Perspective on Risk - Next

What’s Ahead for 2023? More Zoltan; Take Your Marks; Sovereign Debt; Expected Returns; NYDFS & Coinbase Compliance; 50 Years Ago Today

What’s Ahead for 2023?

It’s prediction season. I wanted to highlight two of the better ones I have read. They present two very different perspectives, and hence differences in the perceived risks.

Atlantic Counsel

By far, the most interesting read was from the Atlantic Counsel. From their mission statement:

The Council provides an essential forum for navigating the dramatic economic and political changes defining the twenty-first century by informing and galvanizing its uniquely influential network of global leaders.

Leaders from the @AtlanticCouncil ’s sixteen programs and centers recently gathered to take stock of 2022, peer into the future, and predict the biggest global risks and opportunities that 2023 could bring.

Here is a link to The Top 23 Risks and Opportunities For 2023.

Top Risks

A surge in climate adaptation curtails progress on cutting emissions, locking in at least 1.5 degrees of warming [High]

Iran becomes a nuclear-weapons power [High]

The United States loses Colombia—and with it, increasingly, Latin America [Medium]

The internet splinters entirely and irrevocably [Low]

The United States and its allies give up on Ukraine and acquiesce to a Russian victory there [Low]

Jihadists construct a “terrorist bridge” from the Red Sea to the Atlantic [Medium]

A crisis just short of war erupts over Taiwan [Low/Medium]

Countries—and not just US adversaries—move away from the dollar faster than anticipated [Low/Medium]

New momentum builds for US withdrawal from the Middle East—and this time it doesn’t meet resistance [Low/Medium]

Developing countries suffer a wave of defaults and economic hardship [Medium]

A growing trust deficit destabilizes democracies from within [Medium]

US tech policy toward China drives a wedge in the transatlantic relationship [Medium/High]

In many cases, but not all, their Top Opportunities represent the flip side of the risks.

Top Opportunities

Ukraine wins—and becomes part of the institutional West [Medium]

The transition away from fossil fuels reaches an inflection point [Low/Medium]

Turkey emerges as a security guarantor in the Black Sea [Medium]

The United States demonstrates that “America is back” economically in Asia [Low/Medium]

Putin loses—abroad and at home [Low/Medium]

The European Union starts acting like a great power [Medium]

A push for EU expansion boosts the democratic world [Medium]

Venezuelan oil comes online, relieving pressure on global energy markets [High]

High-skilled visa reform finally happens in the United States [Medium]

Funding for climate adaptation and resilience dramatically accelerates and doubles in size [Medium]

Climate change accomplishes what nothing else will: Unite South Asian nations [Low]

Eurasia Group

Ian Bremmer’s Eurasia Group published their Top Risks 2023. I thought their group did a very good job calling the environment in 2022. I’m less impressed with this year’s report; it feel like conventional thinking and lacks some specificity. Here are their Top 10; I’ve copied in some commentary when the risk raised an economic or financial risk:

Rogue Russia

A humiliated Russia will turn from global player into the world’s most dangerous rogue state, posing a serious security threat to Europe, the United States, and beyond.

Maximum Xi

Xi emerged from China’s 20th Party Congress in October 2022 with a grip on power unrivaled since Mao Zedong. … We see risks in three areas this year…

First, the ill effects of centralized decision-making on public health are now on display … A second area of concern is the economy, where Xi’s drive for state control will produce arbitrary decisions and policy volatility. … A final risk area is foreign policy, where Xi’s nationalist views and assertive style will drive Beijing’s relations with the world.

Weapons of mass disruption

Inflation shockwaves

The global inflation shock that began in the United States in 2021 and took hold worldwide in 2022 will have powerful economic and political ripple effects in 2023. It will be the principal driver of global recession, add to financial stress, and stoke social discontent and political

instability everywhere.

Rising interest rates and global recession will also raise the risk of emerging-market crises.

In the unlikely-but-plausible event of a systemic financial crisis, global policy coordination will be lacking. Neither geopolitics nor domestic politics are in the same place they were in 2008, when the world’s largest economies came together at the G20 to avert disaster. Consumed by domestic challenges, creditor nations have little appetite for multilateral debt restructuring and relief, and international financial institutions such as the IMF could fill only part of the resulting financing gaps. Several countries would be forced to make the difficult decision to default on their debts, further weakening global growth, fueling social unrest, and disrupting politics.

