banks, … [the FHLBs] provided a record volume of advances to ensure their members had access to liquidity in an uncertain market. These bank failures and the ongoing market stress highlighted the need for a clearer distinction between the appropriate role of the FHLBanks ... and that of the Federal Reserve.

FHFA can implement some of the recommendations through ongoing supervision, as well as rulemaking or guidance, under existing statutory authorities. However, there are some recommendations that can only be fully implemented through Congressional action.

There is a litany of “good governance” recommendations, but the proposed changes are at the margin. The most significant is that the FHFA will propose a rule to force many banks to hold 10% of their assets in mortgage loans to maintain access to the system.

The importance is not the substance of the recommendations, but that the report was issued at all. But the chances of a MATERIAL change to the FHLB status at this time is low; if the concern and process of reigning in FNMA and FHLMC are any indication, it will take a decade or two of such studies before action is taken.

And despite my desire to see the status change, one always needs to be reminded on Chesterton’s Fence.

Addendum:

The role of the FHLBs in liquidity provision can be seen in this graph from the report:

During the week beginning March 13, 2023, the FHLBanks funded $675.6 billion in advances, the largest one-week advance volume in FHLBank System history. While the FHLBank advances helped many members withstand market stress, Silvergate Bank (an active borrower) voluntarily dissolved in the prior week. Shortly thereafter, Silicon Valley Bank and Signature Bank failed after actively borrowing from their respective FHLBanks. First Republic Bank, another member, failed approximately seven weeks later. As shown in Figure 11, these four entities increased their borrowings from their FHLBanks starting in late 2022. Th

More Things That May Interest You

Dissecting Gensler’s Treasury speech (Alphaville)

The dissect the Gary Gensler speech that prompted the Ken Griffin commentary we discussed in the last Perspectives, covering in more detail his comments on the Registration of Dealers, the Registration of Trading Platforms, Central Clearing and Data Collection.

The Basis For the Treasury Basis Trade: Leverage Laundering? (Streetwise Professor)

Describes why the Treasury basis trade has grown large, and the linkage to traditional asset management

FSOC vs shadow banks (Alphaville)

AV covers “new analytic framework for financial stability risks and updated guidance on the Council’s nonbank financial company determinations process.” In a reversal of what occurred under the Trump administration “In plain(ish) English, FSOC is once again opening the door for designating non-banks — primarily giant insurance groups, asset managers, private capital firms and hedge funds — as “systemically important”, and therefore subject to more stringent inspection and regulation.”

Why My Recession Rule Could Go Wrong This Time (Bloomberg)

Claudia writes up for Bloomberg the tweet stream we covered in the last Perspective.

@donnelly_brent crafted a Sahm Rule using Initial Claims >30% above lowest weekly reading in the past 12 months

Signature Loan Sale Likely to Lower Commercial-Property Values (WSJ)

The Federal Deposit Insurance Corp. is auctioning off thousands of Signature loans backed by apartment buildings and other commercial properties primarily in the New York region. Loans are expected to sell on average 15% to 40% below their original face amount, according to prospective bidders.

LCR Premium in the Federal Funds Market (Fed Board)

We document the existence of a regulatory premium in the federal funds market related to the implementation of the Liquidity Coverage Ratio (LCR). We find that, after the implementation of LCR, daily reporters paid a higher rate compared to other banks when borrowing in the fed funds market.

NBER Call For Papers: Financial Market Frictions and Systemic Risks

This could be a very interesting conference. I’ve circulated this already to a few of you, but perhaps others may want to contribute.

Woah! This: "Powell and most of his colleagues reluctantly endorsed buying defaulted Treasury securities — an unprecedented move to maintain financial stability — if a legislative debt ceiling solution did not come in time."

How was your vacation in Spain?