Perspective on Risk - Nov. 1, 2023

Credit Conditions; Recession; Quasi-Fiscal Monetary Operations; Barr v Bowman; Blockchain In Real Use; Fed Funds; Research; Jobs

Credit Conditions

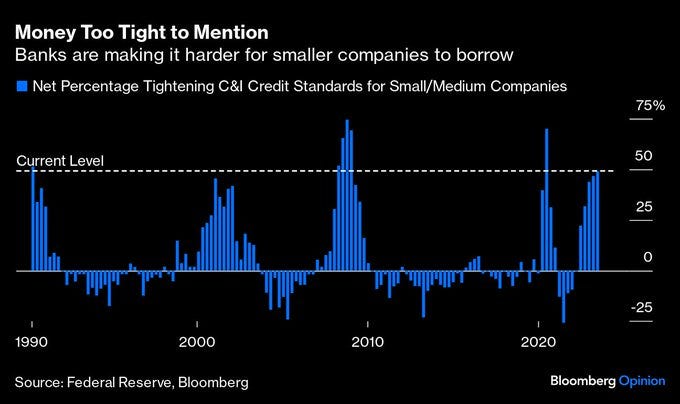

I mentioned in the last Perspective that it seemed credit conditions were tightening. Came across this nice graphical representation (graphing the small/medium company data):

Bloomberg drew the line at 50%, but I went back and looked at 45% to bring in the 2000s. In each case, the signal either immediately proceeded a recession (2Q’90, 1Q’02) or occurred soon after the retroactively declared date of the recession (2Q’08, 3Q’20).

Recession

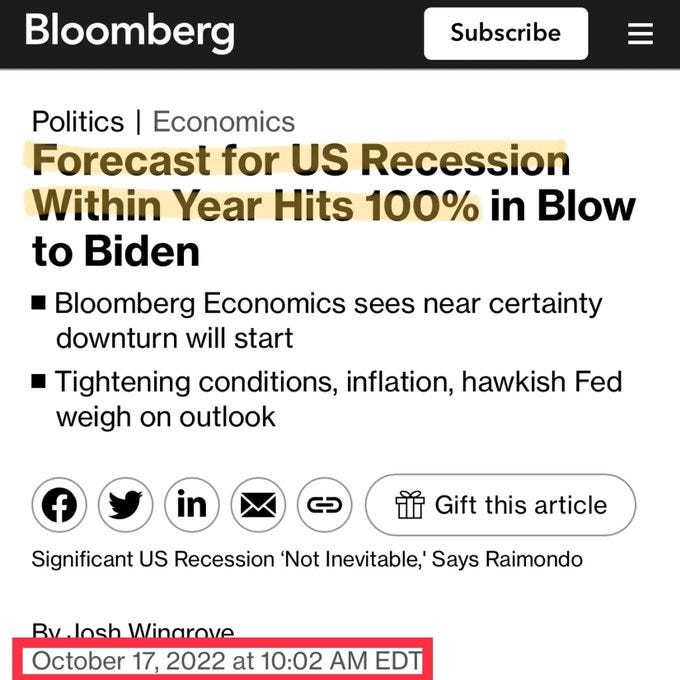

I could be wrong…

…so far, I’ve committed the Cardinal Sin of under-estimating the US concumer’s desire to spend, spend, spend.

Iza Kaminska on Quasi-Fiscal Monetary Operations & Why “This Time May Be Different’

I’ve written on the risk of fiscal and monetary dominance in past Perspectives. And I’ve written that central bank losses don’t matter. Izabella Kaminska has written a tweet stream that begins to pull things together and challenges some of my assumptions.

There are many moving parts to what’s going on in central banking at the moment. But the key factor pulling everything from inflation to Minimum required reserves, cbank losses and CBDCs together is the upcoming normalisation of QFMO

If you pay attention to what institutions like the BIS are saying, you’ll see concerns are rife that the boundaries between monetary and fiscal policy are about to be blurred.

