Perspective on Risk - May 14, 2024 (Climate Update)

What a Year! Climatologist Say We Will Blow Past 1.5C; We Can't/Won't Cut Emissions; What's Next?; Riskiest Places in US; Banks Stress Test For Climate Risks

So this is mostly a climate change post. But if you don’t care to read this stuff, you may at least be interested in the Federal Reserve’s Climate Stress Test results at the end of the post.

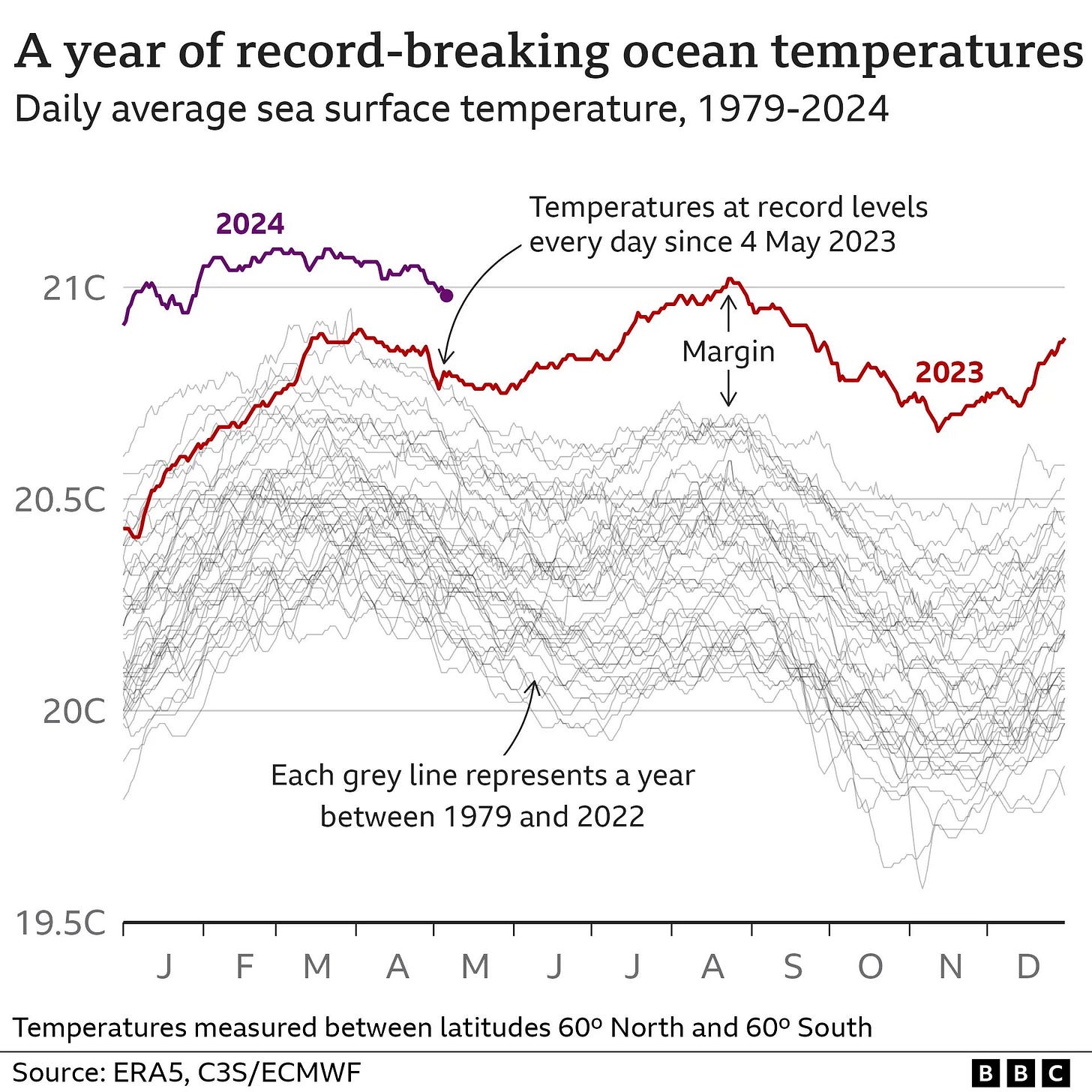

We’ve Had A Year Of Record Breaking Temperatures

The world’s oceans are absorbing record levels of energy

We Continue To Pump CO2 Into The Atmosphere

Rising CO2 levels and Temp Variance Are Correlated

Global Carbon Emissions (CO2-Earth)

The global average concentration of CO2 in the atmosphere increased from about 277 parts per million (ppm) in 1750 to 414 ppm in 2020 (up 49%)

In 2020, global CO2 emissions from fossil fuels were 34.8 GtCO2, a decrease of 5.4% from 36.7 GtCO2 in 2019.

