Perspective on Risk - March 11, 2023 (Quick Bank Update)

Sweep Accounts; SVB’s Crypto Linkages; Maybe Regulation Works Sometimes; Good Summary; Not A Good Look FRBSF; I Bet He Followed The Law; Good Riddance To Bad Management; Just My Opinions

Sweep Accounts

I’ve gotten a few questions about how sweep accounts are handled in resolution. Best info I could find was from the FDIC Resolution Manual. They refer to 12 C.F.R. § 360.8. See also 74 Fed. Reg. 5797–5807 (Feb. 2, 2009)

The FDIC is adopting a final rule establishing the FDIC's practices for determining deposit and other liability account balances at a failed insured depository institution. Except as noted, the FDIC practices defined in the final rule represent a continuation of long-standing FDIC procedures in processing such balances at a failed depository institution. The final rule also imposes certain disclosure requirements in connection with sweep accounts. The final rule replaces the FDIC's interim rule on this subject and applies to all insured depository institutions.

DATES: Effective Dates: The final rule is effective March 4, 2009.

Check with your lawyers.

For regulator types, there is some very interesting similarities to the Triparty repo issue we spent years of our life on.

SVB’s Crypto Linkages

OK, there’s some contagion to crypto (But as Ricky Gervasis says “no one cares”)

Crypto Shaken as SVB Exposure Depegs $37 Billion Stablecoin

The second-largest stablecoin fell from its intended $1 peg, trading as low as 81.5 cents as investors reacted to the exposure of issuer Circle Internet Financial Ltd. to the collapsed bank.

USD Coin, or USDC, is an asset-backed stablecoin and a widely used plank of crypto markets. The token is intended to hold a constant $1 value, fully backed by reserves of cash and short-dated Treasuries. But late Friday, Circle disclosed that $3.3 billion of its roughly $40 billion stockpile of reserves is held with Silicon Valley Bank

Maybe Regulation Works Sometimes

Good Summary Post

The Demise of Silicon Valley Bank

Mark Rubenstein has a nice explainer for weekend reading. I don’t feel the need to duplicate.

Not A Good Look FRBSF

This Will Be Reviewed, But I Bet He Followed The Law

Good Riddance To Bad Management

Silicon Valley Bank chief pressed Congress to weaken risk regulations

In 2015, SVB’s president, Greg Becker, appeared before a Senate panel to push legislators to exempt more banks – including his own – from new regulations passed in the wake of the 2008 financial crisis. Despite warnings from some senators, Becker’s lobbying effort was ultimately successful.

Chesterton’s fence, people.

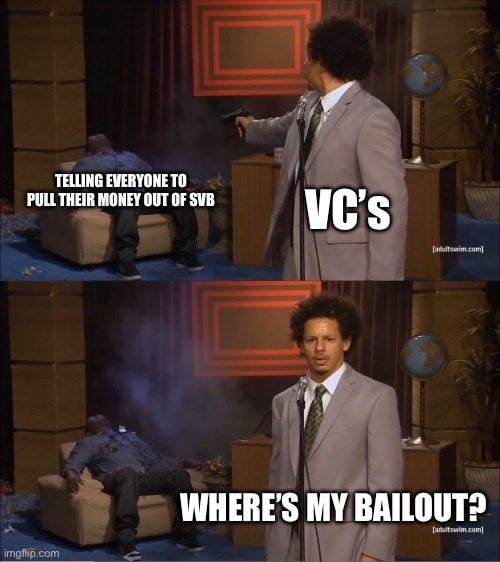

Just My Opinion(s)

FDIC will handle this ‘by-the-book.’ Unlike widely held perception, regulators are constrained by law and don’t want to go to jail.

There will be noise early Monday as the UK has shuttered SVB’s UK subsidiary. Germans have already acted on their branch.

This will not change the Fed’s approach to raising rates. The Fed knows things break when rates rise.