Iran in a corner

Energy crunch

despite mostly sanguine forecasts for this year, a combination of geopolitics, economics, and production factors will create much tighter market conditions, especially in the second half of 2023. That will raise costs for households and businesses, increase the fiscal burden on consumer economies, widen the rift between OPEC+ and major consumers, and create yet another source of increased tensions between the West and the developing world.

Arrested global development

progress has been thrown into reverse by three years of mutually reinforcing shocks, including the Covid-19 pandemic, the Russia-Ukraine war, and the global inflation surge

Divided States of America

Tik Tok boom

Water stress

So What Do They Have In Common?

As I said earlier, very different lists.

The Atlantic Counsel sees the risk as the West stops supporting Ukraine and gives Russia a win. Eurasia group believes Russia “has no good remaining military options to win the war,” … “ has little leverage left over either the United States or Europe,” but “a won’t back down.” As a result, “Rogue Russia will increasingly act like a global version of its now-closest remaining ally of consequence, Iran.”

Both agree that Iran is a top risk. Eurasia Group has a more nuanced take, noting “These three factors—domestic repression, nuclear advances, and involvement in the Ukraine war—all combine to increase the risk of confrontation with Iran this year.” They foresee a reversion to the covert or proxy Israel/Iran conflict, a snap-back imposition of sanctions, and US/Israel saber-rattling about a possible preemptive strike.

Both also highlight the continuation of disinformation campaigns in the West, with the continued growth of a “trust deficit” with Western governments.

More Zoltan

Another piece by Zoltan to close the year: War and Currency Statecraft. He does expand on my speculation about how various countries align between blocs:

Indeed, “G7 + Australia” is being challenged by the “original” BRICS plus the “+” – Turkey, Saudi Arabia, and Argentina. Recently, the first two of these countries started to apply to become members of BRICS, and the “non-aligned countries” of Indonesia, Mexico, and South Korea matter for different reasons: first, Indonesia wants a “lithium OPEC”, Mexico nationalized lithium mining, and South Korea – snubbed by AUKUS – was “told” to uphold the “Three Nos” policy.

Argentina and Iran applied already, as did Algeria (see here, here, and here ), and as noted above, Saudi Arabia and Turkey are planning to apply, while Egypt – a neighbor of Saudi Arabia across the Gulf of Aqaba and neighbor of MBS’s signature city of NEOM project – is als o planning to appl y next year (see here ).

We have yet to hear from Indonesia, Thailand, Kazakhstan, the UAE, Nigeria, or Senegal

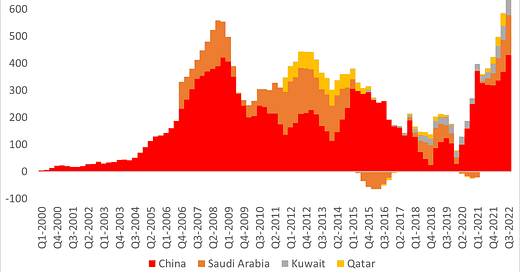

Zoltan references a recent piece by Brad Setzer (who I referenced in the last Perspective), “The New Geopolitics of Global Finance”, that I should have referenced when covering Brad’s assertion that there is not yet solid evidence of a shift in flows.

Both Brad Setzer and China expert Michael Pettis have pushed back on Zoltan’s thesis.

Brad makes the following points in his tweets:

Significant change to the dollar's role in the global financial system would require that borrowers and lenders globally start to denominate financial claims in yuan -- so that the GCC and China could accumulate CNY claims on the world's big borrowers

if China settles its GCC oil import bill with yuan and the GCC countries don't spend the yuan on Chinese imports but rather buy CNY bonds and if Chinese exporters still are paid in USD - China's USD settlement surplus just gets bigger. It still needs to do something with the USD

Michael Pettis makes a related argument:

It is a mistake (albeit a very common one) to see countries like China, Saudi Arabia and Russia as sitting on scarce resources (excess global savings) which they are carefully apportioning to the world's emerging economies. This has it backwards.