For 2021, global CO2 emissions from fossil fuels are projected to grow 4.9% to 36.4 GtCO2, a level which is about 0.8% below the 2019 level. (The 2021 growth of 1.6 GtCO2 is similar to the growth observed in 2010 following the global financial crisis of 2008-2009: 1.7 GtCO2 or 5.5% above 2009 levels.)

Sulfur Had Been Masking The Temperature Rise

But we’ve mostly addressed marine sulfur pollution, and so it no longer is masking the temperature rise. Our World in Data.

One of the most striking changes in air pollution trends has been the abrupt drop in sulfur dioxide (SO2) emissions from shipping. As you can see in the chart — where shipping is highlighted in red — there was a dramatic fall from over 10 million tonnes a year in 2019 to 3 million tonnes a year later.

The change resulted from the International Maritime Organization’s strict limits on marine fuels, introduced in 2020: the maximum percentage of sulfur allowed in these fuels fell from 3.5% to 0.5%. All ships worldwide had to comply.

This drop is positive for tackling local air pollution and acid rain. However, it also has implications for climate change since SO2 has masked some of the warming caused by greenhouse gases.

We Are Breaking The First Rule Of Holes

World’s coal power capacity rises despite climate warnings (Guardian)

The world’s coal power capacity grew for the first time since 2019 last year, despite warnings that coal plants need to close at a rate of at least 6% each year to avoid a climate emergency.

A report by Global Energy Monitor found that coal power capacity grew by 2% last year, driven by an increase in new coal plants across China and a slowdown of plant closures in Europe and the US.

Climatologist Believe We’ll Blow Past The 1.5°C Target

World’s top climate scientists expect global heating to blast past 1.5C target (Guardian)

Almost 80% of the respondents, all from the authoritative Intergovernmental Panel on Climate Change (IPCC), foresee at least 2.5C of global heating, while almost half anticipate at least 3C (5.4F). Only 6% thought the internationally agreed 1.5C (2.7F) limit would be met.

Many of the scientists envisage a “semi-dystopian” future, with famines, conflicts and mass migration, driven by heatwaves, wildfires, floods and storms of an intensity and frequency far beyond those that have already struck.

