Perspective on Risk - June 16, 2023

Waller Chooses Violence; IMF Thinks US Is OK; You Can’t Trust Regulatory Metrics; Swiss Loan Protection For UBS Is A RWA Dodge; Private Credit; Hacking Russia, Hacking the US; Sales Practices; More

Waller Doesn’t Believe In Financial Dominance

I do not support altering the stance of monetary policy over worries of ineffectual management at a few banks. Financial Stability and Macroeconomic Policy

IMF Assessment of US Financial System

The IMF conducted their Article IV assessment of the US. An annual assessment of all member countries is undertaken to identify potential vulnerabilities in a country's economy and suggest corrective measures before crises occur. They are a form of peer review, with both the IMF and the country under review expressing their views on the appropriateness of the country's economic policies.

There is a lot of descriptive content, but it’s useful to read the “staff appraisal” section. I summarize (highlighting is mine):

Bringing inflation back to target will require an extended period of tight monetary policy with the federal funds rate remaining at 5¼—5½ percent until late in 2024

The disinflation process should be supported by a tighter fiscal policy.

A more significant fiscal adjustment will be required over the medium-term to put public debt on a decisively downward path.

Recent bank failures highlight the potential systemic risks posed by even relatively small financial intermediaries.

A range of policies that were proposed in the President’s budget would help address supply side constraints to growth but should be implemented within a fiscal envelope that ensures a downward path for the public debt.

Part of the assessment includes a risk assessment table. Karen Petrou points out the inclusion of regional bank stress as a ‘systemic risk.’

Credit Officers (and retired CCOs, and Kevin in particular) will be interested in Appendix II.

Policy staff will be interested in Appendix IV, where the US authorities “push back” on recommendations to improve financial oversight.

You Can’t Trust Regulatory Metrics

Jon Sindreu writes in the WSJ: It Is Time to Admit It: Bank Regulation Doesn’t Quite Work

Basel III was supposed to turn highflying banks into “boring” investments. A higher cost of capital meant lower profitability, but a negligible risk of failure also meant lower risk.

Yet, though the return on equity of developed-world banks has fallen to a utility-like 10%, from around 15% in the mid-2000s, the bank sector almost matches technology for volatility.

It is time to say that Basel III just doesn’t work as intended.

Bank-regulation experts in Switzerland and abroad are now studying whether Basel III needs amending. It could be argued that regulatory ratios should be increased, or conversely that they should be lowered and governments given even wider legal discretion to act. Liquidity coverage ratios need fine-tuning to better reflect the dangers of a flighty deposit base. Maybe all deposits should be insured.

What is clear is that, as things stand now, investors can’t trust the metrics designed to show banks’ financial health. And that is a systemic problem.

UBS’s Credit Suisse Loss Provision Agreement

As with the JPMC/SVB deal, the loss guarantee is mostly about the RWA of the assets and the related improvement of the ROI on a go-forward basis.

UBS and Swiss government sign Loss Protection Agreement

UBS to bear first CHF 5bn of potential losses realized on a designated portfolio of Credit Suisse non-core assets; the Swiss government to cover next CHF 9bn of potential realized losses

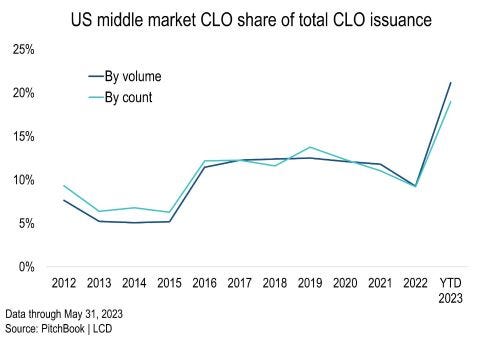

Private Credit

Pitchbook notes the rising volume of middle-market CLOs in As private credit dominates leveraged loan world, middle market CLOs blossom.

By dollar volume, the $2.41 billion in middle market CLOs in May from issuers such as Golub Capital, HPS Investment Partners and Blue Owl Capital is 23% of the $10.6 billion in combined middle market and broadly syndicated CLO activity

The share of middle market deals was higher in April (27%), albeit at a much lower deal count: three middle market CLOs (totaling $1.75 billion), versus 11 BSL deals ($4.69 billion).