The factors driving cbank losses are remunerated reserves which insure you can’t raise rates without incurring a big cbank balance sheet hole. In an ideal world, to avoid this, reserves would have been drained before rates were raised. But draining excess reserves too quickly introduces financial stability risk.

She concludes her tweet stream suggesting that this will have all sorts of implications including affects on bank profitability, financial repression, minimum reserve requirements, central bank funding models, yield curve control, market function and many other areas. Here is the link to that specific tweet.

She highlights a 1996 paper by Mackenzie & Stella Quasi-Fiscal Operations of Public Financial Institutions.

Quasi-fiscal activities (QFAs) refer to operations conducted by central banks or other public financial institutions that have implications similar to fiscal actions but fall outside the conventional budgetary process. Examples of QFAs include below-market lending rates, artificially high reserve requirements, and various forms of subsidies or taxes that affect the profitability of financial institutions.

QFAs can introduce distortions in resource allocation, mask the true fiscal stance of a country, and complicate macroeconomic management. When implemented without transparency or adequate oversight, QFAs can undermine financial stability, distort the allocation of resources, and lead to inefficiencies in the economy. The use of QFAs as fiscal tools, such as artificially high reserve requirements, can crowd out the private sector and mask the true fiscal stance of a country.

QFAs can lead to weakened profitability, financial disintermediation, capital flight, and significant central bank losses.

Substantial losses incurred by a central bank can lead to reduced confidence in monetary policy decisions and potentially fueling inflationary expectations.

To support her contention that the BIS is concerned, she cites this chapter Monetary and fiscal policy: Safeguarding Stability and Trust of the BIS’s 2023 Annual Report. The key point here is that they are firing a warning shot about central bank independence.

Bank Regulation (Barr v Bowman)

Climate-related Risk Management

Agencies issue principles for climate-related financial risk management for large financial institutions. Honestly, there’s nothing too contentious about the guidance. It doesn’t make climate risk a new risk on the par with credit, market, etc. It just says, hey, think about this stuff as you run your business.

The fun is looking at the politics:

Powell & Barr

[Powell] The Federal Reserve has narrow, but important, responsibilities regarding climate-related financial risks, which are tightly linked to our responsibilities for bank supervision. Banks need to understand, and appropriately manage, their material risks, including the financial risks of climate change. The guidance issued today is squarely focused on prudent and appropriate risk management.

[Barr] The guidance we are issuing today helps support the narrow, but important, role the Federal Reserve has in addressing the financial risks of climate change. The Federal Reserve is responsible for ensuring that the banks we supervise are monitoring and addressing their material risks, including climate-related financial risks.

Bowman & Waller

[Bowman] … in my view the final guidance will create confusion about supervisory expectations and will result in increased compliance cost and burden without a commensurate improvement to the safety and soundness of financial institutions or to the financial stability of the United States.

[Waller] I cannot support this issuance of guidance on climate change. Climate change is real, but I disagree with the premise that it poses a serious risk to the safety and soundness of large banks and the financial stability of the United States.

Bowman Dissents on CRA

Gov. Bowman continues her trend of dissenting on regulatory actions: Statement of on the Community Reinvestment Act Final Rule By Governor Michelle W. Bowman

I cannot support the finalization of this rule. In the final rule, the agencies have arguably exceeded the authority granted by the CRA statute. In addition, the final rule is unnecessarily complex, overly prescriptive, and contains disproportionately greater costs than benefits, adding significantly greater regulatory burden for all banks, but especially for community banks.

Blockchain In Real Use

JPMorgan Says JPM Coin Now Handles $1 Billion Transactions Daily (Bloomberg)

JPM Coin enables wholesale clients to make dollar and euro-denominated payments through a private blockchain network. …

The company also runs a blockchain-based repo application, and is exploring a digital deposit token to accelerate cross-border settlements.