The National Weather Service Has Added A New Level Of Risk

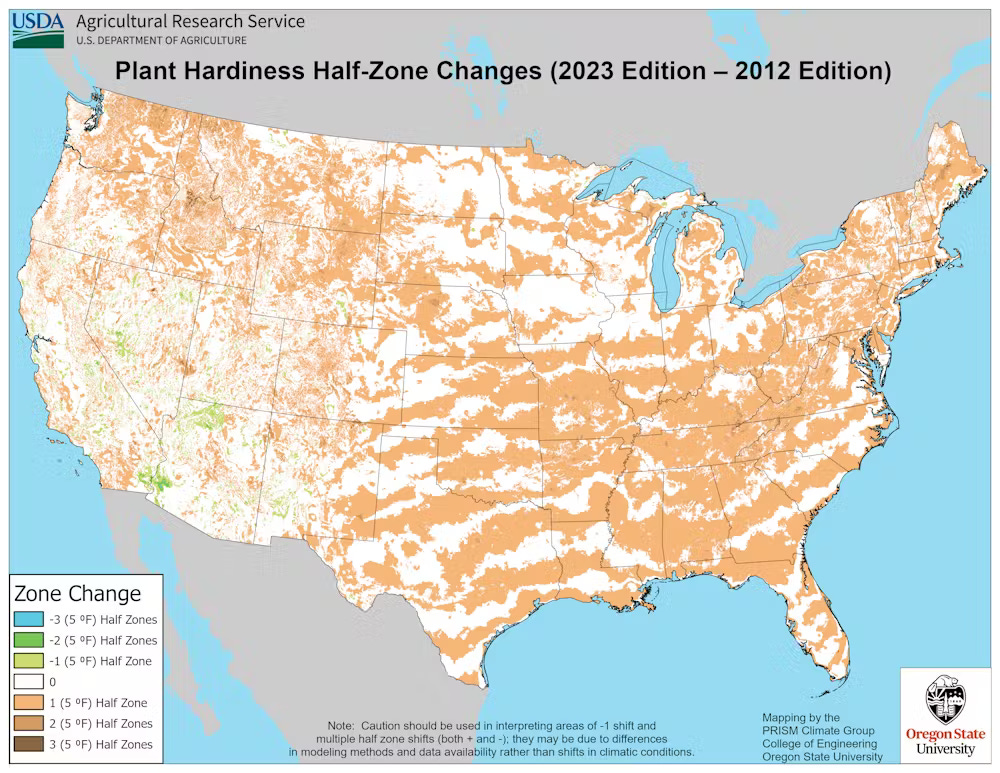

USDA Has Shifted The Plant Hardiness Maps

Climate change is shifting plant growth zones. Here’s what to know for your garden this year (PBS)

Comparing the 2023 map to the previous version from 2012 clearly shows that as climate change warms the Earth, plant hardiness zones are shifting northward. On average, the coldest days of winter in our current climate, based on temperature records from 1991 through 2020, are 5 degrees Fahrenheit (2.8 Celsius) warmer than they were between 1976 and 2005.

Since We Won’t Cut CO2 Emissions

Charging For Emissions

World’s First Global CO2 Charge Inches Closer at London Meetings (Bloomberg)

The International Maritime Organization — which regulates shipping worldwide — inched closer toward such a [green house gas] levy at talks held in London this week. The United Nations agency plans to finalize the detail of the measure next year, and have it introduced in 2027.

Countries including the Marshall Islands — the flag state for thousands of vessels — earlier submitted a proposal for a minimum emissions charge of $150 per ton of CO2-equivalent, which would add hundreds of dollars to shippers’ fuel bills for every ton of oil they burn. Others, including European Union nations, Canada and China have submitted separate documents discussing GHG pricing.

Let’s Try Removing Carbon From The Atmosphere

Global Carbon Capture Capacity Quadruples as the Biggest Plant Yet Revs Up in Iceland (Singularity)

One of the leaders in this space is Swiss company Climeworks, whose Orca plant in Iceland previously held the title for world’s largest. But this week, the company started operations at a new plant called Mammoth that has nearly ten times the capacity. The facility, also in Iceland, will be able to extract 36,000 tons of CO2 a year, which is nearly four times the 10,000 tons a year currently being captured globally.

The company says it’s aiming to reach megaton-scale—removing one million tons a year—by 2030 and gigaton-scale—a billion tons a year by 2050. Hopefully, they won’t be the only ones, because climate forecasts suggest we’ll need to be removing 3.5 gigatons of CO2 a year by 2050 to keep warming below 1.5 degrees Celsius.

Or Not

Harvard has halted its long-planned atmospheric geoengineering experiment (MIT Technology Review)

Harvard researchers have ceased a long-running effort to conduct a small geoengineering experiment in the stratosphere, following repeated delays and public criticism.

The plan for the Harvard experiments was to launch a high-altitude balloon, equipped with propellers and sensors, that could release a few kilograms of calcium carbonate, sulfuric acid or other materials high above the planet.

… plans were canceled on the recommendation of the project’s advisory committee, which determined the researchers should hold discussions with the public ahead of any flights. The effort was also heavily criticized by the Saami Council, which represents the indigenous Saami peoples’ groups in Sweden and neighboring regions, as well as environmental groups and other organizations, who argued it’s too dangerous a tool to use.

When asked why he decided to stop work on the experiment, and if it had anything to do with the public pushback or delays, Keutsch replied via email that he “learned important lessons about governance and engagement throughout the course of this project.”

Cloud Brightening Study in California Is Halted by Local Officials (NYTimes)

Researchers had been testing a sprayer that could one day be used to push a salty mist skyward, cooling the Earth. Officials stopped the work, citing health questions.

The experiment, which began on April 2, marked the first time in the United States that researchers had tested such a device outdoors. But on May 4, the City of Alameda wrote on its Facebook page that it had instructed the researchers to stop, citing possible health concerns.

LOL

So What Happens Next?