Bank loan activity frequently alternates between direct bank lending and the capital markets. In periods where investor demand is robust, and market conditions are favorable, the CLO market can significantly ramp up loan origination volumes. Similarly, when banks scale back their lending, non-bank institutions can step in, underwrite loans, and offload the risk through the CLO market.

Capital and liquidity regulations exert a significant impact on the balance between bank-funded deals and the CLO market. As bank capital regulation is tightened, it changes the return expectations to on-balance sheet lending. Similarly, regulation that forces banks to hold higher levels of high quality liquid assets will result in reduced bank lending portfolios. These regulations can also affect the non-bank market by changing the risk weights associated with banks providing repo facilities on these assets.

Karen Petrou is highlighting the risk of credit intermediation moving outside of the banking system in Private Credit’s Public Cost. Now we should be cautious reading this as her primary clientele historically has been the large bank community lobbying against capital and liquidity regulation.

Japan’s giant SoftBank isn’t exactly a canary, but it’s nonetheless a reliable omen of trouble in the financial mine shaft …

Now comes news that SoftBank is going big into private credit, already a $1.4 trillion sector with big plans for super-sonic growth now that new bank capital standards are sure to suppress bank lending.

Another early warning is Federal Reserve insouciance to looming financial system instability borne of its banking blinders. … Its most recent financial stability report essentially ignores private credit in its nonbank financial intermediation fretting.

The IMF … are often prescient about looming systemic risk. Their most recent report sees a lot to worry about when it comes to private credit. First, there’s the intersection of acknowledged systemic sectors – life insurance and pension funds – with growing books of private-credit loans exacerbating major asset/liability mismatches and thus liquidity risk under stress. Further, the IMF thinks the sector is vulnerable on its own due to the preponderance of highly-leveraged buyout loans, deteriorating covenant quality, and round-robin private-equity financing for competitor deals that increases concentration even as, we would add, it erodes market discipline.

There is, though, an even better early-warning flare: private capital’s unbounded confidence in its ability to grow without constraint now that banks are going into a capital box. Apollo for one big, big player in this sector says private capital could soon replace as much as $40 trillion in the fixed-income market. And why not? Global bank lending has dropped 37 percent just this year. Competitors in a capital corner combined with the sector’s exemption from regulatory capital, incentive misalignment, and boundless ambition augur shadows the size of a solar eclipse.

Cyber-Stuff

Hackers Take Down Russia’s Payment System

Hackers claim to have crippled Russia’s banking system

Pro-Ukrainian hacktivists allegedly took down Infotel, a Russian internet service provider (ISP) crucial for operating a platform that Russian banks use to facilitate the financial system.

While taking down a single ISP is not a tectonic event, the attack’s side effects have the potential to have severe ramifications for Russia’s banking system: Infotel runs the Automated System of Electronic Interaction (ASEI) for the Central Bank of Russia.

It looks like they took the network down between June 8th and June 13th. No official announcements.

Russian Ransomware Attack Against Western Firms

Big Russian ransomware attack hits numerous Western firms.

MOVEit Attack: CL0P Ransomware Group Exploits Vulnerability, BBC and Ofcom Affected

Progress Software is a US company that supplies MOVEit Transfer to many businesses for them to securely move files around company systems. In a security advisory released by the company, it was revealed that a vulnerability had been discovered in the MOVEit Transfer software that could lead to “escalated privileges and potential unauthorized access to the environment.”

On the 27th of May 2023, the CL0P ransomware gang - also known as TA505 - began exploiting a previously unknown SQL injection vulnerability (CVE-2023-34362) in the MOVEit Transfer software.

US government agencies hit in global cyberattack (CNN)

The US Cybersecurity and Infrastructure Security Agency “is providing support to several federal agencies that have experienced intrusions affecting their MOVEit applications,”

Aside from US government agencies, “several hundred” companies and organizations in the US could be affected by the hacking spree, a senior CISA official told reporters later Thursday, citing estimates from private experts.