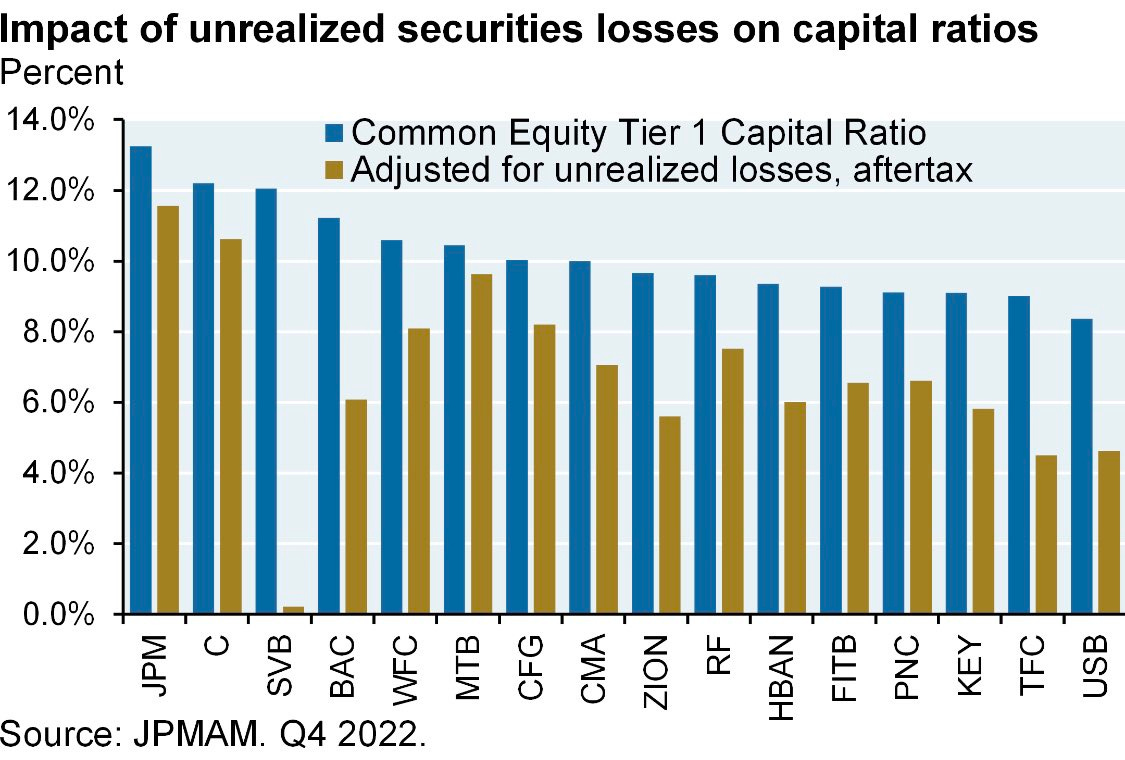

Yes, as I said yesterday, there will be deposit flight from other banks with 1) large unrealized securities losses, and 2) banks with large loan exposure to startups. Worth monitoring but probably not enough for the regulators to step in.

JPMC’s stock tends to go up during the flight-to-Jamie. He’ll raise prices until a new equilibrium is reached.

If this causes some of these banks to raise capital and/or liquidity to mitigate flight, that’s a good thing.

One issue here, on a much smaller scale than in the GFC, is that outsiders may not know the size of the hole at the lenders. This is where the due diligence associated with a capital raise works

Startups with promise will find funding through their VC contacts; let’s not get all crazy. If the VCs aren’t willing to help a firm, there is information content there. Solves the market-for-lemons

I don't see the doomsday scenario playing out in SV for startups who unfortunately banked with SVB. Instead, VCs are coming together to provide 0 interest bridge financing to help companies make payroll and meet other needs for the coming weeks.

I don't see the doomsday scenario playing out in SV for startups who unfortunately banked with SVB. Instead, VCs are coming together to provide 0 interest bridge financing to help companies make payroll and meet other needs for the coming weeks.No need for a Fed liquidity program, etc.