Texas Has A Lot Of 100°F Days

Over the period 1895–2021, the average daily maximum and minimum temperatures in Texas increased by 0.8 Celsius degrees, and overall average temperature is projected to increase by another 1 Celsius degree by 2036 relative to the 1999-2020 average. While the absolute number of days above 100◦F (38◦C) varies geographically across the state, this projected temperature increase means that locations across Texas would experience 40% more days above 100◦F (38◦C) (

Each 1°C Leads to a 12% decline in GDP

The Macroeconomic Impact of Climate Change: Global vs. Local Temperature*

This paper estimates that the macroeconomic damages from climate change are six times larger than previously thought. We exploit natural variability in global temperature and rely on time-series variation. A 1°C increase in global temperature leads to a 12% decline in world GDP. Global temperature shocks correlate much more strongly with extreme climatic events than the country-level temperature shocks commonly used in the panel literature, explaining why our estimate is substantially larger. We use our reduced-form evidence to estimate structural damage functions in a standard neoclassical growth model. Our results imply a Social Cost of Carbon of $1,056 per ton of carbon dioxide. A business-as-usual warming scenario leads to a present value welfare loss of 31%. Both are multiple orders of magnitude above previous estimates and imply that unilateral decarbonization policy is cost-effective for large countries such as the United States.

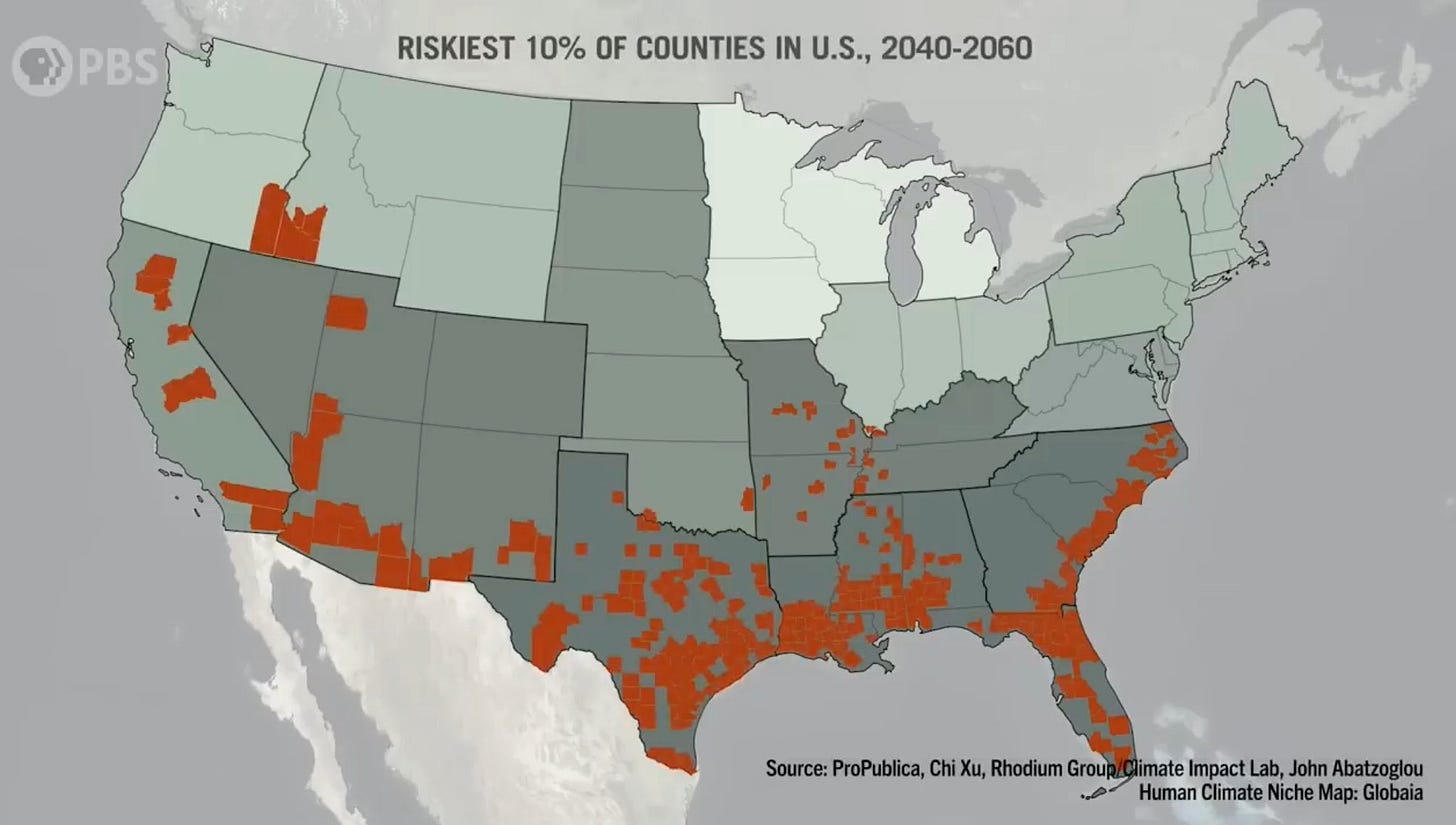

Where Is The Riskiest Places In The US?