These countries must export capital because they have no choice. For structural reasons that are very hard to resolve they are incapable of delivering enough domestic demand to satisfy their growth needs, and do have to run large surpluses.

what matters globally for the role of the US dollar is not who controls excess savings but rather who is willing and able to absorb them. That pretty much means the US (and the other Anglophone economies) plus India.

Pettis links to an a paper he wrote in October: Will the Chinese renminbi replace the US dollar? The abstract does a nice job of summarizing the obstacles to de-dollarization.

First, for China to upend the dominance of the US dollar and replace it, even partially, with the renminbi would require major – and probably disruptive – changes in China’s financial markets and monetary policies.

Second, the end of US-dollar dominance would probably come about only after specific actions were taken by US policymakers to limit the ability of foreigners to use US financial markets as the absorber of last resort of global savings imbalances.

And third, the US economy and financial system absorbs nearly half of the world’s savings imbalances (with much of the rest absorbed by the other major Anglophone economies, for many of the same reasons). A global economy without the US dollar as the dominant currency would also likely be one without large, persistent trade and savings imbalances. This would force substantial and potentially disruptive structural changes on economies whose growth depends partly on their ability to externalize the costs associated with their international ‘competitiveness,’ which in turn depends on distortions in the distribution of income between households and businesses.

I respect the folks on both sides of the argument. From a risk manage perspective, uncertainty (which per se cannot be quantified) is more troubling than (measurable) risk. What this warrants is discussion within your firms about how any changes would affect your firm (for better or worse) and markets.

Take Your Marks

Private equity and hedge fund investments can be a CFO’s best friend. Marks on these products only flow through to the P&L account with a delay, enabling CFOs to take action to manage the accounts. @CliffordAsness has been railing against firms not marking to market, rightfully referring to the practice as ‘volatility laundering.’

As a CRO, the situation is a bit more nuanced. When the balance sheet has positions that one knows are not represented at the proper value, even if you have not yet received the information necessary to formally take the marks, what do you do? To my mind, this is where the CRO has to be a bit firm and insure that the probable marks are reflected in the decisions being made around the capital account, whether that is through a stress test or VaR metric, or decisions on the use of capital (buybacks, dividends). Internal transparency is the key.

How much did Blackstone just pay to avoid taking a mark on BREIT?

Matt Levine does a good job writing up the deal in Private Markets Don’t Like to Go Down.

The attraction of private investments is that they don’t have to go down when the market goes down. … as a general matter, the explanation is that private investments don’t trade, and so when the market sells off, they don’t.

Unlike many real estate investment trusts, BREIT’s shares don’t trade on exchanges.

[Y]esterday BREIT announced … a new fundraising round with structure?

UC Investments is buying $4 billion of BREIT common stock at the same price as BREIT’s other investors, and with a sixish-year lockup: As a matter of headline valuation, UC is providing “a massive affirmation … of the values of the assets here.” But Blackstone … is effectively kicking in $1 billion of those shares to guarantee UC’s returns.

Basically if things go well at BREIT, UC Investments will get almost the same upside as other investors, though it will give up about 5% of it; if things go poorly, then Blackstone will end up paying UC Investments $1 billion for this $4 billion investment.

This is basically a floored 6-year total return swap struck somewhere near a 10.25% return that Blackstone has paid to get the deal done, affirm their ‘mark’ on the BREIT portfolio, and provide liquidity. I’m not going to do the full modelling or the math as I expect someone smarter than me will eventually do. To me it suggests that if you are invested in BREIT you should continue to withdraw funds as they are holding the marks above market.

Anyway. here is a link to the Blackstone press release if you want to see the terms of the deal yourself.

Anyway, here are two other recent stories about marks.

JPMorgan’s Credit-Trading Loss Hinged on Internal Valuations (Bloomberg)

JPMorgan Chase & Co.’s loss-making bets on European bonds and credit-default swaps have sparked queries from market participants disgruntled by what they saw as out-of-step prices and aggressive tactics and saw the bank scrutinize how its positions were valued.