Sales Practices

Japan Watchdog Seeks Penalty On Regional Banks Over Bond Sales

The Securities and Exchange Surveillance Commission on Friday asked the Financial Services Agency to punish Chiba Bank Ltd. and its brokerage subsidiary, as well as Musashino Bank Ltd. The agency said they sold these products without properly checking customers’ investment preference and experience, or explaining the risks involved.

It’s the first time in nearly two decades that the watchdog has issued such a recommendation in relation to structured bonds, an official said at a briefing. The move is a further step in an ongoing clampdown on structured securities, which offer higher returns than regular debt products but at significantly higher risk. It also suggests that authorities are getting more serious about cleaning up improper sales practices in the industry.

The FSA is following up on how brokerages sold 140 billion yen ($1 billion) worth of risky debt issued by Credit Suisse Group AG.

Follow-up on Fake Nickle

You’ll remember than they found that some of the nickle in the LME warehouse was fake. Oops. Saw this article that provides an update

Billionaire Reuben Brothers Sue Trafigura Over Nickel Fraud (Bloomberg)

Trafigura said it expected to lose nearly $600 million in what it called a “systematic fraud” perpetrated by Indian businessman Prateek Gupta.

Hyphen Trading Ltd. … alleges that the fraud didn’t just involve thousands of tons of missing nickel, but also counterfeit shipping documents — which ended up being used to obtain financing from leading commodity bank ICBC Standard Bank Plc. It describes how containers supposedly holding nickel were shipped back and forth around the world, apparently to avoid having to open them and reveal their true contents.

The allegation that fraudulent shipping receipts – known as bills of lading – have been circulating in the nickel market

Should Have Applied For The Trademark

Not to be confused with the far more useful Perspective on Risk series ;>

OCC’s Semi-annual Risk Perspective - Spring 2023

Seems like their risk scale is off: operational risk and compliance risk is rated “elevated” but credit risk is “moderate” - really???

Language is very rearview mirror focused, describing what has occurred, rather than what might occur. Some statements seem downright contradictory:

Investment portfolio values and banks’ access to cost-efficient funding sources are likely to remain under pressure …

Investment portfolio losses will likely remain unrealized if banks maintain sufficient access to cost-efficient sources of liquidity. Liquidity in banks remains sound, but the need to monetize securities in a period of rising rates and quantitative tightening could have a material impact on earnings and capital.

Here is the distribution of Matters Requiring Attention (MRAs); unsurprising. There is almost no information content here; this distribution is incredibly stable going back to 2018.

A Risk I Over-Estimated

Most of you know I’m kind of a science geek. As such, I’ve always been interested in gamma ray bursts, and since this obsession developed in my youth, I always worried about a direct hit by a gamma ray burst.

Well, scientists just observed the brightest super-nova yet. We were lucky to observe it since it was pointed right at us! A telescope happened to be pointing at the brightest supernova yet observed

The first 100 minutes saw over 64,000 photons detected at energies above 200 giga-electron volts.

For context, converting the entire mass of a proton to energy would produce slightly less than one GeV.

Guess it wasn’t that big of a risk.

Apophenia

Forget about the Chinese, the sea mammals are organizing.