JPMorgan Chase & Co.’s digital token JPM Coin now handles $1 billion worth of transactions daily …

…but remains a small fraction of the $10 trillion in US dollar transactions moved by JPMorgan on a daily basis.

HSBC Takes Stab at Using Blockchain to Modernize London’s Antiquated Gold Market

HSBC Holdings Plc has launched a platform that uses distributed ledger technology to tokenize ownership of physical gold held in its London vault

What sets HSBC apart is its clout in the bullion market. It is one of the world’s largest custodians of precious metals and one of four clearers on the London gold market, where over $30 billion of the metal changes hands every day.

Fed Funds (Really!)

In the era of QE, does anyone care about the Fed Funds market anymore? Robin Wigglesworth writes in Alphaville The mysterious, emasculated, modern fed funds market about a NY Fed Liberty Street post Who’s Borrowing and Lending in the Fed Funds Market Today?

One of the weirdest aspects of the global financial system is that the entire edifice rests precariously on a shrivelled market dominated by obscure US mortgage co-operatives and a motley group of foreign banks.

It’s all about regulatory arbitrage:

The FHLBs … use their implicit state backstop to get cheap funding and extend the benefits on to their members.

FHLBs must hold liquidity portfolios — partly to meet minimum regulatory requirements, but also to satisfy advances to their member [and] … unlike domestic banks and FBO branches, FHLBs do not earn interest on their balances at the central bank, which creates an incentive for them to lend at rates below the IORB rate.

And foreign bank branches are the biggest borrowers because their different regulatory treatment allows them to eke out an arbitrage by borrowing at the fed funds rate and reinvesting it in the IORB.

But one mystery remains: the largest FBO borrower is Taiwan’s Mega Bank:

Alphaville still doesn’t have a good understanding of just why, say, Mega Bank is so hot for this trade.

Research

Corporate Bond Factors: Replication Failures and a New Framework

A good paper by a bunch of good economists who did the hard work of cleaning the data.

We demonstrate that the literature on corporate bond factors suffers from replication failures, inconsistent methodological choices, and the lack of a common error-free dataset. Going beyond identifying this replication crisis, we create a clean database of corporate bond returns where outliers are analyzed individually and propose a robust factor construction. Using this framework, we show that most, but not all, factors fail to replicate. Further, while traditional factors are constructed from individual bonds, we create representative firm-level bonds, showing which bond signals work at the firm-level. Lastly, we show that a number of equity signals work for corporate bonds. In summary, most factors fail, but so does the CAPM for corporate bonds.

Many corporate bond factors cannot be reproduced even when attempting to use the methodology of the corresponding paper. More broadly, even factors that can be reproduced should be questioned, since the corporate bond literature is based on data full of errors.

Jobs

Thought I’d help out the Yale folks by publishing their opening for Research Associates.

Research Associate, Yale Program on Financial Stability New Bagehot Project

Position Focus:

Research Associates will be part of a team working to launch the Yale Program on Financial Stability’s New Bagehot Project, an online platform for the dissemination of information on how to respond to financial crises such as the Global Financial Crisis of 2007-2009 (the GFC). Working under the supervision of senior staff, Research Associates will be responsible for developing case studies of specific interventions attempted by policymakers during the GFC and other crises throughout history. These case studies focus on the critical design decisions made in establishing the interventions and will serve as the backbone for an online “playbook” that future policymakers can consult to help guide them during financial crises.

As you know, as I wrote in Perspective on Risk - May 19, 2023 (Bagehot is out of date), Bagehot is dead, long live Bagehot.

I’d like to suggest that the financial world is much different from that of the 1870s, and that along with the rethinking of deposit insurance guarantee we need to revisit Bagehot.

In particular, I think three changes to the financial system drive this need for rethinking; deposit insurance … bank balance sheets are much more transparent [and] … the speed with which information is transmitted, and with which money can be moved from a suspect bank.