Perspective on Risk - March 2, 2023

Has Financial Repression Ended? BIS Quarterly Review; Risk Management (& the NDS); National Cyber Defense Strategy; Private Equity; A Top in Housing; ORSA; Housing; Compliance; Lehman; Celsius

Has Financial Repression Ended?

While we haven’t met the classical definition of financial repression, the post-Covid economy and markets have exhibited the characteristics thereof, and one can argue that quantitative easing policies are a form of financial repression.

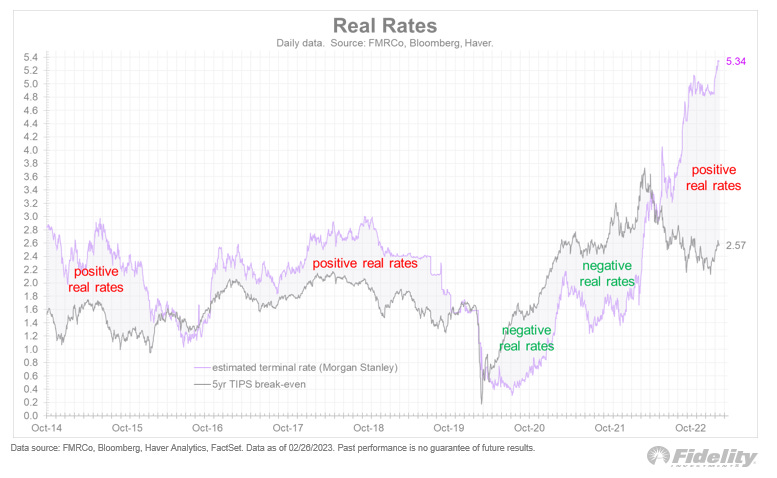

Financial repression is generally characterized by low or negative real interest rates, and equity and bond prices that move in similar directions as low interest rates affect both similarly.

The market is clearly looking at positive forward real rates.

And the correlation between equity and bond returns

AQR has a nice piece on correlations: A Changing Stock-Bond Correlation

BIS Quarterly Review

The BIS Quarterly Review is the one financial stability report that should be consistently read. They succinctly start with the central conundrum:

Investors’ expectations about future policy rate paths stood in contrast to central bank communications. While several major central banks slowed the pace of monetary tightening, they remained cautious about the interest rate path going forward, particularly in view of the persistent strength of labour markets. Nevertheless, interest rate futures continued to relay market participants’ expectation that rate hikes will end this year, followed by steep rate cuts stretching well into 2024

The concurrent fall in forward-looking gauges of market volatility suggested that valuations were boosted by benign risk perceptions. In a similar vein, credit spreads narrowed further, on the heels of declines in perceived default risks, and corporate bond issuance showed signs of recovery in January

Valuations in corporate credit markets improved along with those of equity markets.

Lower corporate credit spreads seemed to reflect mostly an improvement in investors’ default risk perceptions. A decomposition of corporate spreads suggests that their narrowing during the review period owed almost entirely to this improvement. Similarly, spreads on high-yield corporate bonds declined in line with a fall in expected default frequencies.

The strong run of global equity markets is hard to reconcile with the macroeconomic backdrop that weighed on expected earnings for most of the period. The long-term outlook for earnings deteriorated in the United States and the euro area. … The analysis suggests that the recent market rally owed entirely to the drop in equity risk premia.

The plummeting equity risk compensations required by investors could be explained, in part, by a decrease in the perceived risks. In the United States, perceived equity risks dropped in tandem with a perceived fall in US inflation risk, which moderated the expected pace of monetary tightening. In the case of the euro area, the drop in key energy prices from their extreme highs seen earlier in 2022 and the fading likelihood of a deep recession probably played a major role.

For us financial stability geeks, there is an entire section Prudential policy and financial dominance.

We explore the conditions under which monetary tightening may usher in stress and whether prudential tightening reduces the likelihood of such an outcome. We contribute to the literature by analysing prudential tightening specifically in the context of monetary tightening episodes and by considering various indicators of stress.