Houston, we have a problem.

Youtube (13:29) from What is the RISKIEST Region in the US as the Climate Changes? (PBS Terra)

Florida, Louisiana, Texas and the California-Arizona border look like places you should think twice about moving to. But according to the Propublica study, there is one county that comes out on top: Beaufort County, NC. This county is at risk for nearly all of the natural hazards.

Ironically, I just visited Beaufort County a month ago, halfway between Charleston and Savannah. Hear Hilton Head and Paris Island.

Banks Stress Test For Climate Risks

The Federal Reserve published an under-reported, and quite interesting, paper on the results of a climate risk stress test. The Fed is at its best when it conducts some of these exercises. This reminded me very much of the Senior Supervisors Group exercises I helped undertake.

The summary describes how these banks are using climate scenario analysis to explore the resiliency of their business models to climate-related financial risks. Participating banks took a wide range of approaches in this exercise to consider the possible implications of different physical and transition risk scenarios. The exercise highlighted data gaps and modeling challenges that arise when estimating the financial impacts of highly complex and uncertain risks over various time horizons.

The 2023 pilot CSA exercise had two primary objectives:

To learn about large banking organizations’ climate risk-management practices and challenges; and

To enhance the ability of large banking organizations and supervisors to identify, estimate, monitor, and manage climate-related financial risks.

The paper was interesting as it highlighted commonalities and differences in the approach to stress testing, and areas of pure Knightian uncertainty. The Insights section of the paper is most interesting. Some things I found most interesting:

Most participants worked with third-party vendors to conduct the pilot CSA exercise. For the physical risk module, some participants used catastrophe models provided by third-party vendors to simulate a large number of physical risk events and related damages to individual properties under the pilot CSA exercise scenarios, while others used vendors to estimate the property damage caused by their internally-generated, bespoke scenarios.

This is pretty standard practice in the insurance industry but the first I have seen it in banking.

… some participants noted the importance of developing a more nuanced understanding of insurance markets, including understanding the evolution of insurance pricing and its impact on property prices and obligors’ cashflows, in order to manage climate-related risks.

Results are assumption dependent, and here is an area of uncertainty.

Participants noted that information obtained through public disclosures, engagement with obligors, and/or third-party vendors led to a more nuanced understanding of potential transition risk effects on obligors’ business strategies, profitability, and capital needs.

Some banks took the exercise a step further, and gained additional insight. I was really surprised to see “engagement with obligors” here. Kudos to whichever firm did this.

… participants are uniquely exposed to different types of physical and transition risks, and standardization limits their ability to tailor scenarios to risks most material to their portfolios. Similarly, greater prescription in methods and data foster comparability of estimates but could obscure idiosyncratic risks and stifle innovation as practices continue to evolve.

Yup, maybe the Fed is learning that standardized routine stress testing crowds out the more nuanced stress testing that is vital for firms.

They then had some insights on scenario design:

The exercise did not require participants to capture indirect impacts, such as damage to critical infrastructure (e.g., bridges and power stations) or supply chain disruptions, that could lead to prolonged disruption to local economies. In addition, the exercise did not require participants to capture the effects of chronic risks like sea level rise or higher average global temperatures.

Participants noted that consideration of different types of physical risk shocks, the cumulative effects of multiple hazards over time, or a more comprehensive incorporation of indirect impacts and chronic effects, could meaningfully affect the nature of the exercise and the channels through which physical risks could impact their portfolios.

For the physical risk module, participants described the scenarios (e.g., a 200-year return period loss consistent with SSP 8.5/RCP 8.5) as relatively severe acute physical hazard events, particularly when assuming no insurance coverage. By contrast, most participants viewed the two scenarios used in the transition risk module (i.e., Current Policies and Net Zero 2050) as orderly, rather than stress, scenarios

Climate-estimated impacts were applied at a point of the credit cycle when credit quality was strong … As with other external shocks, the effects of adverse climate shocks could be different if the shocks were to occur during an economic downturn.

Financial protections, such as effectively functioning insurance markets, can limit the credit risk that large banking organizations face from climate-related physical risks in their real estate portfolios.

Participants noted their ability to rebalance their portfolios over the forecast horizon could significantly mitigate risk.

Those interested in the details or the results can read the paper themselves.

What would be really interesting, from a macro-prudential perspective, would be to run an exercise like this across both banking and insurance simultaneously.