Perspective on Risk - March 14, 2023 (another short obscure bank update)

Does This Look Systemic? Let the Worst One Fail; Root Cause - Speed of Rate Rise; Horrified About Signature; SVB Was An Outlier; The System is Sound; Sneaky Liquidity Games; CS; Financial Dominance

Life is about choices

Does This Look Systemic to You?

Let the Worst One Fail

Philippon and Wang late last year published a paper Let the Worst One Fail: A Credible Solution to the Too-Big-To-Fail Conundrum.

We study time-consistent bank resolution mechanisms. The key constraint is that governments cannot avoid bailouts that are ex post efficient. Contrary to common wisdom, we show that the government may still avoid moral hazard and implement the first best allocation by using the distribution of bailouts across banks to provide incentives.

This paper generally aligns with my view.

Root Cause - Speed of Rate Rise

In the 1990s, the then comparatively fast rate rise blew up the derivative customers of a number of banks and made household names of places like Orange County. This tightening sequence is both an admission the Fed waited too long, and a natural experiment to see the effect of a rapid rate rise.

As far as I’m concerned, it has worked better than expected (so far). We’ve expected something to break, SVB is the second thing to break (after the British pension scheme). So far, neither has been systemic (despite the Fed’s use of the ‘systemic risk exemption.”

I’m Particularly Horrified About Signature

I can’t believe Nouriel Roubini and I agree. This rarely happens.

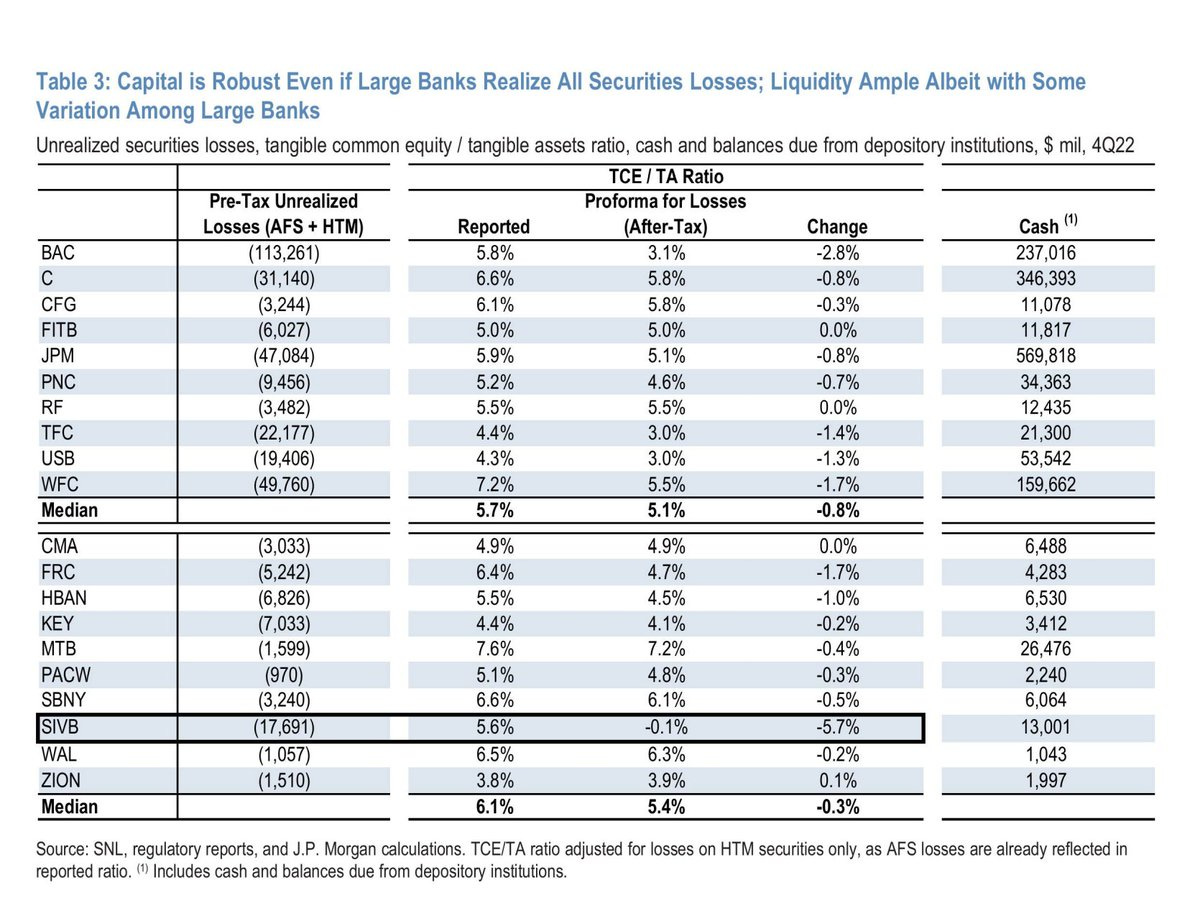

SVB Was An Outlier - 99.9% of Banks Are Fine

The Banking System is Sound

From Mark Zandy of Moodys Analytics: Financial System Shaken, Not Rattled

The bank crisis is unlikely to push the U.S. economy into recession.

Recent U.S. bank failures are disconcerting to watch, but they are not symptomatic of a serious broader problem in the financial system.

Policymakers’ aggressive response should ensure the failures do not weaken the system or the fragile economy.

[It] is unlikely that the recent bank failures are signaling more bank runs and failures are in train. … The banking system’s strong financial performance is also not consistent with any significant problems.

SVB Playing Sneaky Liquidity Games

Doug Dachille found SVP made changes to its sweep programs to benefit its own liquidity. Sweep programs traditionally take excess liquidity in bank accounts and invest it in Treasury securities or mutual funds overnight. Doug found that SVP changes its allocation, investing the proceeds into an internal Target Allocation Sweep Account.

Legal, but sneaky and disingenuous.

Credit Suisse Can’t Get Its Act Together

Credit Suisse Finds ‘Material’ Control Lapses After SEC Prompt (Bloomberg)

Credit Suisse Group AG said it found “material weaknesses” in its reporting and control procedures for the past two years, after questions from US regulators last week.

The Zurich-based bank said Tuesday it will take steps to fix ineffective checks on the process it follows to pull together its financial reports. But the firm said its statements for 2022 and 2021 “fairly present” its financial condition.

Their CDS have spiked

Fiscal Dominance, Monetary Dominance & Financial Dominance

This paper by Marcus Brunnermeier, FINANCIAL DOMINANCE, may start finding more discussion as we think about the effect of the bailout on the path forward for monetary policy.

Under a monetary dominance regime the central bank is in the driver’s seat and fiscal authorities have to adjust the fiscal budget to cover funding shortfalls. By contrast, under fiscal dominance, the fiscal authority has the upper hand and the monetary authority gives in, potentially resulting in inflation. Which authority prevails is often the outcome of a “game of chicken” between the fiscal and the monetary authority.

Under financial dominance few losses can be pushed onto the financial sector and even worse, it might be necessary to bail it out. A second game of chicken between the fiscal or monetary authority might arise on who has to bail out the financial sector.