My central bank collogues will want to read the whole section. For you lay readers the conclusions suffice:

There is evidence that monetary policy tightening raises the likelihood of financial stress down the road if the hikes take place when the initial level of private sector debt is high and inflationary pressures call for a strong policy reaction. This pattern has been present even since the 1990s, when the variation in inflation has been much smaller than in the past.

All else equal, today’s historically high levels of private debt and the surge in inflation would raise the odds that the current monetary tightening might usher in financial stress down the road. But the findings also indicate that a tightening of prudential measures should help to reduce that risk.

The Quarterly Review also has a section Commodity prices, the dollar and stagflation risk. We’ve touched on commodity prices in the past, but mostly in the context of decoupling. Here they look at the “unusual co-movement during much of 2021 and 2022” between commodity prices and the US dollar. They conclude:

There’s also some more central bank geeky stuff, such as the sovereign, central bank, insurance company nexus.

Risk Management (and the National Defense Strategy)

Don’t ask why I was reading the 2022 National Defense Strategy. I just was.

But what was most interesting is that the NDS has a risk management section! They highlight two risks, Foresight Risk and Implementation Risk.

Under Foresight Risk, they state:

The rate at which a competitor modernizes its military, and the conditions under which aggressions manifests, could be different than anticipated. Our threat assessments may prove to be either over- or underestimated. We might fail to anticipate which technologies and capabilities may be employed and change our relative military advantage. …

Foresight risk can be hedged and of course must be managed as they arise. Hedging options include continuing to exercise Joint Force against multiple contingencies and developing new, more resource-efficient concepts of operation, in light of continuously updated intelligence and security assessments.

Under Implementation Risk, they state:

This strategy will not be successful if we fail to resource its major initiatives or fail to make the hard choices to align available resources with the strategy’s level of ambition; if we do not effectively incorporate new technologies and identify, recruit and leverage new talent; and if we are unsuccessful in reducing the barriers that limit collaboration with Allies and partners. We aim to mitigate these and other risks through ruthless prioritization. … Implementation risk will be forstalled by leadership focus and discipline, as well as consistent attention to monitoring implementation in line with clear metrics to enable assessment and course correction.

I LOVE THESE !!!!!

This is perhaps most important things senior risk managers do, and an inordinate amount of time is devoted to these tasks.

National Cyber Defense Strategy

National Cyber Defense Strategy. Some interesting stuff.

They are moving more responsibility onto the large central players.

The most capable and best-positioned actors in cyberspace must be better stewards of the digital ecosystem. Today, end-users bear too great a burden for mitigating cyber risk. Individuals, small businesses, state and local governments and infrastructure operators have limited resources and competing priorities, yet these actors’ choices can have significant impact on our national cybersecurity.

There is an emphasis on creating

a level playing field so that companies are not trapped in a competition to underspend their peers on cybersecurity.

The government will be taking a more aggressive role in assessing industry gaps, and will be ‘deepening” ties with vendors.

Section 3.3 is a big one for my P&C insurer colleagues. The proposal wants to block companies from shirking liability thru contracts and create special duties of care in "high-risk scenarios." Additionally, the USG will develop "safe harbor framework" to protect good actors.

We must begin to shift the liability onto those entities that fail to take reasonable precautions to secure their software while recognizing that even the most advanced software security programs cannot prevent all vulnerabilities.

The administration will work … to develop legislation establishing liability for software product and services.

Section 3.6 is also interesting. It’s entitled “Develop a Federal Cyber Insurance Backstop.”

Structuring [a government] response before a catastrophic event occurs … could provide certainty to markets and make the nation more resilient.

Worth a read by those with these responsibilities.

Private Equity

Bain issued their GLOBAL PRIVATE EQUITY REPORT 2023. The PE industry is used to bearing risk, but they state that the current environment is something different: uncertainty.

The net result is the dreaded “U word”—uncertainty, a deal killer if there ever was one. As buyers, sellers, and lenders all wait for clarity around the economic forces that could affect cash flows, uncertainty will continue to act as a cap on deal activity, especially for the largest transactions that require the most leverage. Dealmakers are still finding ways to finance smaller transactions with private credit and larger equity infusions. But the overall decline in new deals and exits will likely persist, creating a knock-on effect for fund-raising.

