Perspective on Risk - March 15, 2023 (more)

Moody’s Disagrees With Moody’s; CS; Here Comes The Recession; Fire-Sale Vulnerability; Resi; PIKs Again; Fallen Angels; Matt Levine Effect; Nickel; Defined Benefit Pension; CBDC; Sandwiches; Oprah

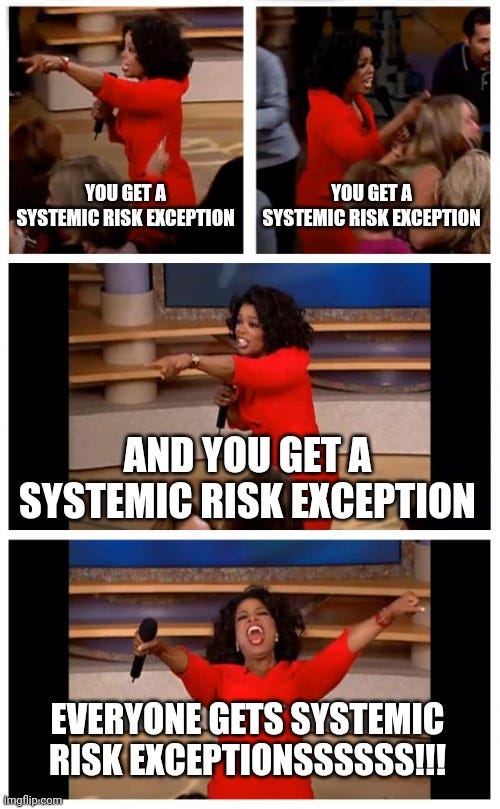

Let’s try and get back to normal. SVB was an idiosyncratic outlier. As I’ve said, life is about choices and the USG made a choice different from one I would have made, and I believe they exacerbated the problem

Sorry for sending so many of these, I really want to get back to reading my Russians.

Moody’s Disagrees With Moody’s

In the last Perspectives, I highlighted Mark Zandi’s (of Moody’s Analytics) thoughts, which were relatively sanguine. Moody’s Investor Services has come out with a more negative take, downgrading the US banking sector: Outlook Changed To Negative On Rapidly Deteriorating Operating Environment.

Credit Suisse Is Real Systemic Risk

Credit Suisse has been a mess for some time now. With yesterday’s statement about weaknesses in its accounts, a statement by a primary shareholder that they would not give further support, and general skittishness about banks, CS’s credit default swaps (which are a market measure of the probability of failure and loss) have gone through the roof, and are now at levels that have historically indicated serious problems.

Unlike the two small banks that failed in the US, Credit Suisse has been designated a systemically significant bank.

Now enough time has gone by that presumably most of the major banks have worked to reduce the number of trades with CS, tearing up contracts and strengthening collateral positions.

With Credit Suisse, one issue is its absolute size relative to the capacity of the Swiss economy. The two big swiss banks are a much larger share of Swiss GDP than the US banks are.

I sense in this environment, CS will need the Swiss supervisors and central bank to soon step in to provide support. They will protect their banking industry. We may see a bail-in here. The market has drastically changed with the Fed/USG actions.

Here Comes The Recession

I’ve been highlighting the Estrella/Mishkin 3m/10y yield curve that has been strongly predicting a recession for a while. I recently say this on @GalvinSBaker twitter feed. He is highlighting a graph from Variant Perception of WARN data. WARN is the acronym for Worker Adjustment and Retraining Notification Act that requires firms with more than 100 employees to give 60 days notice of layoffs. It is hard to compile this data as it is maintained seperetely by each state. These notices are spiking again.

I can’t vouch for the data, but thought it worth sharing.

Fire-Sale Vulnerability

The NY Fed published a research report Non-Bank Financial Institutions and Banks’ Fire-Sale Vulnerabilities

We assess the vulnerability of U.S. banks to fire sales potentially originating from any of twelve separate nonbank segments and identify network-like externalities driven by the interconnectedness across nonbank types in terms of asset holdings. We document that such network externalities can contribute to very large multiples of an original fire sale, thus suggesting that conventional assessments of fire-sale vulnerabilities can be grossly understated and highlighting the value of treating nonbank financial institutions as one organic whole for monitoring purposes.

Some interesting observations:

Finance companies and life insurers rank first in terms of the relative ability to impose direct, first-round losses on banks because of their size and direct asset overlap with banks.

Once the knock-on, second-round effects are taken into account, bond and equity funds, but also pension funds, rise to the top of the ranking because they can impose diffused first-round losses across all segments or concentrated losses on

segments highly influential on banks.

Life insurers and P&C insurers are vectors of shock propagation [to the banking sector] because of their very diversified asset portfolios, which make them especially vulnerable to first-round losses originating from a diverse cross-section of other segments.

Residential

Why aren’t home prices falling (yet)? Folks with low rate mortgages aren’t putting homes up for sale. The inventory of homes remains quite low.

Are We Really Doing PIKs Again Already

Fallen Angels

An angel falls from auto heaven

About $10bn of Nissan Motors bonds will slide into high-yield bond markets in April, after S&P Global Ratings downgraded the automaker this week.

The Matt Levine Effect

A paper from Paul Connell from Columbia, A Matt Levine Effect?, explores whether Matt Levine's vacation drives market volatility [higher] as has been speculated on the internet. The paper finds

that contrary to expectations, Levine’s vacations have an (almost) statistically significant effect in the opposite direction: decreasing market volatility.

I’m off on a trip to Egypt and Jordan, though I doubt there is a Peters effect.

Nickel

AQR Leads 10 Funds Suing LME One Year After Nickel Debacle

The London Metal Exchange has been hit by new lawsuits from ten hedge funds including AQR Capital Management over its decision to cancel billions of dollars in nickel trades last year.

The new claims come on top of judicial review proceedings brought by Elliott Investment Management and Jane Street last year. The AQR claims don’t raise any issues that are not already subject to the earlier proceedings, and will be on hold pending their outcome, according to the statement.

Trafigura Doing ‘Major’ Audit of Nickel Fraud Missteps, CEO Says (Bloomberg)

Trafigura, one of the largest traders of energy and metals, shocked the commodities world last month when it announced it was facing losses of nearly $600 million after finding that cargoes of nickel it had bought didn’t contain any nickel.

Trafigura did not always insist on getting a “certificate of analysis,” verifying the contents of the cargoes, before paying for them.

Defined Benefit Pension

Risk Transfer Report 2022 (Hymans Robertson)

Although Covid-19 brought about another year of uncertainty for many, it was still a successful year for defined benefit (DB) pension schemes looking to transfer risk

Looking forward, 2022 is set to be another busy year with a significant proportion of trustees indicating that they will be seeking buy-in quotations over the next year

[I]ncreased innovation in the deferred longevity hedging space led to some very attractive full buy-out pricing for DB pension schemes reaching their end-game goal.

We also expect further developments in the market for alternative risk transfer solutions over the next year and the first transfers to a superfund to complete in 2022.

Central Bank Digital Currencies

SWIFT to Conduct More Tests With CBDC Project

The project, which included banks such as France's BNP Paribas, Italy's Intesa Sanpaolo and the U.K.'s Standard Chartered (STAN), as well as the central banks in France and Singapore, will now move on to a second phase of testing to assess applications like trade finance and securities settlement.

Best Sandwiches

I have eaten way to few of these, and sorry, Avocado Toast? Uggh.