We’ve Cooked The Ocean

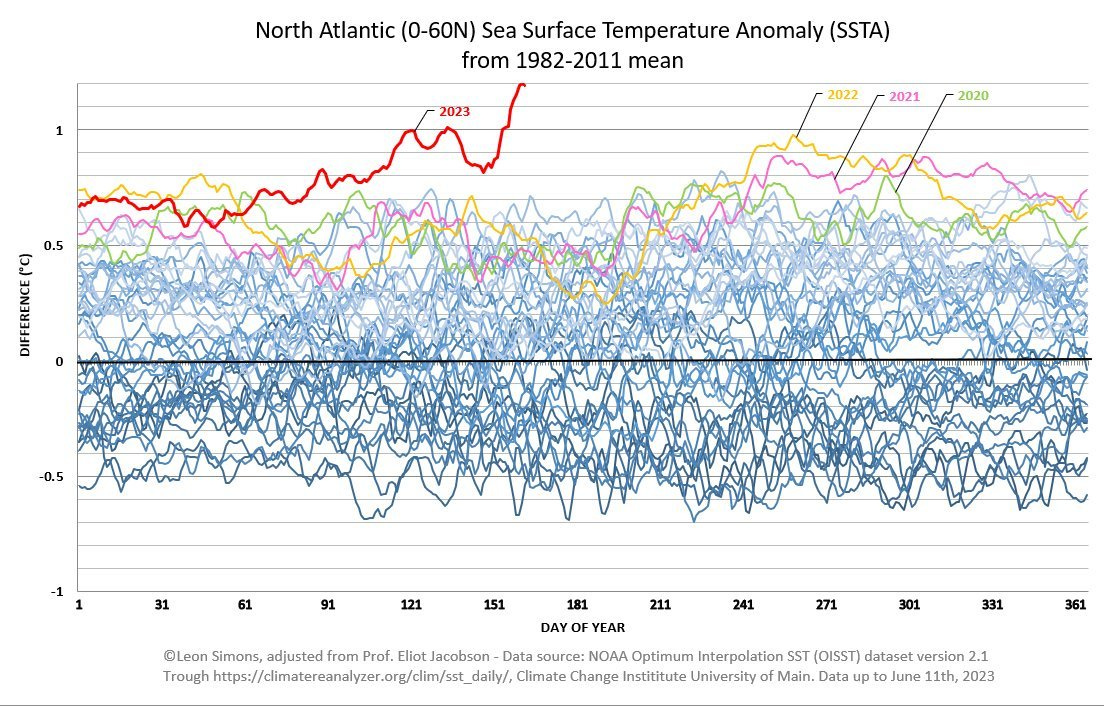

Climate Twitter and the climate scientist community has been lit very recently due to a few graphs that are circulating that show a SIGNIFICANT warming of the world’s oceans. This graph set off the concern:

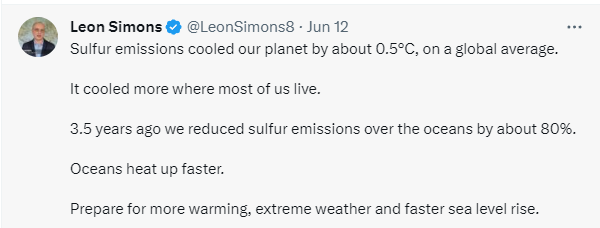

While global warming is partially the cause, our success in reducing sulfur dioxide by having ships burn cleaner fuel is also thought to be a major contributor. In 2020, cargo ships, which traditionally burned the dirtiest of fuel, were forced to substantially reduce Sulphur dioxide (SO2) emissions. Now, cargo ships are running much cleaner.

This article from WFLA, Spike in ocean heat stuns scientists: Have we breached a climate tipping point?, does a very nice job of telling the story.

The ORCAs are pissed and fighting back.

In and around the Straight of Gibralter, ORCAs are attacking boats. It’s happening nearly every day. White Gladis is their leader. Three boats have been sunk. Here’s footage of Orca’s in Spain attacking ship rudders.

A study published in June 2022 in the journal Marine Mammal Science has found that assaults by the orcas are directed mainly at sailing boats. There is a clear pattern of orcas striking the rudders, with spade rudders the most targeted and damaged type, and then losing interest once the boat has successfully stopped. Here is a link to the study: Killer whales of the Strait of Gibraltar, an endangered subpopulation showing a disruptive behavior

The study theorises some motivations that the orcas had to interact with vessels: a ‘punctual aversive incident’ such as collision with a vessel; the natural curiosity of the animals; or pressures already identified for killer whales such as prey depletion, boat disturbance and interaction with fisheries.

Others, however, suggest Recent boat attacks might be driven by trauma

They’re now gathering forces on our coasts. Researchers spot rare sight: Orcas in New England waters, along with dozens of other whales, dolphins.

WHAT IS BIDEN DOING TO PREVENT THE COMING ORCA WAR?

Theater Review

Recently saw Good Night, Oscar. Strongly recommend. Sean Hayes is terrific as a lead.