On 4Q Marks

While the S&P 500 closed 2022 down 19% and the MSCI Europe Index finished the year with a 17% decline, valuations for the private equity holdings of the largest public alternative asset managers—Blackstone, KKR, Apollo, and Carlyle—all held up better (see Figure 27). In fact, two of the four posted gains over the year. Buyout funds more broadly posted some write-downs in the second and third quarters, but nothing to match the downturn in public equities. …

It’s true that the fourth quarter is typically when the most pronounced adjustments to portfolio company valuations occur. There is one audited appraisal required annually, and that typically happens as funds wrap up their year. These should be the most reliable estimations of value that investors see in any 12-month period.

Data from Burgiss, a private capital data and analytics provider, confirms that if changes are on the way, they are most likely to show up in the fourth quarter. But the analysis also shows that the magnitude of change is typically not that dramatic. Close to 60% of the time over the past decade, the fourth quarter adjustment has been less than 10% one way or the other (see Figure 29). Change greater than 20% occurs only 21% of the time.

Burgiss analysis also calls into question the notion that 2022 represents a sudden break in the historical relationship between public and private valuations. …

The conclusion one might draw from this data is that GPs are simply overvaluing their assets. But, if anything, new analysis shows that GPs skew toward the conservative. Over the past decade, buyout funds have exited assets at valuations exceeding their last quarterly mark nearly 70% of the time (see Figure 31). If fund managers err, in other words, it is on the side of promising less and delivering more, not the other way around.

On Inflation

The recurring theme throughout the report is the fear of inflation. The report points out that all but the most senior partners have not lived through a period of rising or high inflation.

The report closes with a whole section on inflation.

High rates mean pressure on multiples—and a new imperative to create value through margin improvement and organic growth.

Higher rates and inflationary pressures pose a twin threat for general partners. The data is clear: Private equity returns have come largely from multiple expansion in recent years, rather than from revenue and margin growth (see Figure 3). But GPs won’t have that luxury moving forward, as higher rates continue to put downward pressure on asset prices. That means returns will increasingly have to come from growth in earnings before interest, taxes, depreciation, and amortization (EBITDA). Yet slowing market expansion and inflationary cost pressures will likely make those gains harder to come by.

Own-Risk Self Assessment (ORSA)

I imagine that some of you may have helped author this paper from the CRO Forum.

ORSA Stress and Scenario Testing – Best practice for assessing risks

This paper builds on the prior CRO Forum paper and provides an overview of the CRO Forum members’ views on the development of the ORSA and the purpose and role of stress and scenario testing within it. This includes insights on current practices amongst CRO Forum members regarding the definitions, number, severity and likelihood of the scenarios chosen.

The papers usefulness, I think, comes in bringing together a number of disparate processes into something of a whole. It at least brings forward a number of the tensions risk managers face.

For instance, it tries to make the necessary distinction between scenarios that are useful for firms as going concerns, and those that are larger and hit upon recovery activities. It describes a range of practice in areas without being prescriptive (instantaneous vs longer scenarios; scenario consistency vs scenarios attuned to current conditions). It addresses the tensions between Group and entity ORSAs.

Sad to see that my former employer did not contribute to this paper. I consider it reflective of their current attitude (though tbf the CRO Forum is a predominantly European group).

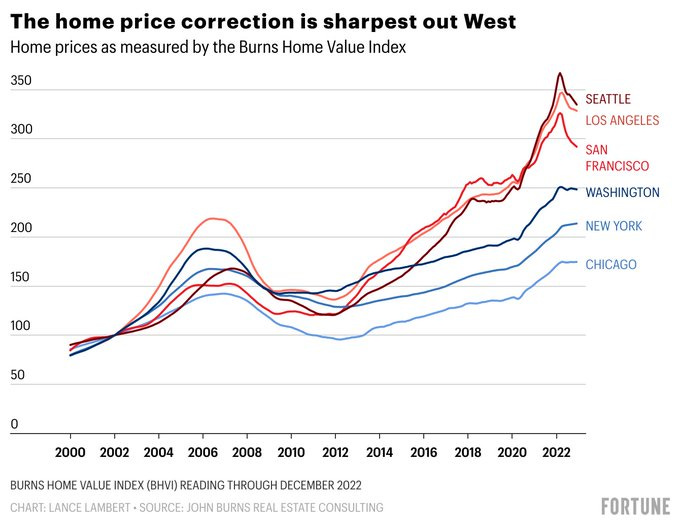

Finally, a Top in Housing

But the decline is not equally distributed

Why Compliance Matters

TD Bank Settles With Estate of Stanford Financial Group

Compliance processes are usually about protecting you from yourself.

