Perspective on Risk - May 8, 2023 - (What The Fed Knew)

What the FRB Knew & When They Knew It; Engaging with Regulators; Adam Tooze Has A Nice Piece on JPMC; Long & Variable Lags; Soft Landing; 26.46% Discount Rate?; ‘Financial Armageddon.’; Simple Advice

What the FRB Knew & When They Knew It

Here is the Federal Reserve examiner’s presentation on interest rate risk that was made to the Board of Governors.

Presentation was given on Feb. 14, 2023, which unfortunately was pretty late in the saga. Jointly presented by FRBKC & Board staff

Title was pretty clear: Impact of Rising Rates on Certain Banks and Supervisory Approach

The language in the report is also quite direct.

As interest rates increase, banks with large market value losses could experience increased financial and risk management challenges

Banks reporting large unrealized losses may have limited ability to sell securities to fund loan demand or support any unanticipated deposit withdrawals without recognizing losses.

Banks with large unrealized losses face significant safety and soundness risks

Securities have traditionally been used for liquidity purposes; Today, the level of unrealized losses are causing some banks to face tough choices

There were two important slides.

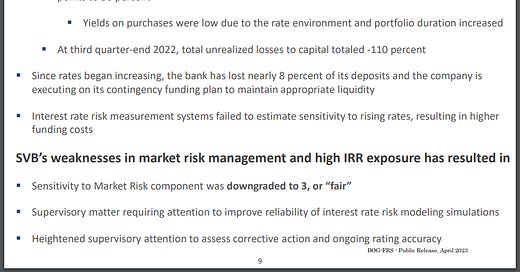

The first is the slide specifically calling out SVB; they did not explicitly mention any other bank.

The second shows the current scope of the problem.

If there is a problem, it is in response to the information. The deck talks about:

“increased bank risk identification, monitoring efforts, and interagency

collaboration

conducting internal training

creating “Documents created to ensure consistency of supervisory approach and guide examiners on appropriate risk considerations in developing supervisory ratings”

conducting outreach “to raise awareness and encourage a

dialog between affected banks and their supervisors

Nothing about specific direction to raise capital and/or liquidity.

Engaging with Regulators

I forwarded this article to you separately: Engaging with regulators, insights from near and afar, an interview with Chris Calabia - former regulator at the Federal Reserve Bank of New York (Axial substack). But I’ linking again in case it went to spam.

Chris, who I worked with at FRBNY, has a great perspective here.

The first thing he talks about is that ‘success’ as a bank examiner looks different in different countries, and I would add it looks different even in the same country at different times and in different conditions. As a manager, this is often difficult to impress upon the staff.

Adam Tooze Has A Nice Piece on JPMC

Those of us who worked in Bank Supervision know about JPMC’s centrality to both the payment system and the financing of non-bank markets. Adam Tooze has a nice piece on JPMC Chartbook #213 Expanding the fortress: Why JP Morgan is even more important than you think! if you want some sense of what makes JPMC important and powerful.

In the financial crisis of 2008 there were two big winners. One was BlackRock, which, as I discussed in Chartbook #82, emerged from the GFC as the dominant asset manager of the following decade. In banking, if there was a big winner in 2008, it was JP Morgan.

JP Morgan is not just the largest non-Chinese bank by size. It is also a universal player with a powerful position in investment banking, retail banking, and asset management.

As Carolyn Sissoko showed in an important paper, published in the thick of the COVID financial crisis of 2020, the newly merged JP Morgan Chase in the late 1990s and early 2000s was pivotal to the emergence of the repo-based money market.

Sissoko’s story is consistent with the quantitative evidence painstakingly compiled by Gary B. Gorton, Andrew Metrick, and Chase P. Ross in their article “Who ran on repo”.

When JPMC pulled back from Lehman as the first line lender of last resort, it was the Fed that had to step in to backstop the entire banking system of the dollar and eurodollar world.

A really nice read.

Long And Variable Lags

Those who have been following along know I put a fair amount of weight on the predictive power of the 10Y-3M yield curve inversion from Estrella and Mishkin. It first inverted last October, and has become progressively more inverted since then. So where’s the recession?

The original paper gives us increasing probabilities of a recession four quarters ahead based on the spread. There is a 50% chance of a recession when the spread reaches -0.82, and a 90% probability when the level is -2.40.

The spread touched the first level on December 16th, and the spread is currently -1.82% which is close to the 80% probability level.

The NY Fed publishes a 12-month forward prediction based on the spread. They have the 12 month forward probability at 68%, the highest it has been since 1983.

Arturo published this tweet below that shows a 10-20 month lag from when the curve first inverts until the effects on employment are seen. If we take Nov 1 as when the curve first inverted, we are looking at August to possibly see the first employment effects in the data.

So Q3 and Q4 look distinctly at risk. Enjoy the summer.

What The Soft Landing Folks Are Counting On

From Jason Furman.

And this is the Beveridge curve which continues to move down--w/ openings falling w/o unemployment rising, which is the best hope for the possibility of a soft landing.

Not super-surprising given there was never any good reason it shifted out so much. We'll see how far it goes.

26.46% Discount Rate?

Twitter pointed me to take a look at the supplementary disclosure for Blackstone Loan Financing Limited in the Monthly Report. Is the CLO market really implying a 26.46% discount rate?

‘Financial Armageddon.’

Katherine Rampell at the Washington Post asks What would U.S. default actually look like? I mean, these are all like first-order effects. I worry more about 6 and 7 than the rest.

Here’s a summary of what market experts relayed. Our scenario assumes the U.S. government fails to pay for not only key services such as Social Security checks and military salaries but also principal or interest on at least some U.S. Treasury securities.

Treasurys get downgraded — as does virtually every other asset on earth.

Interest rates rise

Global investors likely would sell U.S. dollar-denominated assets

Stock markets plummet.

Companies holding Treasurys suffer hits to both revenue and balance sheets

Scramble to close out trades that people would otherwise hold (due to margin calls)

Some of the infrastructure underpinning large parts of the financial system (called “central counterparty clearinghouses”) could essentially get overwhelmed and go down

Simple Advice

I was reminded the other day of the career guidance I gave out. It was pretty simple.

Don’t be a dick

Don’t work for a dick