The bank has reviewed the valuations of some positions overseen by Gianfranco Canepa, former co-head of high-yield trading for Europe, the Middle East and Africa, according to people familiar with the matter. Marking the value of those trades using prices closer to other banks’ bids helped to push that book into a loss of $70 million for the year from a profit.

At the heart of the issue were two trades, a short position on the debt of French grocer Casino Guichard-Perrachon SA and a long position issued by Metalcorp, a subsidiary of commodities firm Monaco Resources Group SAM, the people said. Canepa’s trading desk was a large buyer of credit default swaps that insure Casino’s debt as part of a wager that amounted to €500 million ($530 million)

Fidelity marks down value of Twitter stake by 56% (Reuters)

Fidelity Blue Chip Growth Fund's stake in Twitter was valued at nearly $8.63 million as of Nov. 30, compared to $19.66 million at October-end, days after Musk closed the acquisition.

Sovereign Debt

Again, one of the two more vulnerable spaces I see is EM debt. In particular, as we have touched on in the past, there is a new dynamic afoot with Chinese lending to African and Asian countries, and how that intersects with IMF programs. From Chatham House’s The response to debt distress in Africa and the role of China:

At present, 22 low-income African countries are either already in debt distress or at high risk of debt distress.

Chinese lenders account for 12 per cent of Africa’s private and public external debt, which increased more than fivefold to $696 billion from 2000 to 2020. China is a major creditor of many African nations, but its lending has fallen in recent years and is set to remain at lower levels.

Restructuring debt under an IMF Program has traditionally had a number of steps. Specifically:

But China hasn’t provided the “assurances” required for Zambia and Sri Lanka to enter into an IMF Program.

Into this, one of the deans of sovereign debt restructuring, Lee Buchheit, has authored Time to scrap ‘financing assurances’? in the FT. He argues that, because of changes in the population of creditors and the deliberately vague requirements defining “financial assurances” has frozen restructurings. He is proposing changes to the IMF’s order of operations to modernize practices and break the logjam.

Instead of asking lenders to give financing assurances as a condition to taking a program to the IMF’s Executive Board, let the Board approve the program but withhold any significant cash disbursements until existing lenders have agreed to provide the needed debt relief.

This would (i) adequately safeguard Fund resources, (ii) put pressure on the debtor and the existing lenders to come to definitive terms on the debt restructuring or risk a cancellation of the program and (iii) deny to any one large creditor or creditor group the ability to stymie the process by withholding its financing assurances.

Expected Returns

Vanguard is out with its predictions:

Our return expectations are 2.25 percentage points higher than last year. From a U.S. dollar investor’s perspective, our Vanguard Capital Markets Model projects higher 10-year annualized returns for non-U.S. developed markets (7.2%–9.2%) and emerging markets (7%–9%) than for U.S. markets (4.7%–6.7%).

Damodaran has updated his equity risk premium estimates. He recently tweeted this graph that shows how his 1-year expected return has increased along with the components of his estimates. He suggests a one-year nominal return of 9.82%

NYDFS Nails Coinbase For Significant Failings in the Company’s Compliance Program

Here is the NYDFS press release and consent order. This consent order follows an MOU issued last February. The Department’s Examination that led to the MOU found:

significant deficiencies across Coinbase’s compliance program, including its Know-Your Customer/Customer Due Diligence (“KYC/CDD”) procedures, its Transaction Monitoring System (“TMS”), and its OFAC screening program.

The Examination also found that Coinbase failed to conduct adequate annual Anti-Money Laundering (“AML”) risk assessments since 2017, as required by 23 NYRCC 200.15(b), and that Coinbase had not provided evidence of a validation review of its TMS system, as required by 23 NYCRR 504.3(a).

Subsequently:

[D]uring the course of the Department’s investigation, the compliance situation inside Coinbase reached a critical stage. By the end of 2021, Coinbase had a backlog of unreviewed transaction monitoring alerts grew to more than 100,000 (many of which were months old), and the backlog of customers requiring enhanced due diligence (“EDD”) exceeded 14,000.

A good and useful read for operational risk managers and compliance officers.

50 Years Ago Today

50 years ago today Bruce Springsteen released his epic debut album "Greetings from Asbury Park, N.J."