Allen Stanford ran a massive Ponzi scheme that defrauded investors out of billions of dollars by issuing fraudulent certificates of deposit (CDs) through its offshore bank in Antigua, promising high returns that were backed by non-existent assets.

The SEC brought a suit against Allan Stanford in 2009, and he was subsequently found guilty on 13 counts of fraud, conspiracy, and obstruction of justice, sentenced to 110 years in prison and ordered to forfeit $5.9 billion in assets.

The court-appointed receiver for the Stanford Financial Group pursued a separate legal action to recover assets for the victims of the fraud. They settled with insurance companies and others.

Now it’s TD Banks turn.

The court-appointed receiver sued TD Bank asserting that the bank knew, or should have known, that wire transfers and other transactions that were part of Stanford's Ponzi scheme, that TD Bank ignored warnings from its own employees and failed to properly investigate suspicious transactions (including ignoring transactions flagged as high-risk by TD Bank's anti-money laundering (AML) software), and failed to meet AML requirements, including the failure to file required suspicious activity reports (SARs) in connection with the transactions involving Stanford's accounts.

They settled for $1.2 billion. TD Bank to pay US$1.2 billion to settle Stanford Ponzi scheme lawsuit

Lehman (Fun, Easy Read)

Another great, easy read from Stories.Finance. This one is on Lehman’s failure and has a nice description of the issues faced by JP Morgan as Lehman’s clearing bank. These were many of the issues we were obsessed with at the Fed. Maybe some of you that I worked with will now understand my obsession with clearing and settlement; it comes from working at the Fed.

Why Lehman Brothers Failed When It Did

Lehman Brothers filed for bankruptcy on 15 September 2008. It was history’s largest bankruptcy, involving over $600 billion of liabilities. The security firm business model, the Global Financial Crisis, and Lehman’s business decisions coalesced to cause the firm’s failure. But collateral calls by Lehman’s clearing banks to cover intraday exposures, mainly calls by JPMorgan, are what drove Lehman into bankruptcy at 1:45 am on that particular Monday in September 2008.

I got the task of understanding Lehman’s failure when Lehman’s bankruptcy examiner hired my consulting firm employer. This is what I found when I helped write our 2209-page report to the bankruptcy court.

Now I thought I knew most every lesson to be learned from Lehman’s failure, but I found a new twist I was unaware of:

In our examination long after the bankruptcy filing, we realized that JPMorgan had missed another problem with Lehman’s collateral. The leveraged loans in the CLOs Lehman had posted were participated to the CLOs rather than sold or assigned to the CLOs. This meant that payments from the loan borrowers passed through Lehman instead of being paid directly to the CLOs. Those loan payments would be trapped inside Lehman if Lehman went into bankruptcy. So these CLOs were also practically useless as protection against a Lehman default.[55]

Crypto - Celsius Final Report

Remember Celsius? They were one of the crypto firms that went toes up. The appointed examiner issued the final report, and its a doozy.

The business model Celsius advertised and sold to its customers was not the business that Celsius actually operated. …. Behind the scenes, Celsius conducted its business in a starkly different manner than how it marketed itself to its customers in every key respect.

Although Celsius sold its customers on its ability to manage risk—claiming that risk management was “what Celsius does best”—Celsius did not have a risk management function or written risk policies in place before 2021. In 2021, in response to the significant losses it had suffered, Celsius hired its first risk management team—four individuals who had previously held risk compliance positions with traditional financial institutions. … Celsius never fully implemented a robust risk management policy before it filed for bankruptcy

The 30 page executive summary is a case study in running a ponzi.